Creating a loan without a cosigner can be a daunting process, often requiring significant financial assistance. However, for many individuals, a cosigner can provide a crucial safety net, making the loan more accessible and reducing the risk for the lender. A cosigner is someone who agrees to be legally responsible for the loan if the borrower defaults. This arrangement can be a valuable tool for those with limited credit history, low income, or who lack the collateral to secure a traditional loan. Understanding the nuances of a cosigner loan agreement is essential for both borrowers and lenders. This guide provides a comprehensive overview of what you need to know about cosigner loans, including the different types, requirements, and potential pitfalls. Let’s delve into the world of cosigner loans and how they can help you achieve your financial goals.

The prevalence of cosigning a loan is increasing, driven by factors such as rising interest rates, stricter lending criteria, and a growing desire for financial security. Traditionally, securing a loan required a substantial down payment and a strong credit score. However, the rise of co-signers has broadened the pool of potential borrowers, particularly for those who might not qualify for a traditional loan. A cosigner’s commitment adds a layer of security, reassuring lenders that the borrower is serious about repaying the loan. It’s important to remember that a cosigner’s agreement is a legal contract, and it’s crucial to understand the terms and conditions before signing. The lender will assess the cosigner’s creditworthiness, income, and overall financial stability to determine if they are comfortable with the risk.

