The process of securing a loan can be complex, filled with legal jargon and intricate requirements. Navigating this landscape requires a solid understanding of the legal framework and a well-structured agreement. That’s where a Lma Loan Agreement Template comes in – a crucial document that outlines the terms and conditions of a loan, protecting both the lender and the borrower. This template provides a foundation for a legally sound agreement, minimizing the risk of disputes and ensuring a smooth transaction. Choosing the right template is paramount, as variations can significantly impact the agreement’s enforceability and clarity. This guide will delve into the key components of a comprehensive Lma Loan Agreement Template, offering practical advice and best practices.

A well-drafted Lma Loan Agreement Template isn’t just a formality; it’s a vital tool for any business or individual seeking financing. It clarifies expectations, protects interests, and establishes a clear path for repayment. Without a solid template, lenders may be hesitant to extend credit, and borrowers may be unsure of their rights. The template acts as a roadmap, reducing the likelihood of misunderstandings and potential legal battles. It’s a proactive step towards securing a favorable loan and fostering a sustainable business relationship. Furthermore, utilizing a template ensures consistency and reduces the potential for errors that can arise from drafting the agreement from scratch.

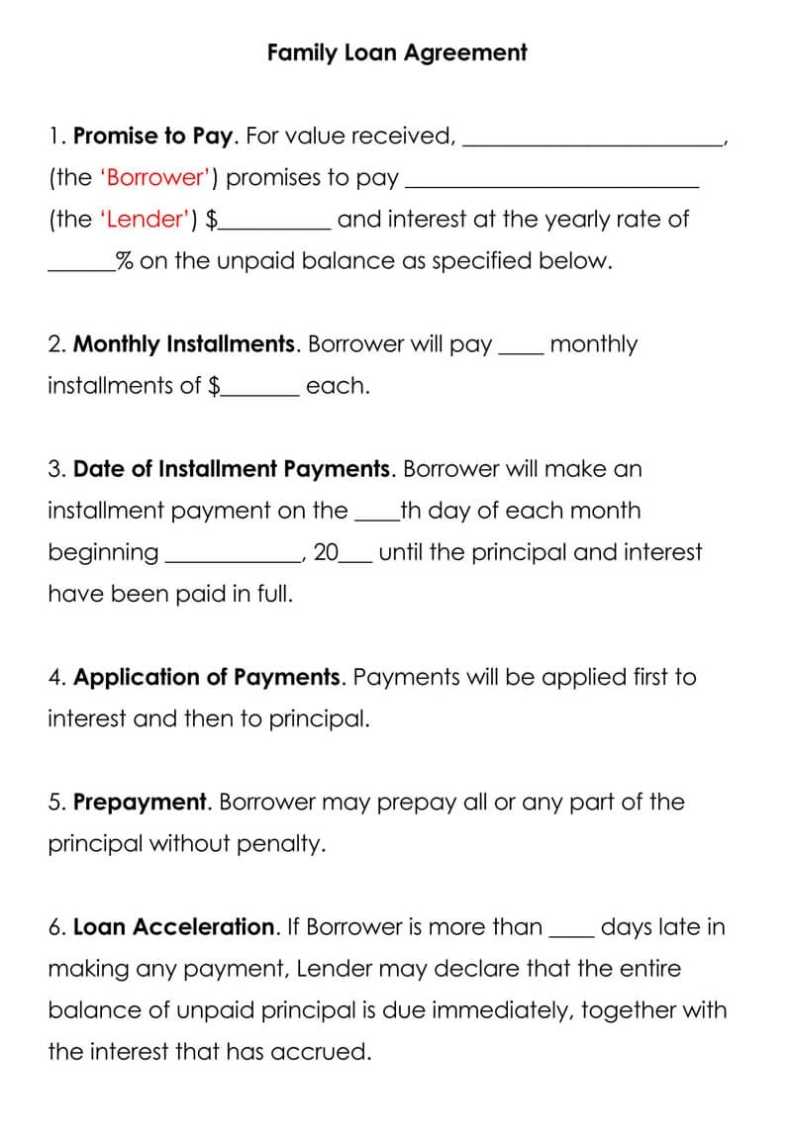

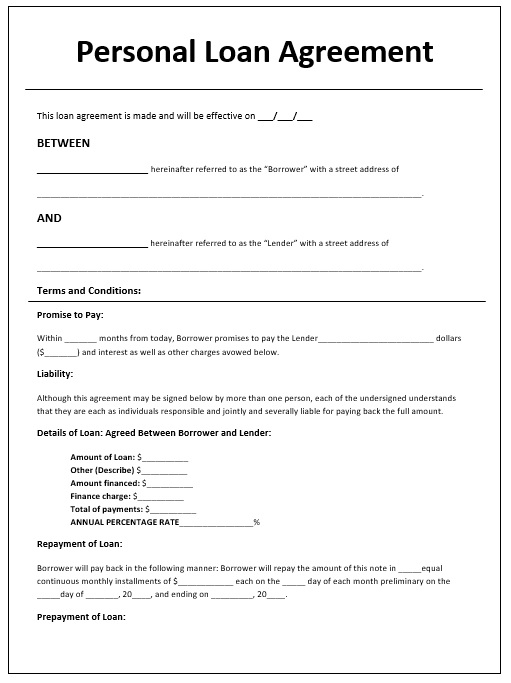

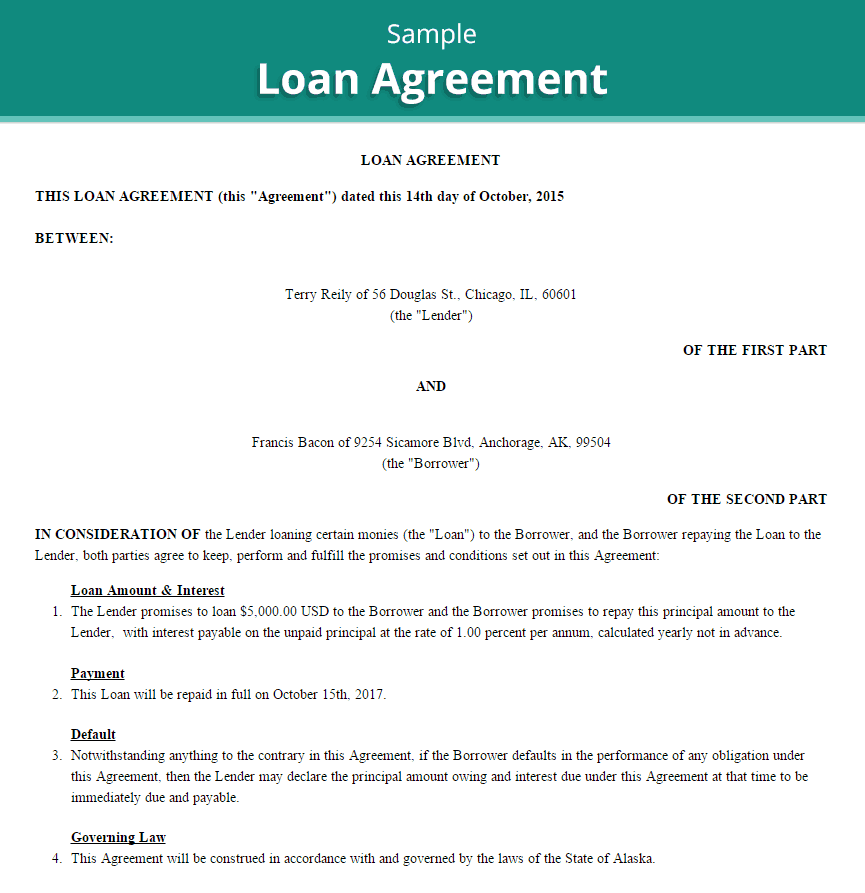

A comprehensive Lma Loan Agreement Template typically includes several key sections. These sections are designed to address various aspects of the loan, ensuring all parties are aligned and protected. Let’s examine some of the most important components:

