Extending credit is a fundamental aspect of many business operations, enabling transactions, fostering growth, and building lasting client relationships. However, the generosity of offering goods or services on credit comes with inherent risks if not properly managed. To navigate this landscape effectively, ensuring both parties understand their obligations and rights, a robust Credit Terms Agreement Template serves as an indispensable legal document. This template provides a standardized framework that clearly defines the conditions under which credit is extended, establishing a foundation of clarity and legal protection for both the creditor and the debtor.

The absence of a clear, legally binding credit agreement can lead to misunderstandings, payment delays, and even costly disputes. Businesses that rely on credit sales, whether B2B or B2C, need a reliable mechanism to outline payment schedules, interest rates, late fees, and the process for resolving potential issues. A well-drafted agreement mitigates these risks, providing a clear roadmap for financial interactions and safeguarding the creditor’s assets.

By utilizing a meticulously prepared template, businesses can save significant time and legal expenses that would otherwise be spent drafting agreements from scratch. It ensures consistency across all credit-based transactions, projecting professionalism and adherence to best practices. Furthermore, a comprehensive credit terms agreement acts as a critical piece of evidence should a dispute arise, strengthening a business’s position in legal or collection proceedings. It’s not just a formality; it’s a strategic asset in financial management.

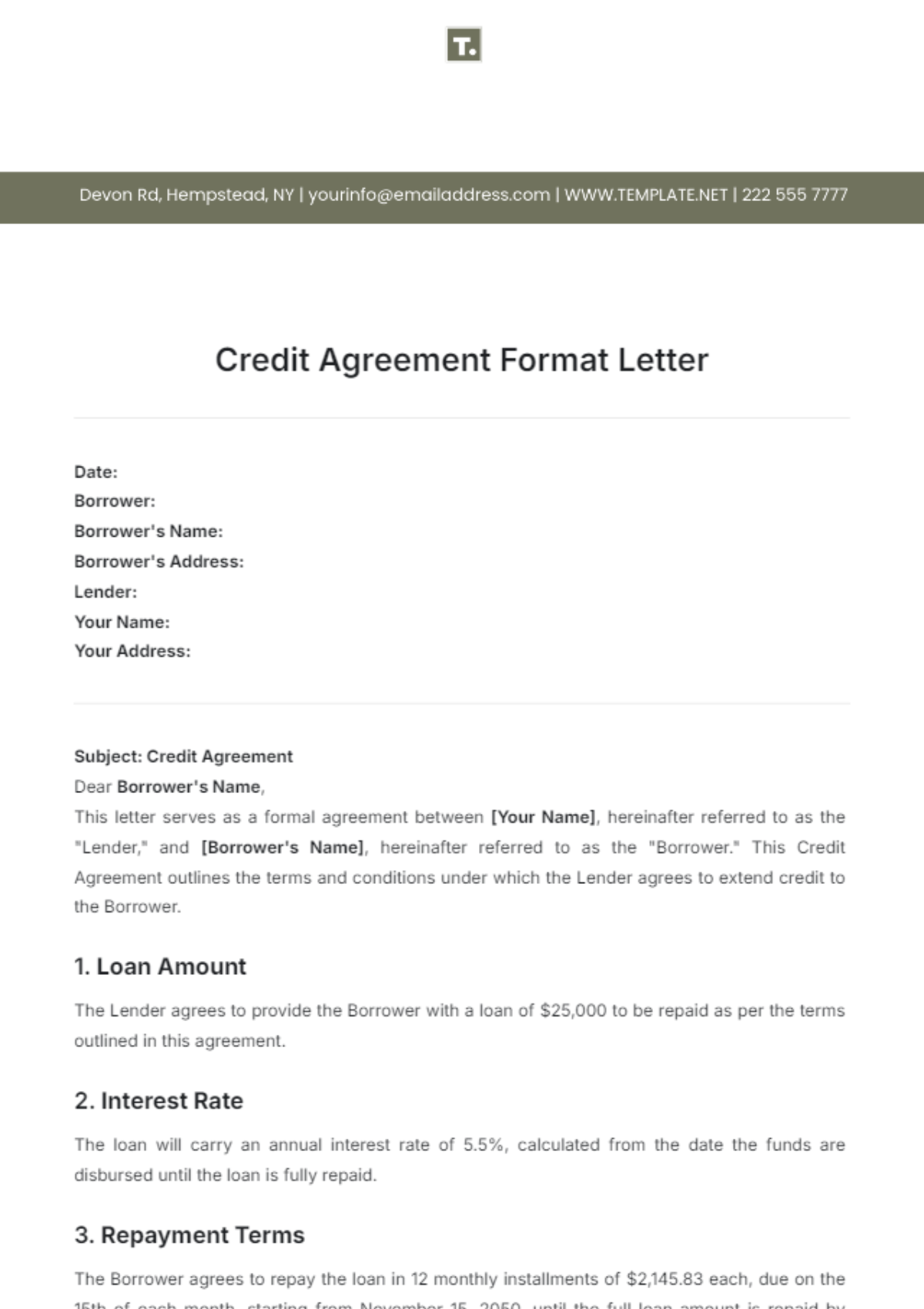

A credit terms agreement, often simply referred to as credit terms, is a legally binding contract that outlines the specific conditions under which a seller (creditor) extends credit to a buyer (debtor). This document details the expectations for payment, the consequences of non-payment, and the rights and responsibilities of both parties throughout the credit period. It effectively formalizes the credit relationship, moving it beyond verbal promises into a concrete, enforceable document.

The primary purpose of such an agreement is to protect the interests of the creditor by ensuring timely payment and providing recourse in the event of default. Simultaneously, it offers clarity to the debtor, outlining their financial obligations and the terms they must adhere to. This bilateral understanding is crucial for maintaining healthy business relationships and preventing future disagreements.

Credit terms encompass a range of financial stipulations that govern the extension of credit. These typically include:

