Maintaining a good credit score is vital for financial health, impacting everything from loan approvals to interest rates. However, errors on your credit report are surprisingly common. These inaccuracies can negatively affect your score, leading to denied credit, higher insurance premiums, and even difficulty securing employment. Fortunately, you have the right to dispute these errors with the credit bureaus – Experian, Equifax, and TransUnion – and a well-crafted Credit Report Dispute Letter Template can significantly increase your chances of a successful outcome. This article will guide you through the process, providing templates and advice to help you correct inaccuracies and improve your credit standing.

Dealing with credit report errors can feel daunting, but it’s a crucial step in protecting your financial well-being. The Fair Credit Reporting Act (FCRA) grants you the right to dispute information on your credit report that you believe is inaccurate, incomplete, or unverifiable. This includes errors like incorrect account balances, wrongly reported late payments, accounts that don’t belong to you, or outdated information. Ignoring these errors won’t make them disappear; proactively disputing them is the most effective way to rectify the situation.

The key to a successful dispute lies in providing clear, concise, and documented evidence. Simply stating an error exists isn’t enough. You need to explain why the information is incorrect and provide supporting documentation to back up your claim. This is where a solid Credit Report Dispute Letter Template becomes invaluable. It ensures you include all the necessary information and present your case in a professional manner.

Before diving into the templates, it’s important to understand the dispute process. The FCRA mandates that credit bureaus investigate your dispute within 30 days (or 45 days if you submit additional information). During the investigation, they are required to forward your dispute to the information provider – the lender, creditor, or other entity that reported the information.

Experian, Equifax, and TransUnion are the three major credit bureaus in the United States. They collect and maintain credit information on consumers. When you dispute an error, they act as intermediaries, verifying the information with the source. They don’t decide whether the information is accurate; they simply investigate and report the results back to you.

The information provider is the entity that originally reported the inaccurate information. They are responsible for verifying the accuracy of the data they provided. If they can’t verify the information, the credit bureau must remove it from your report.

After the investigation, the credit bureau will notify you of the results. There are three possible outcomes:

