Debt can be a heavy burden, impacting not only financial stability but also mental well-being. When individuals find themselves struggling to manage their debts, exploring options like debt agreement templates can provide a structured path towards resolution. These templates serve as frameworks for negotiating with creditors, outlining repayment plans, and ultimately regaining control over financial obligations. This article will explore the intricacies of debt agreement templates, their benefits, and how to use them effectively.

A debt agreement, often referred to as a debt management plan, is a legally binding contract between a debtor and their creditors. It outlines the terms and conditions for repaying outstanding debts, often involving reduced interest rates, consolidated payments, or even a partial write-off of the debt. Using debt agreement templates simplifies the process of creating this agreement, ensuring all necessary clauses are included and properly formatted. The aim is to provide a more manageable repayment schedule for the debtor while offering creditors a reasonable assurance of receiving payments.

The advantage of utilizing debt agreement templates lies in their adaptability and ease of use. They can be customized to fit specific financial situations, debt amounts, and creditor preferences. However, it’s crucial to understand the legal implications and potential drawbacks before entering into any debt agreement. Seeking professional financial advice is always recommended to ensure the agreement aligns with your overall financial goals.

This guide aims to provide a comprehensive understanding of debt agreement templates and how they can be used effectively. By understanding the intricacies of these templates, individuals can confidently navigate their debt resolution journey.

A debt agreement is essentially a formal arrangement between a borrower and their creditors to repay outstanding debts under revised terms. These agreements are designed to provide a structured approach to debt repayment, often involving concessions from creditors to make the debt more manageable. The core principle is to create a win-win situation where the debtor can realistically repay their debts, and creditors can recover at least a portion of what is owed.

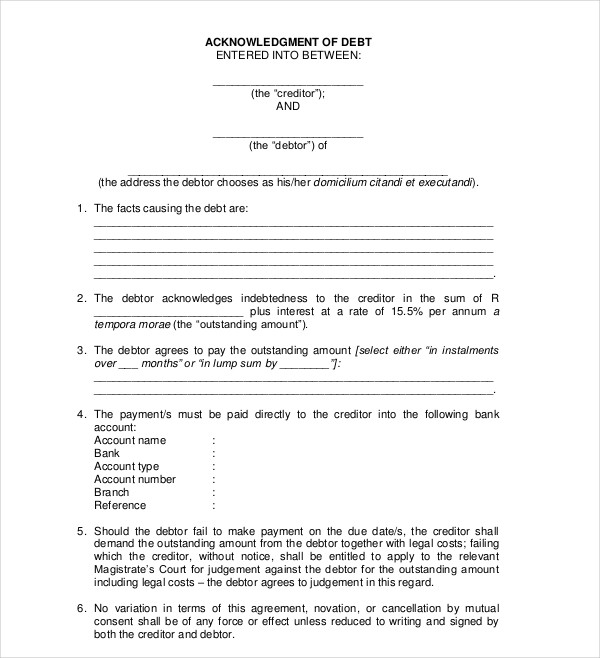

A typical debt agreement will include several essential components:

Debt agreements can cover a wide range of debt types, including:

However, some debts, such as student loans and tax debts, may not be eligible for inclusion in a standard debt agreement and might require different negotiation strategies or specific programs.

Using debt agreement templates offers several advantages to both debtors and creditors. For debtors, it provides a structured framework for negotiating with creditors and creating a manageable repayment plan. For creditors, it offers a reasonable assurance of receiving payments, even if they are reduced or extended over a longer period.

