Starting a new business is exhilarating, but it also demands meticulous planning, particularly in the realm of finances. A well-structured financial plan template for startup business is more than just a formality; it’s the roadmap to your company’s success, helping you secure funding, manage cash flow, and make informed decisions. This document outlines your financial goals, strategies, and projections, providing a clear picture of your startup’s financial health.

Without a solid financial plan, even the most innovative ideas can falter. It’s not just about knowing how much money you need; it’s about understanding where that money will come from, how it will be used, and what returns you can expect. This plan is a living document that should be regularly reviewed and updated to reflect the changing realities of your business.

Think of your financial plan as the compass guiding your ship through the turbulent waters of the startup world. It helps you stay on course, avoid financial pitfalls, and make the necessary adjustments to navigate towards profitability. It’s an invaluable tool for attracting investors, securing loans, and making crucial decisions about pricing, marketing, and operations.

This article will explore the essential components of a financial plan, offer practical tips for creating one, and highlight the importance of using a financial plan template for startup business to ensure accuracy and efficiency. Whether you’re a seasoned entrepreneur or a first-time founder, understanding how to create and utilize a robust financial plan is paramount to your startup’s long-term viability.

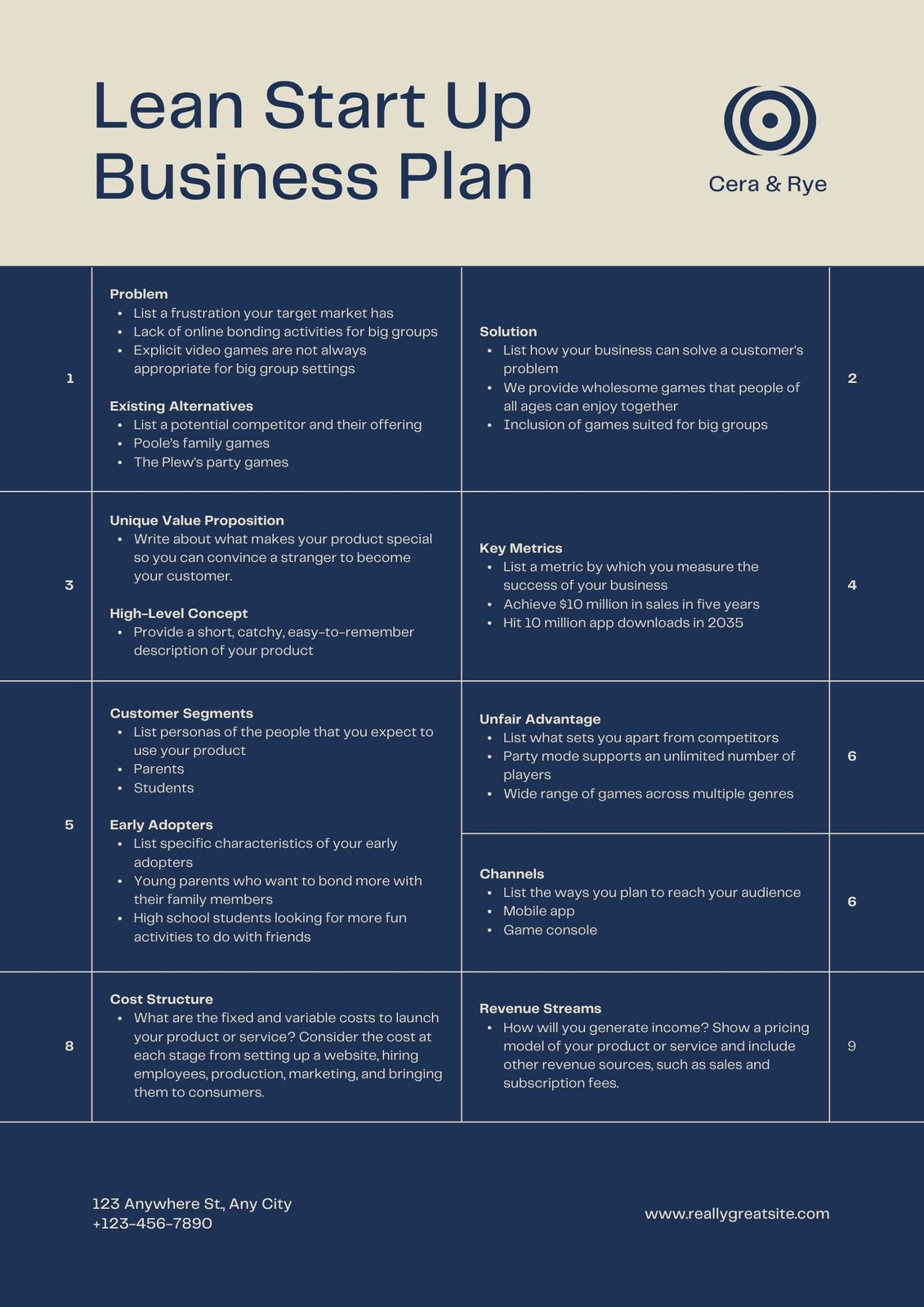

A comprehensive financial plan encompasses several key components, each providing a different perspective on your startup’s financial standing. These components work together to paint a complete picture of your current situation and future prospects.

The executive summary is a brief overview of your entire financial plan. It should highlight the key financial goals, strategies, and projections in a concise and compelling manner. This section is often the first thing investors or lenders will read, so it needs to be impactful and persuasive. Include information about the company’s mission, key achievements to date, and the financial resources needed to achieve future growth.

