Creating a comprehensive and accurate company expense report is crucial for financial transparency and compliance. A well-structured template ensures that all expenses are properly documented, tracked, and approved. This guide provides a robust framework for developing a professional and effective company expense report template, designed to streamline the process and minimize potential errors. Company Expense Report Template is more than just a document; it’s a vital tool for maintaining financial integrity and fostering trust with stakeholders. The benefits of utilizing a standardized template extend beyond simple record-keeping; it promotes accountability, reduces administrative burden, and facilitates informed decision-making regarding budget allocation. Investing in a quality template is an investment in operational efficiency and financial health.

Expense reports are a fundamental component of corporate accounting. They provide a detailed record of all business-related expenditures, allowing for accurate cost analysis and reporting. Company Expense Report Template is the cornerstone of this process, enabling businesses to track spending, identify trends, and demonstrate compliance with relevant regulations. Without a clear and organized system, it’s difficult to determine where money is being spent, whether it aligns with strategic goals, and whether expenses are being managed effectively. Poorly managed expense reports can lead to discrepancies, audits, and potential financial penalties. A well-designed template empowers companies to proactively manage their spending and ensure responsible financial stewardship.

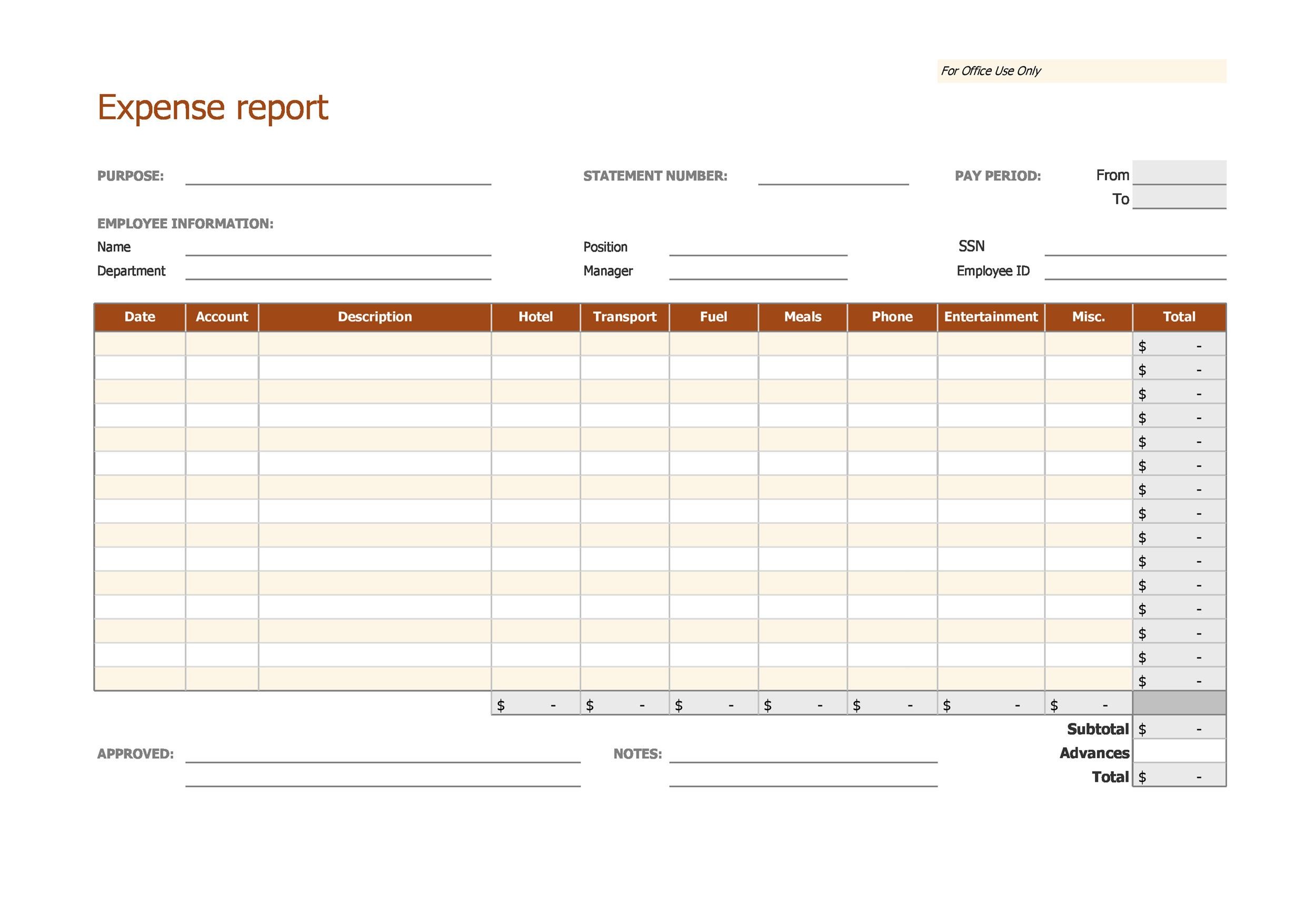

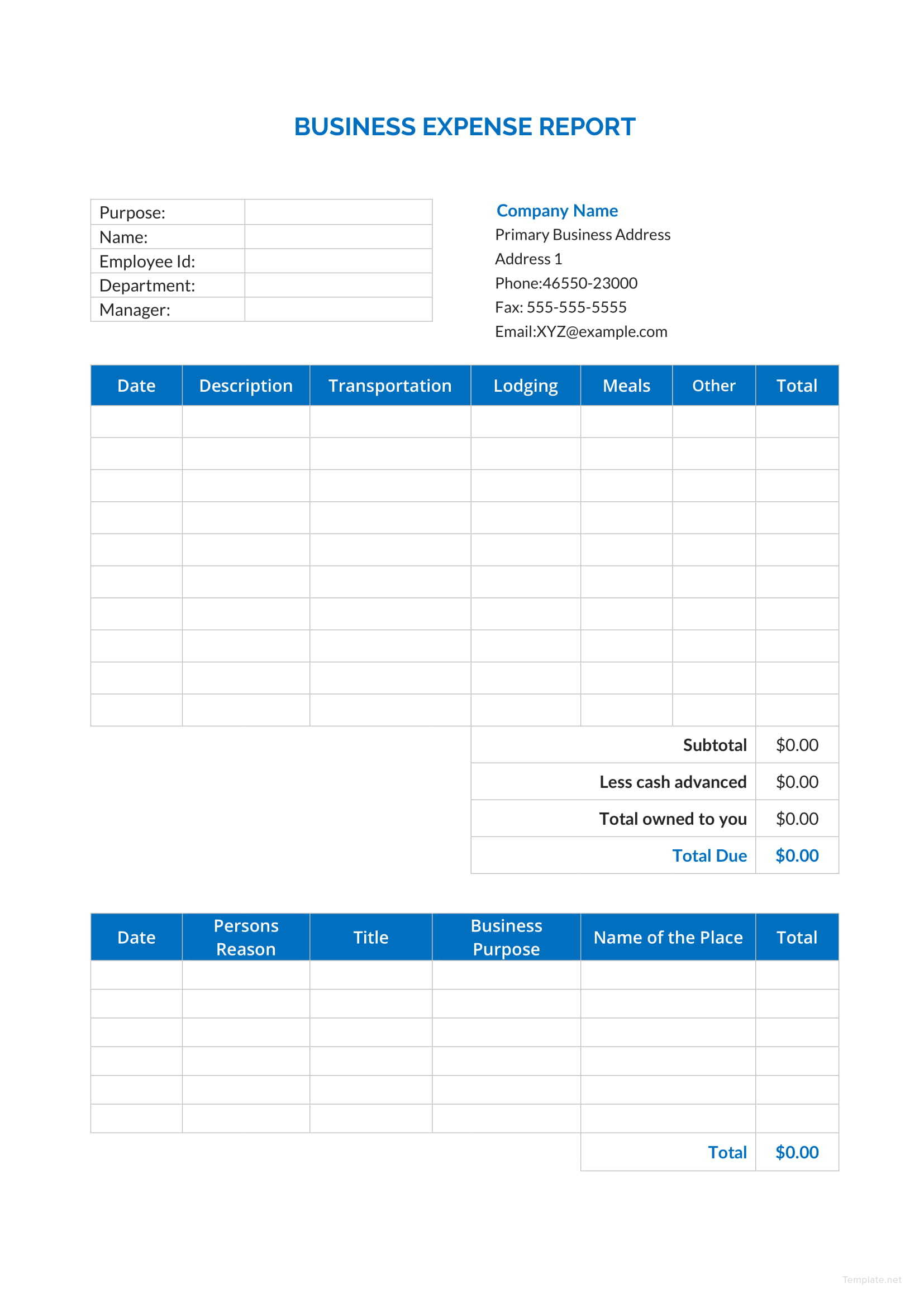

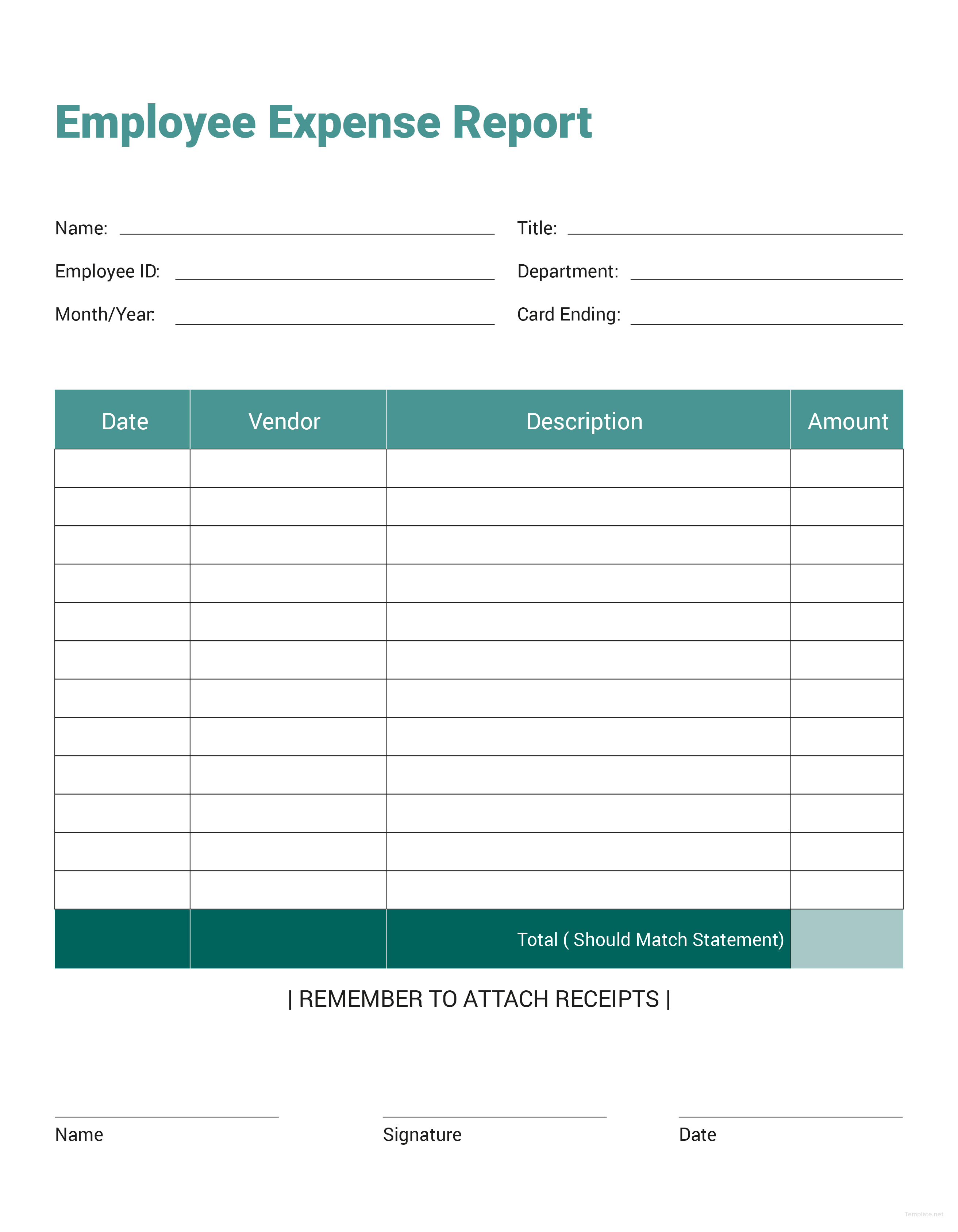

A successful company expense report template should include several key sections to ensure thoroughness and accuracy. The first section typically requires detailed information about each expense, including the date, vendor, amount, and description. Next, a clear categorization system is essential for organizing expenses by type (e.g., travel, meals, office supplies). Finally, a section for approval and tracking is necessary to maintain accountability and ensure that expenses are properly vetted. Many templates incorporate features like expense categorization, mileage tracking, and receipt scanning, further enhancing the efficiency of the process. The level of detail required will vary depending on the company’s size and industry.

This section is the heart of the expense report, requiring meticulous record-keeping. Each expense should be clearly and concisely described. The following information is mandatory:

Categorizing expenses is critical for understanding spending patterns and identifying areas for potential cost savings. A well-defined category system allows for easier analysis and reporting. Common expense categories include:

