Conditional Fee Agreements (CFAs) represent a significant shift in how legal services are financed, allowing individuals and businesses to pursue claims they might otherwise be unable to afford. Accessing justice shouldn’t be limited by upfront costs, and a well-drafted Conditional Fee Agreement Template is the cornerstone of this accessibility. These agreements outline the terms under which a solicitor will take on a case without requiring payment if it is unsuccessful, instead receiving a percentage of the damages recovered if the case is won. This article will delve into the intricacies of CFAs, providing a comprehensive guide to understanding, utilizing, and creating effective agreements. We’ll explore the benefits, risks, essential clauses, and practical considerations for both clients and legal professionals.

The rise of CFAs has been driven by a desire to level the playing field, particularly in cases against larger, better-resourced opponents. Traditionally, the cost of litigation could be prohibitive, effectively denying access to justice for many. CFAs address this issue by transferring the financial risk from the client to the solicitor. However, it’s crucial to understand that while CFAs reduce upfront costs, they don’t eliminate them entirely. Clients may still be liable for certain expenses, known as ‘disbursements,’ even if the case is lost.

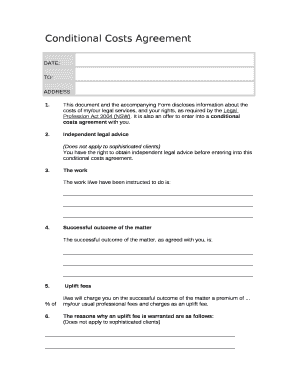

Understanding the nuances of a CFA is paramount. It’s not simply a ‘no win, no fee’ arrangement. The agreement details the percentage uplift the solicitor will receive – a premium on their standard hourly rate – if the case succeeds. This uplift is designed to compensate the solicitor for the risk they’ve taken. A clear and transparent Conditional Fee Agreement Template is therefore vital to ensure both parties are fully aware of their rights and obligations.