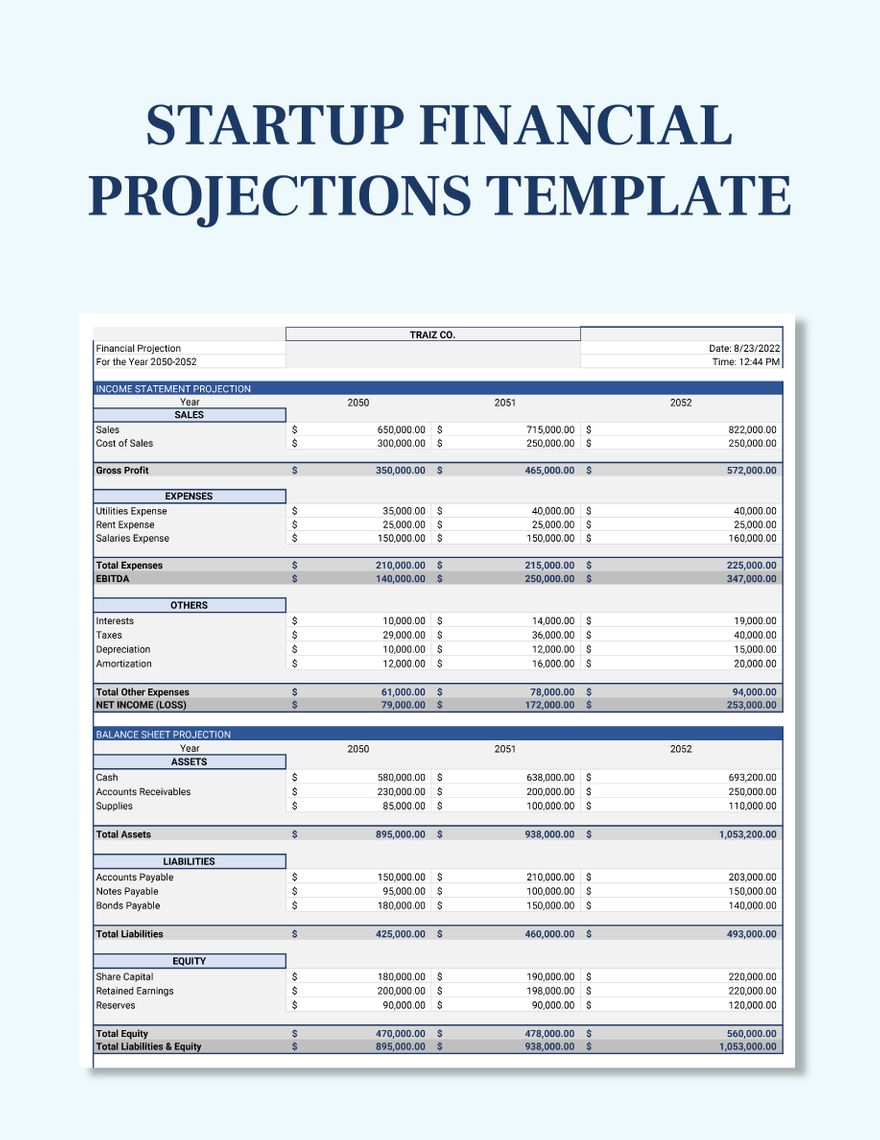

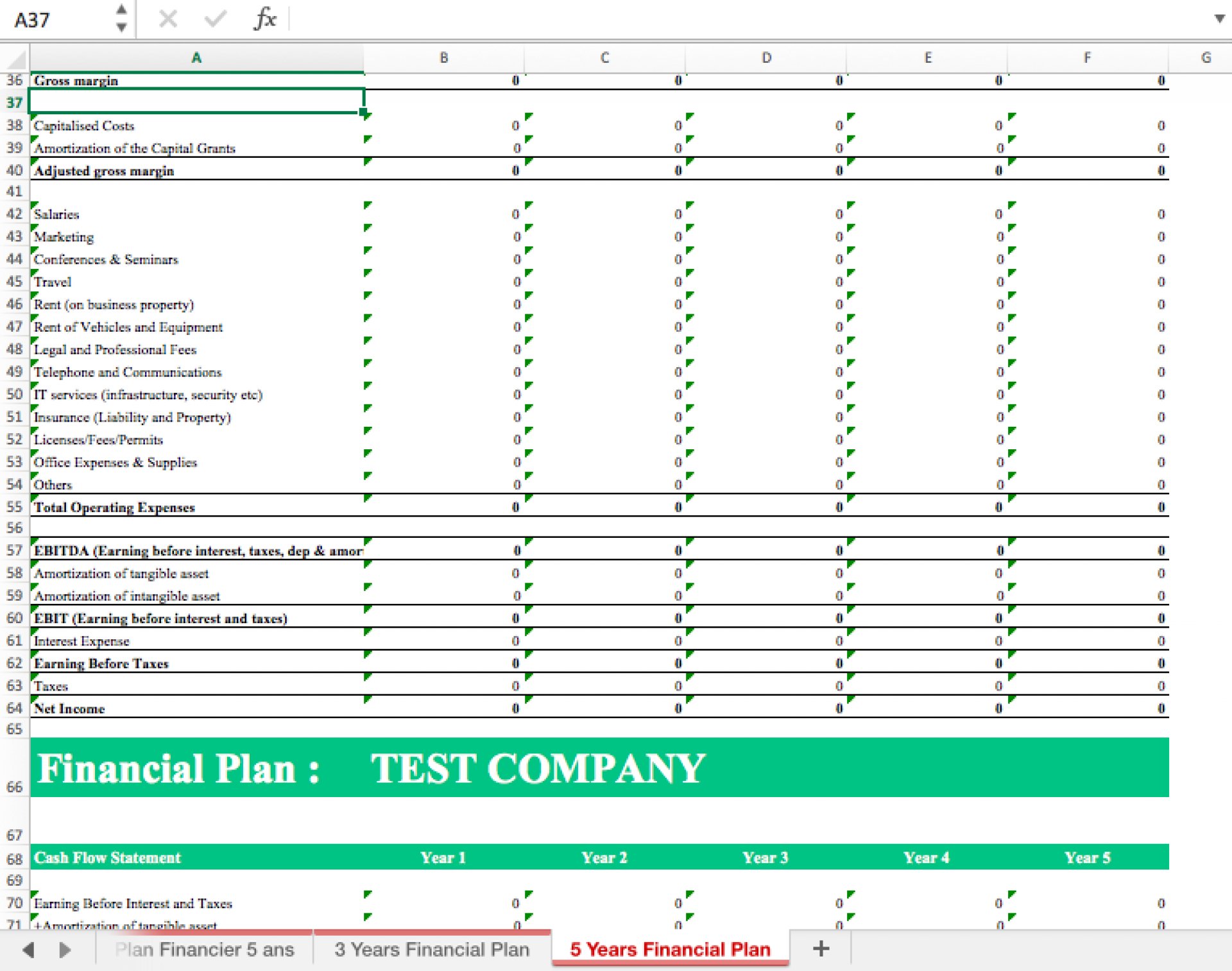

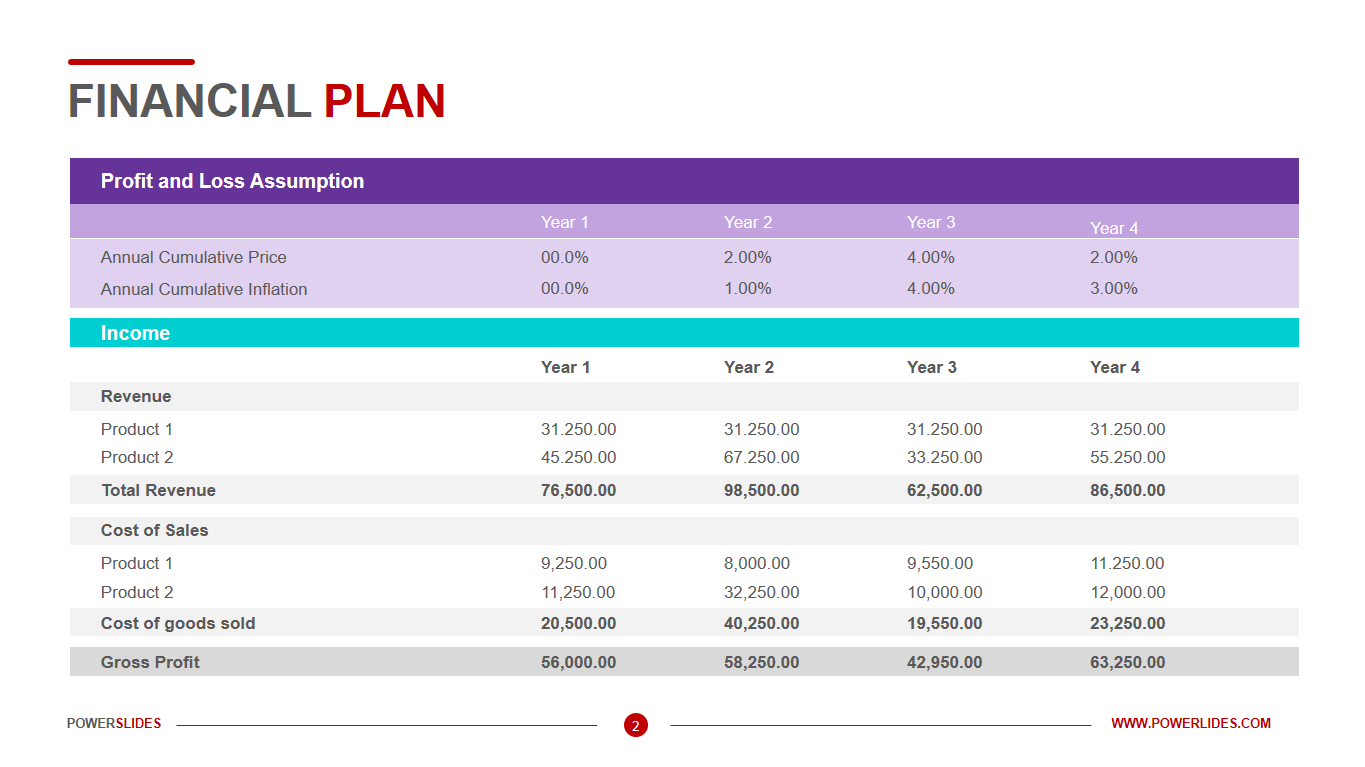

An income statement, also known as a profit and loss (P&L) statement, projects your startup’s revenue, expenses, and net income over a specific period, typically three to five years. This projection is crucial for understanding the potential profitability of your business. You will need to estimate your sales volume, pricing, cost of goods sold (COGS), and operating expenses. A detailed and realistic income statement projection will demonstrate your understanding of the market and your ability to generate revenue.

