Receiving a letter from the IRS can be a daunting experience. Whether it’s a simple inquiry, a request for more information, or notification of an audit, knowing how to respond appropriately is crucial. The key to a successful resolution lies in crafting a clear, concise, and well-organized response. Using an IRS response letter template can significantly simplify this process, ensuring you address all necessary points and maintain a professional tone.

Understanding the Importance of a Well-Crafted IRS Response

Ignoring an IRS letter is never a good idea. A timely and professional response demonstrates your commitment to tax compliance and can often prevent minor issues from escalating into more serious problems. A well-written response ensures that the IRS has all the information they need to understand your situation, potentially leading to a faster and more favorable outcome.

An IRS response letter template provides a structured framework for your reply, guiding you through the essential elements required to address the IRS’s concerns effectively. It helps you avoid overlooking crucial details and ensures that your response is clear, concise, and well-organized, minimizing the risk of miscommunication.

Key Elements of an Effective IRS Response Letter Template

A solid IRS response letter template should include several essential components. These ensure clarity, accuracy, and professionalism, demonstrating your commitment to resolving the issue at hand.

- Identification Information: This includes your name, address, Social Security number (SSN) or Employer Identification Number (EIN), and the specific notice number from the IRS letter you are responding to. Accurate identification is paramount to ensure your response is correctly associated with your case.

- Date: Clearly indicate the date you are sending the letter.

- IRS Contact Information: Include the address and contact information of the specific IRS department or agent to whom you are responding. This information is usually found on the IRS letter you received.

- Subject Line: A clear and concise subject line summarizing the purpose of your letter will help the IRS quickly understand the context of your response. For example: “Response to Notice CP2000 – Verification of Income.”

- Body of the Letter: This is where you address the specific issues raised in the IRS letter. Provide clear, factual information, supported by relevant documentation. Be polite and professional in your tone.

- Supporting Documentation: Include copies (never originals) of any documents requested by the IRS or that support your claims. Clearly label each document and reference it in the body of your letter.

- Closing: End your letter with a polite closing, such as “Sincerely” or “Respectfully,” followed by your signature and printed name.

Utilizing an IRS Response Letter Template: A Step-by-Step Guide

While templates provide a solid foundation, it’s vital to tailor them to your specific situation. Here’s how to effectively use an IRS response letter template:

- Carefully Review the IRS Letter: Understand the specific issue or question the IRS is raising. Highlight key points and note any deadlines.

- Gather Supporting Documentation: Collect all relevant documents that support your claims, such as tax returns, W-2s, 1099s, receipts, and bank statements.

- Choose an Appropriate Template: Select a template that aligns with the type of IRS notice you received (e.g., notice of deficiency, request for information, audit notification). Many online resources offer free or paid templates.

- Personalize the Template: Fill in all the required information accurately, including your identification details, the IRS’s contact information, and the date.

- Address the IRS’s Concerns: Clearly and concisely explain your position, referencing the relevant sections of the IRS letter. Provide factual information and avoid emotional language.

- Organize Your Supporting Documentation: Label each document clearly and refer to them in the body of your letter.

- Proofread Carefully: Before sending your letter, carefully proofread it for any errors in grammar, spelling, or factual information. Ask someone else to review it as well.

- Send Your Letter Certified Mail: Sending your letter via certified mail with return receipt requested provides proof that the IRS received your response. Keep a copy of the letter and all supporting documentation for your records.

Common Mistakes to Avoid When Responding to the IRS

While using a template helps, avoid these common pitfalls:

- Ignoring the Letter: Ignoring an IRS letter will not make the problem go away. It will only escalate the issue.

- Sending Original Documents: Always send copies of your documents, never the originals.

- Providing Incomplete Information: Make sure your response is complete and addresses all the issues raised in the IRS letter.

- Using Emotional Language: Maintain a polite and professional tone, even if you disagree with the IRS’s assessment.

- Missing Deadlines: Respond to the IRS within the specified timeframe. Failure to do so can result in penalties and further action.

Seeking Professional Assistance

If you are unsure how to respond to an IRS letter or if the issue is complex, consider seeking professional assistance from a tax attorney or certified public accountant (CPA). These professionals can provide expert guidance and represent you before the IRS.

By understanding the importance of a well-crafted response, utilizing an IRS response letter template, and avoiding common mistakes, you can effectively address IRS inquiries and resolve tax issues with confidence.

