Running a small business is a challenging endeavor, and managing your finances effectively is paramount to its success. Many small business owners struggle with keeping track of their income, expenses, and profitability. Fortunately, there’s a powerful tool that can simplify this process: Excel templates. These templates offer a streamlined way to organize your financial data, automate tasks, and gain valuable insights into your business’s performance. This article will explore the benefits of using Excel templates for small business accounting, showcasing some of the most popular and effective options available. Understanding how to leverage these tools can significantly improve your financial management and ultimately, your bottom line. Let’s dive in and discover how Excel templates can transform your accounting workflow.

Before we delve into specific templates, it’s crucial to understand why using Excel for accounting is so beneficial. Traditional methods like spreadsheets on a computer or using manual ledgers often lead to errors, inconsistencies, and difficulty in generating accurate reports. Excel offers a centralized, automated system that minimizes these risks. It allows you to easily record transactions, calculate key metrics, and generate reports with a single, powerful tool. Furthermore, the ability to customize templates allows you to tailor them to your specific business needs, ensuring that your financial data is relevant and actionable. Without a robust system, small business owners risk making poor decisions based on incomplete or inaccurate information. Investing in the right Excel templates is an investment in the long-term health and stability of your business.

There’s a wide variety of Excel templates available, catering to different business sizes and accounting needs. Here are a few of the most popular choices:

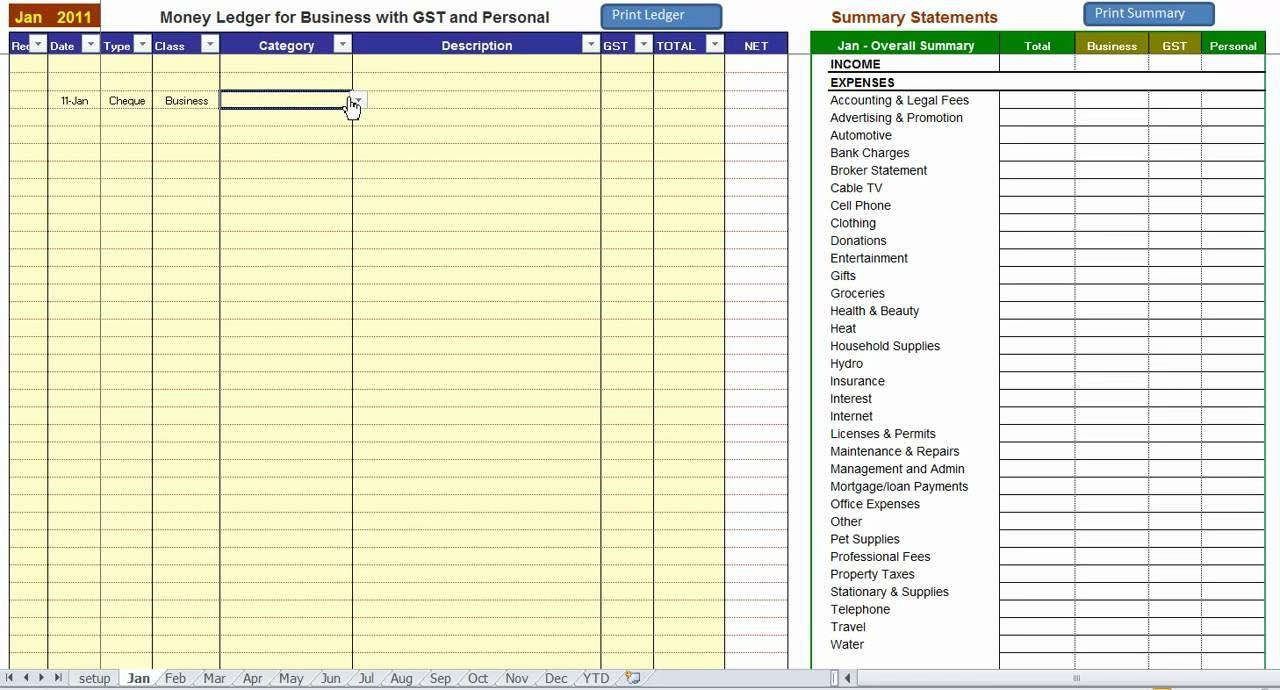

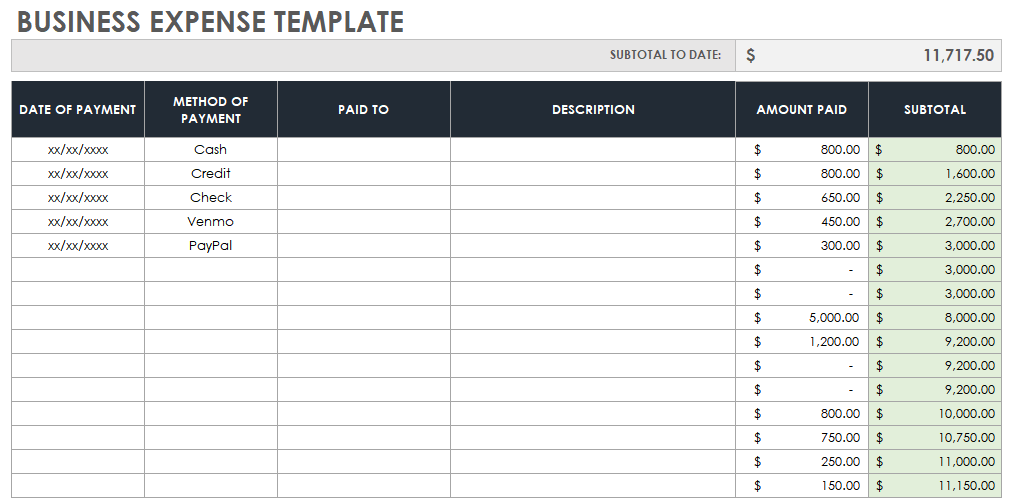

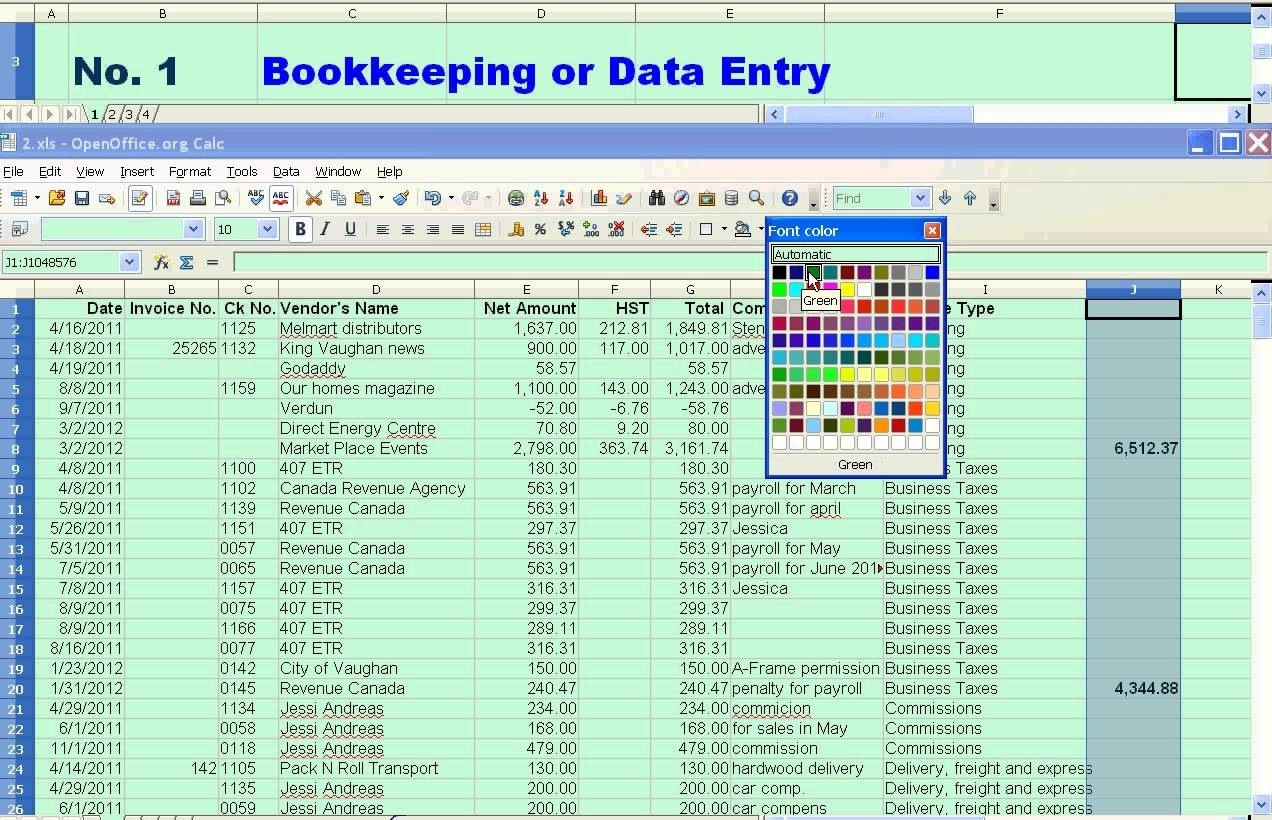

Tracking expenses accurately is a cornerstone of good accounting. Many templates provide pre-built lists of common expenses, allowing you to quickly record and categorize them. These templates often include fields for date, vendor, description, amount, and category. Some popular options include:

These templates are a fantastic starting point for anyone looking to implement a basic expense tracking system. They’re readily available online and can be easily adapted to fit your specific business requirements.