The balance sheet provides a snapshot of your startup’s assets, liabilities, and equity at a specific point in time. A projected balance sheet estimates these figures for future periods, allowing you to anticipate changes in your financial position. Assets include cash, accounts receivable, and inventory, while liabilities include accounts payable, loans, and deferred revenue. Equity represents the owners’ stake in the business.

The cash flow statement tracks the movement of cash into and out of your startup over a period of time. This statement is critical for managing your working capital and ensuring you have enough cash on hand to meet your obligations. It’s divided into three sections: cash flow from operating activities, investing activities, and financing activities. A well-managed cash flow projection helps you avoid cash shortages and make informed decisions about investments and financing.

A break-even analysis determines the point at which your startup’s revenue equals its total costs. This analysis helps you understand the sales volume required to cover all expenses and start generating a profit. It is a crucial metric for setting pricing strategies and evaluating the financial viability of your business model.

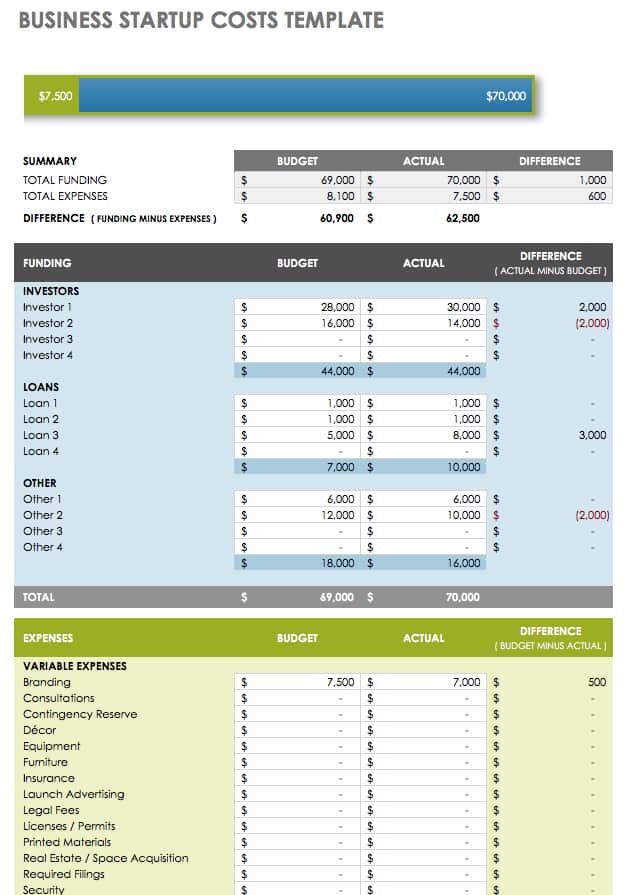

If you are seeking external funding, your financial plan should include a detailed funding request. This section should clearly state the amount of funding you need, how you plan to use the funds, and the expected return on investment for investors. Provide a compelling narrative that highlights the market opportunity, your competitive advantage, and the potential for growth.

