Are you struggling to efficiently manage your credit card payments? Do you find yourself spending hours manually entering payment details and tracking your outstanding balances? A well-structured credit card payment spreadsheet template can revolutionize your financial organization, streamlining your processes and providing valuable insights into your spending habits. This article will explore the benefits of using a spreadsheet to track your credit card payments, covering everything from creating a basic template to advanced features for analysis and control. Credit Card Payment Spreadsheet Template is more than just a tool; it’s an investment in your financial well-being. Let’s dive in.

The modern world demands efficient financial management. Many individuals and businesses find themselves overwhelmed by the sheer volume of credit card statements and payments. Traditional methods – pen and paper, or even basic spreadsheets – often fall short, leading to errors, missed payments, and a general lack of control. A dedicated spreadsheet provides a centralized, automated system for tracking your credit card payments, eliminating the need for manual entry and significantly reducing the risk of errors. This is particularly crucial for individuals who frequently make multiple payments or those who want to monitor their spending closely. The ability to quickly access and analyze payment data empowers you to proactively manage your finances and avoid potential financial pitfalls.

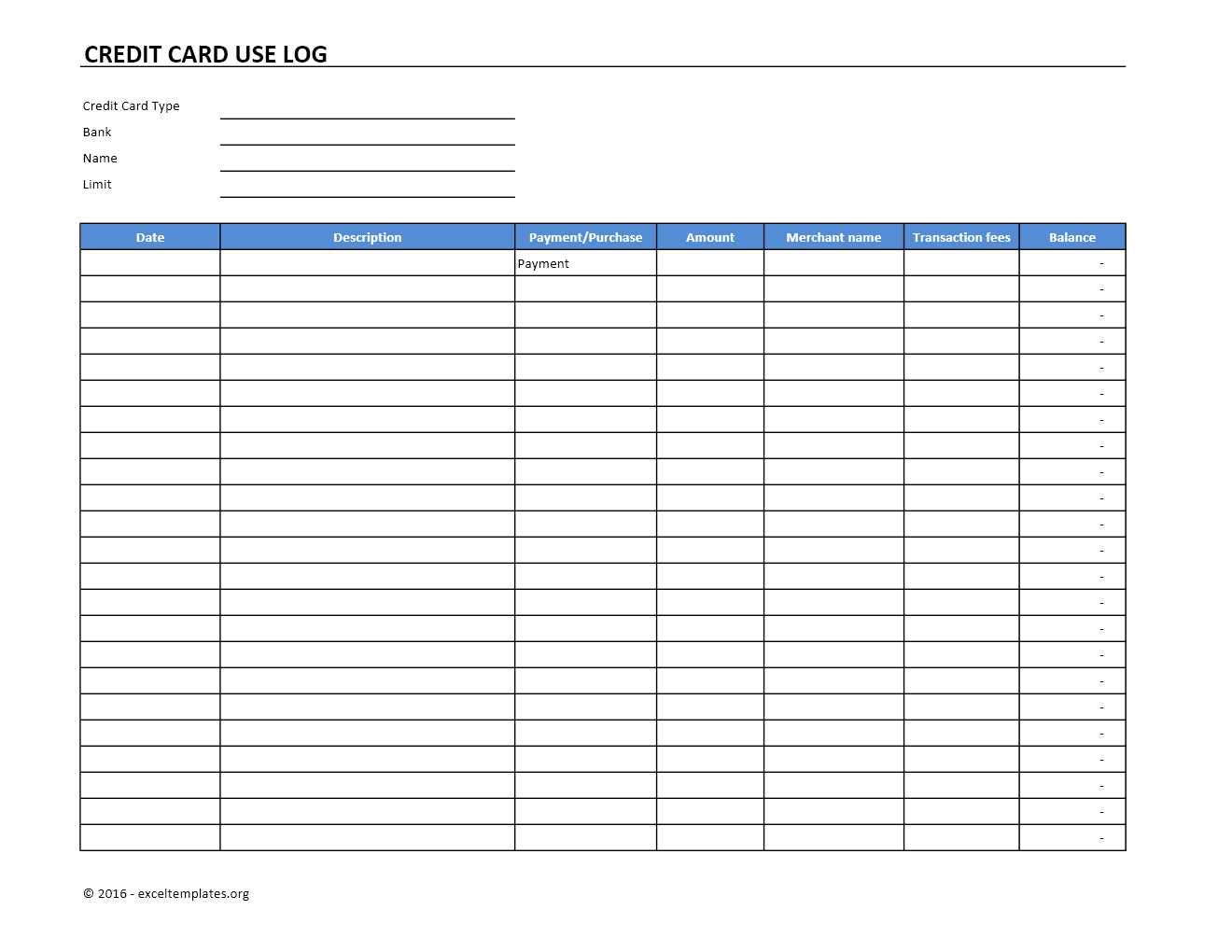

Creating a solid foundation for your spreadsheet is the first step to success. Here’s a breakdown of the essential columns you’ll need:

![]()

You can easily create this template in Google Sheets, Microsoft Excel, or any other spreadsheet program. There are numerous free templates available online that you can adapt to your specific needs. Focus on simplicity initially – you can always add more columns as your needs evolve. A clean and organized spreadsheet is far more effective than a cluttered one.

