Customs Commercial Invoice Template: Your Essential Guide

Navigating the world of international trade can feel overwhelming, especially when it comes to documentation. One of the most crucial documents for ensuring smooth and compliant international shipments is the Customs Commercial Invoice. This document serves as a detailed record of the transaction between the exporter and importer, providing customs authorities with the necessary information to assess duties, taxes, and compliance with import/export regulations. A well-prepared commercial invoice is your key to avoiding costly delays, penalties, and even seizure of your goods.

This comprehensive guide will walk you through everything you need to know about customs commercial invoice templates, including what they are, why they’re important, how to use them effectively, and where to find a reliable template. We’ll also address common questions and provide best practices to help you confidently navigate the complexities of international shipping.

A commercial invoice is essentially a bill of sale for goods being shipped internationally. Unlike a pro forma invoice (which is an estimate), the commercial invoice represents the final and legally binding agreement for the transaction. Customs authorities rely on this document to verify the value of the goods, their origin, and other relevant details to determine the appropriate import duties and taxes.

Why is a Customs Commercial Invoice Important?

The importance of a properly completed commercial invoice cannot be overstated. Here’s why:

- Customs Clearance: It’s a primary document required for customs clearance in the importing country. Without it, your shipment will be held, causing delays and potentially incurring storage fees.

- Duty and Tax Assessment: Customs authorities use the invoice to determine the correct amount of import duties and taxes to be levied. Accurate information ensures correct assessment and avoids penalties.

- Compliance: The commercial invoice helps ensure compliance with import/export regulations, including trade restrictions, licensing requirements, and valuation rules.

- Payment: It serves as a formal request for payment from the buyer to the seller, outlining the terms of the sale.

- Record Keeping: It provides a permanent record of the transaction for both the exporter and importer, essential for accounting and auditing purposes.

Key Elements of a Customs Commercial Invoice Template:

While specific requirements may vary depending on the importing country, most customs commercial invoice templates include the following key elements:

- Invoice Number: A unique identifier for the invoice.

- Invoice Date: The date the invoice was issued.

- Exporter Information: The full legal name, address, and contact details of the exporter.

- Importer Information: The full legal name, address, and contact details of the importer.

- Consignee Information: If different from the importer, the full legal name, address, and contact details of the party receiving the goods.

- Seller Information: The full legal name, address, and contact details of the seller, if different from the exporter.

- Buyer Information: The full legal name, address, and contact details of the buyer, if different from the importer.

- Description of Goods: A detailed description of each item being shipped, including quantity, unit of measure (e.g., kilograms, pieces), and material composition. Generic descriptions like “parts” are not sufficient.

- Harmonized System (HS) Code: The HS code for each item, which is an internationally standardized system of names and numbers used to classify traded products. Accurate HS codes are crucial for determining the correct duty rates.

- Country of Origin: The country where the goods were manufactured or produced.

- Unit Price: The price per unit for each item.

- Total Price: The total price for each item (unit price multiplied by quantity).

- Currency: The currency in which the prices are quoted.

- Incoterms (International Commercial Terms): The agreed-upon Incoterms that define the responsibilities and liabilities of the buyer and seller (e.g., FOB, CIF, EXW).

- Shipping Terms: Information about the mode of transport (e.g., air, sea, road) and the port of loading and discharge.

- Freight Charges: The cost of transporting the goods.

- Insurance Charges: The cost of insuring the goods during transport.

- Discounts or Rebates: Any discounts or rebates offered on the goods.

- Total Invoice Value: The total value of the shipment, including the cost of goods, freight, insurance, and any other charges.

- Declaration Statement: A statement certifying that the information provided on the invoice is true and accurate.

- Signature and Date: The signature of the exporter or an authorized representative and the date of signing.

How to Use a Customs Commercial Invoice Template Effectively:

- Accuracy is Key: Double-check all information for accuracy. Even small errors can lead to delays and penalties.

- Use Clear and Concise Language: Avoid ambiguous or vague language. Use specific and detailed descriptions of the goods.

- Research HS Codes: Take the time to research the correct HS codes for your products. Many online resources are available.

- Understand Incoterms: Clearly understand the Incoterms you are using and their implications for your responsibilities.

- Consider Translation: If the importing country’s official language is different from yours, consider providing a translated version of the invoice.

- Keep Records: Retain copies of all commercial invoices for your records.