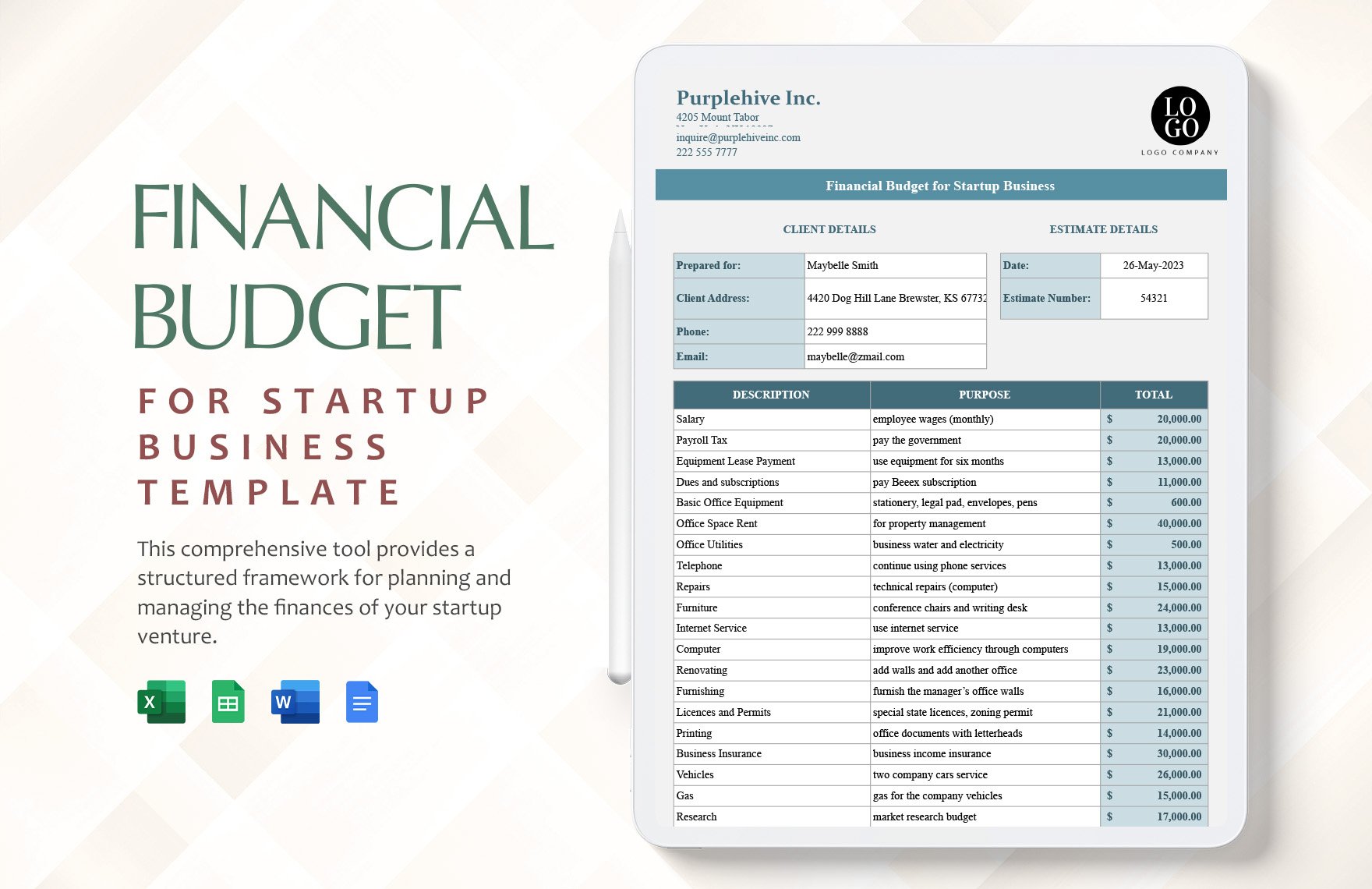

Creating a financial plan from scratch can be a daunting task, especially for first-time entrepreneurs. A financial plan template for startup business offers a structured framework and pre-built formulas to streamline the process.

Templates eliminate the need to build a financial plan from the ground up. They provide a ready-made structure with pre-populated sections and formulas, saving you valuable time and effort. This allows you to focus on gathering and inputting the relevant data, rather than spending hours formatting spreadsheets and writing reports.

Templates often include built-in formulas and calculations that help minimize errors and ensure consistency throughout your financial plan. This is particularly important for complex financial projections, where even small errors can have a significant impact. The structure helps you consider every element of the plan.

A well-designed financial plan template can help you present your financial information in a professional and organized manner. This is crucial when presenting your plan to investors, lenders, or other stakeholders. A polished presentation can enhance your credibility and increase your chances of securing funding.

Templates make it easier to collaborate with financial advisors, accountants, and other team members. Everyone can work from the same document, ensuring consistency and avoiding misunderstandings. This collaborative approach can lead to a more robust and well-informed financial plan.