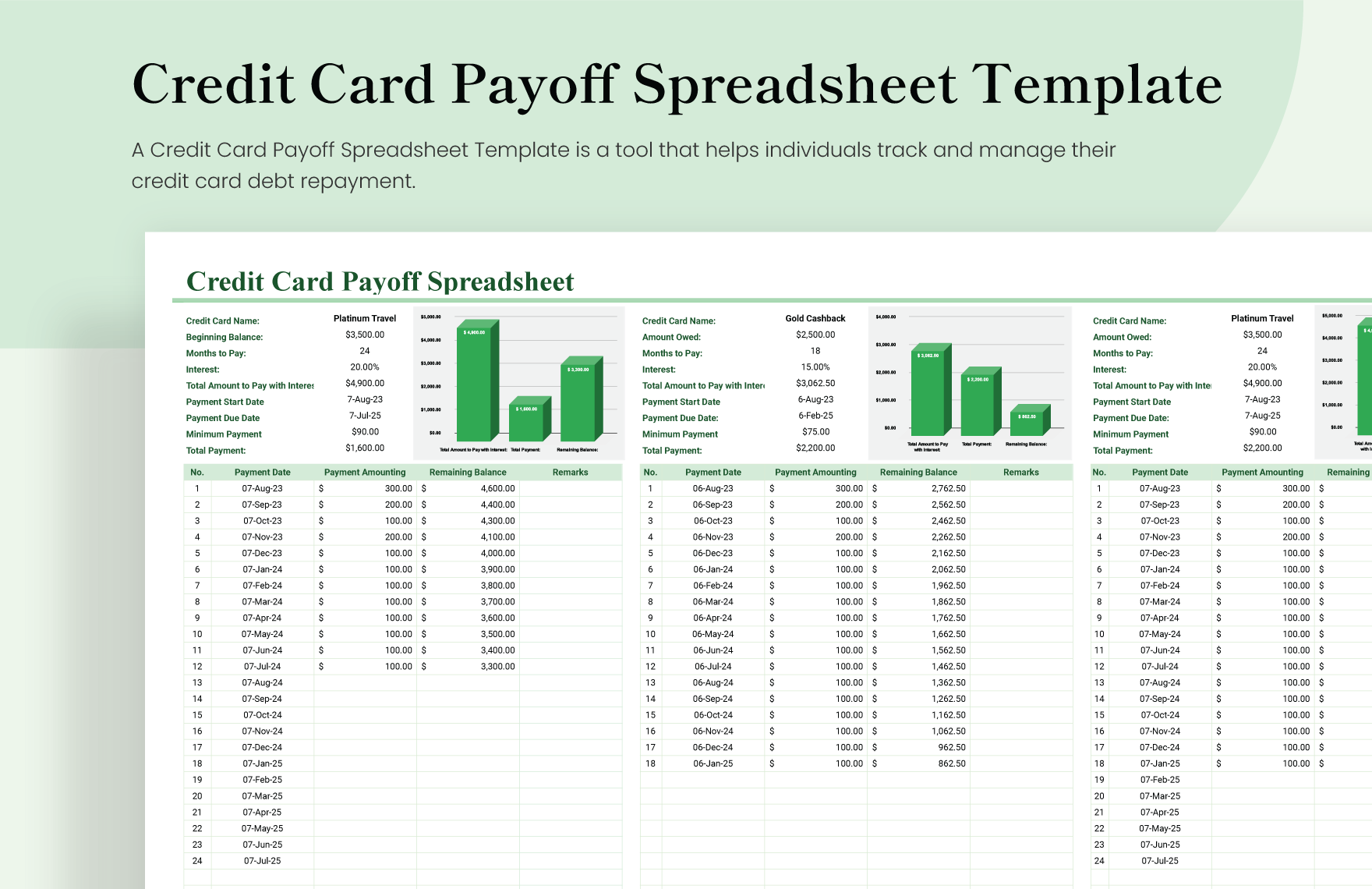

Once you have a basic template in place, you can unlock powerful features to gain deeper insights into your credit card payments.

One of the most valuable aspects of a credit card payment spreadsheet is the ability to categorize your payments. Don’t just track the amount; assign it to a relevant category. Common categories include:

![]()

Categorizing allows you to easily identify spending trends and track your overall budget. You can also use this data to create custom reports.

![]()

A crucial element of effective financial management is tracking your payment history. Your spreadsheet should allow you to easily view a chronological list of all your payments, including the date, vendor, amount, and status. This provides a clear record of your spending and helps you identify any potential issues, such as missed payments or late fees. You can also set up alerts to notify you when a payment is due.

A powerful feature of a credit card payment spreadsheet is the ability to generate reports. You can create reports based on various criteria, such as:

These reports provide valuable insights into your spending habits and help you stay on top of your finances. You can export these reports in various formats, such as CSV or PDF, for easy sharing and analysis.

![]()

Don’t let missed payments slip through the cracks. A well-designed spreadsheet can be configured to send you reminders before a payment is due. This proactive approach can help you avoid late fees and maintain a good credit score. You can customize the reminder frequency and timing to suit your individual needs.