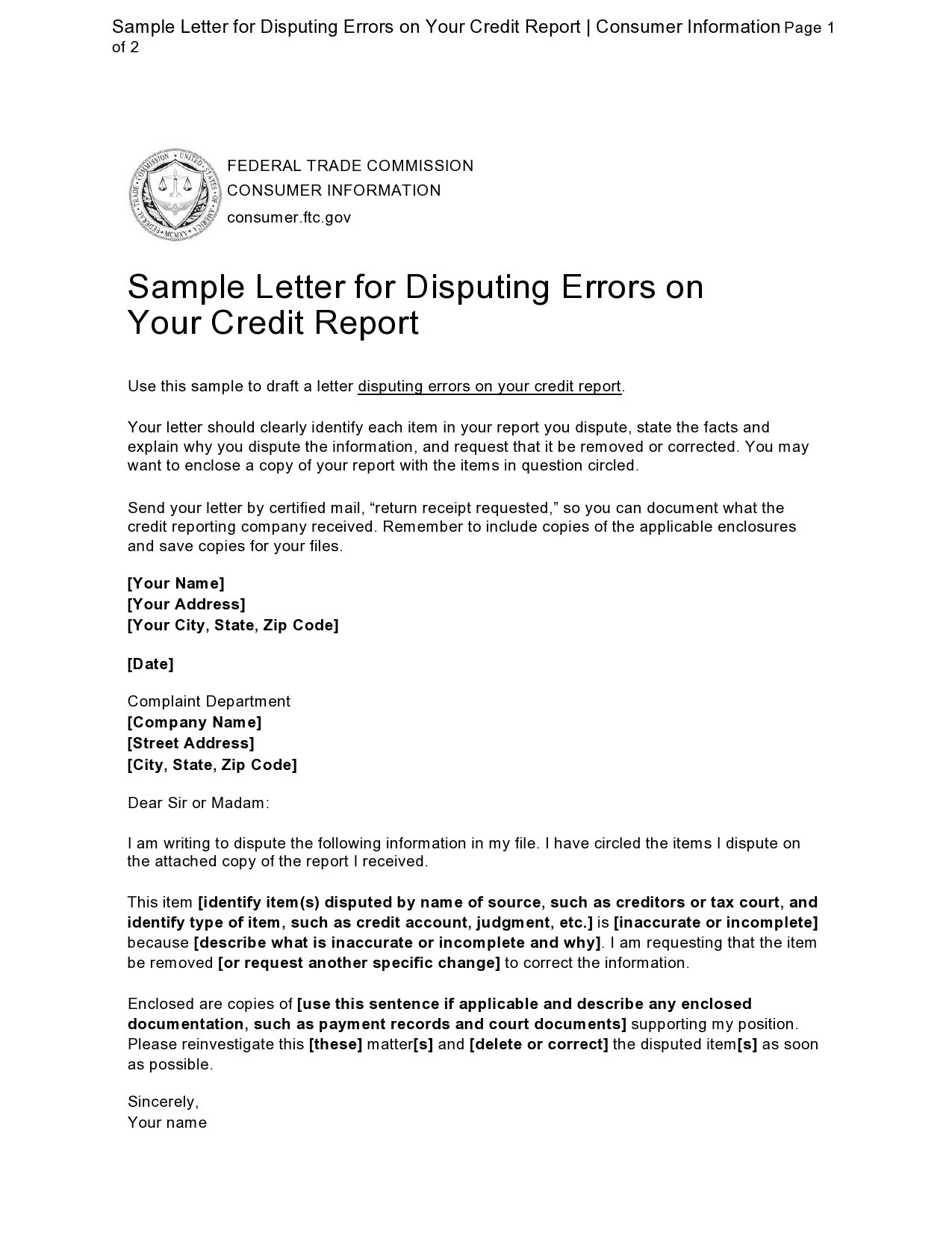

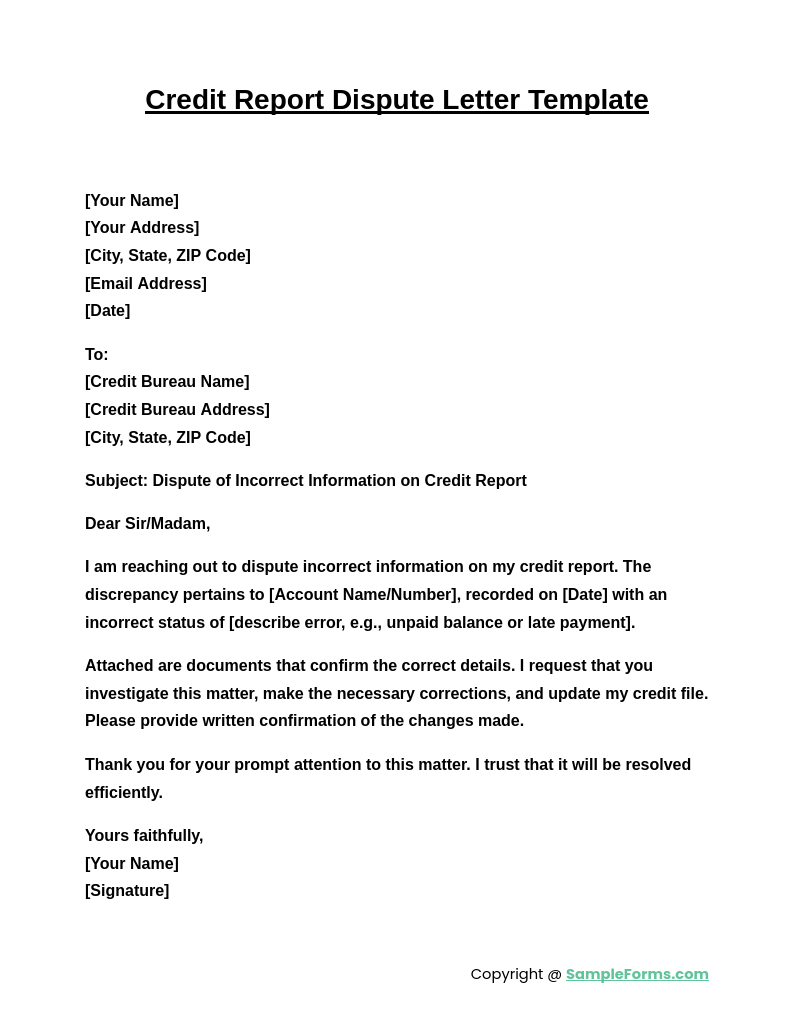

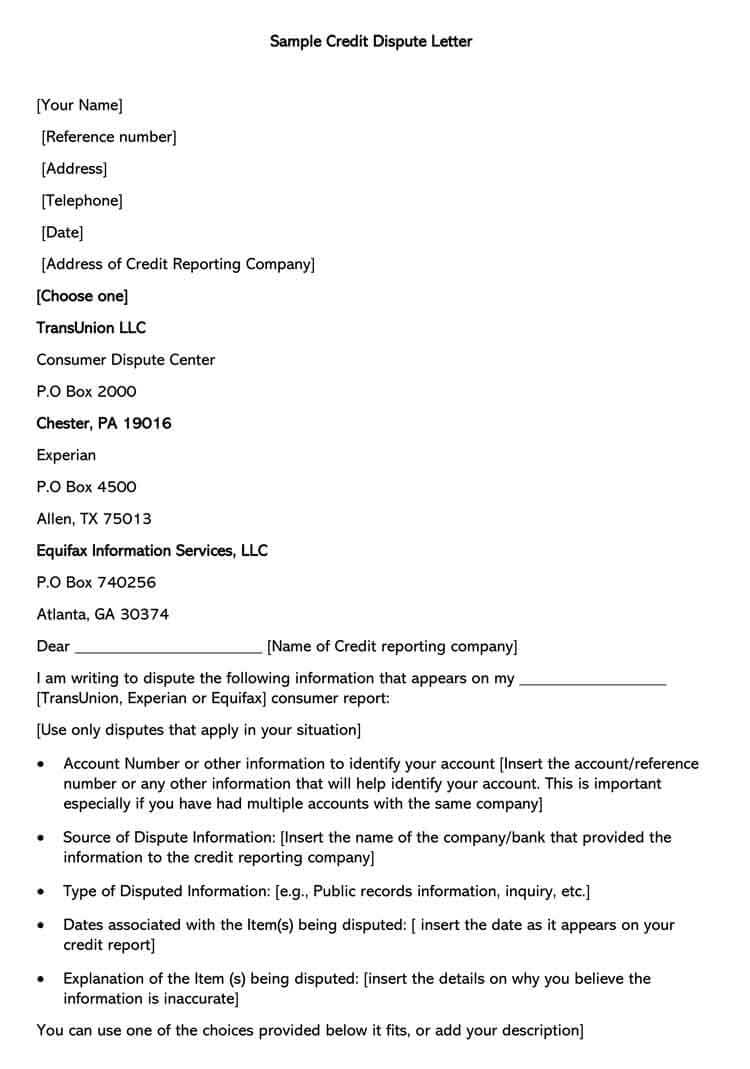

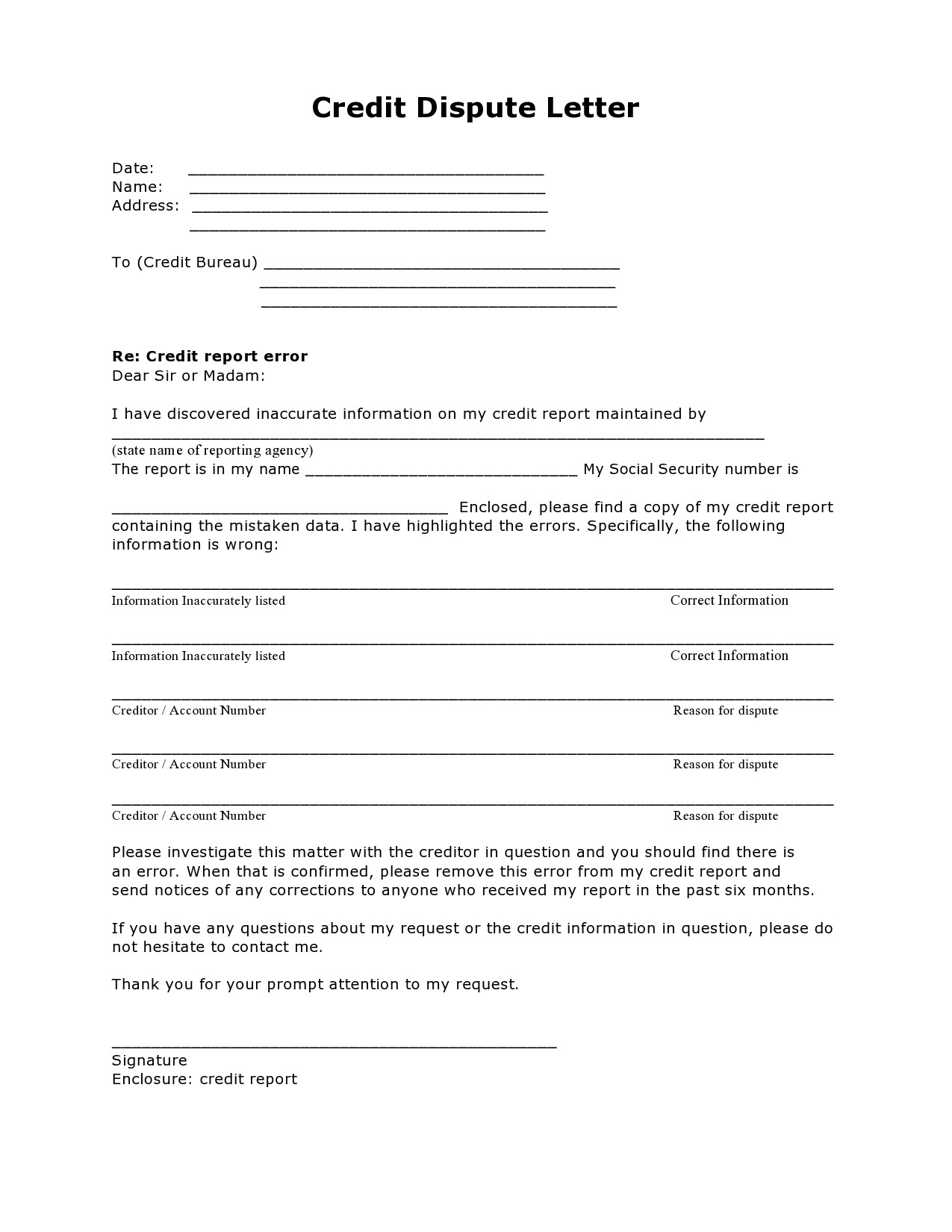

A well-written dispute letter is crucial for success. Here’s a breakdown of the essential components:

Using a Credit Report Dispute Letter Template can save you time and ensure you include all the necessary information. Here’s a basic template you can adapt:

[Your Name]

[Your Address]

[Your City, State, Zip Code]

[Date]

[Credit Bureau Name]

[Credit Bureau Address]

[Credit Bureau City, State, Zip Code]

Dear [Credit Bureau Name] Dispute Department,

I am writing to dispute inaccurate information on my credit report. I am disputing the following item(s):

[Specifically describe the inaccurate information. Be detailed.]

I believe this information is inaccurate because [Explain why the information is incorrect. Provide specific reasons].

I have enclosed copies of the following documents to support my dispute:

[List enclosed documents]

I request that you investigate this matter thoroughly and correct or remove the inaccurate information from my credit report.

Thank you for your time and attention to this matter.

Sincerely,

[Your Signature]

[Your Typed Name]

