Facing a credit report riddled with inaccuracies? You’re not alone. Millions of Americans grapple with errors on their credit reports every year, and these errors can have a devastating impact on your financial life. From being denied a loan or a mortgage to paying higher interest rates, inaccurate credit information can cost you dearly. Fortunately, you have the right to dispute these errors and have them corrected. A well-crafted dispute letter is your first and most important tool in fighting for a fair and accurate credit history. But writing a dispute letter from scratch can be intimidating. That’s where a reliable Dispute Letter To Creditor Template comes in handy.

A good template provides a structured framework to clearly and effectively communicate the inaccuracies you’ve identified on your credit report to the creditor responsible for reporting that information. It ensures you include all the necessary details, like your personal information, account number, specific details of the error, and the supporting documentation. Using a template not only saves you time and effort, but also increases the likelihood of a successful dispute resolution. Why? Because it ensures you’re following the proper procedures and providing the creditor with everything they need to investigate your claim thoroughly.

However, remember that a template is just a starting point. You need to personalize it to reflect your specific situation and the particular inaccuracies you are disputing. The more detail you provide, the stronger your case will be. Adding copies of relevant documents, like account statements or payment records, can significantly bolster your claim. Don’t be afraid to tailor the language to clearly and concisely explain the error and why you believe it’s incorrect. A generic dispute letter might not get the attention it deserves, while a well-crafted, personalized letter demonstrates that you’re serious about correcting the error and are willing to back up your claims with evidence.

In the following sections, we’ll outline the essential components of a robust Dispute Letter To Creditor Template, providing you with a foundation to build a compelling case and reclaim control over your credit history. Remember, taking the time to properly dispute errors on your credit report can significantly improve your credit score and open doors to better financial opportunities in the future.

Dispute Letter To Creditor Template: Your Guide to Correcting Credit Report Errors