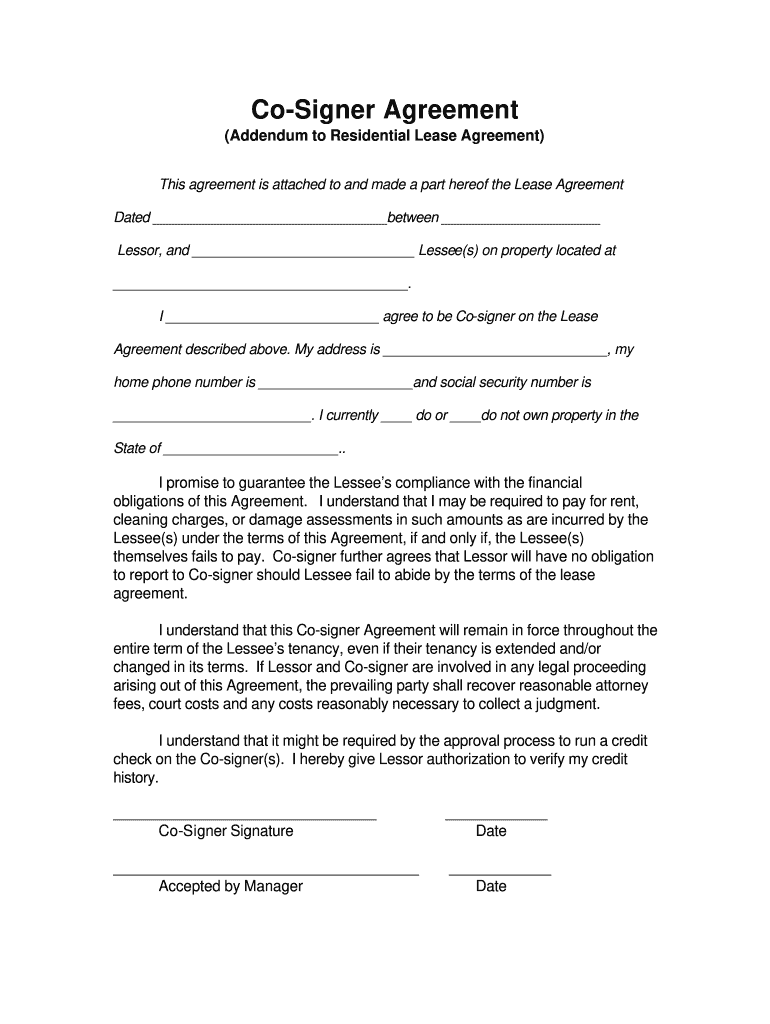

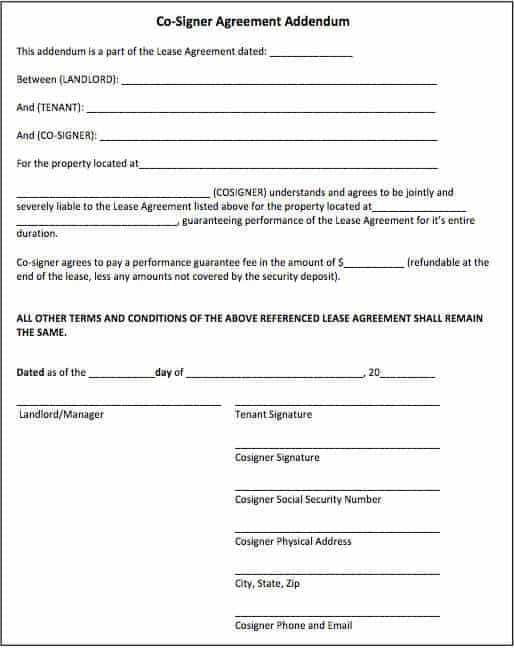

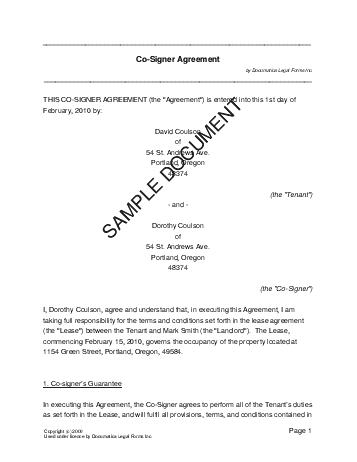

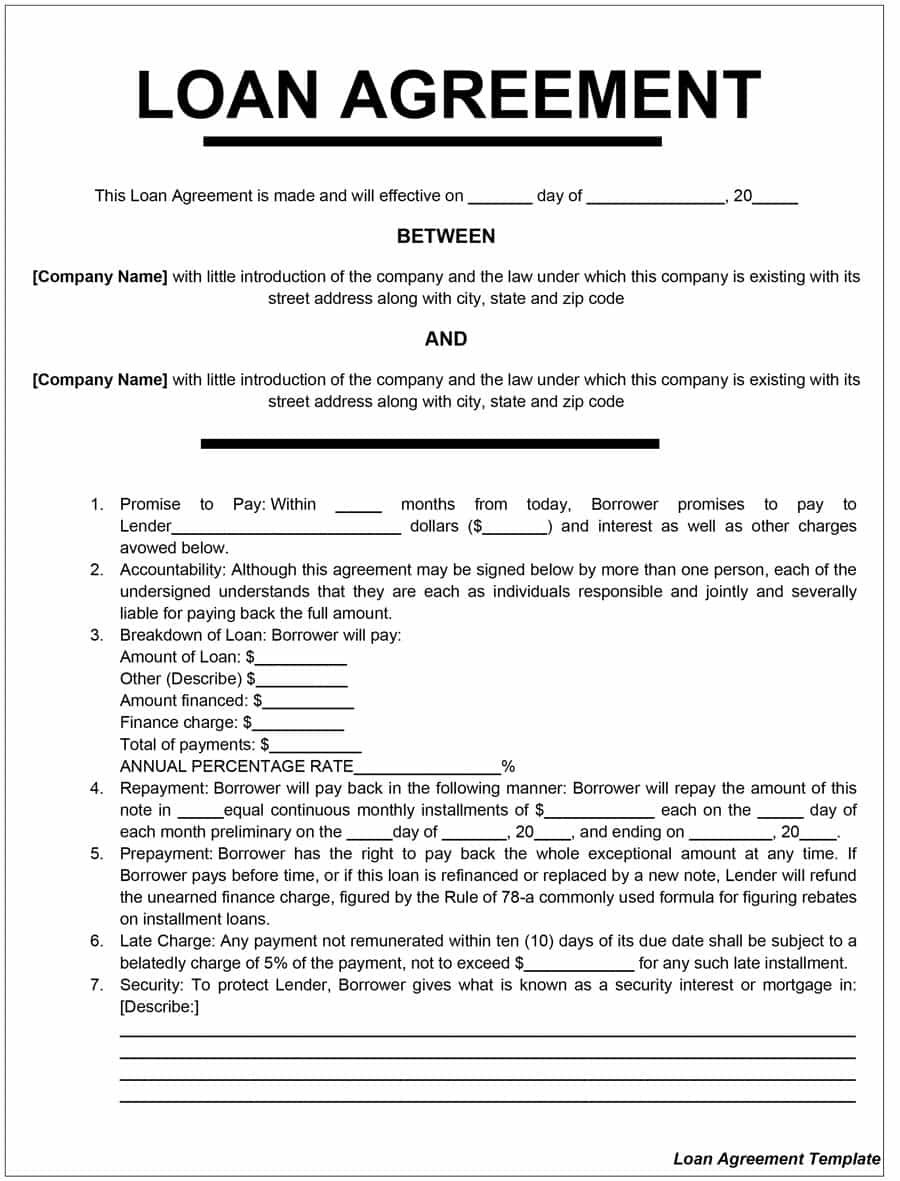

There are several variations of cosigner loan agreements, each with its own specific requirements and implications. The most common types include:

It’s crucial to carefully review the specific terms of each agreement to ensure it aligns with your individual circumstances and the lender’s requirements. Consulting with a legal professional is highly recommended, especially when dealing with complex loan arrangements.

Beyond the agreement itself, several factors contribute to a cosigner’s eligibility and the overall success of the loan. Here’s a breakdown of the key requirements:

A cosigner offers several significant advantages to both the borrower and the lender:

While cosigning a loan offers numerous benefits, it’s important to be aware of potential risks:

Before signing a cosigner loan agreement, it’s crucial to thoroughly review the terms and conditions. Here are some key areas to pay attention to:

A cosigner loan agreement can be a powerful tool for individuals seeking to access financing. However, it’s essential to approach this arrangement with careful consideration and a thorough understanding of the associated risks and responsibilities. By carefully evaluating your financial situation, researching different types of agreements, and consulting with a legal professional, you can maximize the benefits of a cosigner loan while minimizing potential pitfalls. Ultimately, a successful cosigning relationship requires a strong partnership between borrower and cosigner, built on trust and mutual understanding. Remember that a well-structured agreement protects both parties involved, fostering a secure and sustainable financial pathway. Don’t hesitate to seek professional advice to ensure a legally sound and beneficial arrangement.