This article will guide you through understanding and utilizing credit card payment form templates. Whether you’re a small business owner, freelancer, or organization, having a professional and secure way to collect credit card payments is essential. A well-designed credit card payment form template pdf simplifies the process, ensuring you gather all the necessary information efficiently and securely. This comprehensive guide will explore the benefits, key elements, different types, and best practices for using these templates to streamline your payment collection process.

Using a pre-designed credit card payment form template pdf offers numerous advantages over creating one from scratch. One of the primary benefits is time savings. Templates provide a ready-made structure, eliminating the need to design the form elements, layout, and security features. This allows you to focus on other critical aspects of your business. Another significant advantage is professionalism. Templates are usually designed by professionals, ensuring a clean, user-friendly, and trustworthy appearance, which can enhance customer confidence.

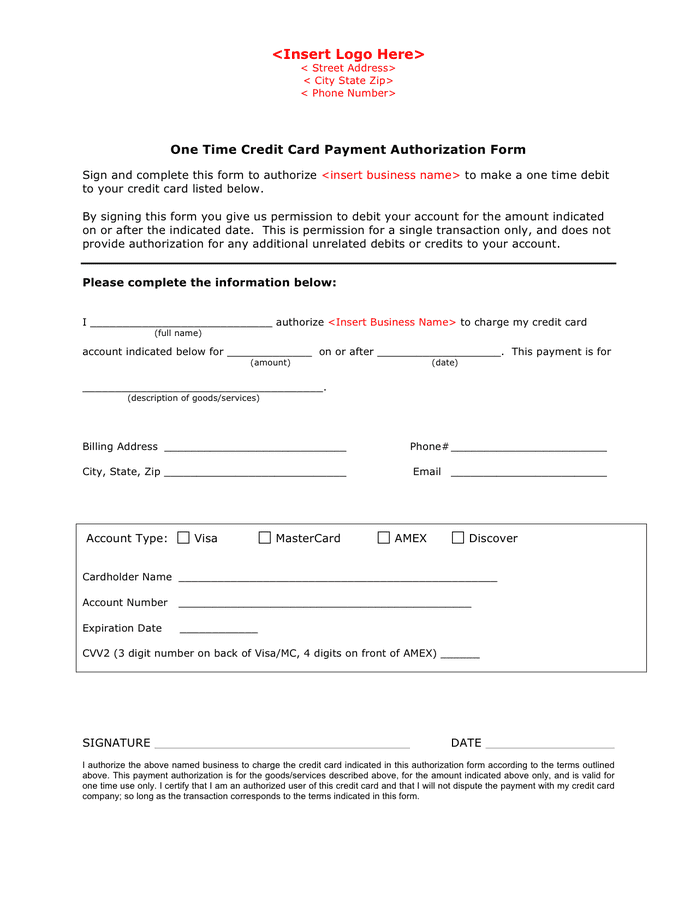

