Creating a solid financial foundation is crucial for any business or individual. One of the most important tools for managing debt and ensuring financial stability is a Free Installment Promissory Note Template. This document provides a readily available framework for establishing a legally sound agreement between a lender and a borrower, outlining the terms of a loan repayment schedule. Understanding the nuances of these templates is vital for protecting both parties involved. This article will guide you through the key components of a well-structured promissory note, ensuring clarity and minimizing potential disputes. The core of this document centers around the concept of a free installment, highlighting its accessibility and ease of use. Let’s delve into how to create a template that’s both practical and legally sound.

The importance of a well-drafted promissory note cannot be overstated. It serves as a formal record of the agreement, protecting both the borrower and the lender. It clarifies the repayment schedule, interest rates (if applicable), and consequences of default. A clear and comprehensive template minimizes the risk of misunderstandings and legal challenges. Furthermore, readily available templates offer a significant advantage, particularly for smaller businesses or individuals who may lack the resources to engage legal counsel. This article will explore the essential elements of a free installment promissory note, providing a practical guide to creating a document that effectively protects your interests. The very act of having a template readily available demonstrates a commitment to responsible financial management.

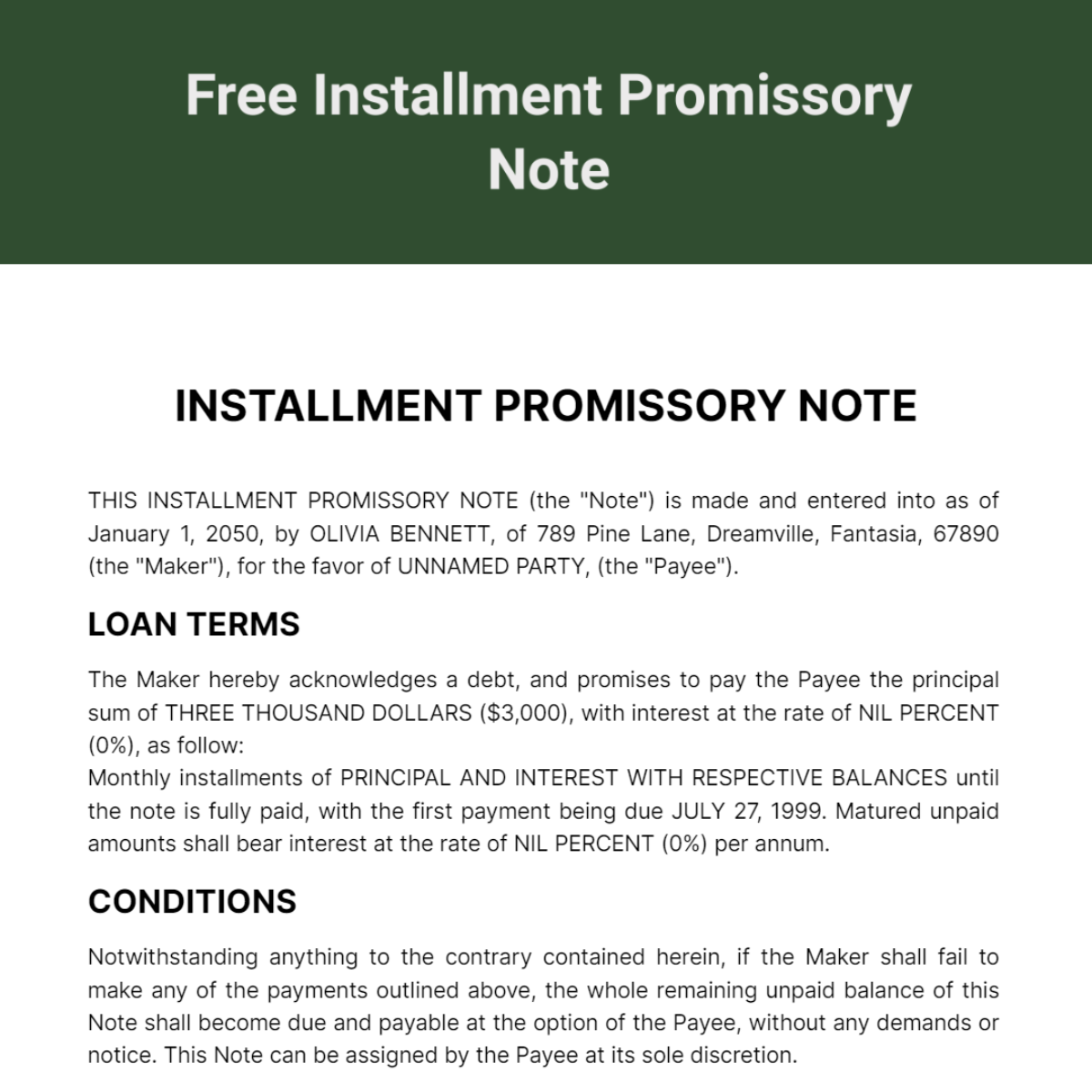