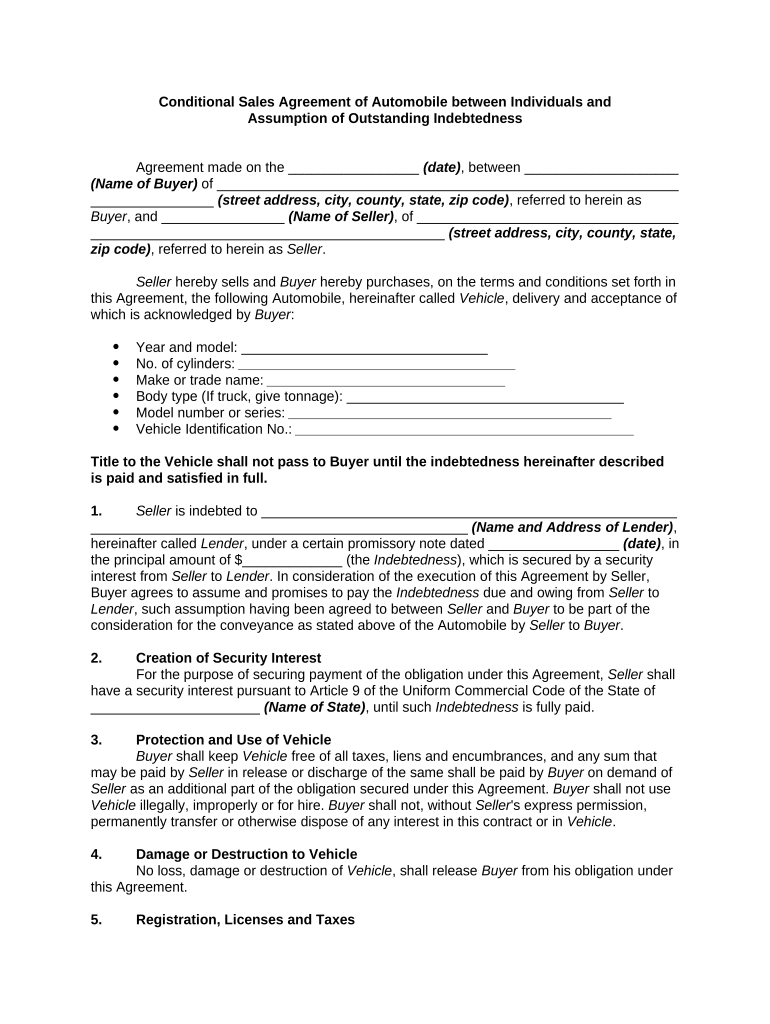

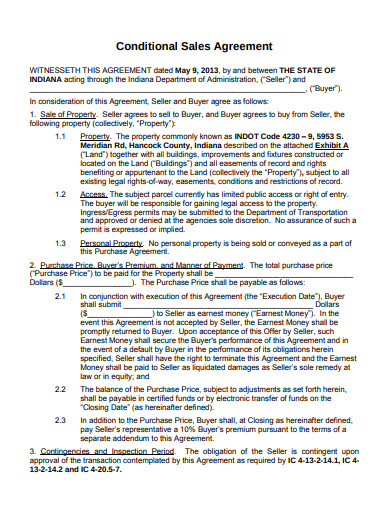

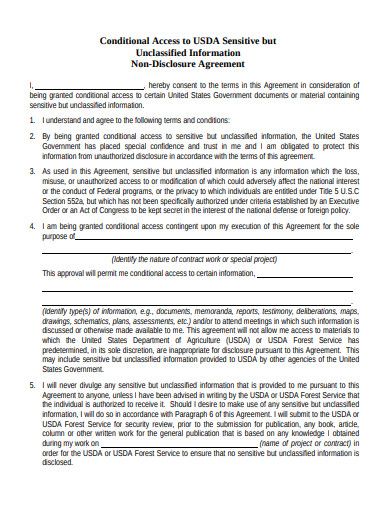

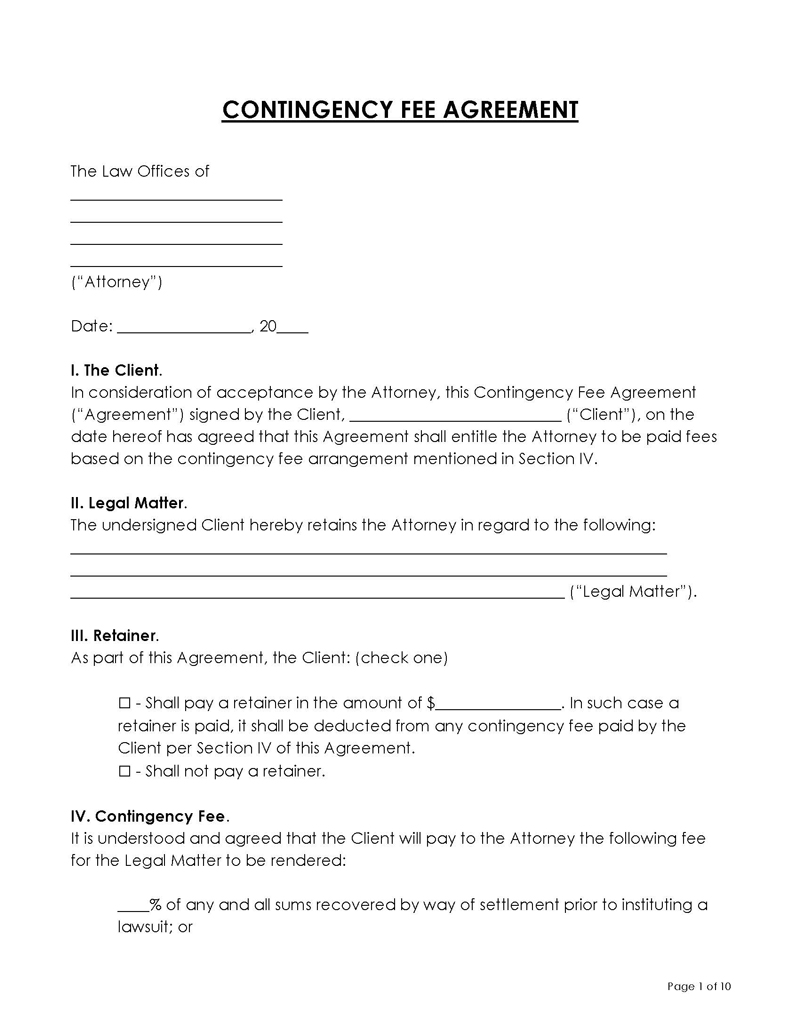

A Conditional Fee Agreement is a contract between a solicitor and a client where the solicitor’s fees are dependent on the successful outcome of the case. This means the client only pays the solicitor’s fees if the case is won or settled in their favour. The fees are typically calculated as a percentage of the damages recovered, in addition to the reimbursement of expenses.

Several key features define a CFA and differentiate it from traditional legal fee arrangements:

Utilizing a Conditional Fee Agreement Template offers numerous advantages for both clients and solicitors. For clients, the primary benefit is reduced financial risk. They can pursue legitimate claims without the fear of incurring substantial legal bills if they lose. This opens up access to justice for a wider range of individuals and businesses.

A robust Conditional Fee Agreement Template must include several essential clauses to protect the interests of both parties. These clauses ensure clarity, transparency, and enforceability.

After the Event (ATE) insurance plays a crucial role in mitigating the financial risk associated with CFAs, particularly concerning disbursements. ATE insurance covers the client’s liability for disbursements if the case is lost. The premium for ATE insurance is typically paid only if the case is successful, adding another layer of protection for the client.

Numerous resources offer Conditional Fee Agreement Template options. Solicitors can find templates through legal software providers, professional associations (like the Law Society), and online legal document services. It’s crucial to select a template that is up-to-date, compliant with current regulations, and tailored to the specific type of case.

While CFAs offer significant benefits, it’s important to be aware of potential risks and pitfalls. These include:

A Conditional Fee Agreement Template is a powerful tool for increasing access to justice, but it requires careful consideration and a thorough understanding of its implications. By utilizing a well-drafted template, both clients and solicitors can benefit from a transparent and equitable fee arrangement. Remember to prioritize clarity, compliance, and independent legal advice to ensure a successful and mutually beneficial outcome. Understanding the interplay between the CFA and ATE insurance is also vital for managing risk effectively. Ultimately, a well-executed CFA empowers individuals and businesses to pursue legitimate claims without being deterred by the financial burden of litigation.