Obtaining a personal loan often involves a degree of trust, especially when it’s between friends or family. Formalizing that agreement with a legally sound document can provide clarity and protect both the lender and the borrower. A free promissory note template for personal loan transactions can serve as that document, outlining the terms of the loan, repayment schedule, and consequences of default. This approach offers a structured method for lending and borrowing, mitigating potential misunderstandings and preserving relationships.

Using a promissory note is a simple yet effective way to establish clear expectations. It details the loan amount, interest rate (if applicable), repayment timeline, and default conditions. This written record helps ensure both parties are on the same page, reducing the likelihood of disputes down the road. It’s a proactive step towards responsible lending and borrowing, even amongst those closest to you.

While informal agreements might seem sufficient, they can quickly unravel when financial pressures arise. A well-drafted promissory note provides a legal recourse should the borrower fail to meet their obligations. This is not about distrust, but about prudence and ensuring that the lender’s investment is protected. Moreover, the structure of a promissory note can encourage borrowers to take their repayment responsibilities seriously, as they are legally bound by the agreement.

In the following sections, we will delve into the specifics of promissory notes, explore the different types available, and provide guidance on how to effectively utilize a free promissory note template for personal loan arrangements. Understanding the key elements and legal considerations will empower you to create a document that is both comprehensive and legally sound, safeguarding your financial interests and preserving your personal relationships.

