Your credit report is a crucial document that lenders, landlords, and even employers use to assess your financial trustworthiness. Unfortunately, errors can and do occur on these reports, potentially harming your credit score and limiting your access to credit. The good news is that you have the right to dispute inaccurate information and have it corrected. This process starts with a well-crafted credit dispute letter.

Navigating the credit repair process can feel overwhelming, especially if you’re unfamiliar with the Fair Credit Reporting Act (FCRA), which protects your rights as a consumer. That’s why we’ve created this resource, complete with a free credit dispute letter template, to help you take control of your credit health. Our template is designed to be easy to use and customizable to your specific situation.

Why Use a Credit Dispute Letter Template?

Using a template offers several advantages when disputing errors on your credit report:

- Clarity and Organization: A template provides a structured framework to ensure you include all necessary information.

- Professionalism: A well-written letter demonstrates that you’re taking the dispute seriously.

- Accuracy: A template helps you avoid common mistakes and ensures you cite the correct legal protections.

- Efficiency: Save time and effort by simply filling in the blanks of a pre-written template.

What to Include in Your Credit Dispute Letter

While our template will guide you, here are the key components to include in your credit dispute letter:

- Your Full Name and Address: Ensure accurate identification.

- Date: Document the date the letter was sent.

- Credit Reporting Agency’s Name and Address: Send the letter to the correct recipient (e.g., Experian, Equifax, TransUnion).

- Account Number(s) in Question: Clearly identify the specific accounts with errors.

- Specific Error(s) Identified: Describe the inaccurate information in detail (e.g., incorrect payment history, wrong account balance, account belonging to someone else).

- Explanation of Why the Information is Incorrect: Provide a clear and concise explanation of why you believe the information is inaccurate. Back it up with documentation whenever possible.

- Request for Investigation and Correction: Clearly state that you are requesting the credit reporting agency to investigate the disputed information and correct it if found to be inaccurate.

- Copies of Supporting Documentation: Include copies (never originals!) of any documents that support your claim, such as payment records, account statements, or identity theft reports.

- Your Signature: A signed letter is required for verification.

Free Credit Dispute Letter Template

Below is a basic HTML template for your credit dispute letter. Remember to replace the bracketed placeholders with your own information and adapt it to your specific situation. You can copy and paste this into a text editor, customize it, and then print it.

-

Sample Credit Dispute Letter Template

Here’s a sample credit dispute letter template in HTML format:

<p>[Your Full Name]<br> [Your Address]<br> [Your City, State, Zip Code]<br> [Your Phone Number]<br> [Your Email Address]</p> <p>[Date]</p> <p>[Credit Reporting Agency Name]<br> [Credit Reporting Agency Address]<br> [Credit Reporting Agency City, State, Zip Code]</p> <p><strong>Subject: Credit Report Dispute</strong></p> <p>To Whom It May Concern:</p> <p>I am writing to dispute the following information on my credit report(s) from [Credit Reporting Agency Name]. My credit report was accessed on [Date you accessed your credit report] and contained the following inaccurate information:</p> <ul> <li>Account Name: [Account Name]<br> Account Number: [Account Number]<br> Specific Error: [Describe the specific error, e.g., incorrect balance, late payment reported in error, account not belonging to me]<br> Explanation: [Explain why the information is incorrect. Be clear and concise.]</li> <!-- Add more <li> elements for each disputed item --> </ul> <p>I am requesting that you investigate these items and correct or remove the inaccurate information as required under the Fair Credit Reporting Act (FCRA).</p> <p>I have enclosed copies of [List enclosed documents, e.g., payment records, ID] to support my claim. Please note that these are copies; I am retaining the originals for my records.</p> <p>My identifying information is as follows:</p> <ul> <li>Full Name: [Your Full Name]</li> <li>Date of Birth: [Your Date of Birth]</li> <li>Social Security Number: [Your Social Security Number (Optional - use with caution)]</li> <li>Current Address: [Your Current Address]</li> <li>Previous Address (if applicable): [Your Previous Address]</li> </ul> <p>Please notify me of the results of your investigation in writing within the timeframe required by the FCRA.</p> <p>Thank you for your time and attention to this matter.</p> <p>Sincerely,<br> [Your Signature]<br> [Your Typed Name]</p>

Important Considerations:

- Send via Certified Mail with Return Receipt Requested: This provides proof that the credit reporting agency received your letter.