These elements, when clearly defined in a Credit Terms Agreement Template, leave no room for ambiguity, ensuring all parties are aware of the financial landscape.

The importance of a well-crafted credit terms agreement cannot be overstated for any business that extends credit. It serves multiple critical functions, from risk mitigation to legal enforceability, fostering transparency and financial discipline. Without such an agreement, businesses expose themselves to significant vulnerabilities, potentially impacting cash flow and profitability.

One of the primary roles of a credit terms agreement is to significantly reduce the financial risks associated with extending credit. By clearly defining payment schedules, interest rates for overdue amounts, and late payment penalties, the agreement incentivizes timely payments. It also provides a legal framework for pursuing collections if payments become delinquent, protecting the creditor’s ability to recover funds. This proactive approach to risk management is vital for maintaining healthy liquidity and financial stability.

A comprehensive credit terms agreement is a legally binding contract. In the event of a payment dispute or default, this document serves as crucial evidence of the agreed-upon terms. It outlines the responsibilities of both parties and the consequences of failing to meet those responsibilities. This legal backing empowers the creditor to pursue collection actions, whether through demand letters, mediation, or ultimately, litigation, significantly increasing the likelihood of recovering outstanding debts.

Clarity is paramount in any financial transaction. A credit terms agreement eliminates assumptions and ambiguities by explicitly stating all conditions. Both the creditor and the debtor have a clear understanding of the payment obligations, grace periods, charges for late payments, and procedures for dispute resolution. This transparency builds trust, prevents misunderstandings, and establishes a professional foundation for the business relationship.

For businesses that regularly extend credit, using a standardized Credit Terms Agreement Template streamlines the process. It ensures consistency across all credit accounts, simplifying record-keeping, billing, and collection efforts. Employees can be trained on a consistent set of terms, reducing errors and increasing efficiency in credit management. This standardization also helps in scaling operations without compromising on legal protection.

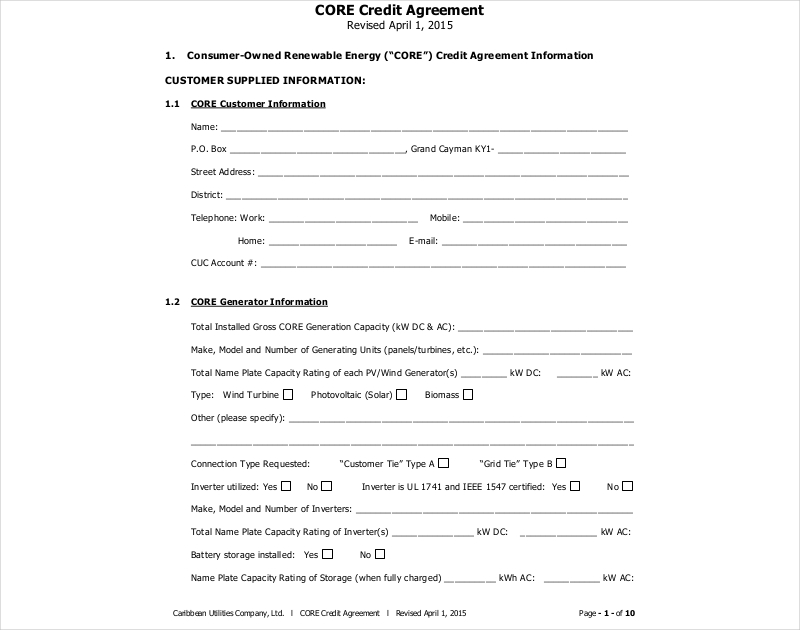

A robust Credit Terms Agreement Template must contain several key clauses and sections to be effective and legally sound. Each component plays a vital role in defining the credit relationship and protecting both parties.