Where to Find a Free Customs Commercial Invoice Template:

Numerous websites offer free customs commercial invoice templates. Look for templates that are customizable and easy to use. Be sure to vet the source to ensure the template is up-to-date and reliable. You can also often find templates provided by shipping companies.

Download a Free Commercial Invoice Template Here

By understanding the importance of the customs commercial invoice and using a reliable template, you can streamline your international shipping process, minimize risks, and ensure compliance with import/export regulations.

If you are searching about Canadian Invoice Template – Australiandivorce Blog you’ve came to the right web. We have 9 Images about Canadian Invoice Template – Australiandivorce Blog like Customs Commercial Invoice * Invoice Template Ideas, Commercial Invoice For Customs Template and also Customs Commercial Invoice * Invoice Template Ideas. Read more:

Canadian Invoice Template – Australiandivorce Blog

australiandivorceblog.blogspot.com

Printable Customs Commercial Invoice Template

www.templatenum.com

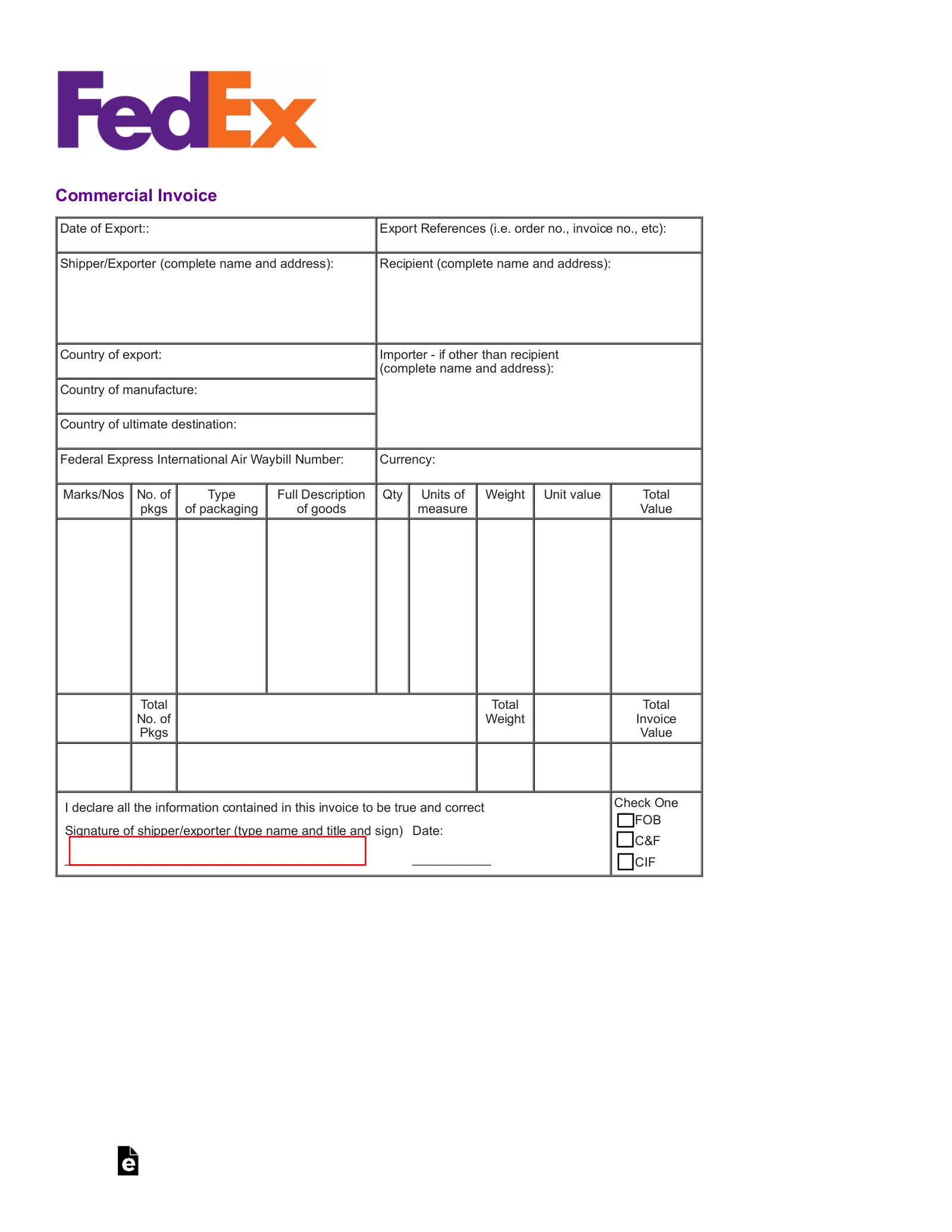

Free FedEx Commercial Invoice Template – PDF – EForms

eforms.com

fedex invoice eforms

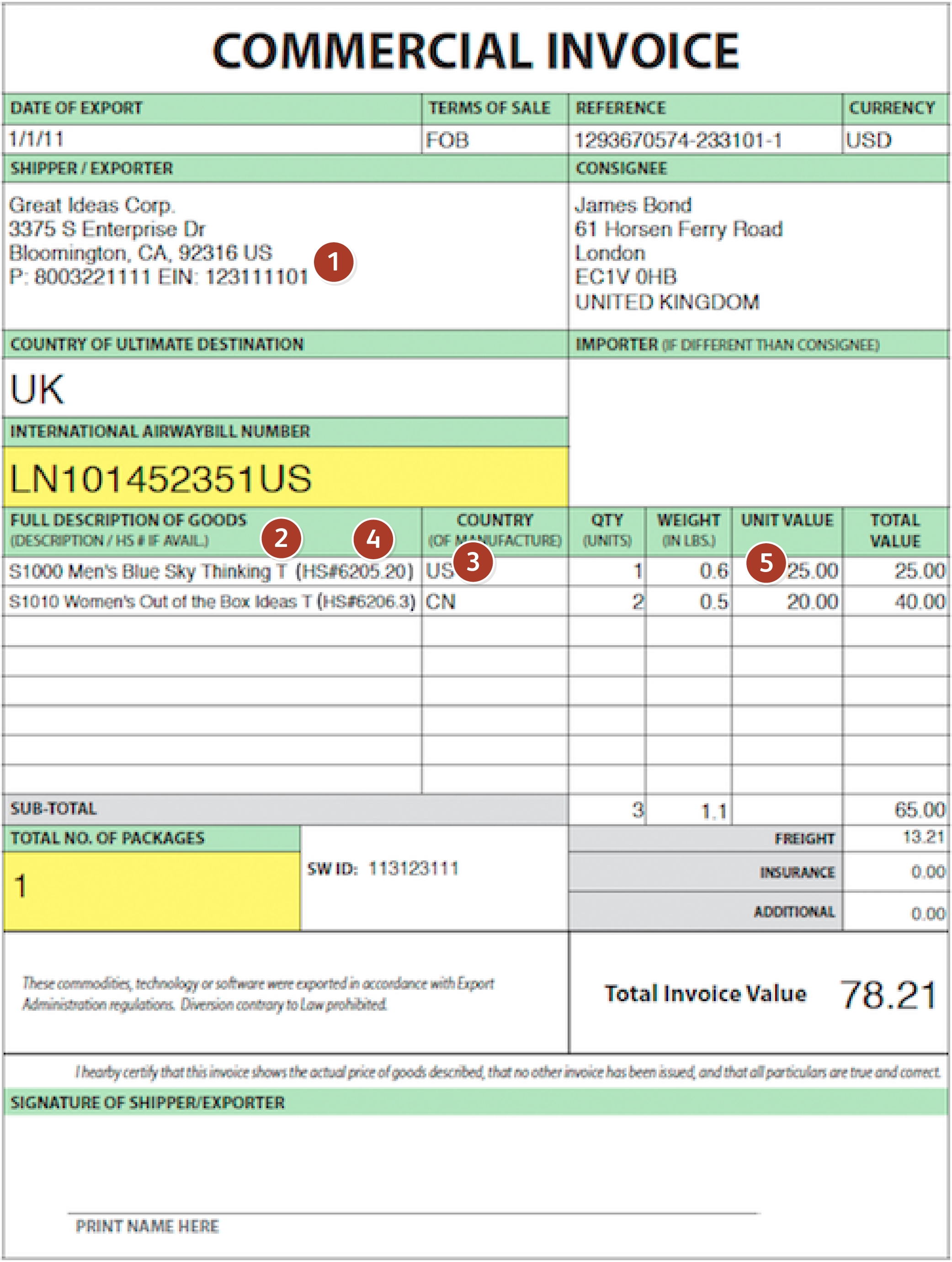

Customs Commercial Invoice * Invoice Template Ideas

simpleinvoice17.net

invoice commercial shipping template customs international meaning label simpleinvoice17 commerc any 2083 templates us contact invoices 2762 examples ideas saved

