Are you struggling to understand how your budget is performing? Do you need a clear, concise report to track your spending and identify areas for improvement? A Flexible Budget Performance Report Template is designed to simplify this process, providing a structured overview of your financial health. This template empowers you to make data-driven decisions, optimize your spending, and ultimately, achieve your financial goals. It’s more than just a report; it’s a tool for proactive financial management. Flexible Budget Performance Report Template is your key to unlocking a clearer picture of your financial situation. This article will guide you through creating a robust and effective report, covering everything from data collection to insightful analysis. Let’s dive in.

Creating a truly effective budget isn’t just about tracking income and expenses; it’s about understanding why you’re spending where you are. A Flexible Budget Performance Report Template provides a centralized location to examine your spending habits, compare them to your budget, and identify trends. Without this tool, it’s easy to lose sight of where your money is going, leading to financial stress and missed opportunities. The ability to quickly assess performance allows for timely adjustments, ensuring you’re staying on track with your financial plan. Furthermore, a well-structured report demonstrates accountability and transparency – crucial for building trust with yourself and others. The benefits extend beyond simple tracking; it fosters a deeper understanding of your financial habits, promoting long-term financial well-being. It’s an investment in your future.

A comprehensive Flexible Budget Performance Report Template typically includes several key sections. Each section is designed to provide a specific perspective on your financial health. Here’s a breakdown of the essential elements:

This section provides a high-level overview of the report’s findings. It should be concise and highlight the most important takeaways. It’s often the first thing readers see, so it needs to be impactful. The executive summary should clearly state the overall budget performance, key variances, and recommendations. Flexible Budget Performance Report Template emphasizes the need for this initial overview.