While templates provide a solid foundation, they can also be customized to meet the specific needs of your startup. You can add or remove sections, adjust formulas, and tailor the presentation to reflect your unique business model and financial goals.

Creating a financial plan using a financial plan template for startup business involves a series of steps, from gathering data to finalizing the document. Here’s a step-by-step guide to help you through the process.

Select a template that is appropriate for your type of business and industry. There are many different templates available online, so take the time to find one that meets your specific needs. Consider factors such as the complexity of your business model, the level of detail required, and the presentation style.

Before you start filling in the template, gather all the necessary financial data. This includes information on your startup costs, revenue projections, operating expenses, and funding sources. The more accurate and comprehensive your data, the more reliable your financial plan will be. Conduct thorough market research to support your sales projections.

Carefully fill in each section of the template with your financial data. Be sure to review all the formulas and calculations to ensure they are correct. Pay close attention to detail, and double-check your work for any errors. Be realistic in your projections, avoiding overly optimistic assumptions.

Once you have completed the template, review it carefully to ensure it is accurate and complete. Seek feedback from financial advisors, accountants, or other experienced entrepreneurs. Use their insights to refine your financial plan and address any areas of weakness.

Your financial plan is not a one-time document. It should be regularly updated to reflect the changing realities of your business. Review your plan at least quarterly, and make adjustments as needed. This will help you stay on track and make informed decisions about your startup’s financial future.

Creating a financial plan is a complex process, and it’s easy to make mistakes along the way. Here are some common pitfalls to avoid.

One of the biggest mistakes startups make is creating overly optimistic revenue projections. It’s important to be realistic and base your projections on solid market research and historical data. Overly optimistic projections can lead to unrealistic expectations and poor decision-making.

Another common mistake is underestimating expenses. Be sure to include all your startup costs, operating expenses, and other potential costs. It’s always better to overestimate expenses than to underestimate them.

Many startups focus on profitability but ignore cash flow. It’s important to track your cash flow carefully to ensure you have enough cash on hand to meet your obligations. A cash flow statement projection can help you identify potential cash shortages and take corrective action.

Sensitivity analysis involves testing the impact of different assumptions on your financial projections. This can help you identify potential risks and develop contingency plans. For example, you might want to analyze the impact of a decrease in sales or an increase in expenses.

Creating a financial plan can be challenging, especially for first-time entrepreneurs. Don’t hesitate to seek professional advice from financial advisors, accountants, or other experienced professionals. They can provide valuable insights and help you avoid costly mistakes.

Beyond securing funding and managing cash flow, a well-crafted financial plan template for startup business offers numerous long-term benefits that contribute to sustained growth and success.

A comprehensive financial plan provides a clear framework for making strategic decisions about your business. By understanding your financial strengths and weaknesses, you can make informed choices about pricing, marketing, and operations.

Your financial plan serves as a benchmark for measuring your startup’s performance. By tracking your actual results against your projections, you can identify areas where you are exceeding expectations and areas where you need to improve.

A solid financial plan can help you attract top talent to your startup. Prospective employees want to work for companies that are financially stable and have a clear vision for the future. A well-articulated financial plan can demonstrate your commitment to long-term success.

As your startup grows, you may need to seek additional funding. A strong financial plan, which has been consistently updated, will be essential for attracting investors and securing loans. Investors want to see that you have a clear understanding of your financial situation and a well-defined plan for future growth.

When you eventually decide to sell your business or seek an acquisition, a detailed financial plan will be crucial for determining its value. A well-documented financial history will provide potential buyers with the information they need to assess the value of your startup.

A financial plan template for startup business is an indispensable tool for entrepreneurs. It provides a roadmap for success, helping you secure funding, manage cash flow, and make informed decisions. By understanding the key components of a financial plan, choosing the right template, and avoiding common mistakes, you can create a document that will guide your startup towards long-term viability. Remember that your financial plan is a living document that should be regularly reviewed and updated to reflect the changing realities of your business. With careful planning and diligent execution, you can increase your chances of building a successful and sustainable startup.