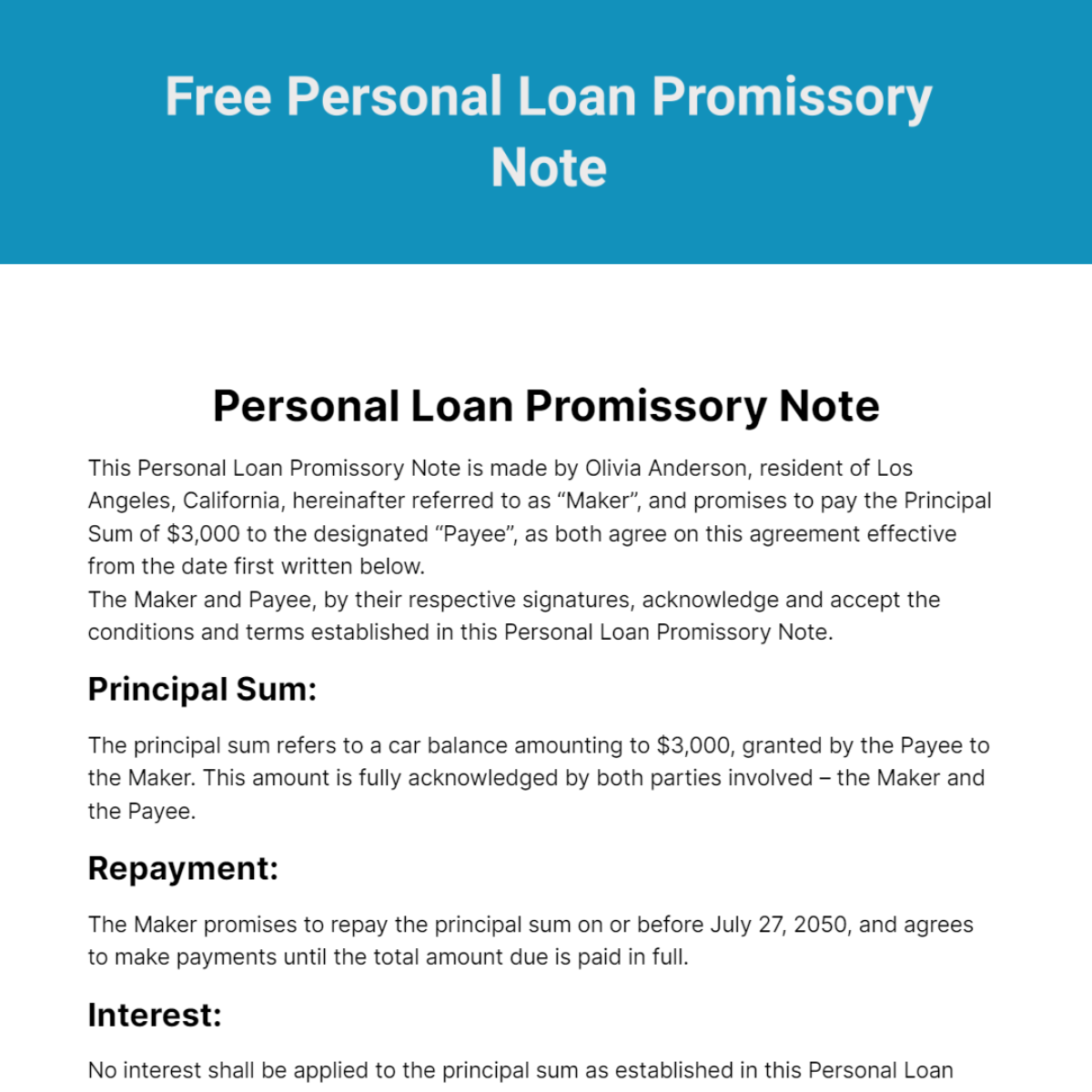

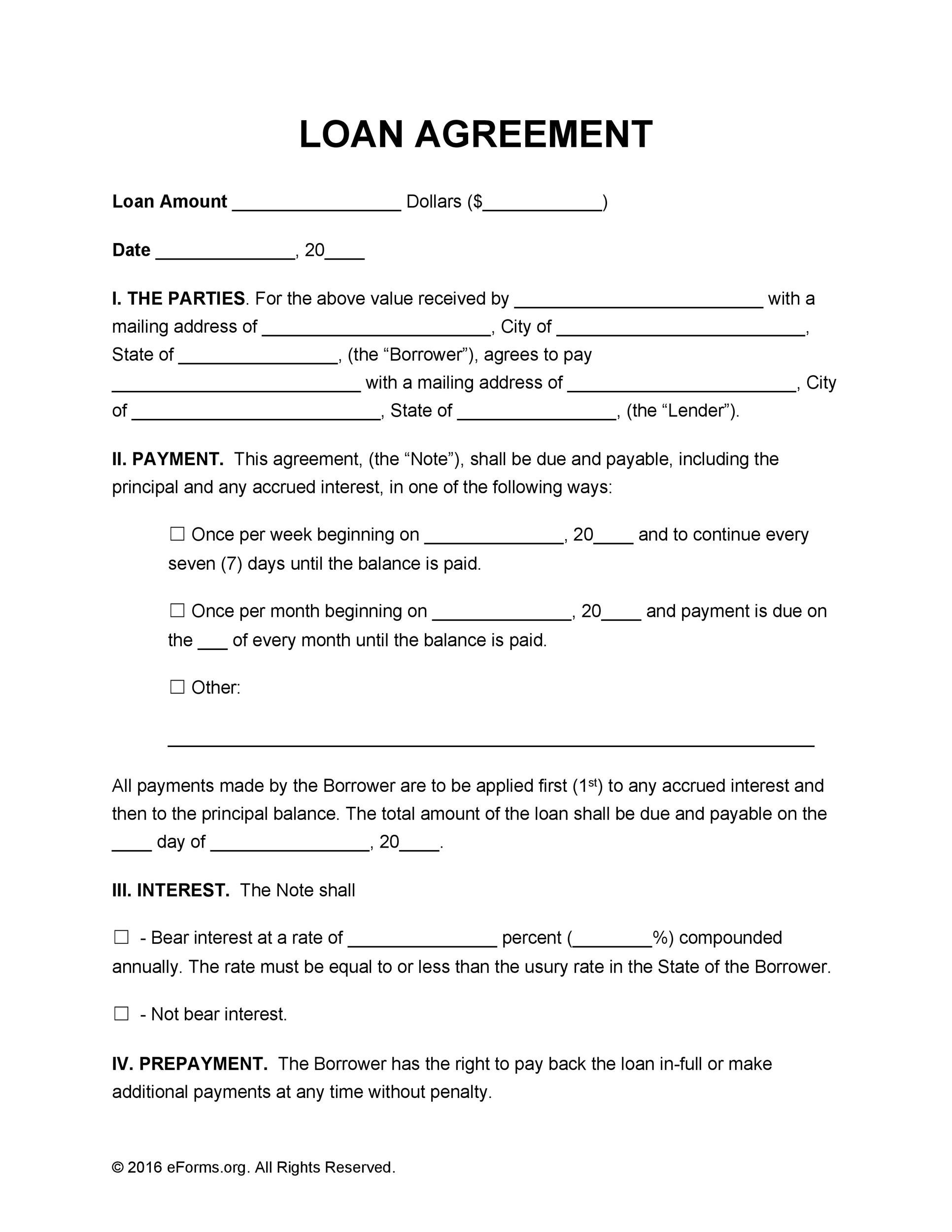

A promissory note is a written agreement where one party (the borrower) promises to pay another party (the lender) a specific sum of money, either on demand or at a predetermined date. It essentially acts as an IOU but with legally binding terms and conditions. Unlike a simple IOU, a promissory note includes critical details like the principal amount, interest rate (if any), repayment schedule, maturity date, and consequences for default.

Think of it as a contract that formalizes a loan agreement. It provides a clear framework for repayment and offers legal protection to the lender in case the borrower fails to fulfill their obligations. The terms outlined in the promissory note are enforceable in a court of law, making it a valuable tool for managing financial risk in personal and business lending scenarios.