The Lma Loan Agreement Template is a living document, and it’s important to tailor it to the specific circumstances of each loan. Here’s a breakdown of how to structure the agreement effectively:

Numerous online resources offer Lma Loan Agreement Template examples and guides. These resources can be helpful for understanding the different components and best practices. However, always remember that a template is a starting point, not a substitute for legal advice. Resources like the Small Business Administration (SBA) and legal databases can provide valuable insights.

A well-crafted Lma Loan Agreement Template is an indispensable tool for anyone seeking financing. By understanding the key components and following best practices, you can significantly increase your chances of securing a favorable loan and minimizing the risk of legal complications. Investing time in creating a robust and legally sound agreement is an investment in your business’s future. Remember to consult with an attorney to ensure the agreement meets your specific needs and complies with all applicable laws. Ultimately, a thoughtfully designed Lma Loan Agreement Template is a cornerstone of responsible lending and a valuable asset for both borrowers and lenders.

The process of securing a loan can be daunting, but a solid Lma Loan Agreement Template provides a crucial framework for a successful transaction. By understanding the key components, tailoring the agreement to your specific needs, and seeking professional legal advice, you can significantly reduce the risk of disputes and ensure a smooth and secure loan experience. The proactive use of a template demonstrates a commitment to responsible lending and fosters a sustainable relationship with your lender. Furthermore, consistently reviewing and updating the agreement as your business evolves is essential for maintaining its effectiveness and protecting your interests. Ultimately, a well-structured Lma Loan Agreement Template is a powerful tool for achieving your financial goals.