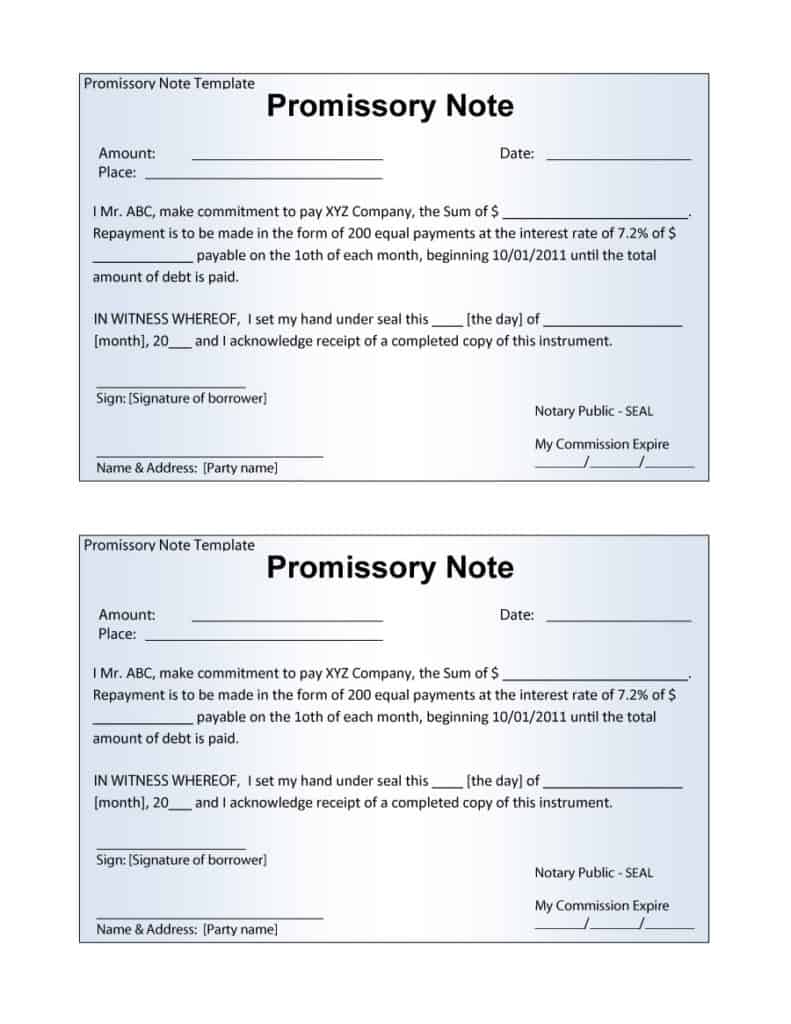

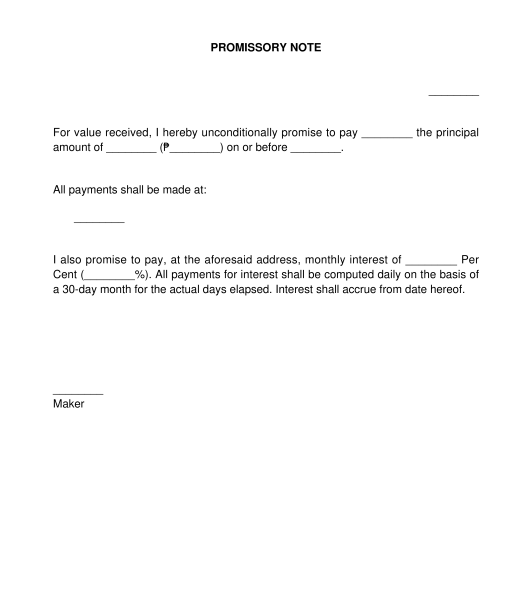

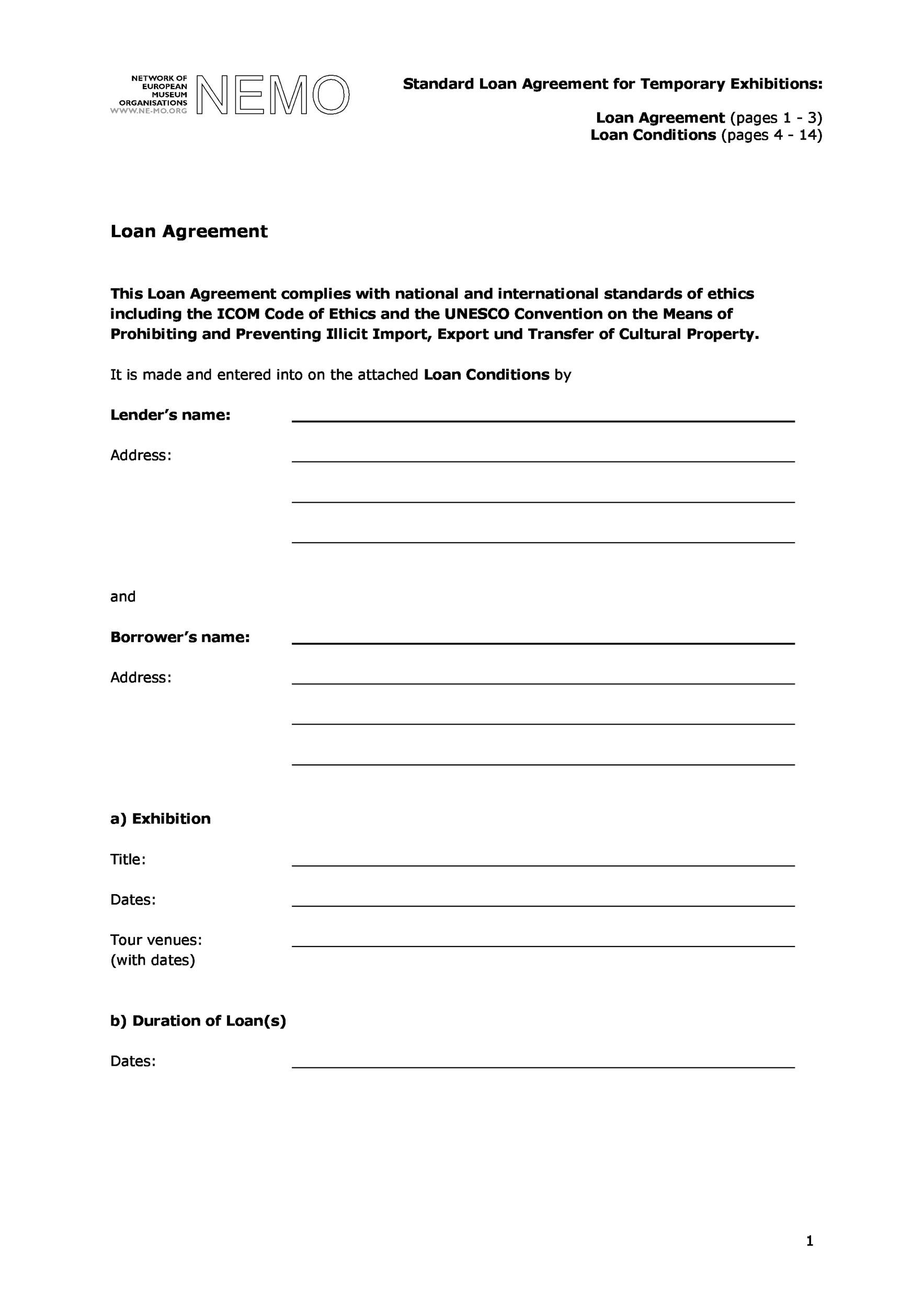

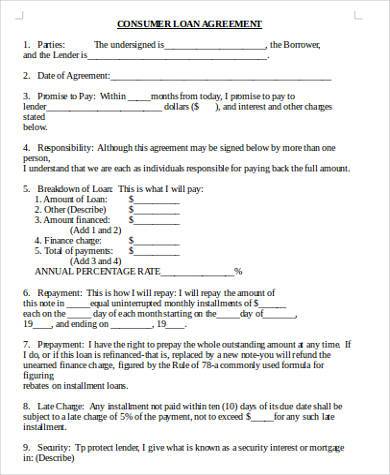

Before diving into the specifics of a free installment promissory note, it’s essential to grasp the fundamental principles. A promissory note is a legally binding agreement where one party (the borrower) promises to repay a specific sum of money to another party (the lender) over a defined period. It’s a contract outlining the terms of the loan, including the principal amount, interest rate (if any), repayment schedule, and consequences of non-payment. A well-defined promissory note is a cornerstone of sound financial planning and responsible borrowing. It’s crucial to understand that a promissory note is not a guarantee of repayment; it’s a legally enforceable agreement.