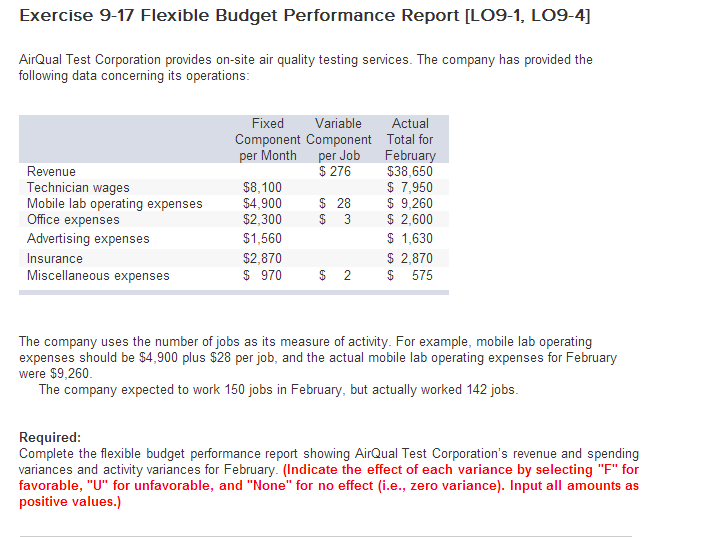

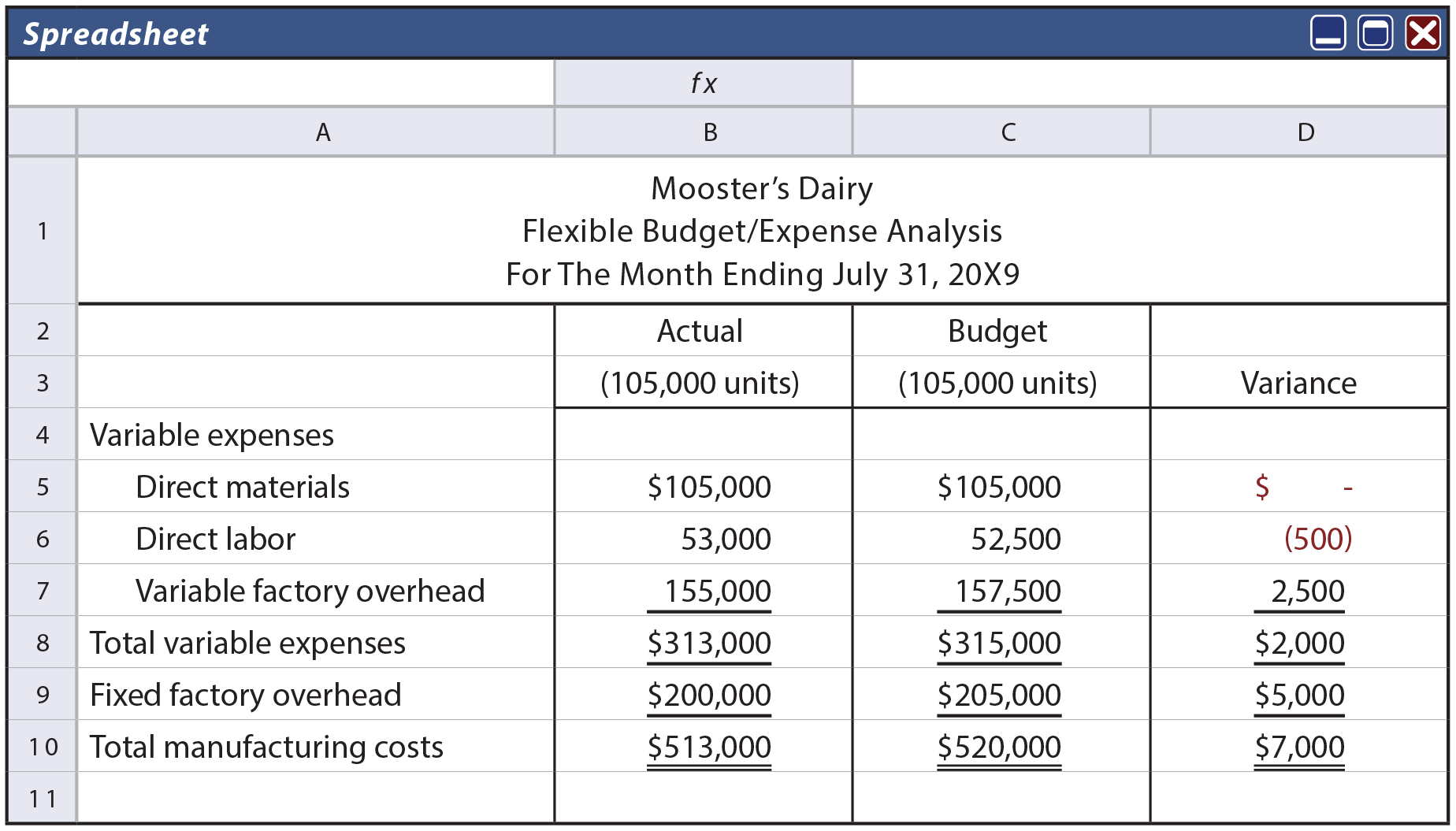

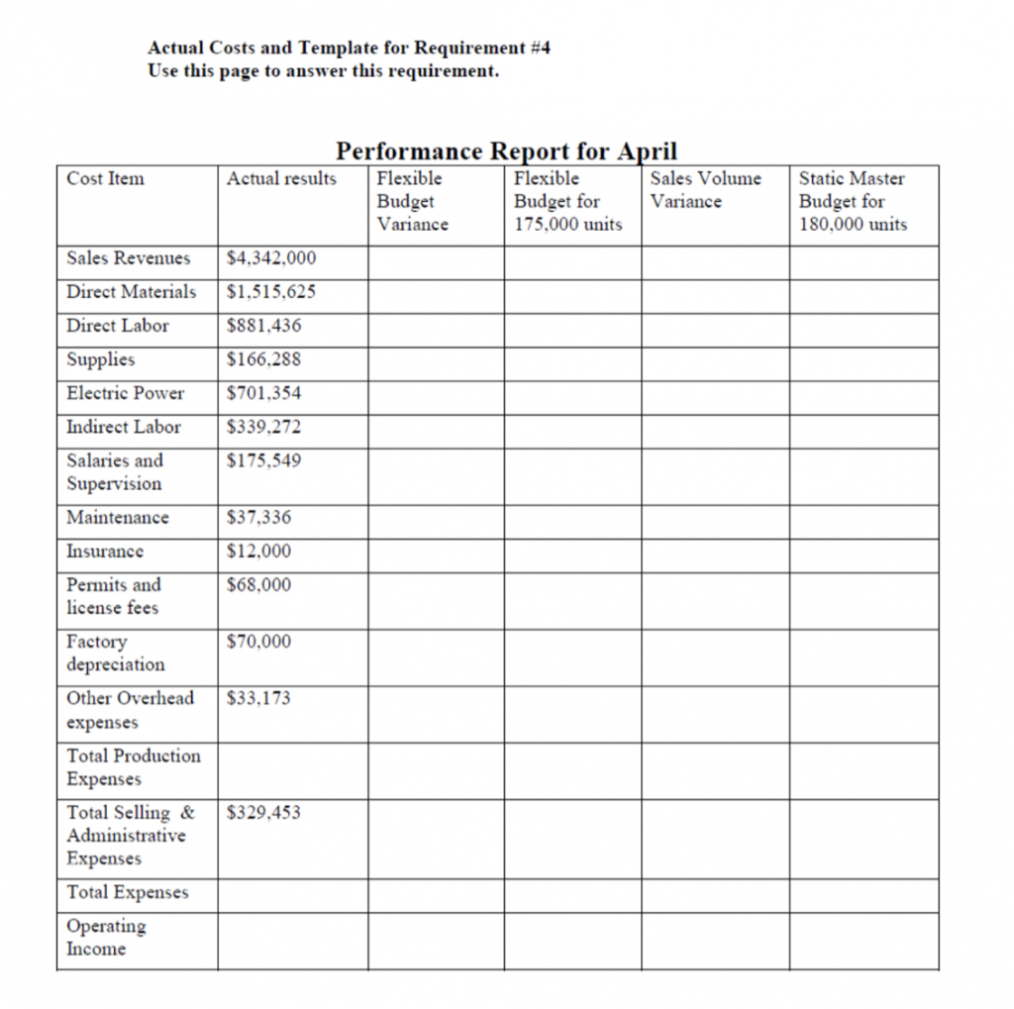

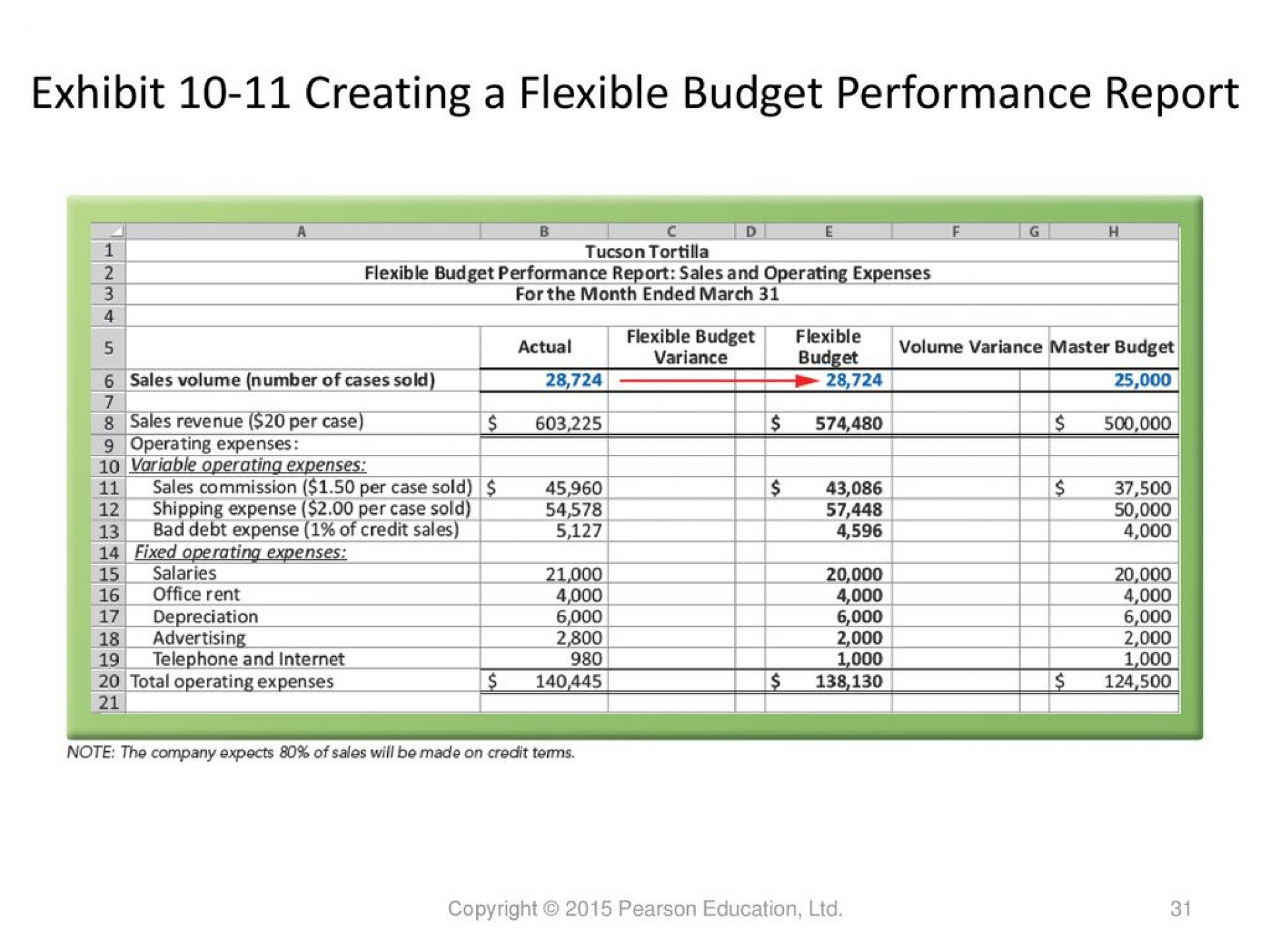

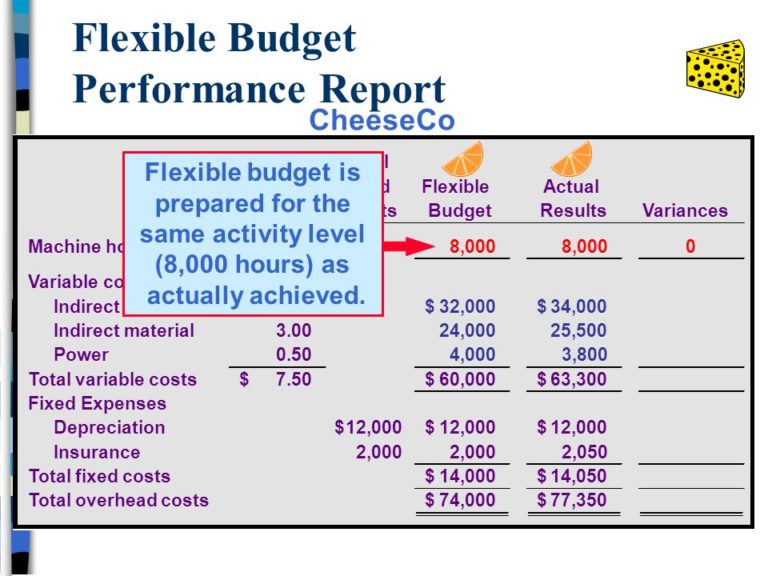

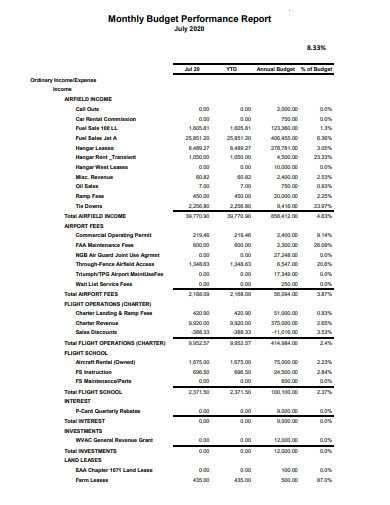

This is the core of the report. It compares your budgeted amounts to your actual spending over a specified period (e.g., monthly, quarterly, annually). Clearly illustrate the variances – the difference between what you planned and what you actually spent. Use charts and graphs to visually represent these variances. For example, a bar chart comparing budgeted vs. actual spending by category can be very effective. Understanding these discrepancies is critical for identifying areas where you’re overspending or underspending. A detailed breakdown of each category is essential.

This section delves deeper into the performance of individual spending categories. You can categorize expenses into broad areas like housing, transportation, food, entertainment, and debt payments. Analyze each category to identify trends and potential problem areas. For instance, if food spending consistently exceeds the budget, investigate the reasons – are you eating out too often? Are you buying unnecessary items? Flexible Budget Performance Report Template encourages a granular level of analysis.