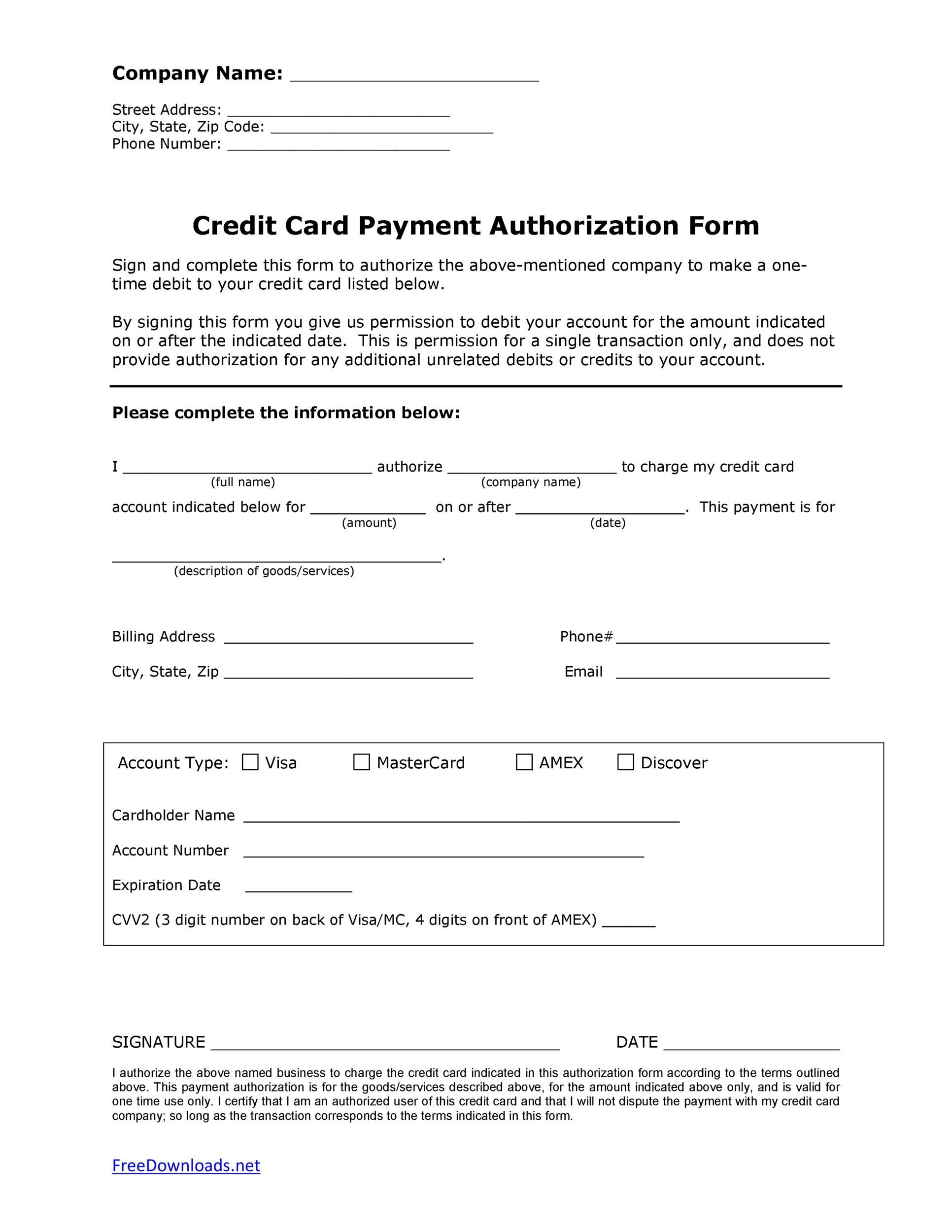

Furthermore, templates often incorporate essential security features, like fields for CVV codes, expiration dates, and card type, and can be designed to be compliant with PCI DSS (Payment Card Industry Data Security Standard), a crucial standard for protecting cardholder data. This reduces your risk of data breaches and potential legal liabilities. Finally, templates are adaptable. Most templates are easily customizable to fit your specific branding and requirements, including adding your logo, company information, and specific payment instructions.

PDF format offers several advantages for payment forms. PDFs ensure that the form’s layout and formatting remain consistent across different devices and operating systems. This prevents issues with distorted fields or misaligned elements. The use of digital signatures can further enhance security and ensure the authenticity of the form. PDFs also allow for easy integration with online payment gateways, making it straightforward to process payments electronically. The ability to easily share and distribute the form digitally is another key benefit.