Jamaica Customs Invoice Import – Invoice

invoice.craftshowsuccess.com

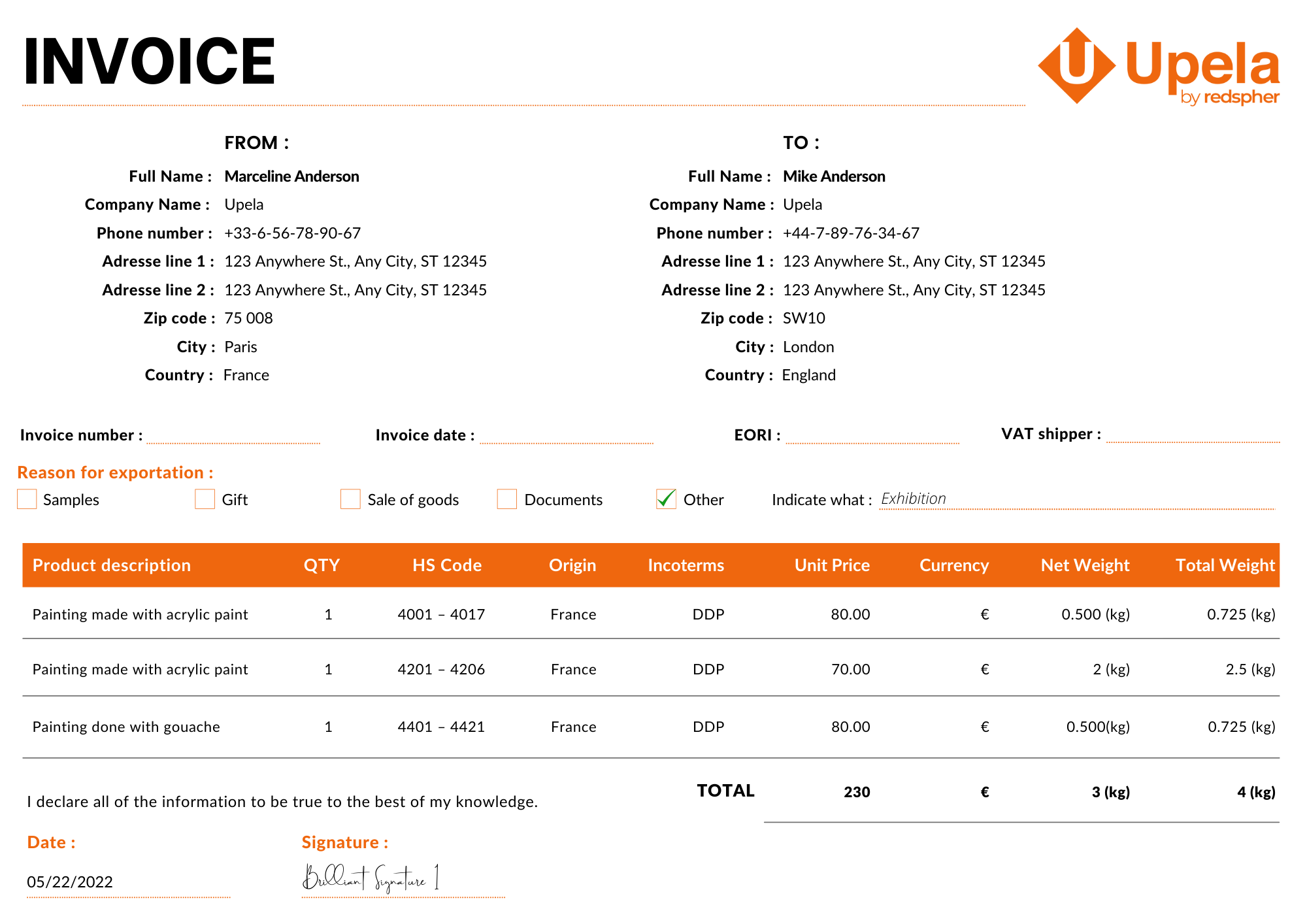

Invoice For Customs Purpose Invoice Template Ideas – Vrogue.co

www.vrogue.co

Customs Invoice

ar.inspiredpencil.com

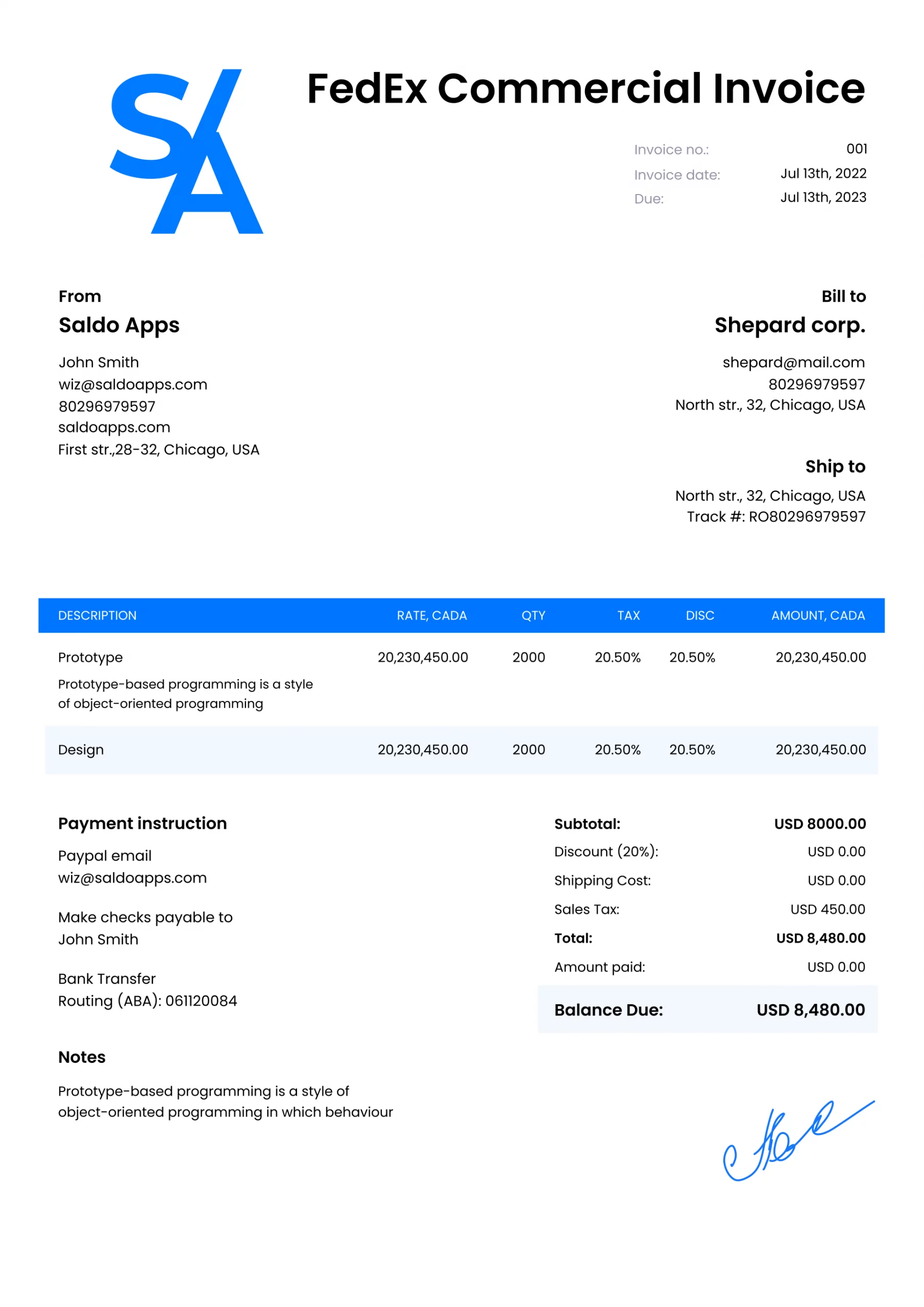

Fedex Commercial Invoice Template – Free I Download – Saldoinvoice

saldoinvoice.com

Commercial Invoice For Customs Template

old.sermitsiaq.ag

Commercial invoice for customs template. Invoice for customs purpose invoice template ideas. Customs invoice