It’s beneficial to create subcategories within each category for greater granularity (e.g., within “Travel,” you might have “Airfare,” “Hotel,” “Ground Transportation”). Consider using a spreadsheet to manage these categories and track expenses within each.

Accurate and readily available receipts are essential for supporting expense reports. The template should include a section for capturing and storing receipts. Ideally, receipts should be scanned and stored digitally, ideally in a secure cloud storage solution. This ensures easy access and reduces the risk of lost or misplaced documents. Consider integrating receipt scanning functionality into the expense report software.

A robust approval workflow is crucial for maintaining accountability and ensuring that expenses are properly vetted. The template should include a section for assigning approval levels (e.g., manager, finance department). Each expense should be routed to the appropriate approver before being finalized. This workflow helps to prevent fraudulent or unauthorized expenses and ensures that all expenses are compliant with company policy. Automated approval workflows are increasingly common and can significantly streamline the process.

Mileage tracking is a critical component of many expense reports, particularly for travel expenses. The template should include a field for recording mileage, using a standardized method (e.g., IRS standard mileage rate). Mileage tracking ensures compliance with regulations and provides accurate data for cost analysis. Consider integrating mileage tracking with GPS devices or mobile apps.

This section provides a space for adding notes and comments to explain the expense. This can be helpful for clarifying the purpose of the expense, providing additional details, or addressing any questions or concerns. It also allows for a record of the rationale behind the expense.

Company Expense Report Template is a powerful tool for managing company expenses effectively. By implementing a well-structured template, businesses can streamline the expense reporting process, improve financial transparency, and ensure compliance with regulations. Investing in a quality template is an investment in operational efficiency, financial control, and ultimately, a healthier bottom line. Regularly reviewing and updating the template ensures that it remains relevant and effective in meeting the evolving needs of the business. Properly utilizing this template will contribute significantly to a more organized and accountable financial environment. The key to success lies in consistent application and adherence to established procedures.

Ultimately, a comprehensive company expense report template is more than just a document; it’s a strategic asset that promotes financial discipline, regulatory compliance, and informed decision-making. By embracing a standardized approach to expense reporting, businesses can unlock significant benefits and maintain a strong financial position. Continuous improvement and adaptation of the template are essential to ensure its continued relevance and effectiveness in a dynamic business landscape.