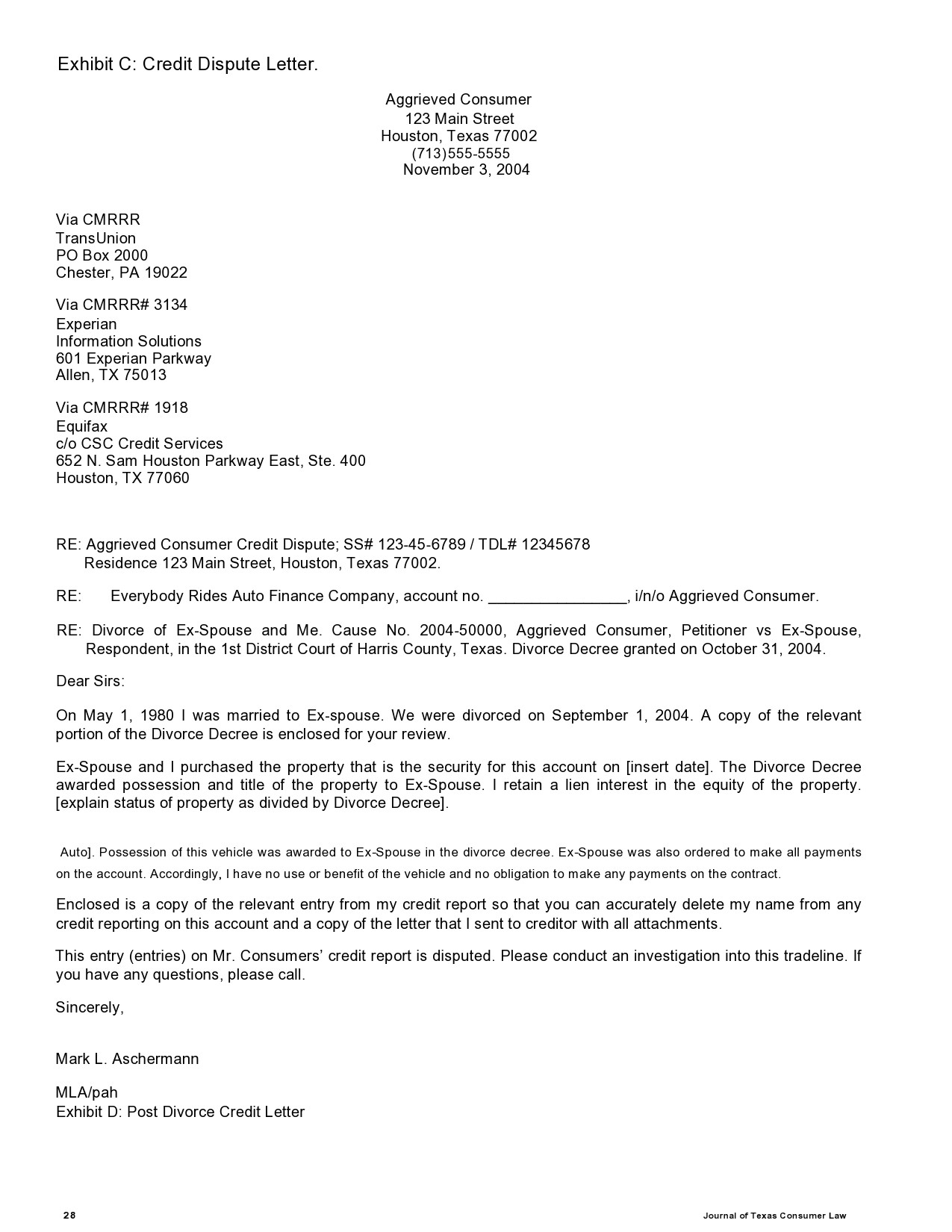

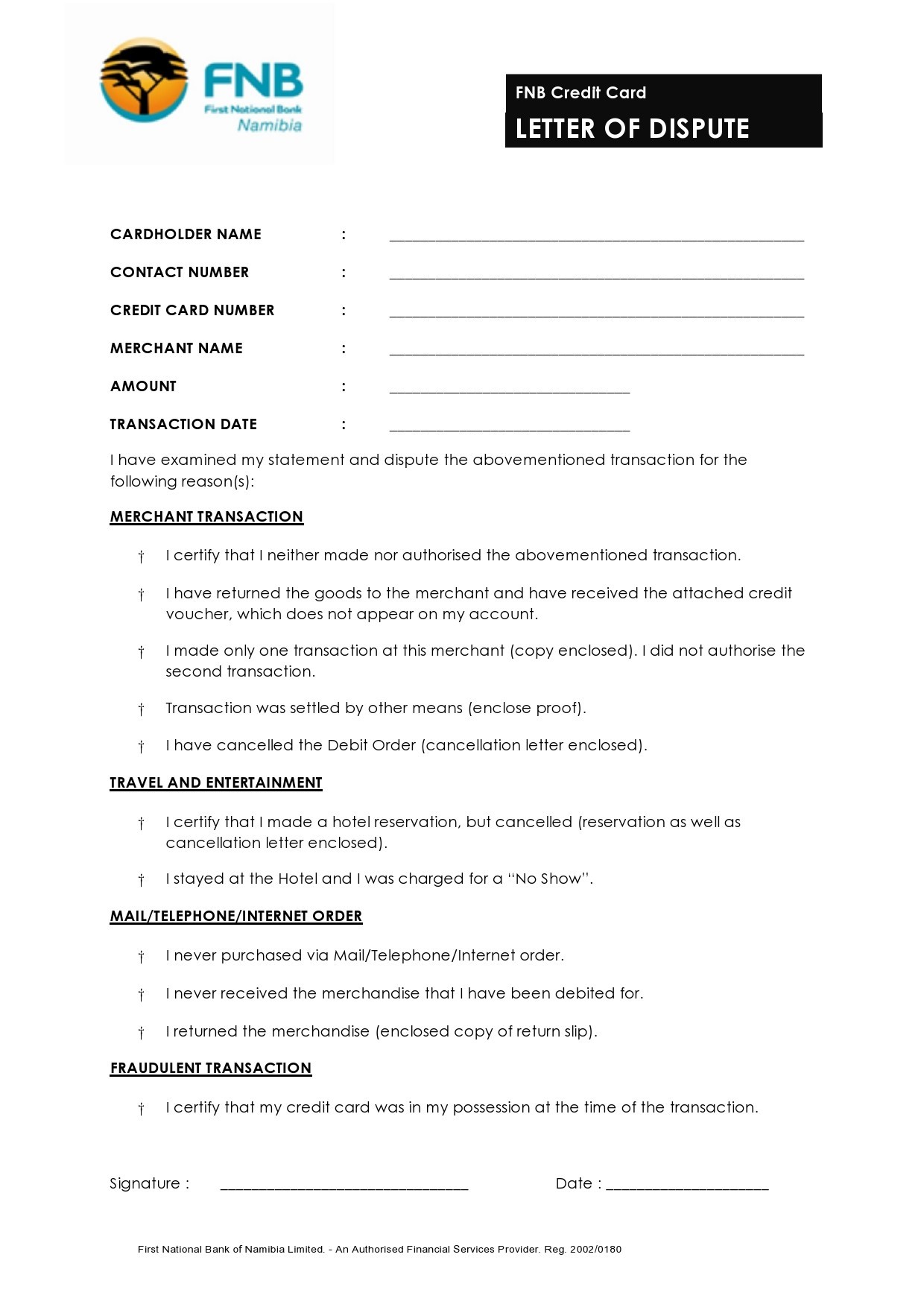

Different types of errors require slightly different approaches. Here are a few examples:

If your credit report shows a late payment that you believe was made on time, your letter should include proof of payment, such as a bank statement or payment confirmation.

If you discover an account on your credit report that you didn’t open, it could be a sign of identity theft. Your letter should state that you did not authorize the account and request that it be removed. You should also file a report with the Federal Trade Commission (FTC).

If the balance reported on your credit report is incorrect, provide a copy of your most recent account statement showing the correct balance.

The credit bureaus offer several ways to submit your dispute:

After submitting your dispute, monitor your credit report to see if the information has been corrected. If the credit bureau denies your dispute, you have the right to add a statement of dispute to your credit report, explaining your side of the story. You can also file a complaint with the Consumer Financial Protection Bureau (CFPB). If you suspect identity theft, continue to monitor your credit report and consider placing a fraud alert or credit freeze on your accounts.

Disputing errors on your credit report is a critical step in maintaining good credit. While the process can seem complex, using a Credit Report Dispute Letter Template and following the steps outlined in this article can significantly increase your chances of success. Remember to be clear, concise, and provide supporting documentation. Don’t hesitate to dispute any inaccuracies you find, as correcting them can have a positive impact on your financial future. Regularly checking your credit report – you are entitled to a free copy from each bureau annually at www.annualcreditreport.com – is the best way to stay on top of your credit health and address any issues promptly.