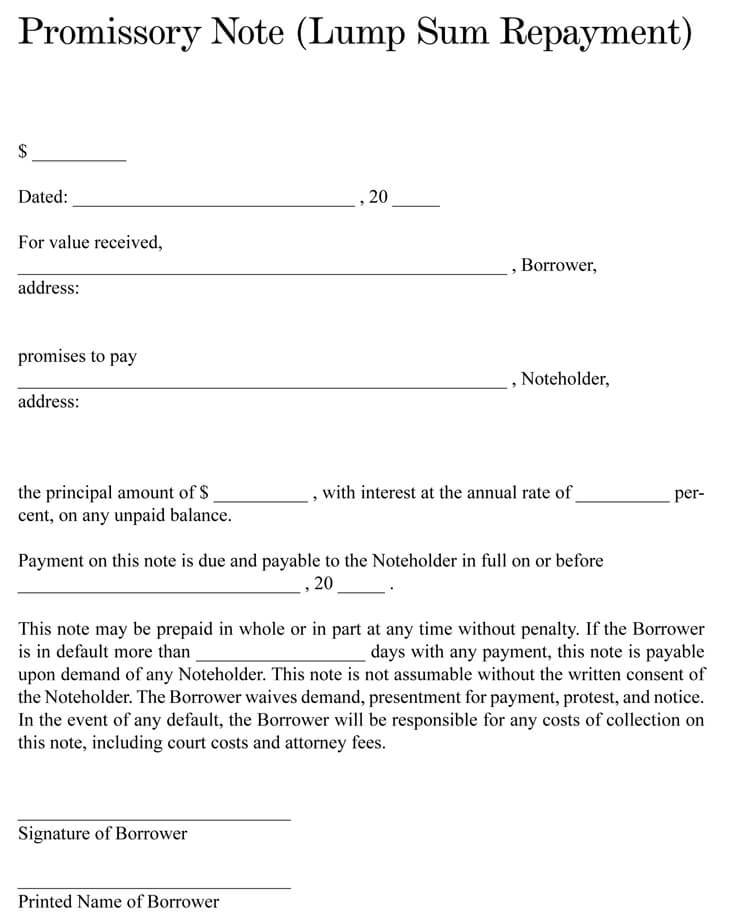

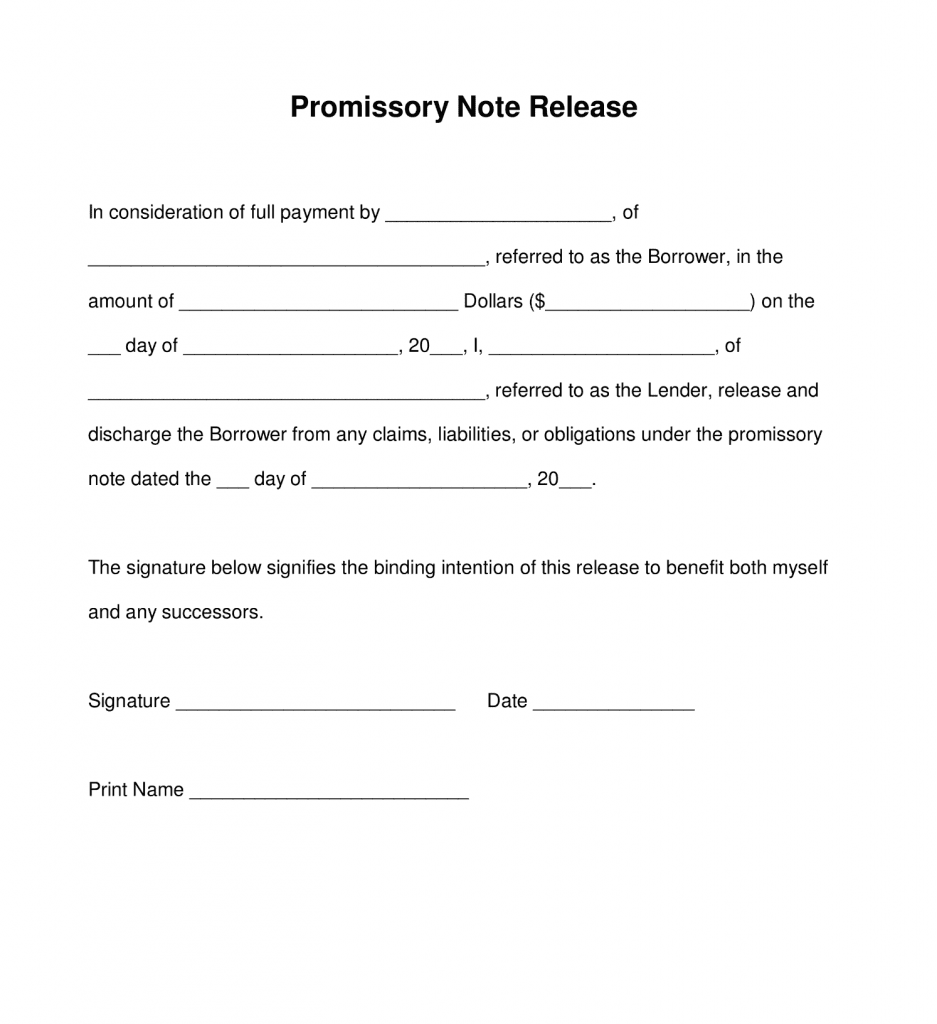

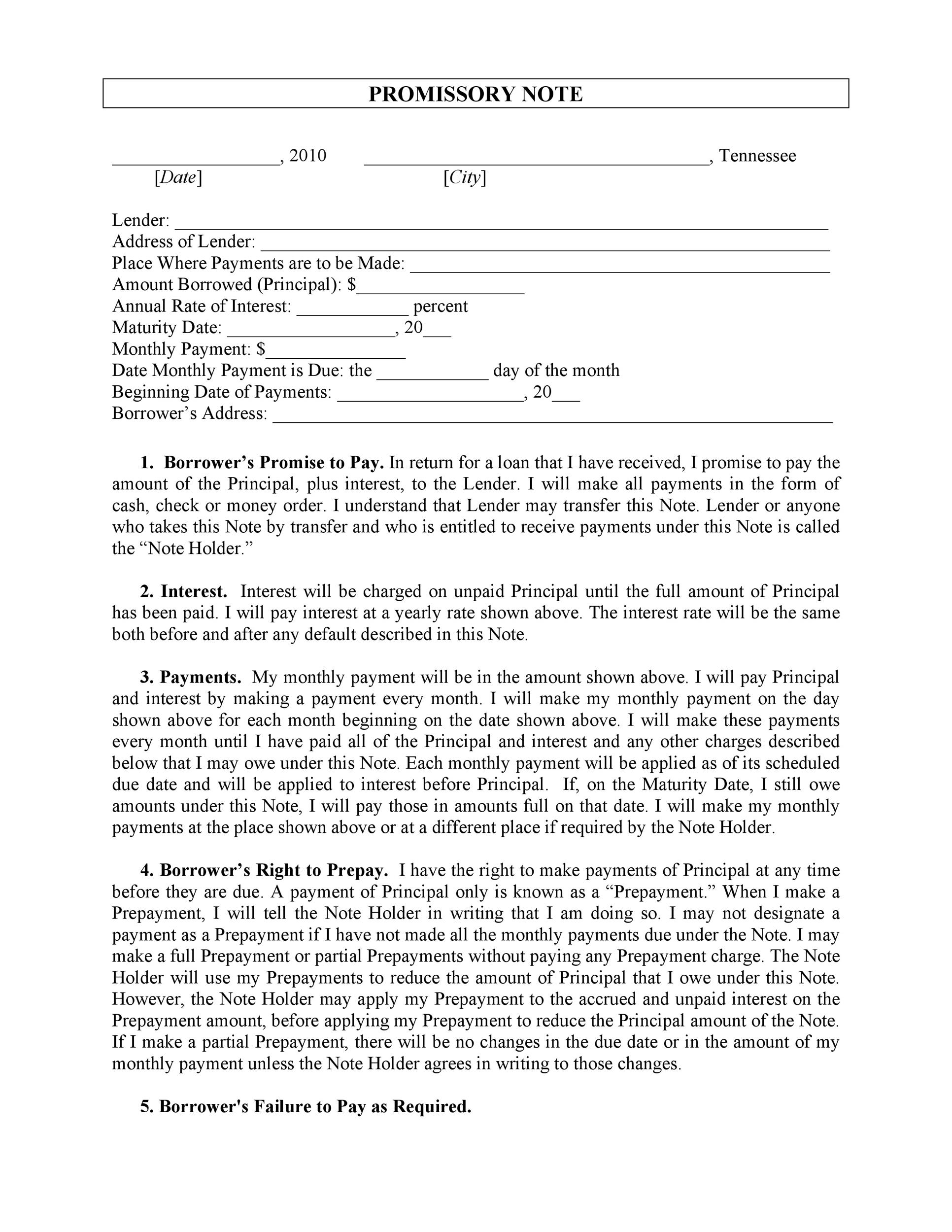

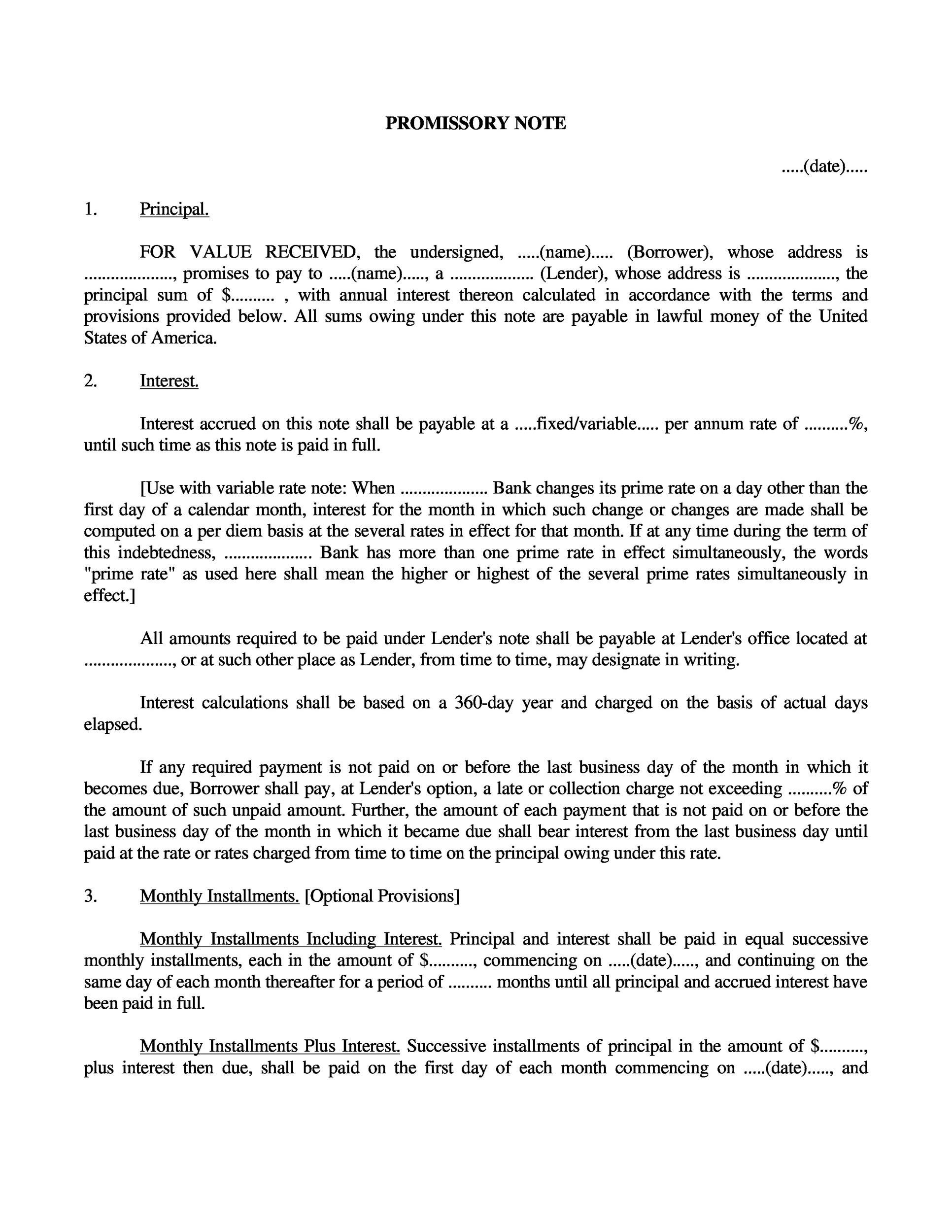

A comprehensive promissory note should include the following essential elements:

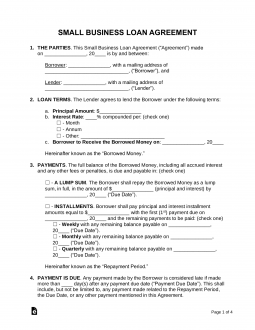

Promissory notes come in various forms, each suited for different lending scenarios. Understanding these distinctions is crucial for selecting the appropriate type for your needs, particularly when considering a free promissory note template for personal loan purposes.

This is the most basic type, outlining the principal amount, interest rate (if any), repayment schedule, and maturity date. It’s suitable for straightforward loan agreements where the terms are relatively simple.

This type allows the lender to demand repayment of the loan at any time. The borrower must repay the loan upon the lender’s request, usually with a specified notice period.

This is used when the loan is repaid in regular installments over a specified period. Each installment typically includes a portion of the principal and interest.

This type is backed by collateral, which the lender can seize if the borrower defaults on the loan. Collateral can be anything of value, such as real estate, vehicles, or other assets.

This type is not backed by any collateral. The lender relies solely on the borrower’s promise to repay the loan. Due to the higher risk, unsecured promissory notes often have higher interest rates.

Using a free promissory note template for personal loan arrangements simplifies the process of creating a legally sound agreement. However, it’s essential to customize the template to accurately reflect the specific terms of your loan.

Download a Reputable Template: Search online for a free promissory note template for personal loan transactions. Ensure the source is reputable and the template is comprehensive. Look for templates that offer customization options.