If you are looking for Page 1207 Free Templates & Examples – Edit Online & Download you’ve visit to the right web. We have 9 Pics about Page 1207 Free Templates & Examples – Edit Online & Download like Irs Response Letter Template in Irs Response Letter Template – 10, Cp Response Letter Sample Professional Resume for Irs Response Letter and also Response To Irs Notice Letter Templates Business Lett – vrogue.co. Here you go:

Page 1207 Free Templates & Examples – Edit Online & Download

www.template.net

Free Response Letter To Summons Template To Edit Online

www.template.net

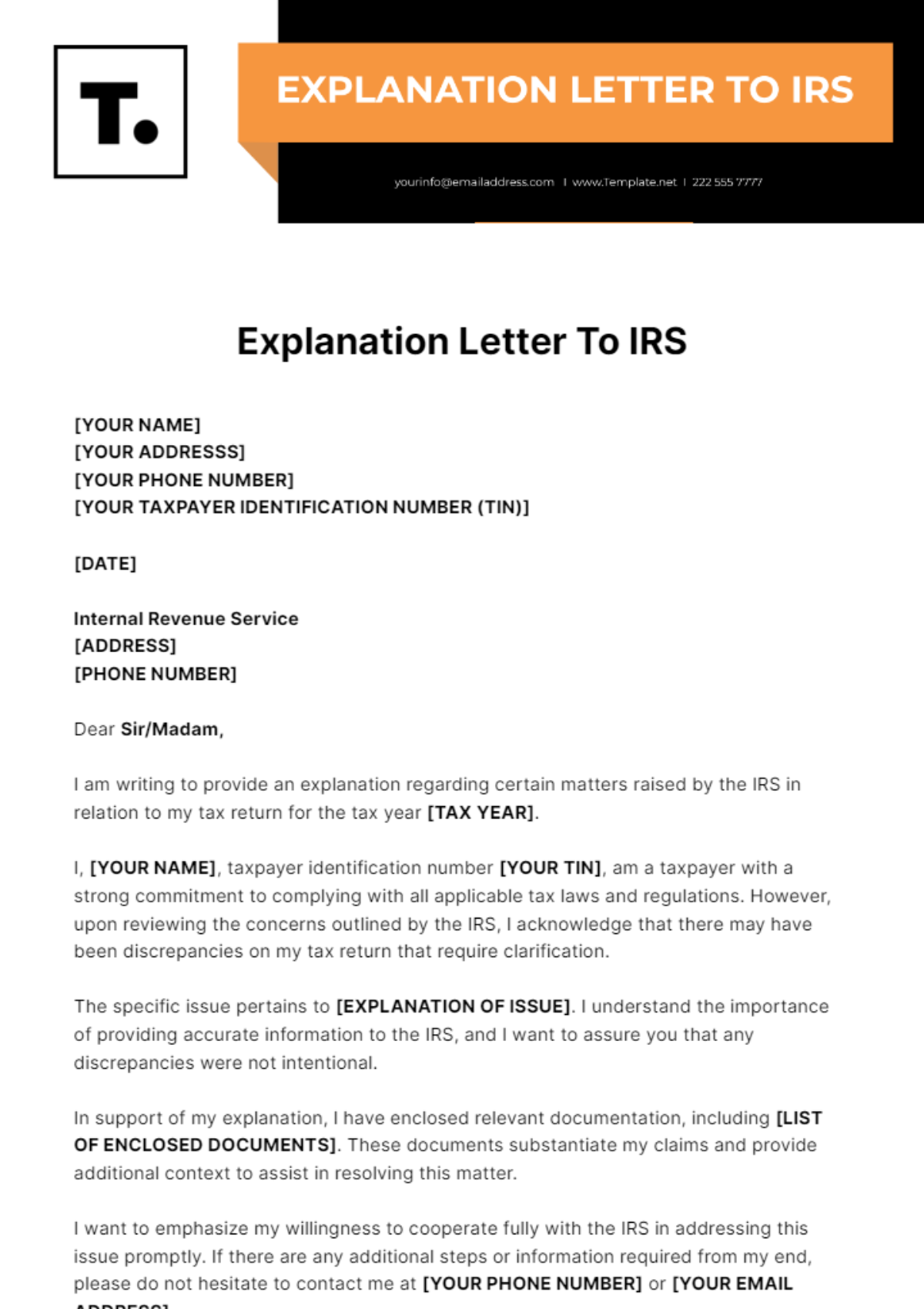

Irs Response Letter Template Samples Letter Template Collection

vancecountyfair.com