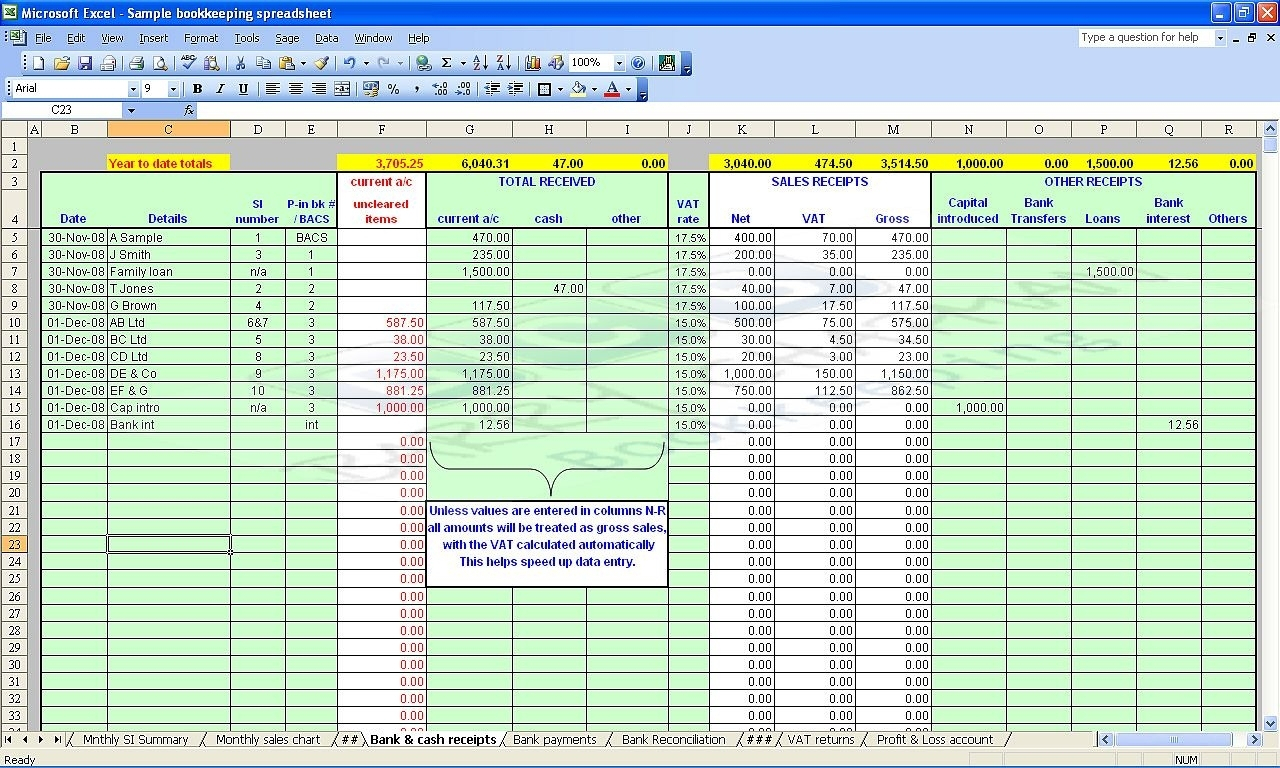

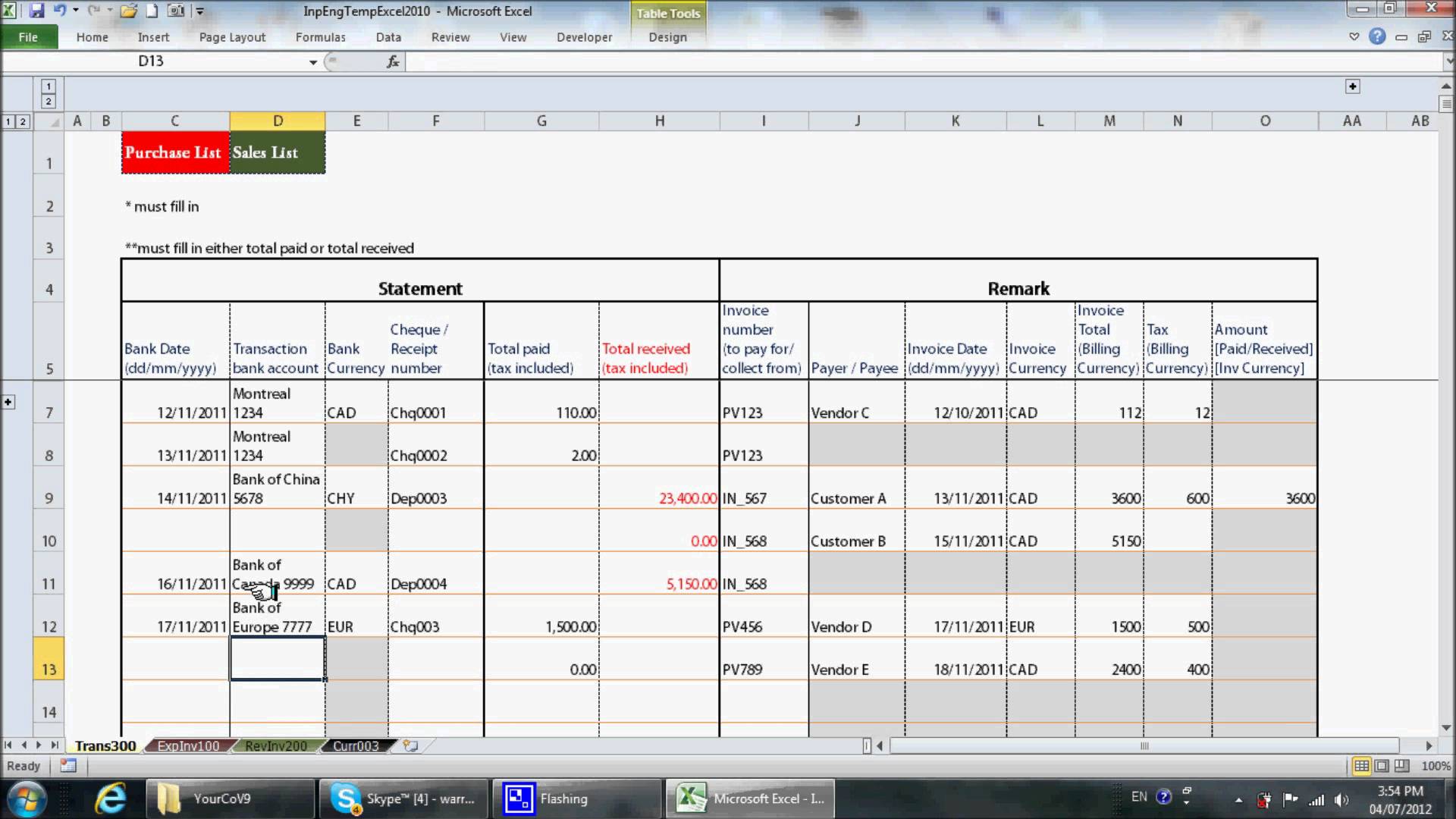

Just as important as tracking expenses is recording your income. Excel templates for income tracking allow you to easily categorize and report on your revenue streams. Key features include:

These templates streamline the invoicing and reconciliation process, freeing up valuable time and reducing the risk of errors.