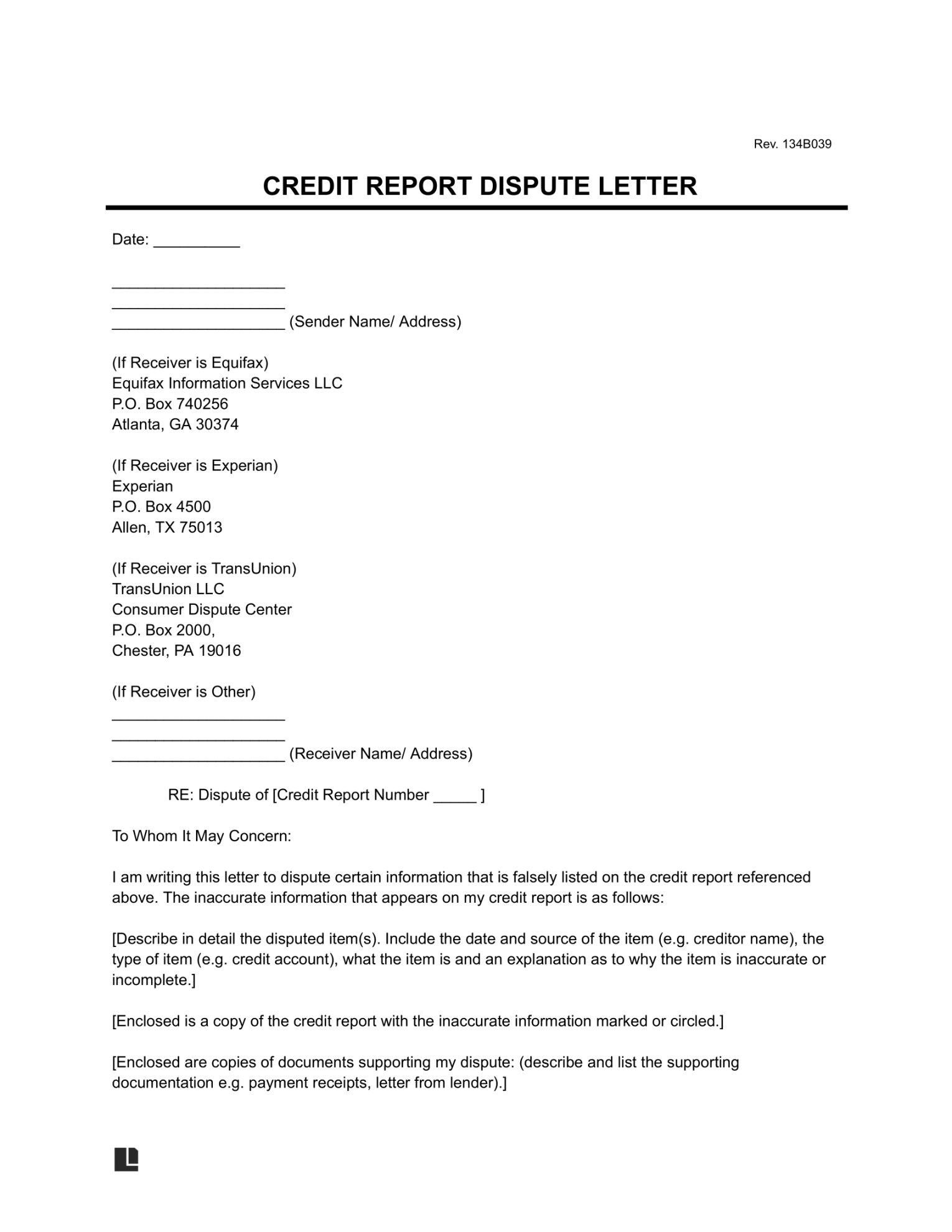

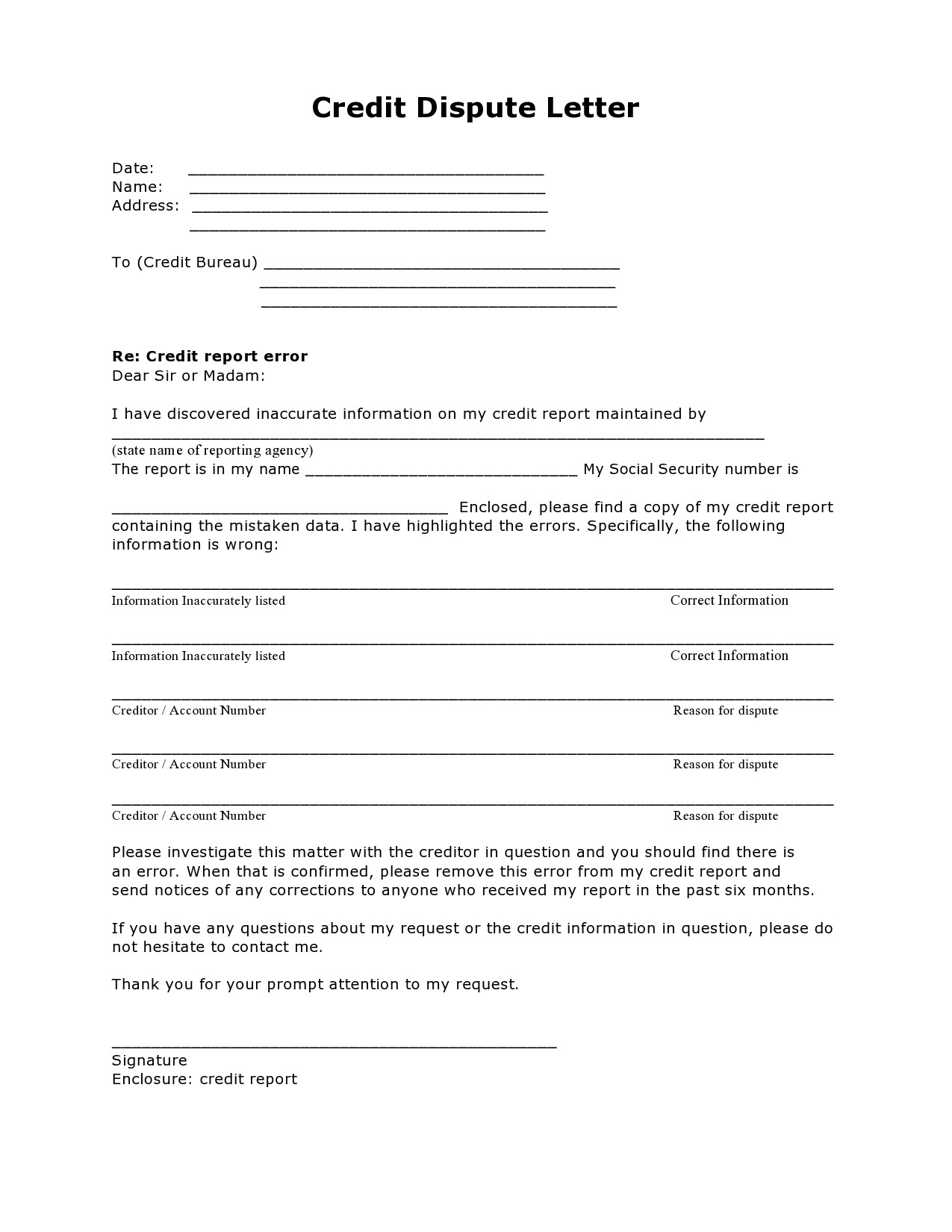

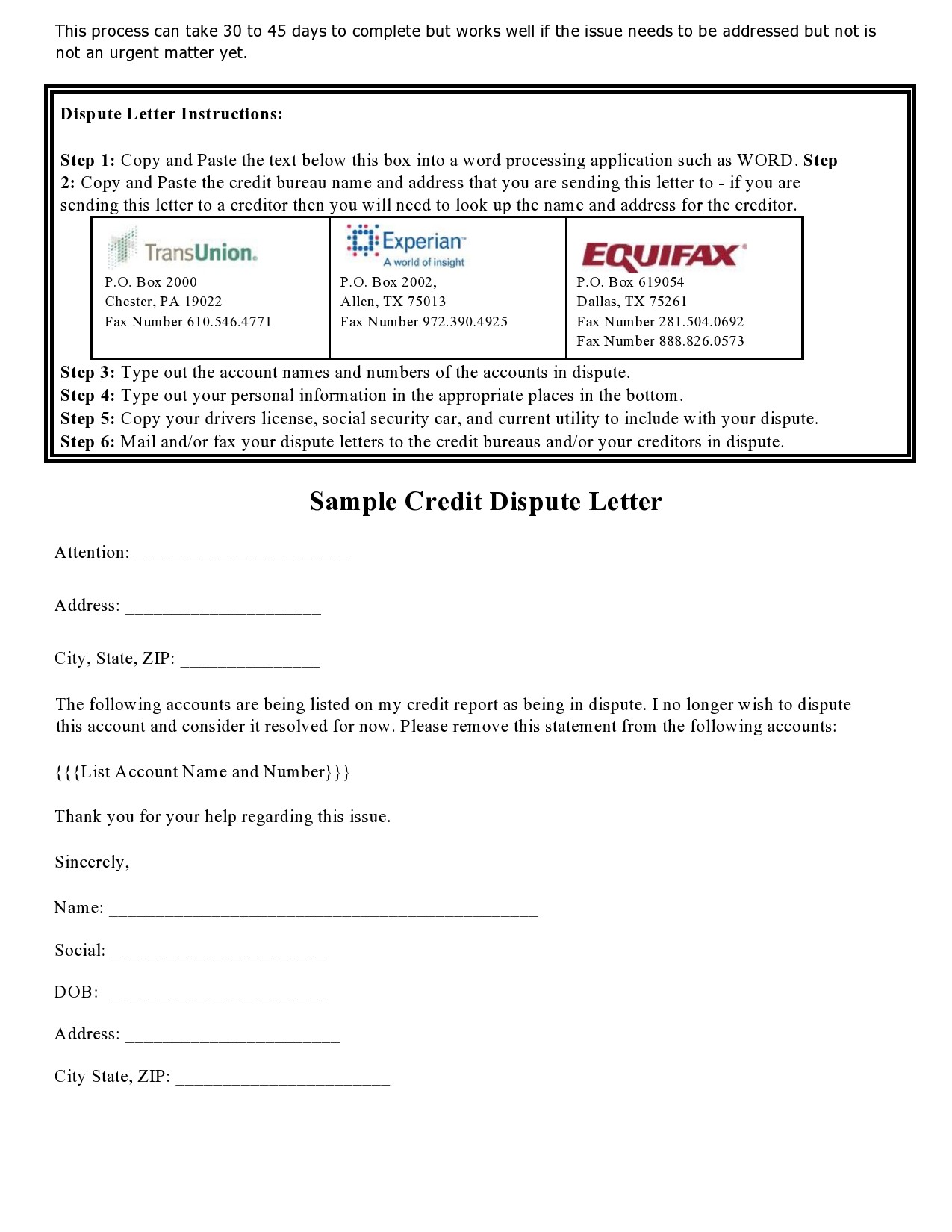

Below is a sample structure for a Dispute Letter To Creditor Template. Remember to tailor each section to your specific situation. While this provides a solid foundation, you should always consult with a legal professional or credit counselor if you have complex credit issues.

-

Essential Elements of a Dispute Letter Template

- **Your Contact Information:** Your full name, address, phone number, and email address. Make sure this information is current and matches what’s on your credit report.

- **Date:** The date you are sending the letter.

- **Creditor’s Information:** The name and address of the creditor or credit bureau you are contacting. Ensure you have the correct address for disputes, as different departments may handle inquiries.

- **Subject Line:** A clear and concise subject line, such as “Credit Report Dispute – Account #[Your Account Number]”.

- **Account Information:** The specific account number(s) associated with the disputed item(s).

- **Explanation of the Dispute:** Clearly and concisely explain what information on the credit report is inaccurate and why you believe it is an error. Be specific and avoid vague language.

