Calculating the precise interest rate on your credit card debt can feel like a daunting task. Understanding how much you’re really paying can be crucial for managing your finances and potentially reducing your balance. That’s where a credit card interest calculator Excel template comes in. This tool provides a straightforward way to determine your interest charges, allowing you to track your progress and make informed decisions about your spending. Credit Card Interest Calculator Excel Template is more than just a calculator; it’s a powerful resource for budgeting and debt reduction. It’s designed to be easily adaptable to different scenarios, making it a valuable asset for anyone looking to control their credit card expenses. Whether you’re struggling to pay down a balance or simply want to understand how much you’re earning on your debt, this template offers a clear and efficient solution. Let’s dive into how to use it effectively.

Before we get into the Excel template, it’s important to grasp the fundamental concepts behind interest calculations. Credit card interest is typically expressed as an annual percentage rate (APR). This rate represents the cost of borrowing money and is calculated based on the amount borrowed, the interest rate, and the repayment period. The longer you take to repay your credit card debt, the higher the APR will be, and consequently, the more interest you’ll accrue. Different credit card offers have varying APRs, so it’s essential to compare your terms carefully. Furthermore, the APR is not the only factor affecting your debt. Fees, late payment penalties, and balance transfers can all contribute to the overall cost of your credit card debt.