- Keep Copies of Everything: Maintain copies of your dispute letter, supporting documents, and any correspondence you receive from the credit reporting agency.

- Be Patient: Credit reporting agencies have 30 days to investigate your dispute.

Taking control of your credit report is an essential step towards financial health. By using our credit dispute letter template and following these guidelines, you can effectively challenge inaccurate information and improve your credit score. Don’t hesitate to start the process today!

If you are looking for Explore Our Image of Credit Inquiry Removal Letter Template | Credit you’ve came to the right place. We have 9 Images about Explore Our Image of Credit Inquiry Removal Letter Template | Credit like Credit Report Dispute Letter Template – Sarseh.com, 50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab and also Free Section 609 Credit Dispute Letter Template Of 609 Dispute Letter. Read more:

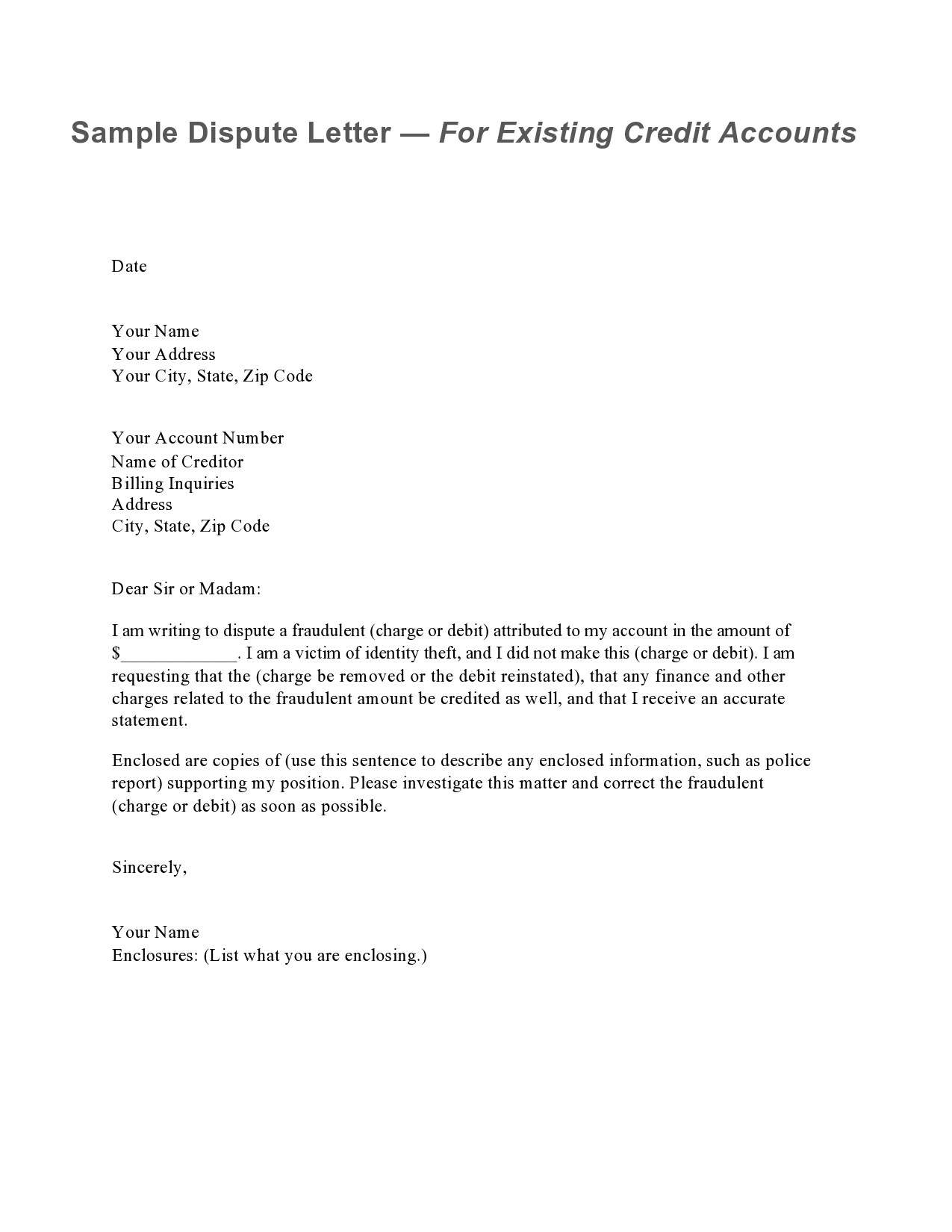

Explore Our Image Of Credit Inquiry Removal Letter Template | Credit

www.pinterest.com

dispute removal inquiry bureaus letters habit example debt creditor atlantaauctionco vancecountyfair

