The world of finance is increasingly reliant on accurate and timely financial data. One of the most crucial pieces of this data is the liquidity report, a detailed overview of a company’s current assets and liabilities. A well-structured liquidity report is not just a document; it’s a vital tool for investors, lenders, and management, providing insights into a business’s ability to meet its short-term obligations. This article will delve into the essential components of a robust liquidity report template, exploring its purpose, key elements, and best practices for effective utilization. Understanding and implementing a comprehensive liquidity report template is a critical step for any organization seeking to maintain financial stability and secure funding. The core of a successful liquidity report lies in its clarity, accuracy, and ability to provide a clear picture of a company’s financial health. It’s a dynamic document, requiring regular updates to reflect changing business conditions. This guide will provide a detailed overview of what to include and how to present this vital information.

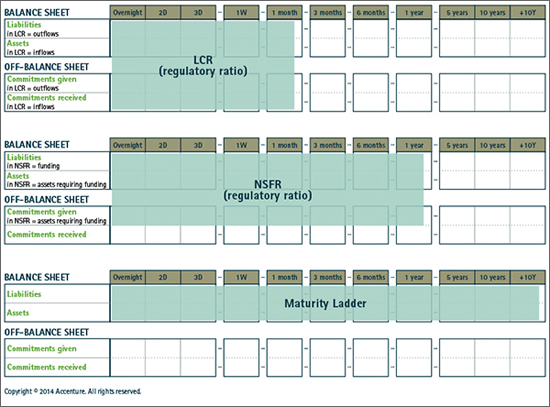

A liquidity report template is a standardized framework designed to systematically assess a company’s ability to meet its short-term financial obligations. It’s a crucial tool for monitoring cash flow, identifying potential liquidity risks, and informing strategic decisions. Unlike a simple balance sheet, a liquidity report goes beyond just showing assets and liabilities; it analyzes the relationship between these elements and assesses the company’s ability to convert assets into cash quickly. The template provides a structured approach to collecting, organizing, and presenting this information, ensuring consistency and comparability across different companies and periods. Different industries and business models may require variations in the specific metrics included, but the fundamental principles remain the same. A poorly constructed or incomplete liquidity report can be a significant warning sign of potential financial distress.

A typical liquidity report template includes several key sections. Each section is designed to address a specific aspect of a company’s liquidity position. Let’s examine some of the most important components:

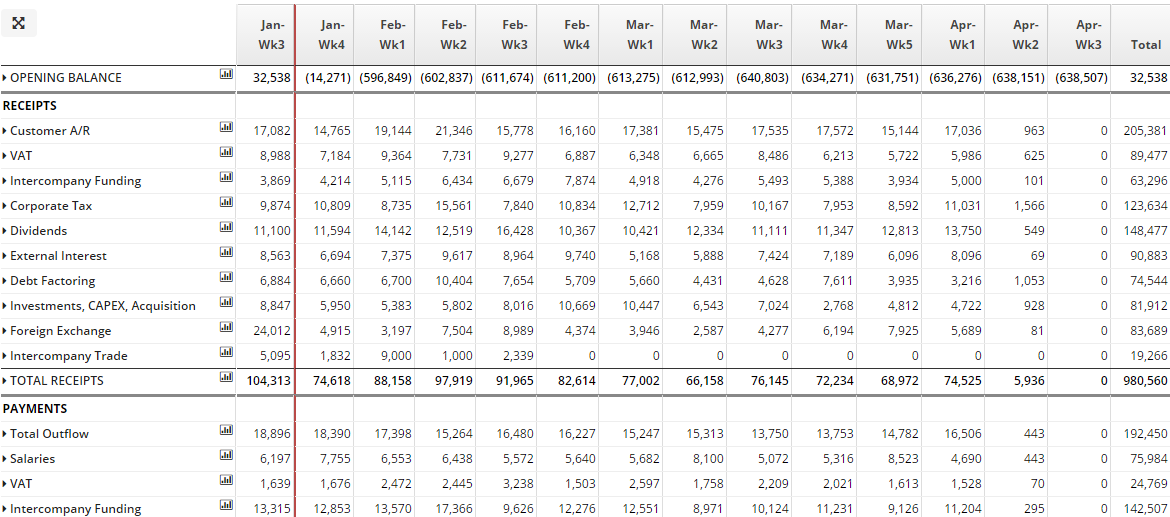

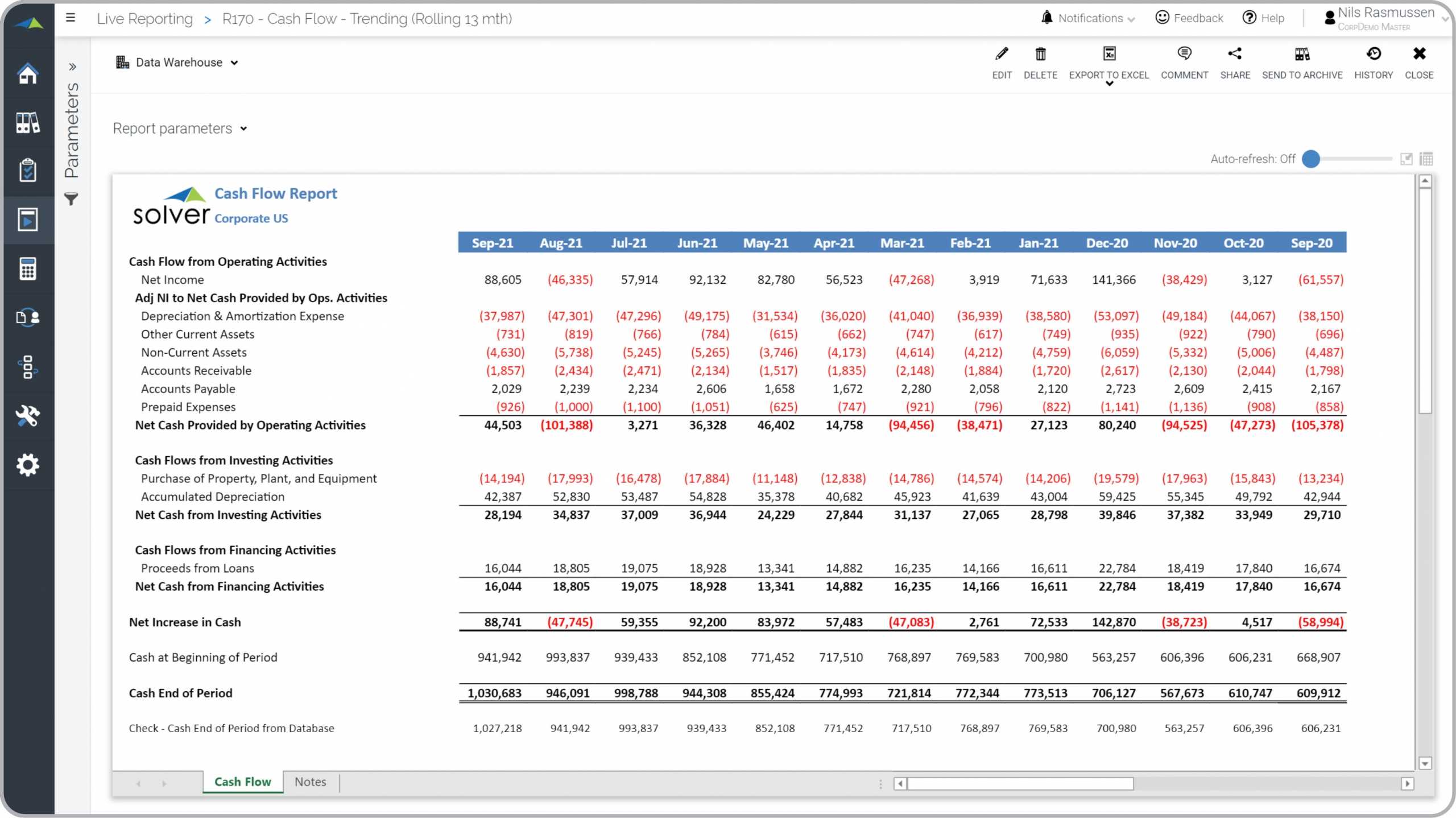

The first section of the report is the cash flow statement, specifically the current period’s statement. This statement details the movement of cash both into and out of the company during the reporting period. It’s crucial to analyze the cash flow from operating activities to understand how the company generates and uses cash. Understanding the timing of cash inflows and outflows is paramount. A healthy liquidity report will clearly show positive cash flow from operations, indicating that the company is generating sufficient cash to cover its short-term liabilities. This section often includes a detailed breakdown of cash receipts (e.g., sales, accounts receivable) and cash payments (e.g., salaries, inventory purchases, loan repayments).