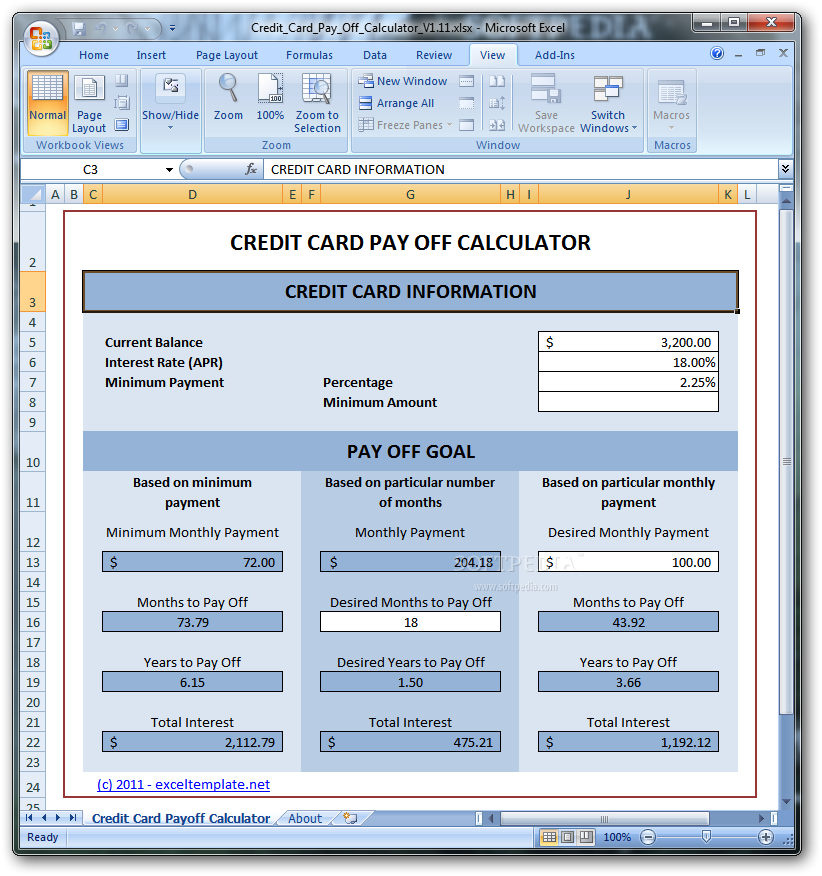

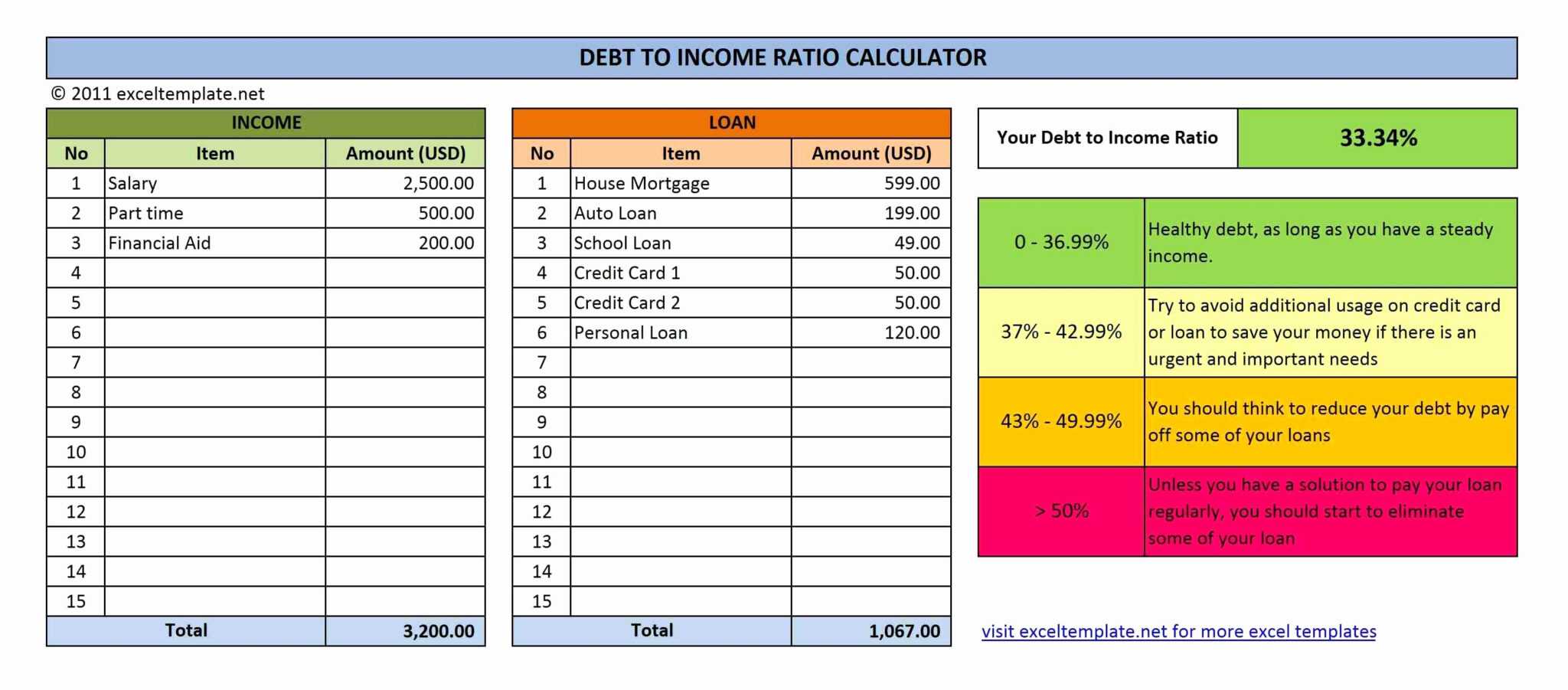

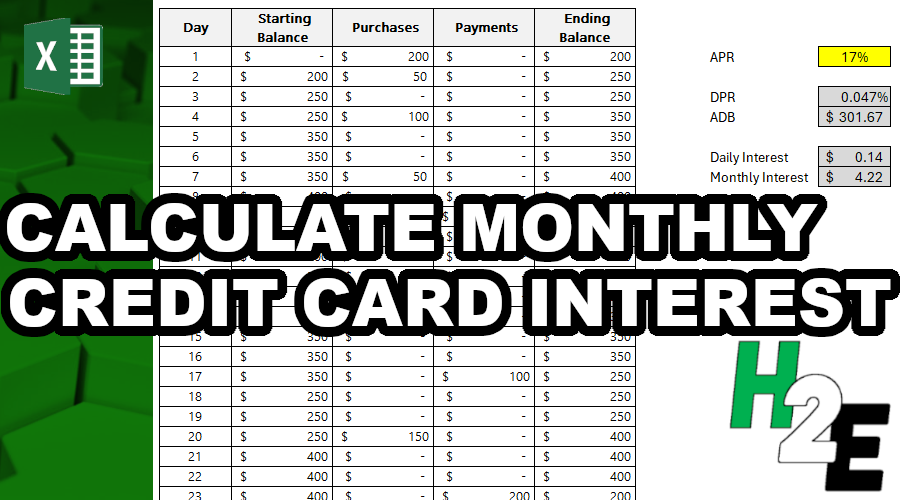

The following Excel template provides a flexible framework for calculating your credit card interest. It’s designed to be easily customized to reflect your specific circumstances. You can copy and paste this template into a new Excel sheet and then adjust the cells to reflect your individual data.