This section examines your income sources. It’s important to understand the stability and consistency of your income. Track income sources like salary, investments, and side hustles. Analyze trends in income to identify potential fluctuations and plan accordingly. A clear picture of your income is vital for maintaining a healthy budget.

If applicable, this section tracks your debt obligations – credit cards, loans, etc. Include details about interest rates, minimum payments, and outstanding balances. Analyze your debt repayment strategy and identify opportunities to reduce interest costs. A proactive approach to debt management is crucial for long-term financial stability.

This section focuses on the movement of cash into and out of your accounts. It’s particularly important for businesses and individuals managing their finances. Track income and expenses to determine your cash flow position. A positive cash flow indicates that you have more money coming in than going out. Understanding your cash flow is essential for making informed financial decisions.

Creating a truly effective Flexible Budget Performance Report Template requires careful data collection and reporting. Here are some best practices:

Modern technology offers powerful tools to streamline the creation and analysis of Flexible Budget Performance Reports. Cloud-based accounting platforms often include built-in reporting features, making it easier to generate customized reports. Furthermore, data visualization tools like Tableau or Power BI can transform raw data into compelling and insightful visuals. These tools can significantly reduce the time and effort required to produce a high-quality report. Flexible Budget Performance Report Template is increasingly reliant on these technologies.

The value of a Flexible Budget Performance Report Template extends far beyond simply presenting numbers. It’s about understanding why those numbers are what they are. Consider these key insights:

A Flexible Budget Performance Report Template is a powerful tool for anyone looking to gain control of their finances. By providing a structured and detailed overview of your spending habits, it empowers you to make informed decisions, optimize your budget, and achieve your financial goals. It’s a commitment to proactive financial management, not just a report. The key to maximizing the benefits of this template lies in consistent data collection, thoughtful analysis, and a willingness to adapt your strategies based on your findings. Ultimately, a well-crafted Flexible Budget Performance Report Template is an investment in your financial future. Flexible Budget Performance Report Template is a foundational element for long-term financial success.