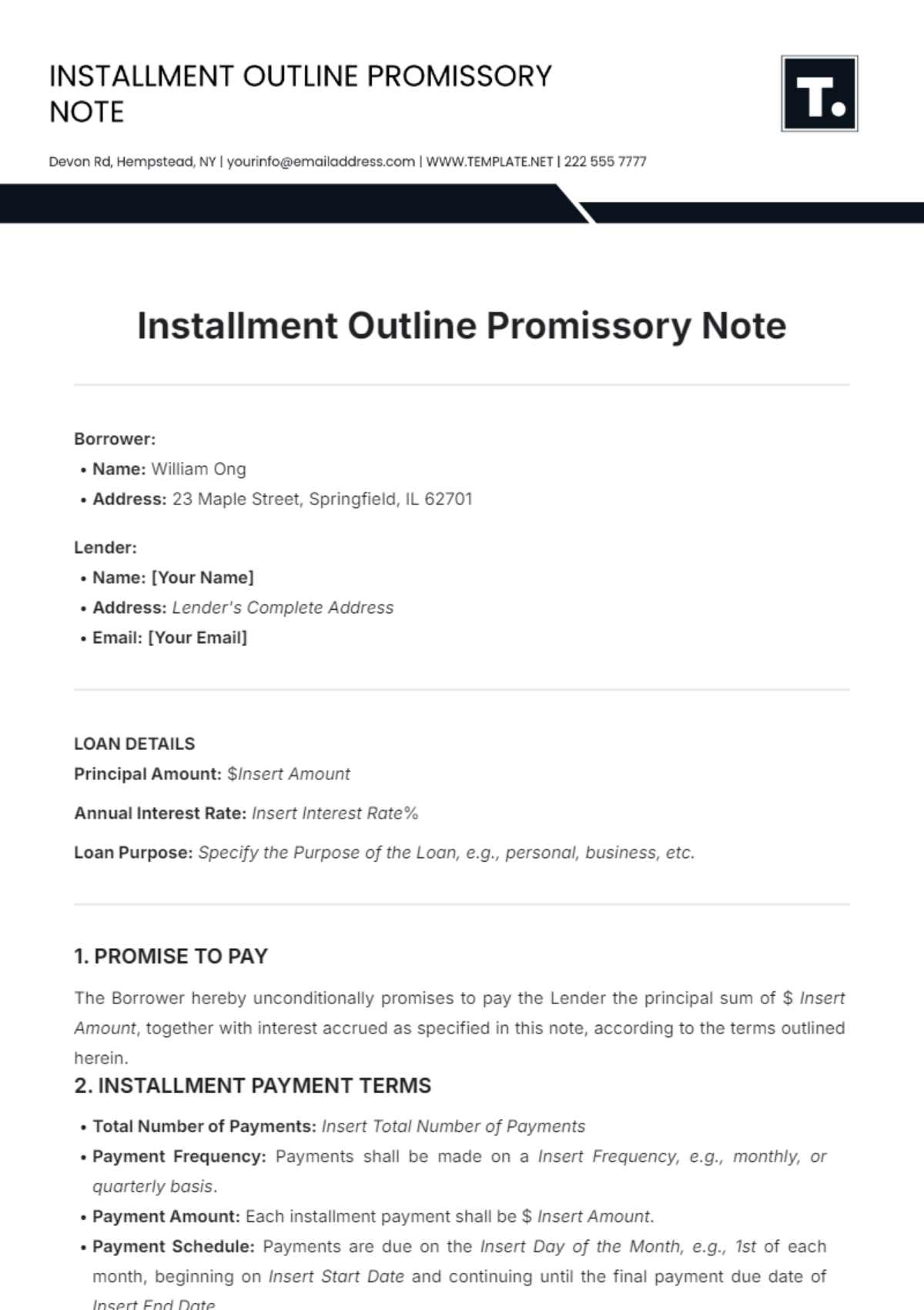

Let’s examine the key components that should be included in a free installment promissory note. Each section contributes to the overall clarity and enforceability of the agreement.