- **Requested Action:** Clearly state what you want the creditor to do, such as investigate the error, correct the inaccurate information, or remove the disputed item from your credit report.

- **Supporting Documentation:** Include copies of any relevant documents that support your claim, such as account statements, payment records, or identity verification documents. **Never send originals.**

- **Closing:** A polite and professional closing, such as “Thank you for your time and attention to this matter. I look forward to your prompt response.”

- **Signature:** Your signature and printed name.

-

Sample Dispute Letter Template (HTML)

[Your Full Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Creditor’s Name]

[Creditor’s Address]

Subject: Credit Report Dispute – Account #[Your Account Number]

Dear [Creditor Contact Person or Department],

I am writing to dispute information on my credit report with your company. I recently obtained a copy of my credit report and found the following inaccuracy:

[Specifically describe the inaccurate information. For example: “The report shows a late payment for June 2023 on account number [Your Account Number], but I have proof that I made the payment on time. A copy of my bank statement showing the payment is enclosed.” Or, “The report incorrectly shows a balance of $[Incorrect Balance] on account number [Your Account Number]. The actual balance as of [Date] is $[Correct Balance]. A copy of my account statement is enclosed.”]

I believe this information is inaccurate because [Explain why the information is incorrect. Be clear and concise. For example: “I have always made my payments on time, and this late payment is an error.” Or, “I have already paid off the outstanding balance on this account, and the report has not been updated.”].

I request that you investigate this matter and correct or remove the inaccurate information from my credit report. I have enclosed copies of [List the documents you are enclosing, e.g., “my account statement, bank statement, and a copy of my driver’s license”] to support my claim.

I look forward to your prompt response and resolution of this issue. Please send written confirmation that the correction has been made to my credit report.

Thank you for your time and attention to this matter.

Sincerely,

[Your Signature]

[Your Printed Name]

Enclosures: [List all enclosed documents]

Remember to replace the bracketed information with your specific details. Always keep a copy of the letter and any supporting documentation for your records.

Using this Dispute Letter To Creditor Template, along with careful documentation and persistence, empowers you to take control of your credit health and ensure the accuracy of your credit reports.