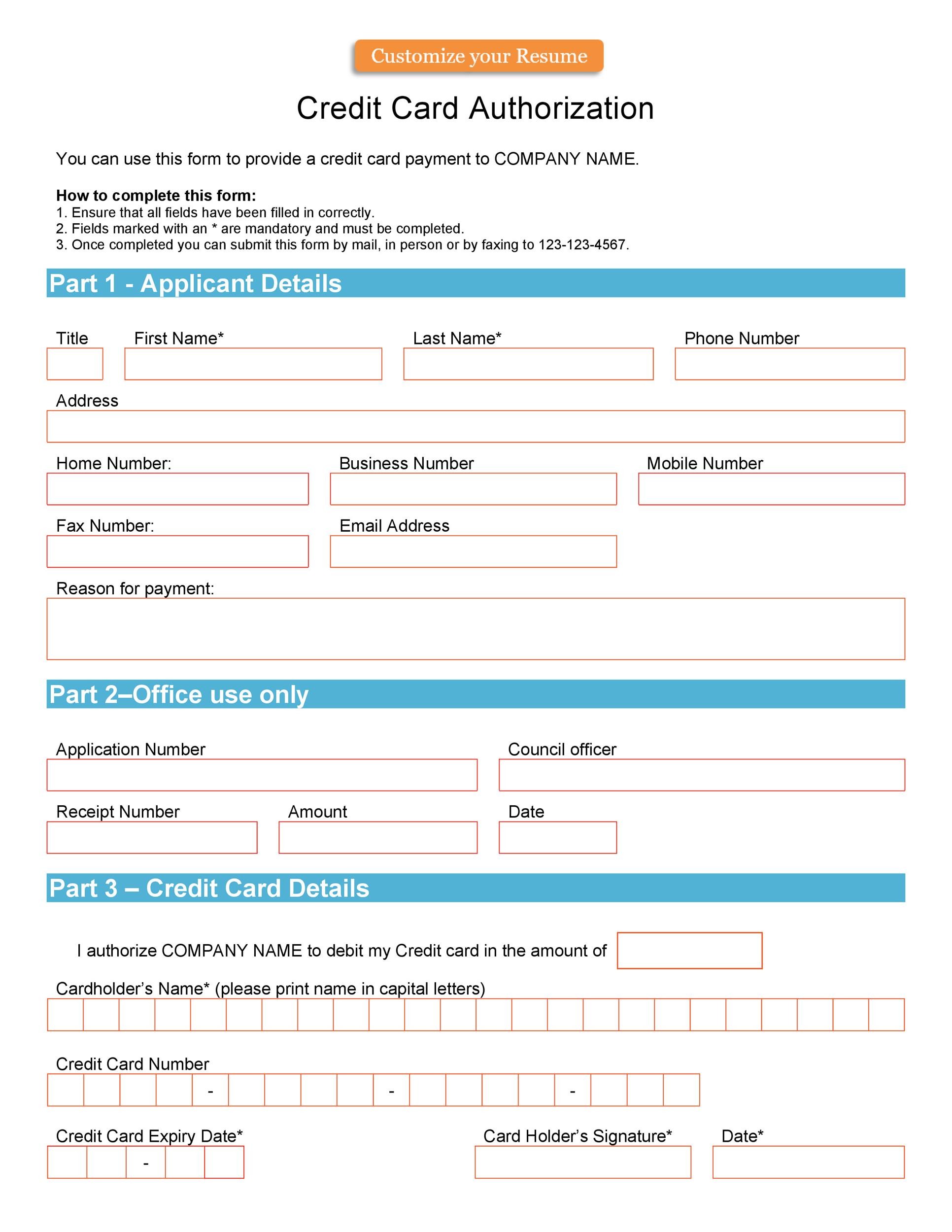

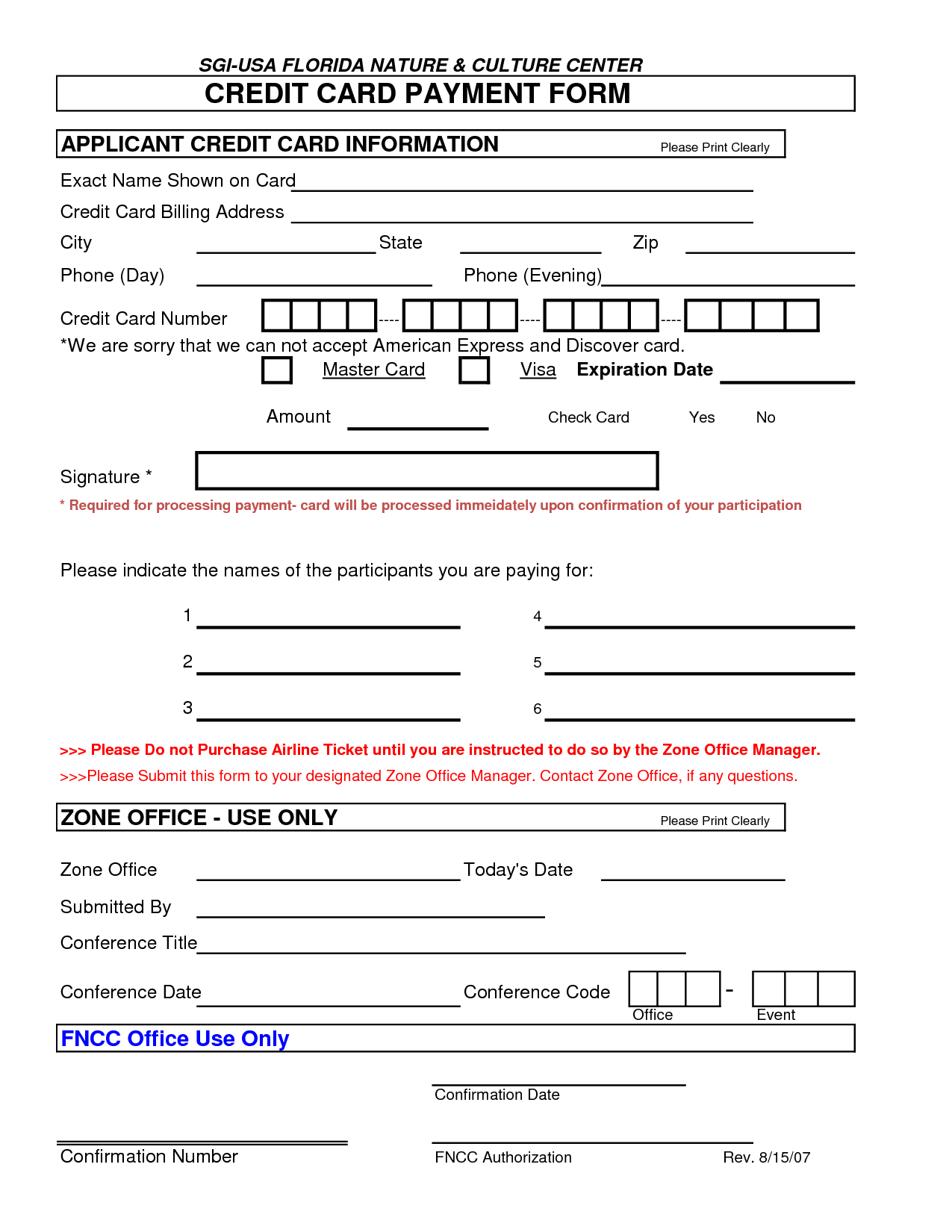

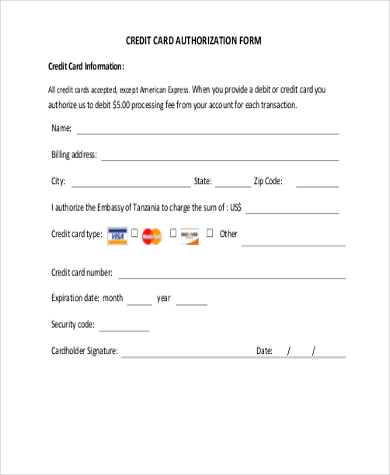

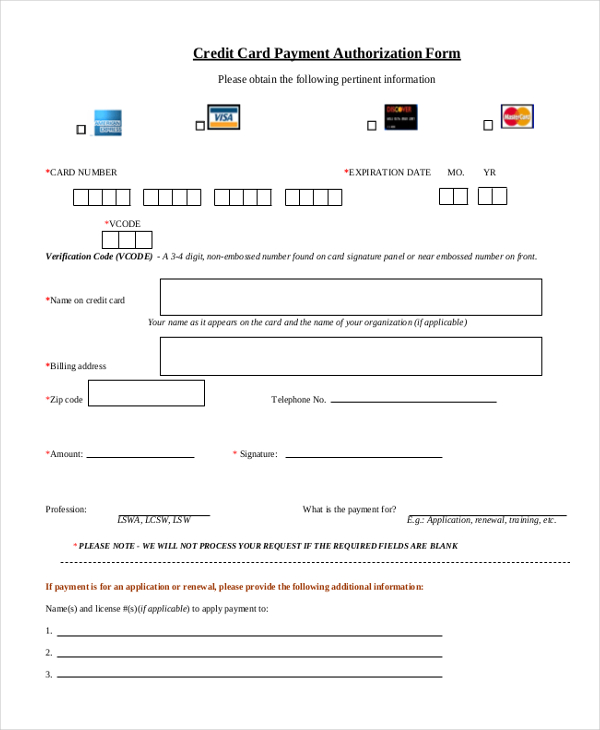

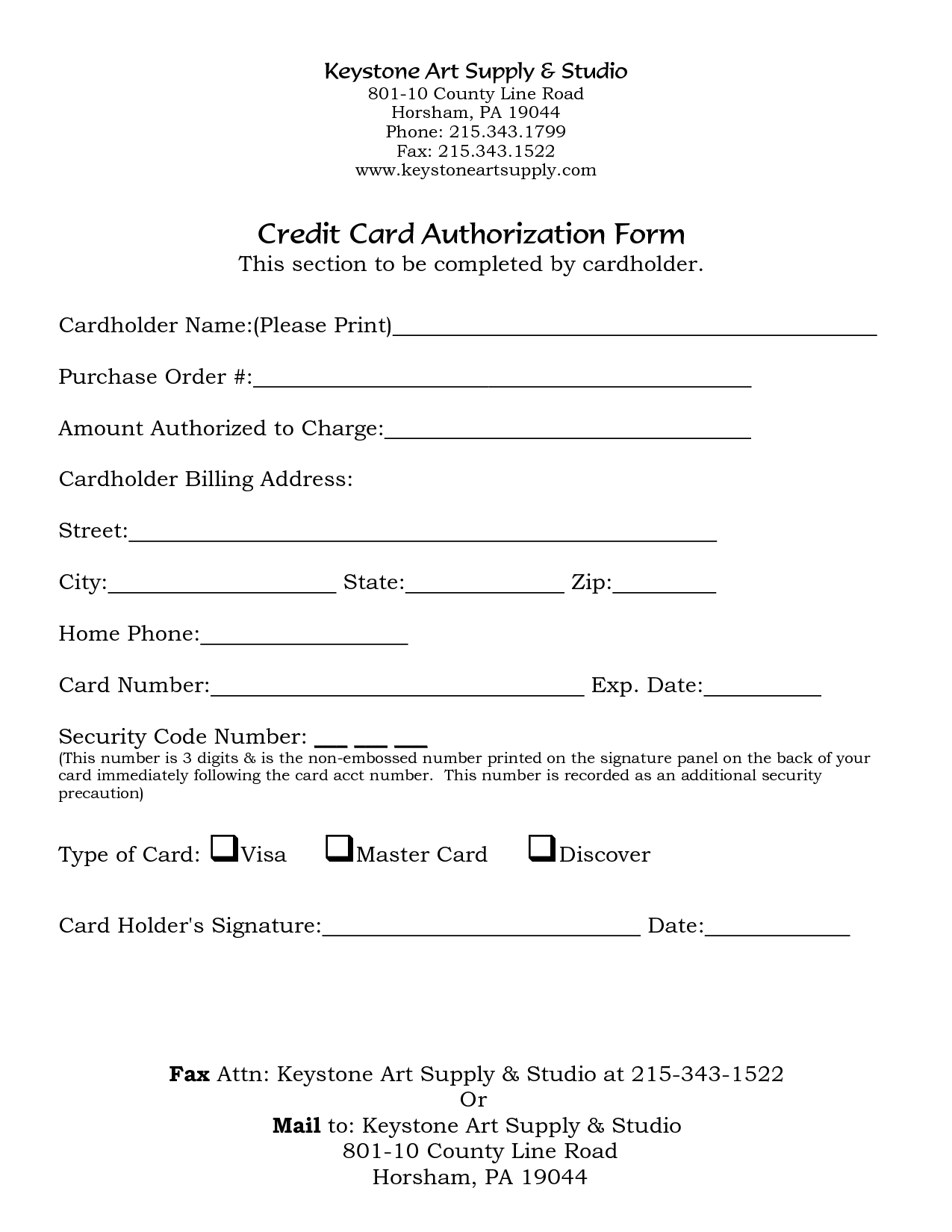

A comprehensive credit card payment form needs to include specific elements to ensure a smooth and secure payment process. Here are the essential fields:

Cardholder Name: This field requires the full name of the person whose credit card is being used.

Card Number: This is the 16-digit number printed on the front of the credit card. It’s crucial to use secure input fields (masked card number) to protect this data.

Expiration Date: This field requires the month and year the credit card expires (MM/YY).

CVV/CVC Code: This is the three or four-digit security code typically found on the back of the credit card. This is a very sensitive piece of information and must be handled with extreme care.

Card Type: This specifies the type of credit card being used (e.g., Visa, Mastercard, American Express, Discover). This information is often auto-detected based on the card number but can be included for confirmation.

Billing Address: This includes the street address, city, state/province, and zip/postal code associated with the credit card. This is often required by the credit card issuer.