The first section of the template should clearly identify the parties involved. This typically includes:

A detailed explanation of the purpose for which the loan is being provided is vital. This clarifies the borrower’s intent and helps ensure the loan is used responsibly. For example, a business loan for equipment purchase should clearly state the intended use.

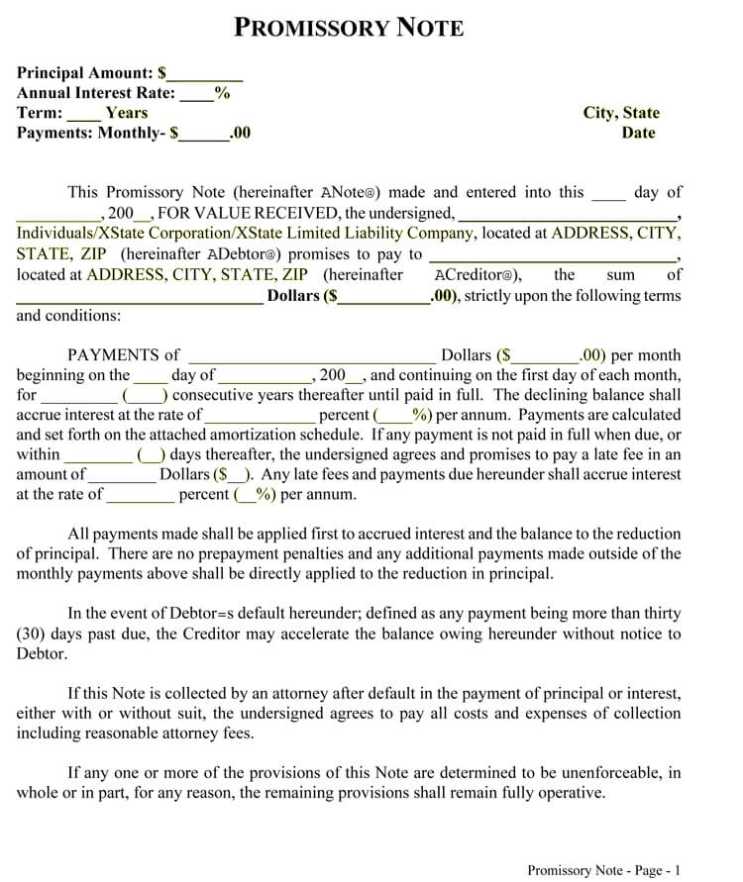

This section outlines the specific terms of the repayment schedule. Key elements include:

If the loan is secured by collateral (e.g., equipment, real estate), this section should clearly define the collateral and its value. A written description of the collateral is essential.

Specify the jurisdiction whose laws will govern the agreement. This is important for resolving any disputes that may arise. Consider including a clause for mediation or arbitration before resorting to litigation.

The template should include spaces for all parties to sign and date the agreement. This demonstrates the parties’ commitment to the terms of the promissory note.

While a free template provides a starting point, it’s important to remember that it’s a tool, not a substitute for legal advice. Here are some practical tips for creating a robust and legally sound promissory note:

The inclusion of interest rates in a free installment promissory note is a critical consideration. While a simple, straightforward loan agreement might not require interest, it’s often beneficial to include a small, fixed interest rate to protect the lender. This provides a buffer against unexpected fluctuations in market rates. The interest rate should be clearly stated and clearly defined. The choice of interest rate should be aligned with the borrower’s financial situation and the lender’s risk tolerance.

Utilizing a free installment promissory note template offers numerous advantages:

Several common mistakes can undermine the effectiveness of a promissory note. Here are a few to be aware of:

Creating a free installment promissory note template is a valuable step towards establishing a secure and legally sound financial agreement. By carefully considering the key components, following practical tips, and seeking professional guidance when needed, you can create a document that effectively protects your interests and promotes responsible borrowing. Remember that a well-drafted template is a tool, and its effectiveness depends on its clarity, specificity, and adherence to applicable laws. Investing in a quality template is an investment in the long-term stability of your financial relationships. The ability to quickly and easily create a document that protects your interests is a significant advantage, particularly for smaller businesses and individuals. Ultimately, a free installment promissory note template empowers you to take control of your finances and build a solid foundation for future success.