If you are looking for Debt Dispute Letter Template Collection Letter Templa – vrogue.co you’ve visit to the right web. We have 9 Pictures about Debt Dispute Letter Template Collection Letter Templa – vrogue.co like Free Credit Report Dispute Letter Template – Sample – Word For Dispute, Debt Dispute Letter Template Collection Letter Templa – vrogue.co and also Goodwill Credit Letter Template – prntbl.concejomunicipaldechinu.gov.co. Here it is:

Debt Dispute Letter Template Collection Letter Templa – Vrogue.co

www.vrogue.co

Formal Template For Credit Report Dispute Letter – Sample Template Ideas

clowncoloringpages.com

Sample Hard Inquiry Dispute Letter

mavink.com

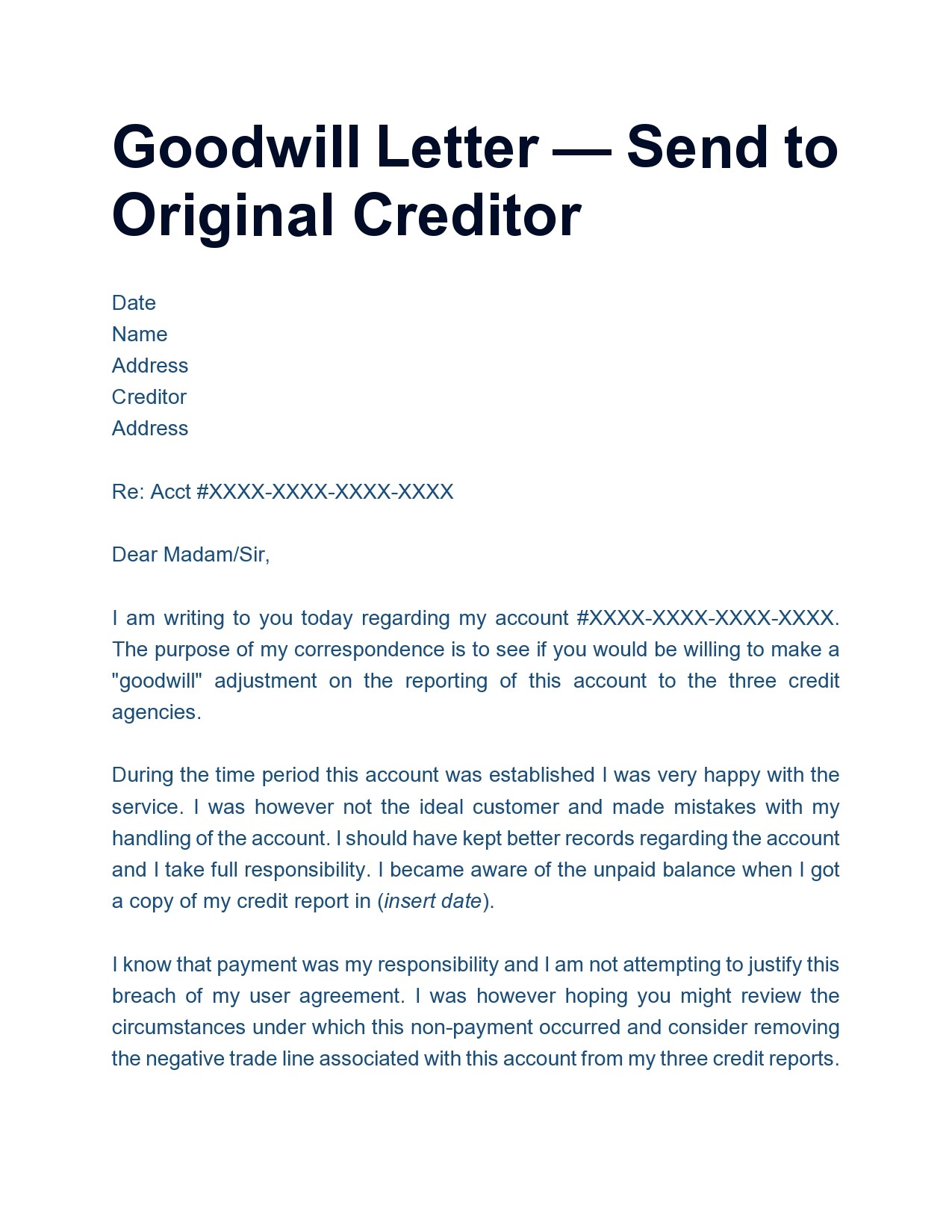