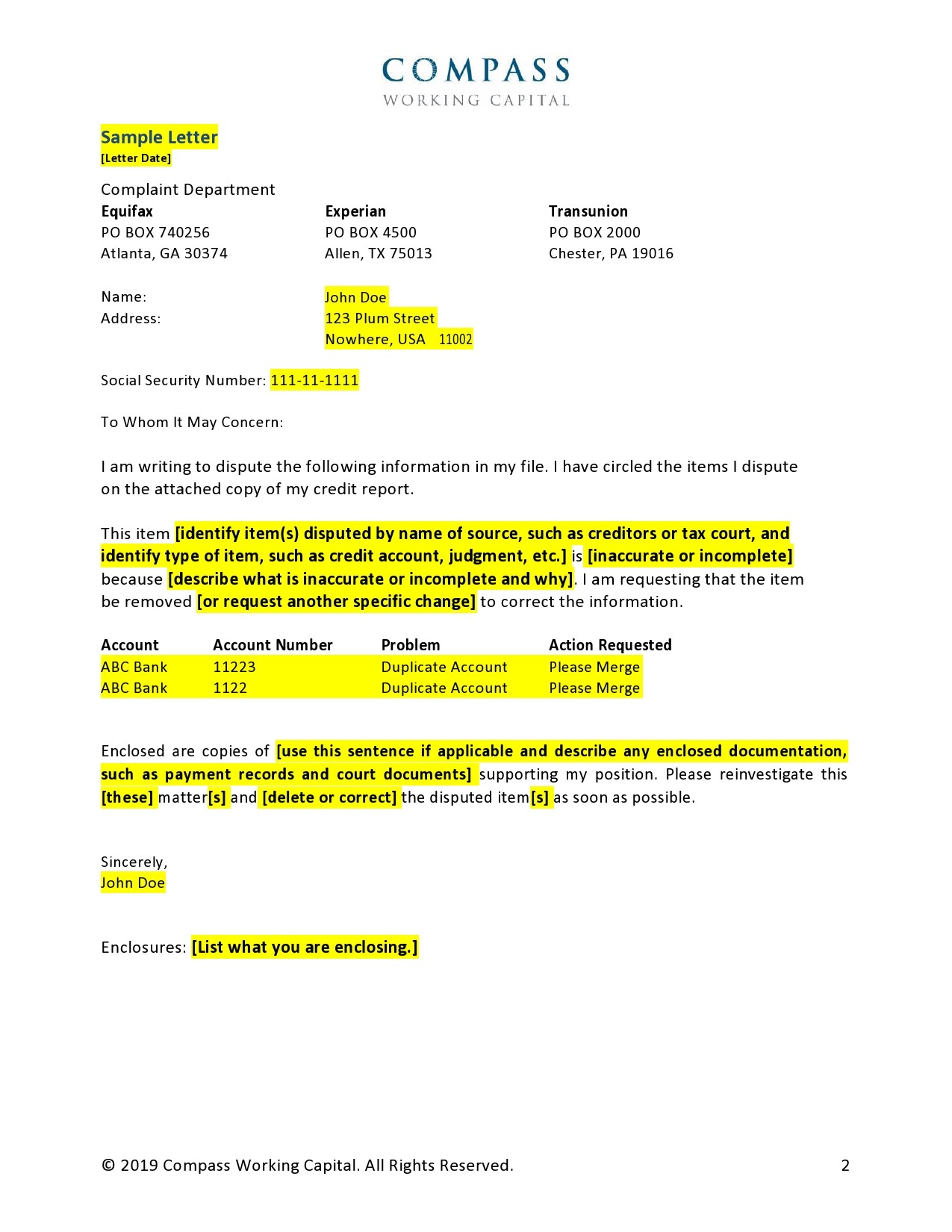

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-03.jpg)