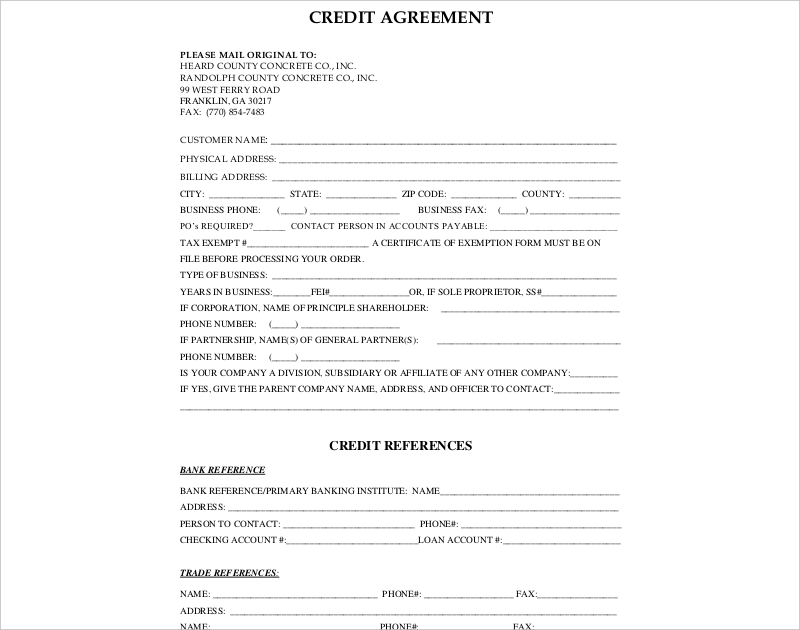

Clearly identify the creditor (the entity extending credit) and the debtor (the entity receiving credit). Include full legal names, addresses, and contact information for accurate identification.

Specify the maximum amount of credit that will be extended to the debtor. This sets a clear boundary and helps manage the creditor’s exposure.

This is a core section, detailing:

* Invoice Date and Due Date: How payment dates are calculated (e.g., Net 30, due upon receipt).

* Payment Methods: Acceptable forms of payment (e.g., bank transfer, check, credit card).

* Currency: The currency in which payments are to be made.

* Early Payment Discounts (if applicable): Specific terms for discounts (e.g., “2/10 Net 30”).

Outline the interest rate that will be applied to any outstanding balances after the due date. This rate should comply with state and federal usury laws. Specify how interest will be calculated (e.g., daily, monthly) and compounded.

Detail any flat fees or percentage-based penalties that will be charged for payments received after the specified due date, in addition to or instead of interest.

This critical section defines what constitutes a “default” (e.g., non-payment, breach of other terms). It also outlines the remedies available to the creditor in the event of default, which may include:

* Acceleration of all outstanding amounts.

* Suspension of further credit.

* Right to repossess goods (if applicable, e.g., under a security agreement).

* Legal action and collection efforts.

If the credit is secured by collateral, this clause grants the creditor a security interest in specific assets of the debtor. This would typically involve a Uniform Commercial Code (UCC) filing in the U.S.

Statements by both parties affirming certain facts (e.g., the debtor has the authority to enter the agreement, financial information provided is accurate).

Specify the state or country whose laws will govern the interpretation and enforcement of the agreement. Also, identify the specific court or jurisdiction where any disputes will be resolved.

Outline the process for resolving disputes, which may include mediation or arbitration before litigation.

A clause stating that if the creditor has to take legal action to collect unpaid amounts, the debtor will be responsible for reasonable attorneys’ fees and collection costs.

State that the document constitutes the entire agreement between the parties and that any modifications must be made in writing and signed by both parties.

A clause ensuring that if one part of the agreement is found to be unenforceable, the remaining parts remain valid.

Virtually any business that extends credit to its customers, clients, or partners can and should utilize a credit terms agreement. This includes a broad spectrum of industries and business models, each facing unique challenges but sharing the fundamental need for financial protection and clarity.

Business-to-business (B2B) transactions frequently involve extending credit, particularly for large orders, ongoing services, or complex projects. Manufacturers selling to distributors, wholesalers selling to retailers, service providers invoicing corporate clients – all operate on credit terms. A robust Credit Terms Agreement Template is crucial here to manage significant outstanding balances, ensure timely payments from corporate clients, and navigate the complexities of commercial law. It protects against the ripple effect of a single delinquent payment impacting the entire supply chain.

Freelancers, consultants, marketing agencies, and other service providers often complete work before receiving full payment. Credit terms agreements define the payment schedule for milestones or upon project completion, safeguarding their earnings. This is particularly important where the “product” is intangible and cannot be repossessed.