Goodwill Credit Letter Template – Prntbl.concejomunicipaldechinu.gov.co

prntbl.concejomunicipaldechinu.gov.co

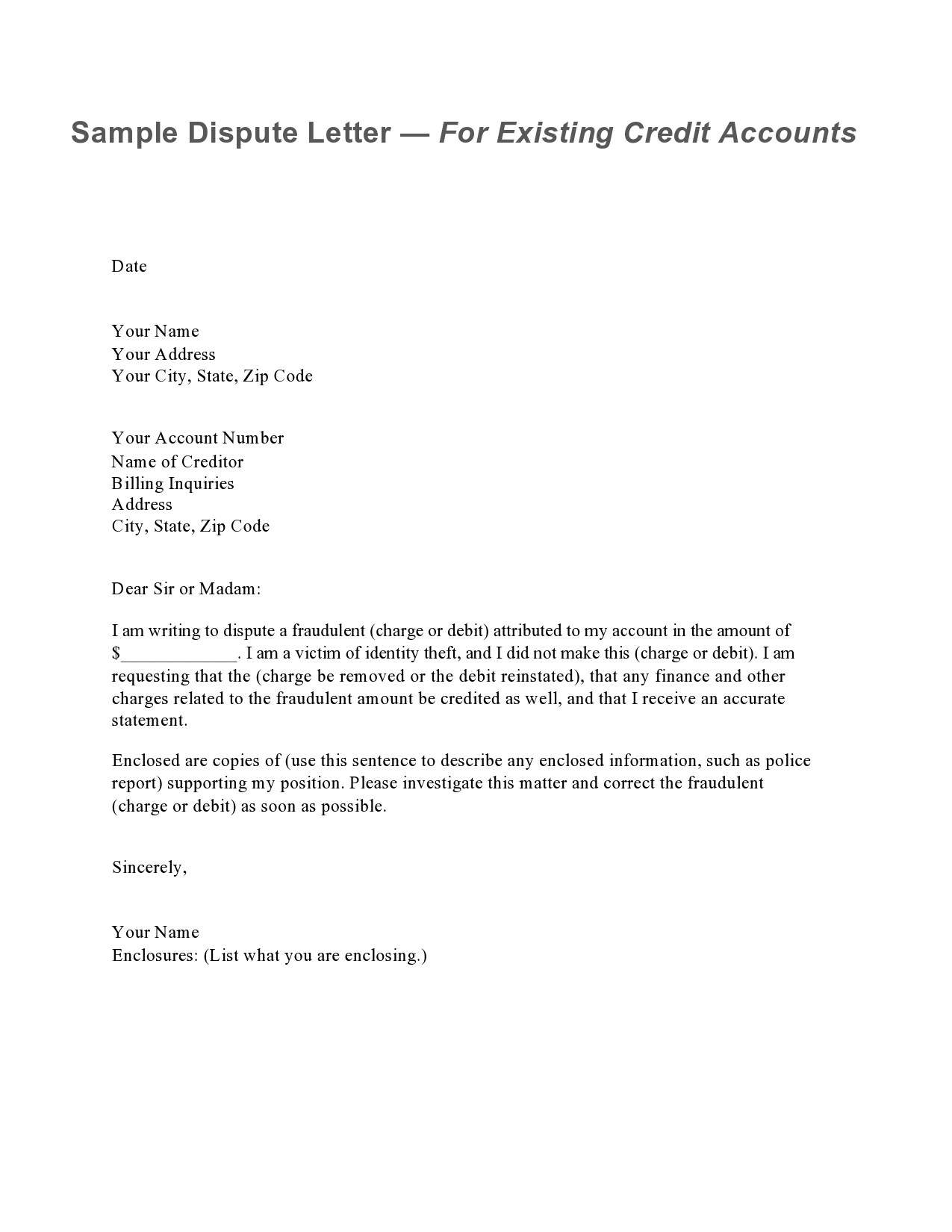

Free Credit Report Dispute Letter Template – Sample – Word For Dispute

professional.fromgrandma.best

dispute creditor template word

Credit Card Dispute Letter Template

old.sermitsiaq.ag

Inquiry Dispute Letter Template

old.sermitsiaq.ag

Free Dispute Letter Template – Templates Printable

templates.markjsullivan.org

A Letter To Someone Requesting That They Are Not Interested On Their

www.pinterest.com

Inquiry dispute letter template. Debt dispute letter template collection letter templa. Credit card dispute letter template