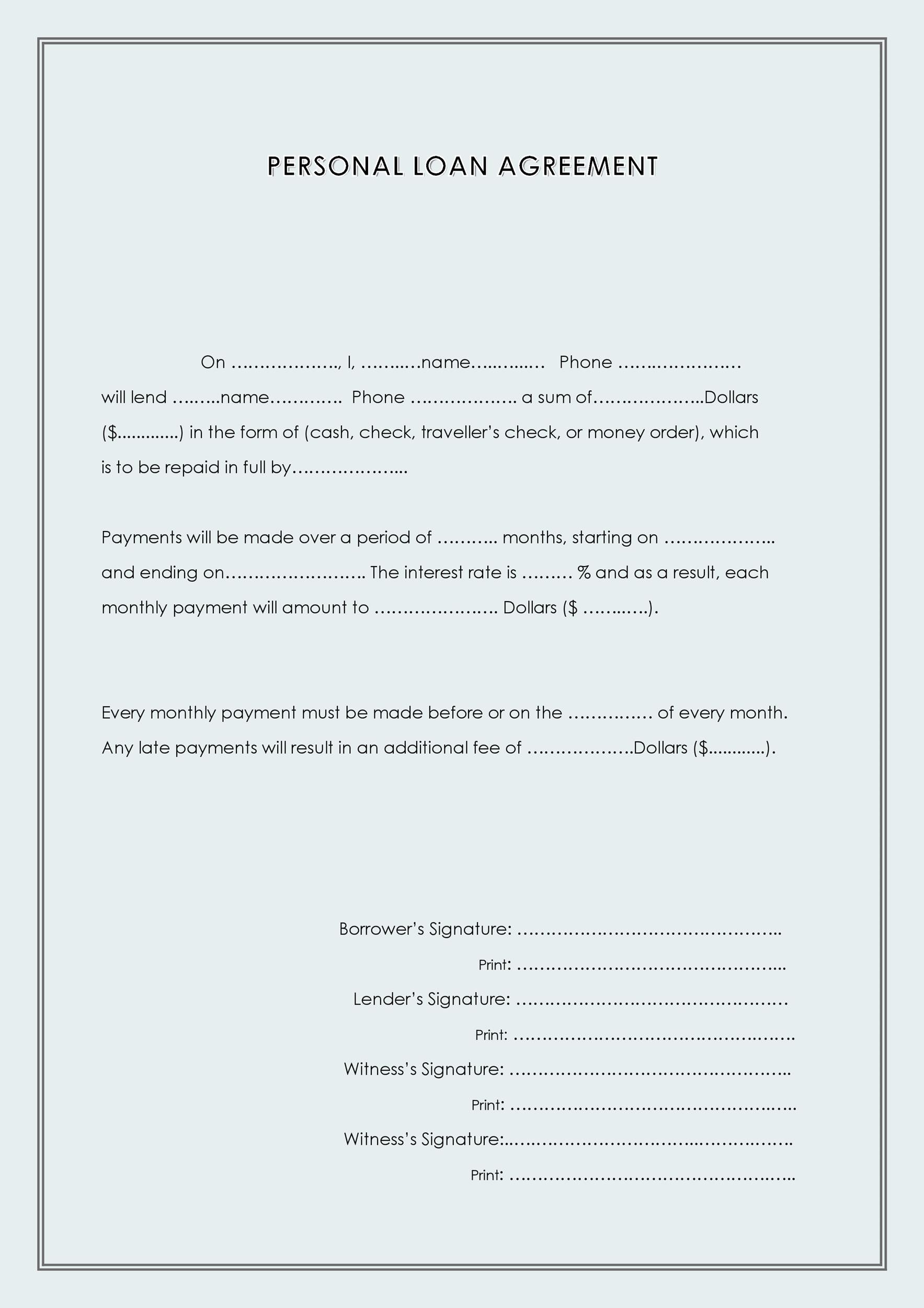

Fill in the Blanks: Carefully complete all the required fields in the template. This includes the borrower’s and lender’s information, principal amount, interest rate (if applicable), repayment schedule, maturity date, and default terms.

Customize the Terms: Don’t hesitate to modify the template to fit your specific needs. Add or remove clauses as necessary to accurately reflect the agreement between the borrower and lender.

Review Carefully: Thoroughly review the completed promissory note to ensure all information is accurate and complete. Have both the borrower and lender independently review the document.

Sign and Date: Once both parties are satisfied with the terms, have them sign and date the promissory note. Consider having the signatures notarized to provide an extra layer of legal validity.

Keep a Copy: Each party should retain a signed copy of the promissory note for their records.

While a free promissory note template for personal loan scenarios offers a convenient starting point, it’s crucial to avoid common pitfalls that can render the agreement unenforceable.

Promissory notes are legally binding contracts, and it’s essential to understand the legal implications before entering into one.

Obtaining and customizing a free promissory note template for personal loan agreements is a practical approach to formalizing financial arrangements, especially between individuals who know each other. This document provides a clear framework for the loan, safeguarding both the lender’s investment and the borrower’s repayment responsibilities. While the free template provides a strong foundation, remember to tailor the terms to your specific needs and seek legal advice when necessary to ensure the document’s enforceability.

A promissory note is a valuable tool for managing financial risk in personal loan transactions. Using a free promissory note template for personal loan arrangements can simplify the process, but it’s crucial to understand the key components, legal considerations, and potential pitfalls. By carefully customizing the template and avoiding common mistakes, you can create a legally sound agreement that protects your financial interests and fosters clear communication between the borrower and lender. Remember that this article provides general information and is not a substitute for legal advice from a qualified attorney. Always consult with an attorney to ensure your promissory note complies with all applicable laws and regulations.