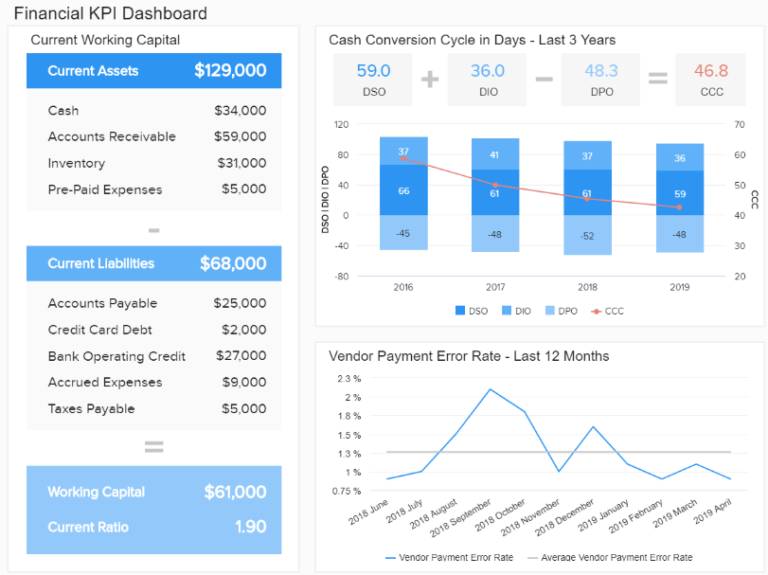

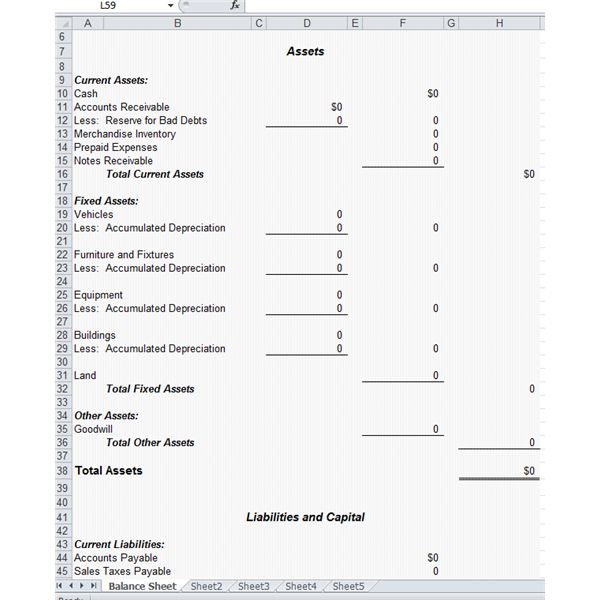

The current ratio is a widely used liquidity ratio that measures a company’s ability to pay its short-term liabilities with its current assets. It’s calculated as: Current Ratio = Current Assets / Current Liabilities. A current ratio of 1.5 or higher is generally considered healthy, indicating that the company has ample liquid assets to cover its short-term debts. However, it’s important to consider the industry context when interpreting the current ratio – a higher ratio may be acceptable in a rapidly growing industry but less so in a stable one.

The quick ratio, also known as the acid-test ratio, is a more conservative measure of liquidity than the current ratio. It excludes inventory from current assets and focuses solely on the most liquid assets – those readily convertible to cash. The calculation is: Quick Ratio = (Current Assets – Inventory) / Current Liabilities. This ratio provides a more realistic assessment of a company’s ability to meet short-term obligations without relying on the sale of inventory.

This section provides a snapshot of the company’s available cash. It’s a vital indicator of the company’s immediate cash position and its ability to respond to unexpected expenses or opportunities. Tracking the cash balance over time is essential for monitoring liquidity trends.

Working capital represents the difference between a company’s current assets and current liabilities. A positive working capital balance indicates that the company has sufficient short-term assets to cover its short-term liabilities. Analyzing working capital trends can reveal potential issues with cash flow management.

This report tracks the age of outstanding invoices. A longer period of receivables indicates potential difficulty in collecting payments, which can strain cash flow. A declining trend in receivables aging is a significant concern.

Similarly, this report tracks the age of outstanding invoices. A longer period of accounts payable indicates potential difficulty in paying suppliers, which can impact cash flow.

Simply presenting a snapshot of liquidity metrics isn’t enough. A truly effective liquidity report requires trend analysis. Analyzing how these metrics have changed over time provides valuable insights into the company’s financial health. Furthermore, comparing the company’s liquidity ratios to industry benchmarks and competitors is crucial for assessing its relative performance. Benchmarking allows for a more informed assessment of the company’s strengths and weaknesses. For example, a company with a consistently high current ratio but a declining quick ratio may be facing liquidity challenges.

Creating a truly useful liquidity report requires careful planning and attention to detail. Here are some best practices:

A well-constructed liquidity report is an indispensable tool for managing financial risk and ensuring the long-term sustainability of any business. It’s more than just a collection of numbers; it’s a strategic document that provides valuable insights into a company’s financial health. By understanding the key components of a liquidity report template, implementing best practices for data management, and consistently monitoring trends, organizations can proactively address potential liquidity challenges and maintain a strong financial position. Ultimately, a robust liquidity report empowers informed decision-making and strengthens the overall stability of the business. Remember, proactive monitoring and timely reporting are key to navigating the complexities of the financial landscape. The ability to accurately forecast and manage liquidity is a competitive advantage in today’s dynamic business environment.