The first step is to gather the necessary information. This includes:

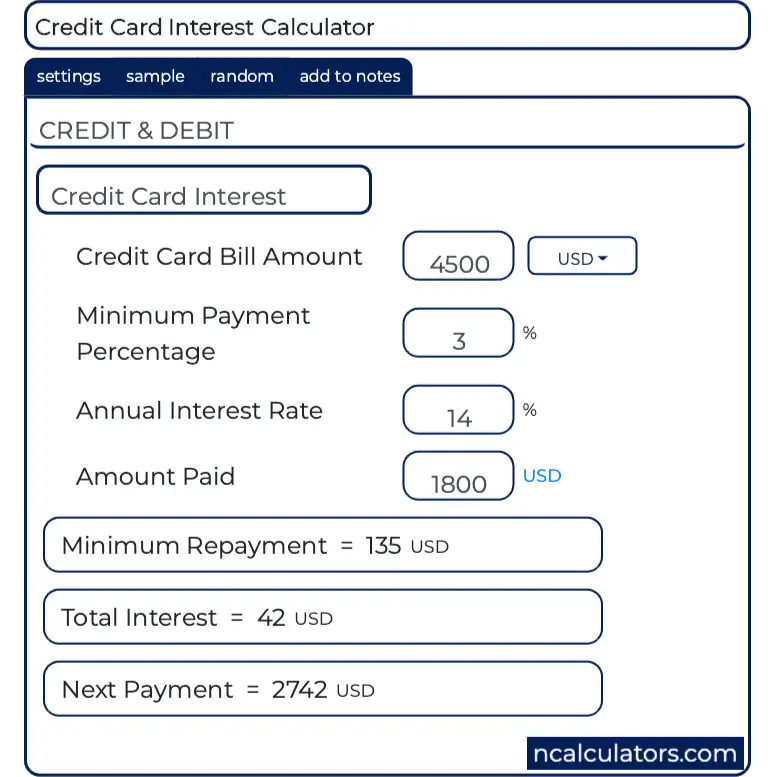

The formula for calculating monthly interest is:

= APR * (Loan Amount / 12)

This formula multiplies the APR by the loan amount divided by 12. This gives you the monthly interest charge. This is the number you’ll use in the next step.

To calculate the total interest paid, we’ll use the following formula:

= Monthly Interest * Number of Months

This formula multiplies the monthly interest charge by the number of months you’ve been repaying the debt.

To calculate the total repayment amount, we’ll use the following formula:

= Monthly Payment * Number of Months

This formula multiplies your monthly payment by the number of months you’ve been repaying the debt.

Finally, you can output the results in a clear and concise format. You can create a table with the following columns:

This template is a starting point. You can customize it to include additional information, such as:

The Excel template can be expanded to handle more complex scenarios. Here are a few examples:

Calculating your credit card interest using an Excel template is a fundamental step towards managing your debt effectively. By understanding the basics of interest rates, repayment terms, and the impact of your payments, you can gain valuable insights into your spending habits and make informed decisions about your financial future. The provided template provides a solid foundation for tracking and controlling your credit card debt. Remember that consistent monitoring and proactive repayment strategies are essential for achieving your financial goals. Credit Card Interest Calculator Excel Template empowers you to take control of your credit card finances and build a more secure financial future.

The credit card interest calculator Excel template offers a powerful and accessible tool for understanding and managing your debt. By utilizing this template and understanding the underlying principles, you can significantly improve your ability to pay down your balances, reduce your interest charges, and achieve long-term financial stability. Continuous monitoring and disciplined repayment strategies are key to maximizing the benefits of this valuable resource. Investing time in mastering this tool will undoubtedly pay dividends in the long run.