Creating and managing your credit card statement can often feel like a daunting task. It’s a detailed record of your spending, payments, and balances, and it’s essential for staying on top of your finances. A well-formatted credit card statement is crucial for accurate record-keeping, potential dispute resolution, and understanding your financial health. This guide will walk you through creating a professional-looking credit card statement template, covering everything from the basic structure to helpful tips for simplifying the process. Credit Card Statement Template is the core of this guide, offering practical advice and examples to help you navigate this often-complex document. Understanding how to create a clear and organized statement is a significant step towards responsible financial management.

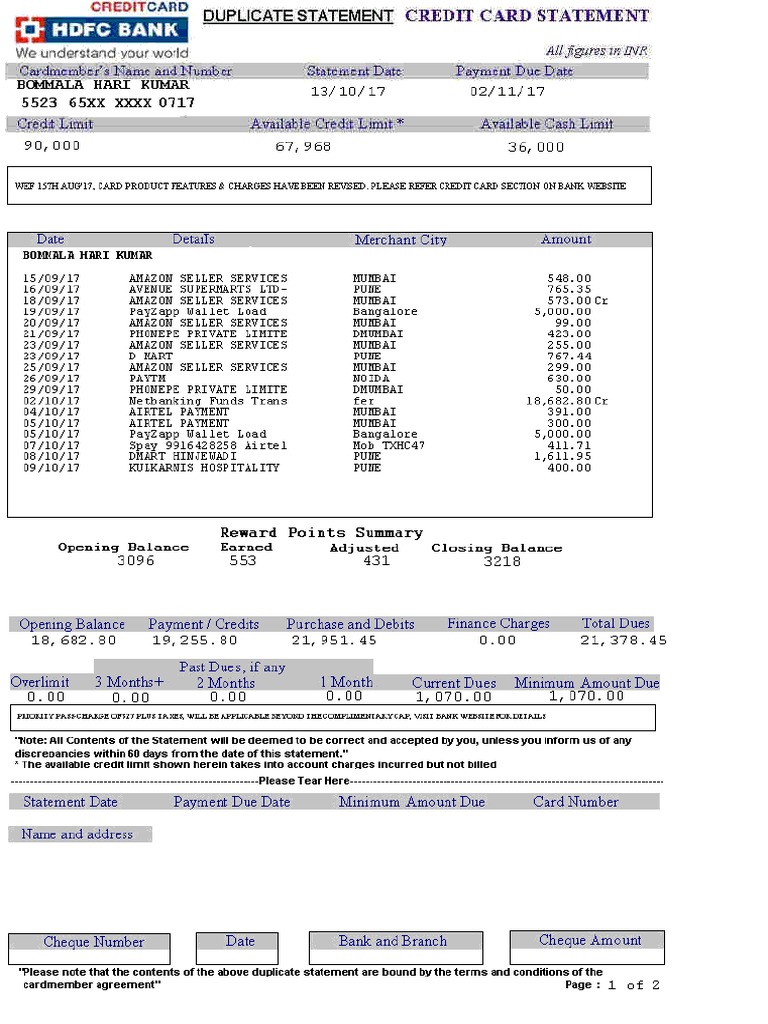

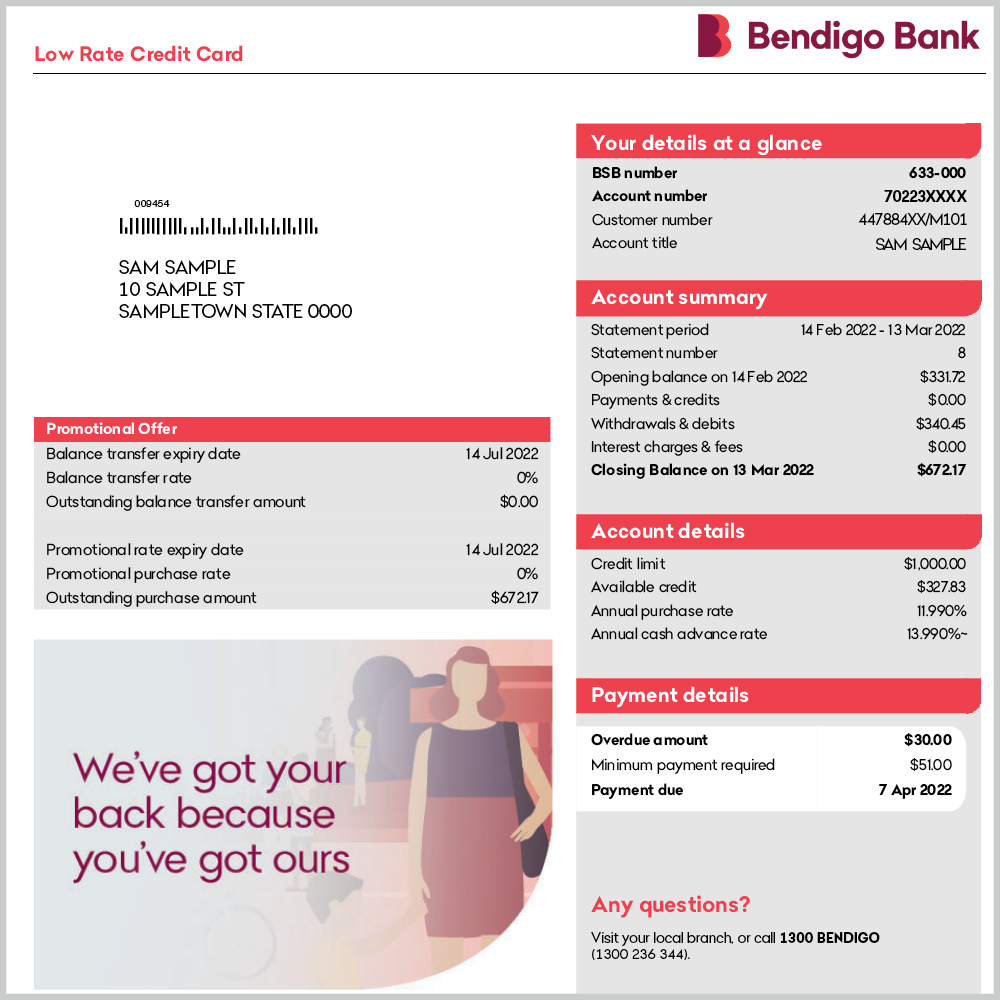

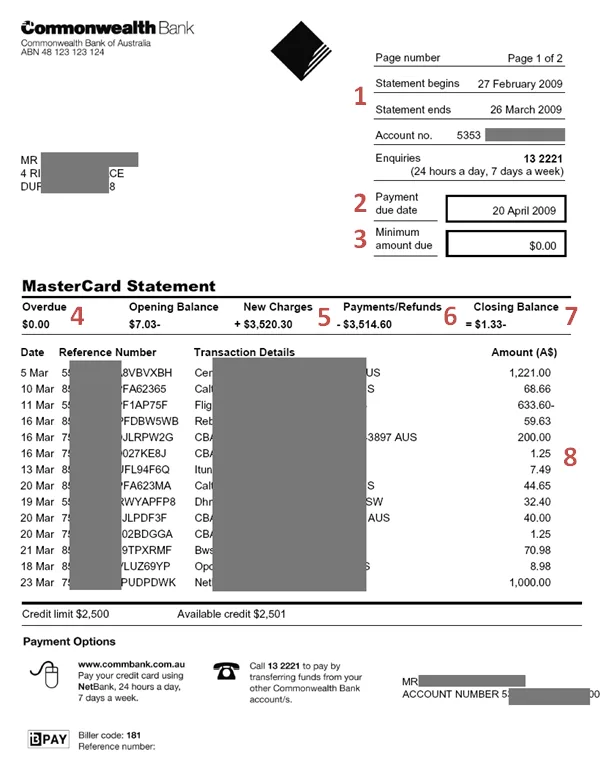

The process of generating a credit card statement can vary slightly depending on your bank or credit card issuer. However, the fundamental elements remain consistent. A standard credit card statement typically includes several key sections, each providing valuable information about your account. It’s important to note that the specific layout and content may differ, so always refer to your bank’s official guidelines for the most accurate information. Furthermore, many banks offer online tools and templates that can streamline the process, making it easier to create a professional-looking statement.