Security Codes/Verification: Many forms include additional security checks, such as asking for the last four digits of the card number or requiring the cardholder to confirm their identity.

Security is paramount when dealing with credit card information. A good credit card payment form template pdf should incorporate security measures like:

Encryption: Encrypting sensitive data both in transit and at rest is essential.

HTTPS: Using HTTPS (Hypertext Transfer Protocol Secure) ensures that all communication between the form and the server is encrypted.

PCI Compliance: Adhering to the Payment Card Industry Data Security Standard (PCI DSS) is crucial for protecting cardholder data.

Data Masking: Masking the card number so that only the last few digits are visible helps prevent accidental exposure.

Several types of credit card payment form templates are available, each suited for different scenarios:

Single-Page Form: This is a concise form ideal for simple transactions or when space is limited.

Multi-Page Form: Suitable for more complex transactions or when collecting additional information beyond payment details.

Online Form: Designed for use on websites and other online platforms. These are often integrated with payment gateways for seamless processing.

Printable Form: For situations where a physical form is required. These are typically in PDF format and can be printed and filled out manually.

Many online platforms provide highly customizable credit card payment form template pdf options that can be easily embedded into your website. These often integrate directly with popular payment gateways like Stripe, PayPal, and Authorize.net. This eliminates the need to manually process payments, streamlining the entire checkout process. The customization features allow you to tailor the form’s appearance to match your brand and add additional fields as needed.

Selecting the appropriate credit card payment form template pdf depends on your specific needs. Consider these factors:

Transaction Volume: High-volume businesses might benefit from online templates integrated with payment gateways.

Security Requirements: Ensure the template incorporates robust security features and is PCI compliant.

Customization Needs: Choose a template that allows you to easily add your branding and tailor the form to your specific requirements.

Ease of Use: Select a template that is user-friendly for both you and your customers.

Following best practices can help ensure a secure and efficient payment process.

Data Minimization: Only collect the information that is absolutely necessary.

Regular Security Audits: Conduct regular security audits to identify and address potential vulnerabilities.

PCI Compliance: Maintain PCI compliance to protect cardholder data.

Clear Instructions: Provide clear instructions to customers on how to fill out the form.

Secure Hosting: Host your payment forms on a secure server.

Using a credit card payment form template pdf is a vital step for any business that accepts credit card payments. It offers numerous benefits, including time savings, increased professionalism, and enhanced security. By understanding the essential elements, different types, and best practices, you can choose the right template and create a secure and efficient payment process for your customers. Prioritizing security, adhering to PCI compliance standards, and ensuring a user-friendly experience are crucial for building trust and protecting cardholder data. Ultimately, a well-implemented payment form is an investment in your business’s success and customer satisfaction.