Response To Irs Notice Letter Templates Business Lett – Vrogue.co

www.vrogue.co

Irs Response Letter Template In Irs Response Letter Template – 10

vancecountyfair.com

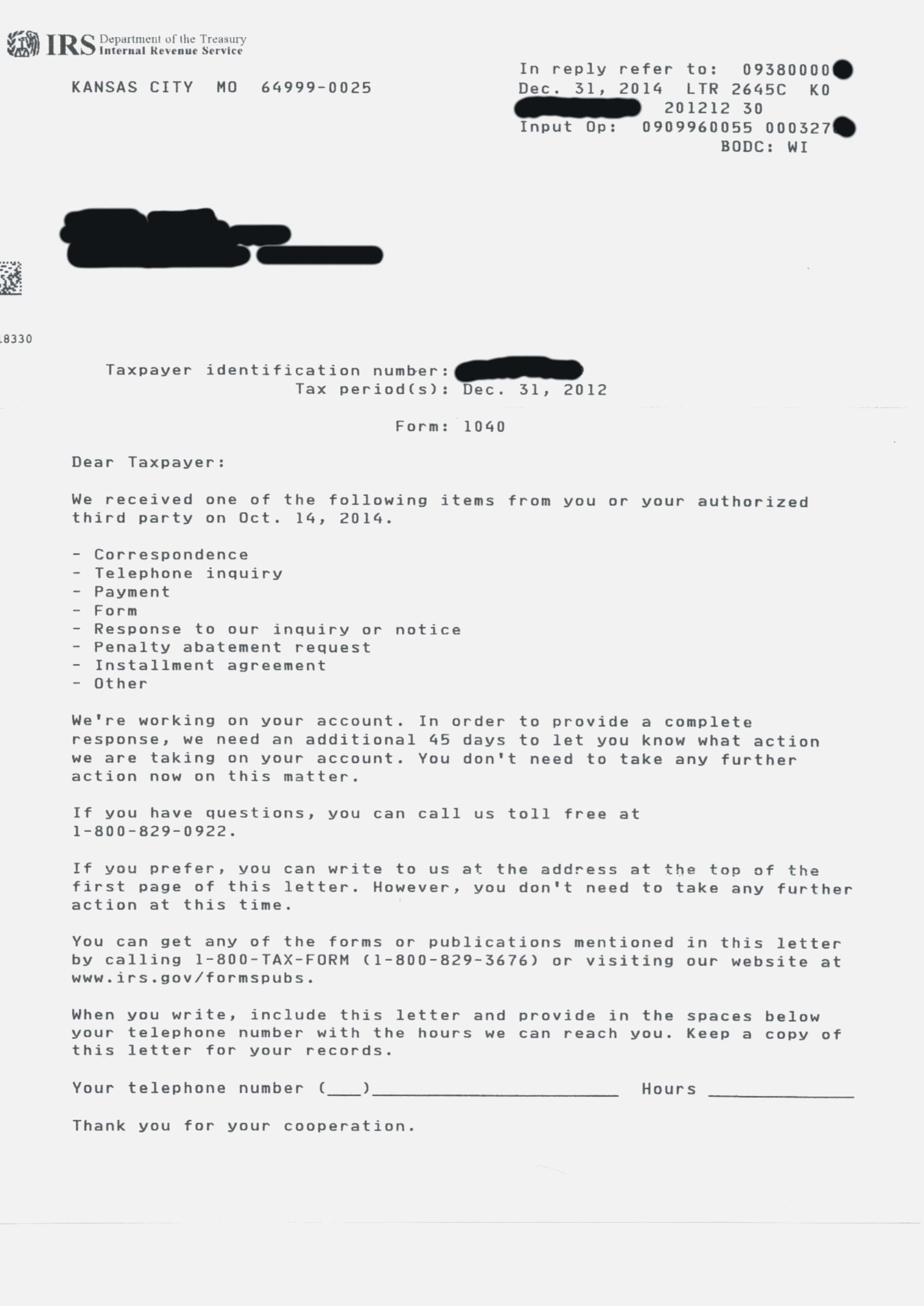

letter irs

Cp Response Letter Sample Professional Resume For Irs Response Letter

vancecountyfair.com

Irs Letter Regarding Irs Response Letter Template Resignation Template

www.pinterest.jp

Page 1225 Free Templates & Examples – Edit Online & Download

www.template.net

Tax Protest Letter Template Collection Letter Templat – Vrogue.co

www.vrogue.co

Irs response letter template in irs response letter template – 10. Page 1225 free templates & examples. Irs letter regarding irs response letter template resignation template