While less common than third-party credit, some retailers offer their own credit lines to customers. A detailed agreement is essential to outline repayment schedules, interest rates, and late fees, much like a traditional loan agreement, but tailored to retail purchases.

For small businesses and startups, cash flow is king. Even a few unpaid invoices can severely impact their ability to operate. A credit terms agreement helps these businesses protect their vital revenue, enforce payment expectations, and project a professional image to larger clients. It provides a legal safety net that allows them to extend credit strategically without undue risk.

While a template provides an excellent starting point, it’s crucial to understand that it is a framework, not a one-size-fits-all solution. Customization is key to ensuring the agreement accurately reflects your specific business practices, industry standards, and legal requirements.

Start by inputting your standard credit policies. What are your typical payment terms (e.g., Net 15, Net 30, due on receipt)? What interest rate do you charge on overdue accounts, and what are your late fees? Do you offer early payment discounts? These specifics must be clearly stated.

Different industries have varying norms for credit. A construction company might have progress payments, while a software company might have subscription-based billing with specific grace periods. Ensure your template is adapted to common practices and regulations within your sector. For example, certain industries might have specific lien rights or reporting requirements.

The legal landscape varies significantly by state and country. The “governing law” clause is critical and must specify the jurisdiction whose laws will apply. Usury laws (maximum interest rates), collection practices, and enforceability of certain clauses can differ. It’s imperative that your agreement aligns with the laws of the relevant jurisdiction.

You might have different credit policies for new customers versus established ones, or for large corporate clients versus small businesses. Consider if you need different versions of your Credit Terms Agreement Template to accommodate these variations. For instance, a higher credit limit might warrant more stringent default clauses.

If you require security for credit (e.g., collateral, personal guarantees), ensure these clauses are robust and legally sound. This often involves specific legal language and procedures (like UCC filings in the US) that must be correctly incorporated.

Perhaps the most important step in customizing a template is to have it reviewed by a qualified attorney. A lawyer specializing in commercial contracts can ensure the agreement is legally enforceable, protects your interests adequately, and complies with all relevant laws and regulations in your jurisdiction. They can identify potential ambiguities or omissions that could prove costly down the line. Investing in legal review upfront can save significant expenses and headaches in the future.

Beyond simply having a Credit Terms Agreement Template, adhering to certain legal safeguards and best practices is essential for its effective implementation and enforcement.

Once you have a refined credit terms agreement, apply it consistently across all relevant transactions. Inconsistent application can weaken the enforceability of your terms and create confusion for your customers. Establish clear internal policies for when and how the agreement is presented and executed.

Ensure the agreement is properly executed by all parties. This typically means signed copies from both the creditor and the debtor. In the digital age, electronic signatures are often legally valid, but ensure your e-signature provider meets legal requirements for authenticity and non-repudiation. Keep accurate records of all executed agreements.

Always provide a copy of the credit terms agreement to the debtor. Encourage them to read it thoroughly and ask questions. Transparency upfront can prevent misunderstandings later. Clearly communicate any changes to your credit terms well in advance, and obtain signed acknowledgment if the changes are significant.

If you extend credit to consumers (B2C), be acutely aware of consumer protection laws, which are often more stringent than B2B regulations. These laws might govern disclosure requirements, permissible interest rates, collection practices, and dispute resolution processes. Failure to comply can result in severe penalties.

Legal and business environments are not static. Laws change, business practices evolve, and new risks emerge. Periodically review your credit terms agreement (e.g., annually) to ensure it remains current, compliant, and reflective of your ongoing business needs. Update it as necessary and ensure all new clients sign the revised version.

Even with a strong agreement, some accounts may become delinquent. Ensure your collection practices adhere to legal standards, such as the Fair Debt Collection Practices Act (FDCPA) in the U.S. (if applicable to your business), and avoid harassment or deceptive practices. The agreement provides the basis for collection, but the method of collection must also be legal and ethical.

The decision to extend credit is a strategic one, aimed at fostering business relationships and driving growth. However, this strategy must be underpinned by a robust legal framework to safeguard financial interests and ensure clarity for all parties involved. A meticulously crafted and properly utilized Credit Terms Agreement Template is not merely a formality; it is an indispensable tool for risk mitigation, legal protection, and efficient financial management.

By clearly defining payment obligations, interest rates, late fees, and procedures for dispute resolution, this agreement minimizes ambiguities and prevents costly misunderstandings. It empowers businesses with a strong legal basis to enforce their rights, recover debts, and maintain healthy cash flow. Customizing the template to fit specific business practices and industry standards, along with seeking professional legal review, ensures its effectiveness and compliance with relevant laws. Ultimately, investing in a comprehensive credit terms agreement is an investment in the stability and success of your business, transforming potential risks into predictable and manageable financial interactions.