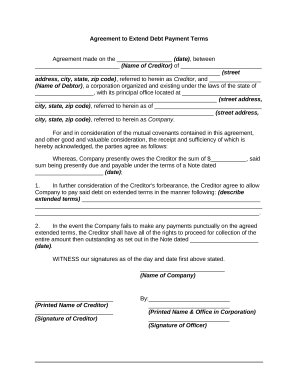

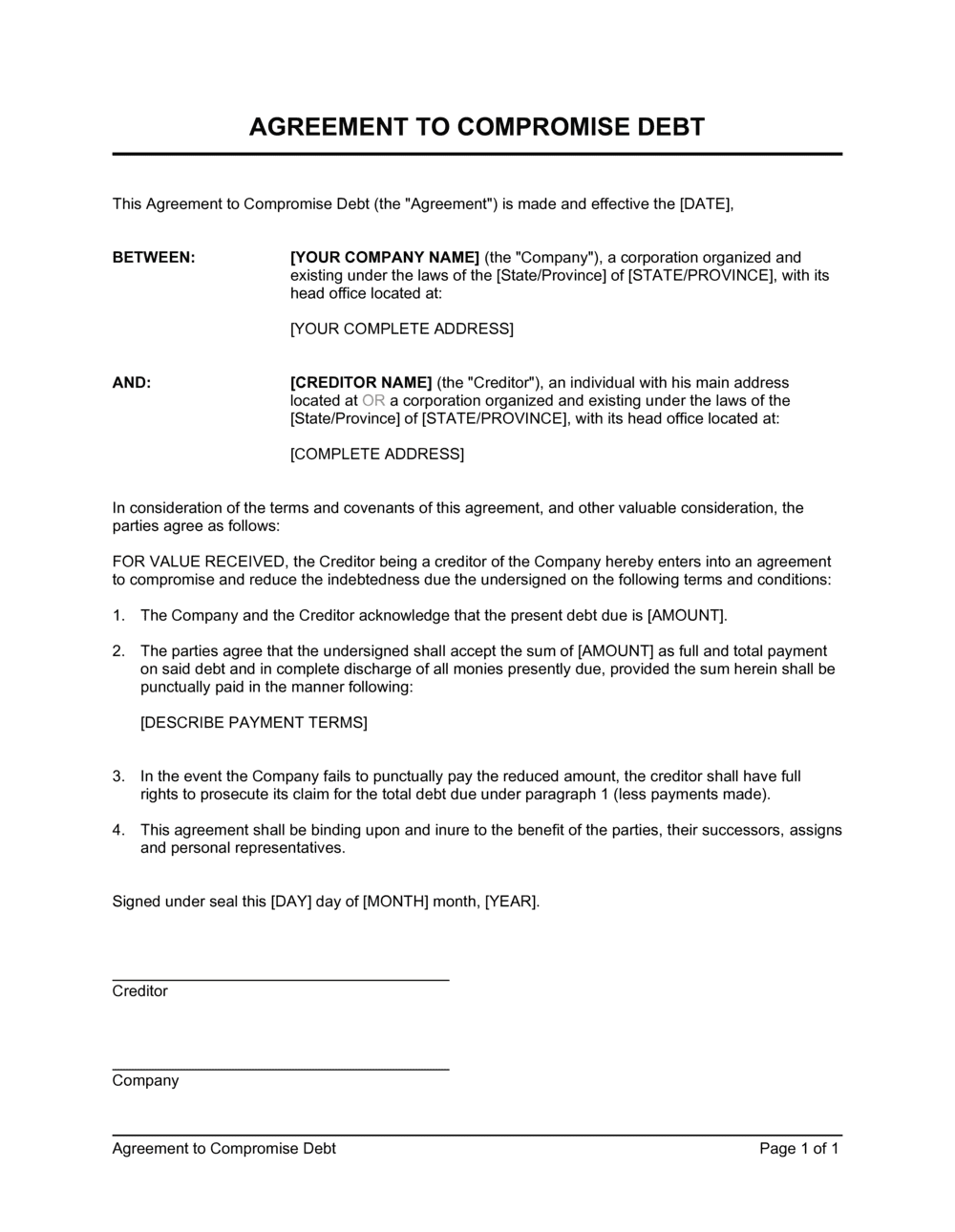

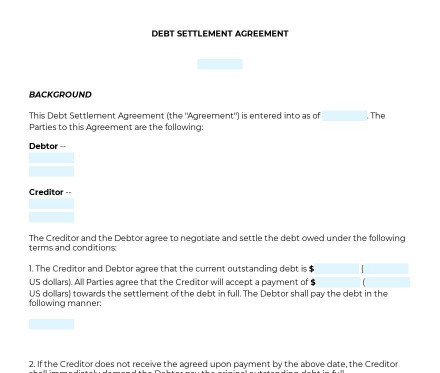

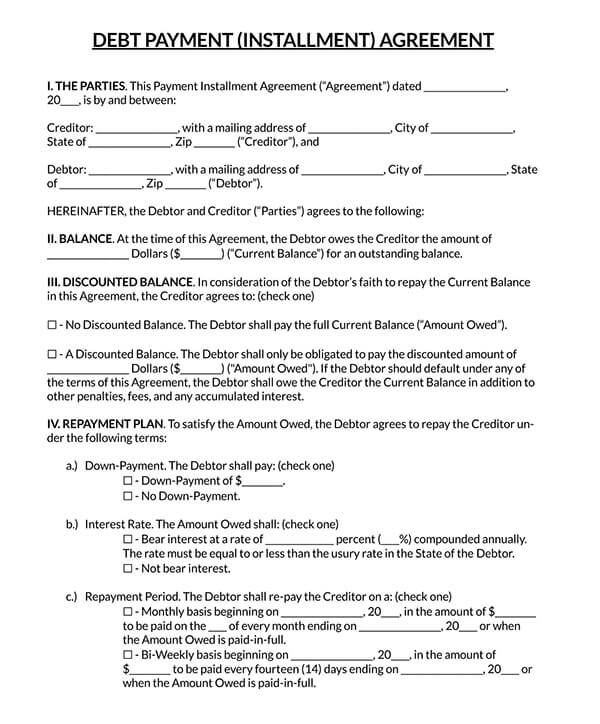

Numerous resources offer debt agreement templates, but it’s crucial to choose a template that is legally sound and appropriate for your specific situation. Free templates are often available online, but they may not be comprehensive or tailored to your needs.

Once you have selected a suitable debt agreement template, the next step is to fill it out accurately and customize it to reflect your specific debt situation and the terms you have negotiated with your creditors.

Successfully negotiating with creditors is crucial to reaching a mutually agreeable debt agreement. Using debt agreement templates as a starting point provides a structured framework for these negotiations.

Before approaching your creditors, gather all relevant financial information, including your income, expenses, assets, and liabilities. Understand your current financial situation and determine a realistic repayment amount that you can afford each month. Be prepared to explain your circumstances and why you are seeking a debt agreement.

While debt agreement templates offer a structured approach to debt resolution, it’s crucial to be aware of potential pitfalls and considerations before entering into an agreement.

Entering into a debt agreement can negatively impact your credit score, especially initially. The agreement will be reported to credit bureaus and may remain on your credit report for several years. However, successfully completing the agreement and making timely payments can eventually lead to improved credit scores.

Depending on the terms of the debt agreement, you may be subject to tax implications. If a portion of your debt is forgiven, the forgiven amount may be considered taxable income. Consult with a tax professional to understand the potential tax consequences of your debt agreement.

Before entering into a debt agreement, explore alternative debt relief options, such as:

It’s highly recommended to have any debt agreement reviewed by an attorney before signing it. An attorney can ensure that the agreement is legally sound, protects your interests, and complies with all applicable laws and regulations.

Debt agreement templates provide a valuable tool for individuals struggling with debt management. By offering a structured framework for negotiating with creditors and creating manageable repayment plans, these templates can help individuals regain control of their finances and work towards a debt-free future. However, it’s crucial to understand the legal implications, potential drawbacks, and alternative options before entering into any debt agreement. Seeking professional financial and legal advice is always recommended to ensure that the agreement aligns with your overall financial goals and protects your best interests.