templatelab.com

Dispute Collection Letter Template

templates.rjuuc.edu.np

Rental Dispute Letter Templates

old.sermitsiaq.ag

Free Section 609 Credit Dispute Letter Template Of 609 Dispute Letter

www.heritagechristiancollege.com

609 dispute bureau inquiries heritagechristiancollege explanation exposed

Credit Report Dispute Letter Template – Sarseh.com

sarseh.com

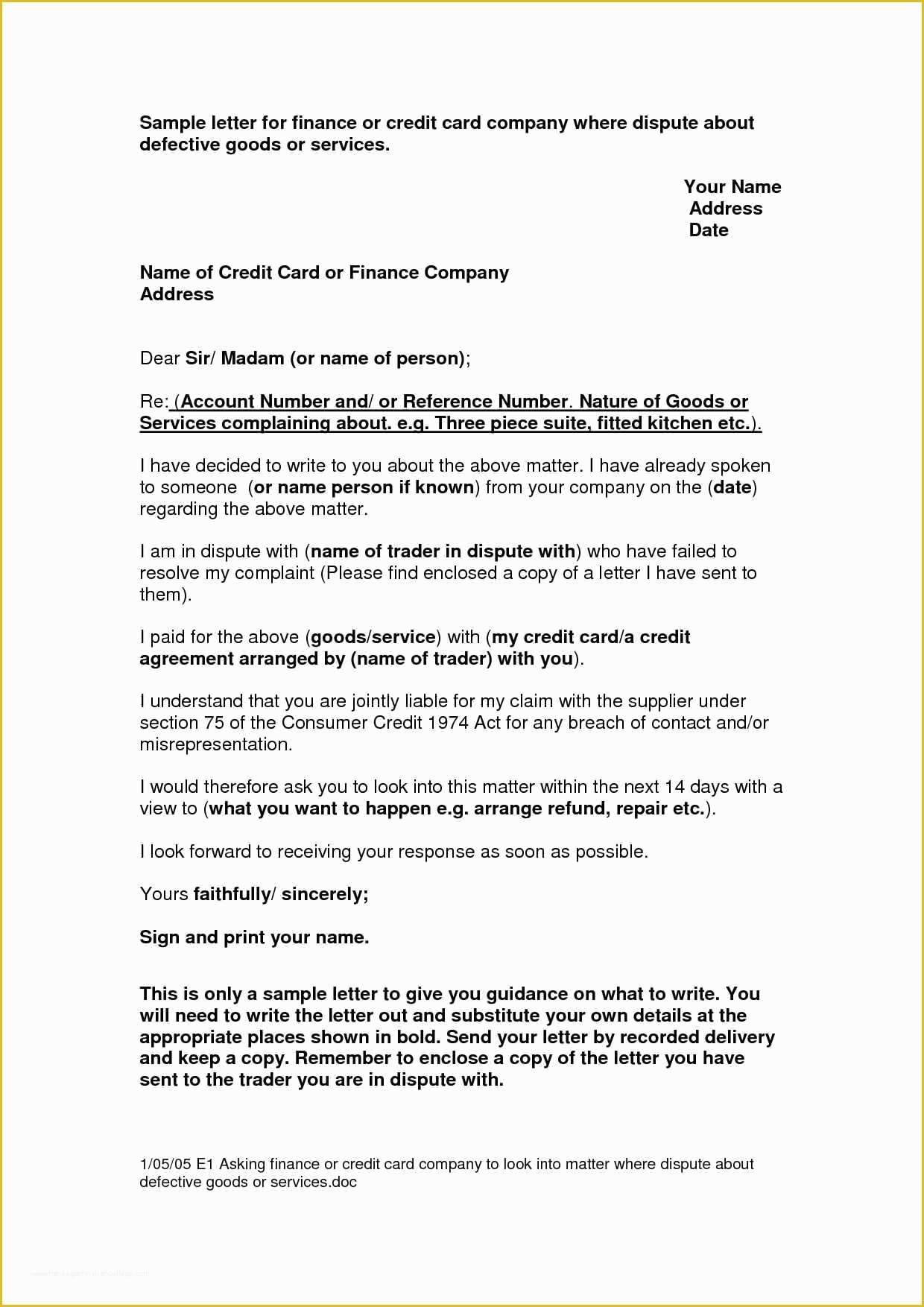

Credit Card Dispute Letter Template

old.sermitsiaq.ag

50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab

![50 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-07.jpg)

templatelab.com

609 Letter Template Free Of Section 609 Credit Dispute Letter Template

www.heritagechristiancollege.com

609 template dispute section vorstellung eigenen schreibt angebote firmen muster heritagechristiancollege kunjungi

Free section 609 credit dispute letter template of 609 dispute letter. Credit card dispute letter template. Explore our image of credit inquiry removal letter template