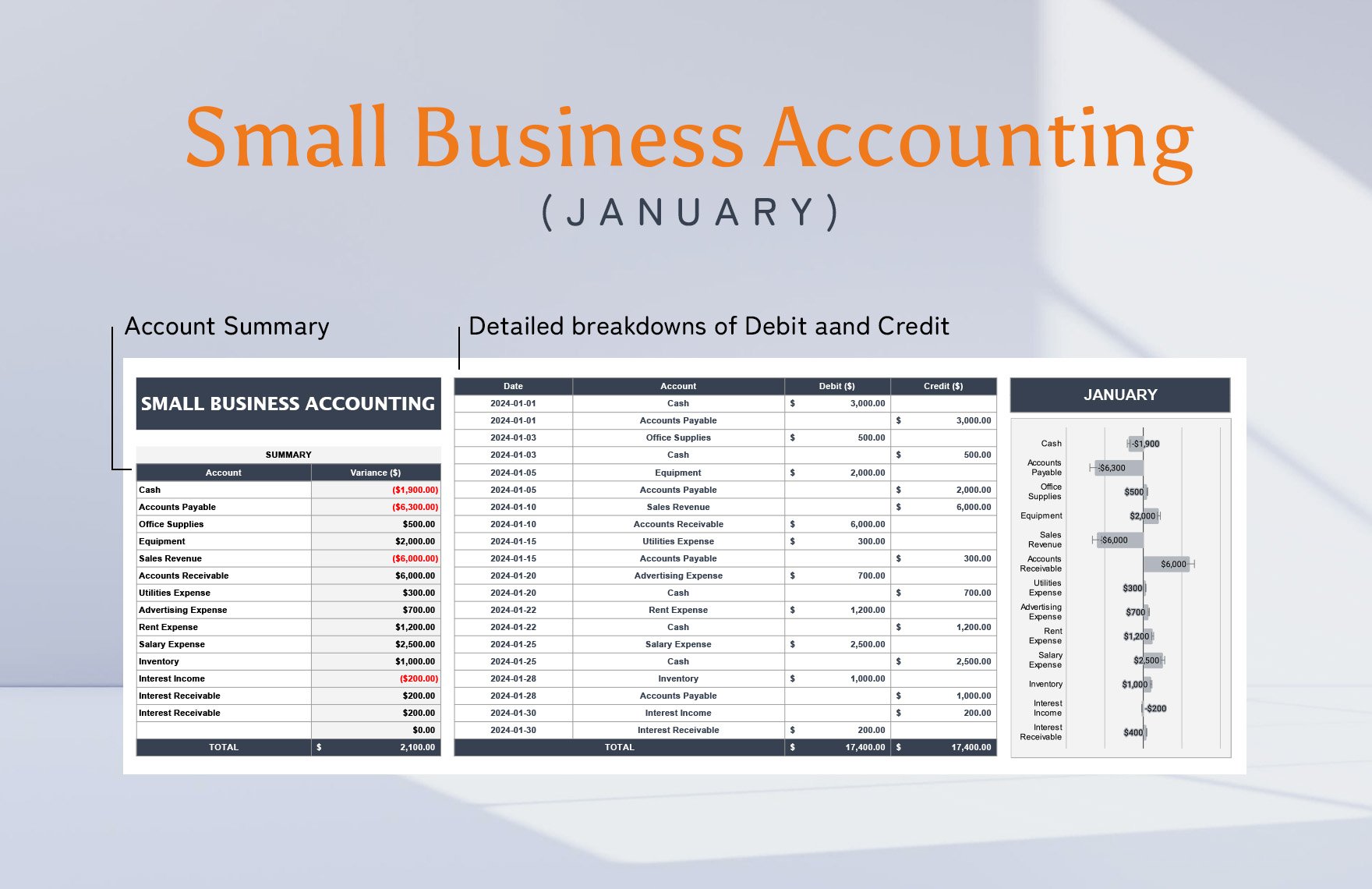

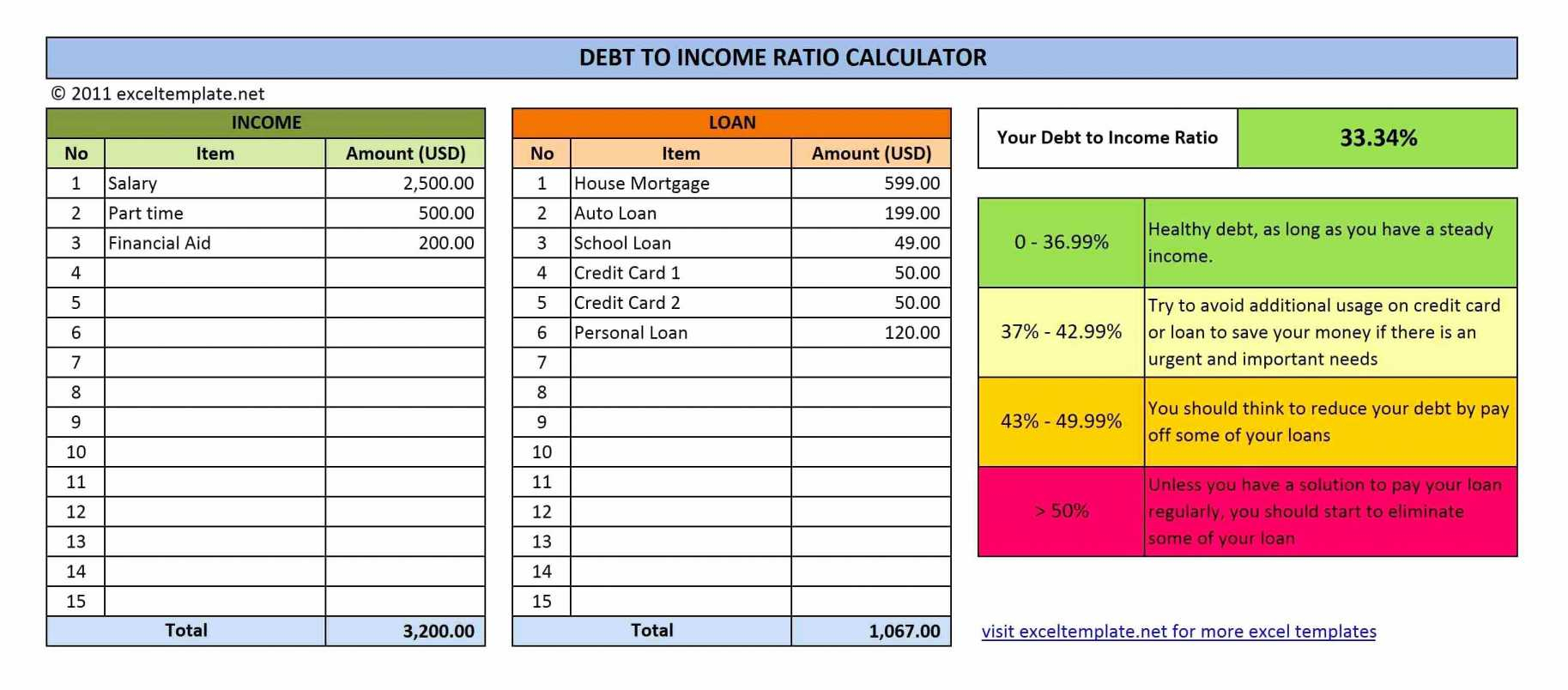

The P&L report is a critical tool for understanding your business’s profitability. Excel templates provide a structured way to calculate your revenue, expenses, and profit. These templates typically include:

These templates are essential for monitoring your business’s financial performance and making informed decisions about pricing, marketing, and operations.

Planning for the future is crucial for any small business. Excel templates can help you create budgets and forecast your financial performance. These templates often include:

These templates empower you to proactively manage your finances and make strategic decisions about your business’s future.

Managing payroll and tax compliance can be complex. Excel templates simplify these processes by providing tools for calculating wages, taxes, and deductions. These templates often include:

These templates can save you significant time and money by reducing the risk of errors and ensuring compliance with tax regulations.

Beyond the specific templates listed above, Excel offers a wealth of features that can significantly enhance your financial management capabilities. These include:

By mastering these features, you can gain a deeper understanding of your business’s financial performance and make more informed decisions.

While many free Excel templates are available, investing in professionally designed templates from reputable providers can offer significant advantages. These templates are often meticulously crafted by financial experts and are thoroughly tested for accuracy. They’re also frequently updated to reflect the latest accounting standards and regulations. Furthermore, professional templates often include features like data validation and security, protecting your sensitive financial information. Choosing a template that’s tailored to your specific business needs will ultimately lead to more efficient and effective financial management.

Excel templates are an indispensable tool for small business accounting. They streamline financial processes, improve accuracy, and provide valuable insights into your business’s performance. By exploring the various options available and leveraging the features of Excel, small business owners can take control of their finances and position their businesses for long-term success. Remember to choose templates that align with your specific needs and to regularly review and update your spreadsheets to ensure they remain accurate and relevant. Don’t underestimate the power of a well-organized and automated financial system – it’s an investment that pays dividends in the long run. The key is to find the right template, learn how to use it effectively, and continuously refine your approach to accounting.