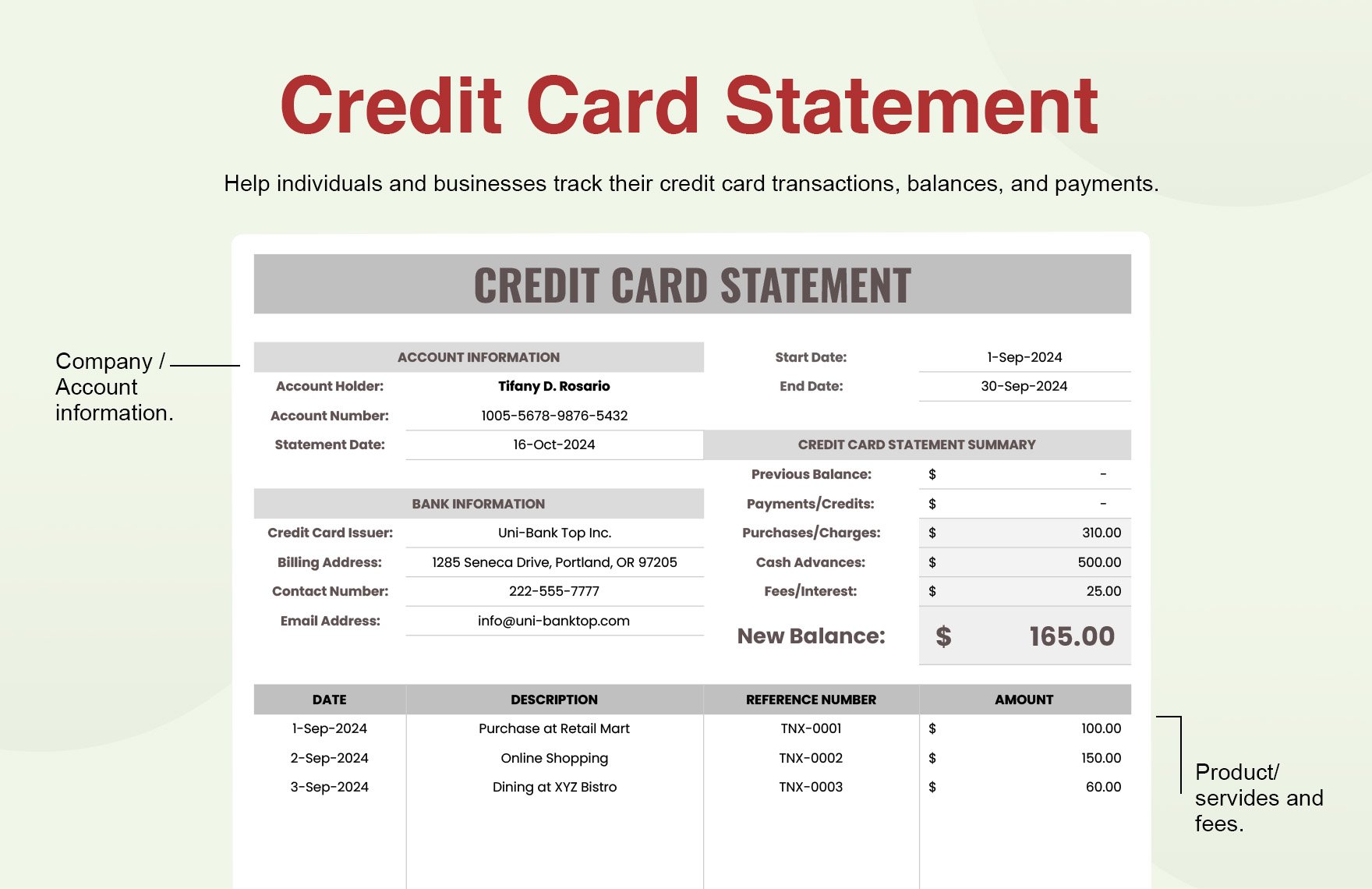

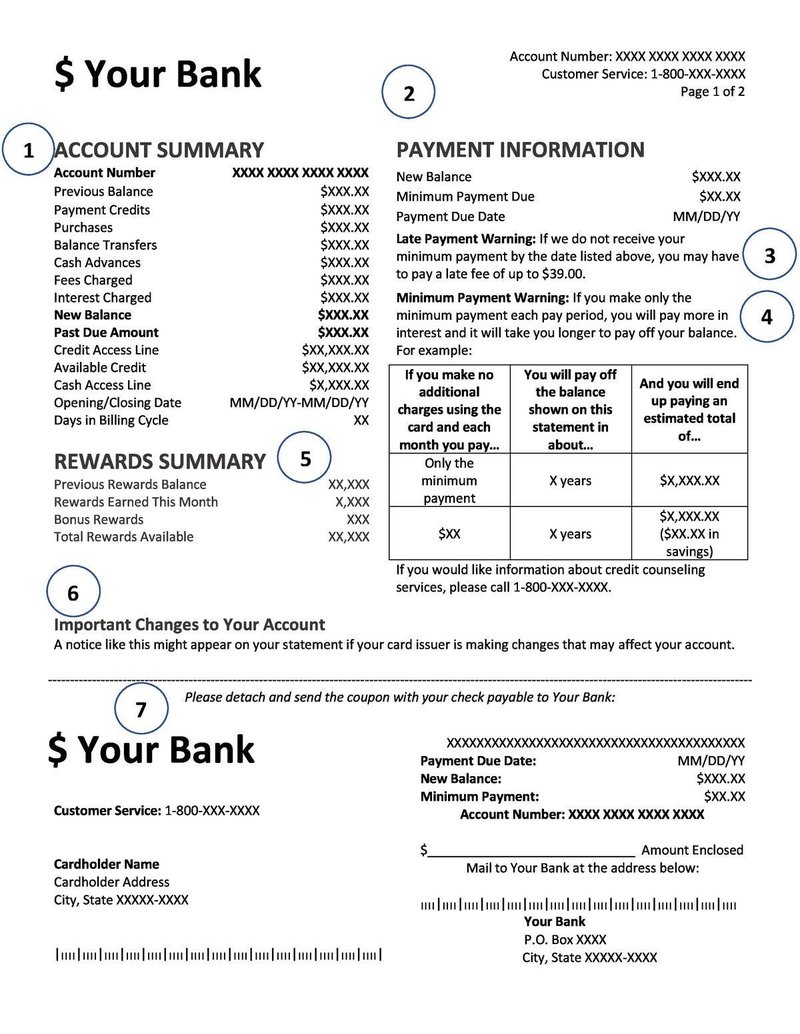

Let’s start with the basic structure of a credit card statement. A typical credit card statement will generally include the following sections:

Now, let’s delve into the practical aspects of creating a credit card statement template. Here’s a breakdown of the key elements and how to format them effectively:

Beyond the essential information, a well-formatted statement can significantly enhance its readability. Here are some additional tips:

The accuracy of your credit card statement is paramount. Incorrect or incomplete information can lead to disputes, late fees, and potential financial problems. Always double-check your statements carefully and promptly report any discrepancies to your bank. Maintaining accurate records is a key component of responsible credit card usage.

Creating a professional and informative credit card statement template is a valuable skill for anyone managing their finances. By understanding the basic structure, utilizing clear formatting, and prioritizing accuracy, you can ensure that your statement is both easy to read and a valuable tool for tracking your spending and managing your credit. Credit Card Statement Template is a fundamental tool for financial control, and mastering its creation and utilization can significantly improve your financial well-being. Remember to always consult your bank’s official guidelines for the most accurate and up-to-date information.

The credit card statement is more than just a document; it’s a reflection of your financial activity. A well-structured and accurately presented statement empowers you to understand your spending habits, track your progress towards your financial goals, and proactively address any potential issues. By investing time in creating a clear and organized statement, you’re investing in a more secure and informed financial future. Properly utilizing this template will undoubtedly contribute to better financial management.