Beyond simply tracking payments, a credit card payment spreadsheet allows you to analyze your spending data. By categorizing your payments and generating reports, you can identify areas where you can cut back on spending. Are you spending too much on dining out? Are you consistently overpaying for groceries? The insights you gain from this analysis can be invaluable in achieving your financial goals. You can also use this data to optimize your budget and make informed decisions about your spending.

A well-structured credit card payment spreadsheet template is an indispensable tool for anyone looking to take control of their finances. By automating the process of tracking payments, categorizing spending, and generating reports, you can gain valuable insights into your financial habits and make informed decisions about your spending. The benefits extend far beyond simple tracking – it empowers you to proactively manage your finances, avoid costly errors, and ultimately achieve your financial goals. Investing time in creating a robust spreadsheet is an investment in your future financial well-being. Don’t underestimate the power of a simple, well-organized system. Credit Card Payment Spreadsheet Template is a foundational element for a financially healthy life.

Ultimately, a comprehensive credit card payment spreadsheet template provides a powerful platform for financial control and awareness. By consistently utilizing this tool, individuals and businesses can significantly improve their financial management, reduce stress, and achieve greater financial stability. The ability to quickly and accurately track payments, categorize spending, and generate insightful reports is a game-changer for anyone seeking to optimize their financial situation. Remember to regularly review and update your spreadsheet to ensure it remains relevant and effective. Continuous improvement is key to maximizing its value.