Borrowing and lending money, whether between friends, family, or businesses, requires clear documentation to protect both parties involved. A well-defined agreement outlines the terms of the loan, preventing misunderstandings and providing legal recourse if necessary. One of the most crucial documents in this process is a Loan Promissory Note Template. This legally binding document details the borrower’s promise to repay a specific sum of money to the lender, under agreed-upon terms. Without a formal note, enforcing the loan agreement can become significantly more difficult, relying heavily on potentially unreliable recollections or informal records.

The importance of a promissory note extends beyond simply stating the amount owed. It establishes a clear record of the loan’s structure, including the interest rate (if any), the repayment schedule, and any collateral securing the loan. This clarity is vital for both the lender, who needs assurance of repayment, and the borrower, who needs a transparent understanding of their obligations. A properly executed note can also be essential for tax purposes, documenting income for the lender and deductible interest payments for the borrower.

While simple verbal agreements might seem sufficient for small loans between trusted individuals, the potential for disputes always exists. Life circumstances change, memories fade, and even the strongest relationships can be strained by financial matters. A written promissory note, created using a Loan Promissory Note Template, provides a solid foundation for a fair and legally sound transaction, minimizing the risk of future conflicts. It’s a proactive step towards responsible lending and borrowing.

Finally, it’s important to understand that a promissory note isn’t just for large sums of money. It’s applicable to a wide range of lending scenarios, from student loans and personal loans to business loans and even real estate financing. The key is to tailor the template to the specific details of the loan, ensuring it accurately reflects the agreement between the parties.

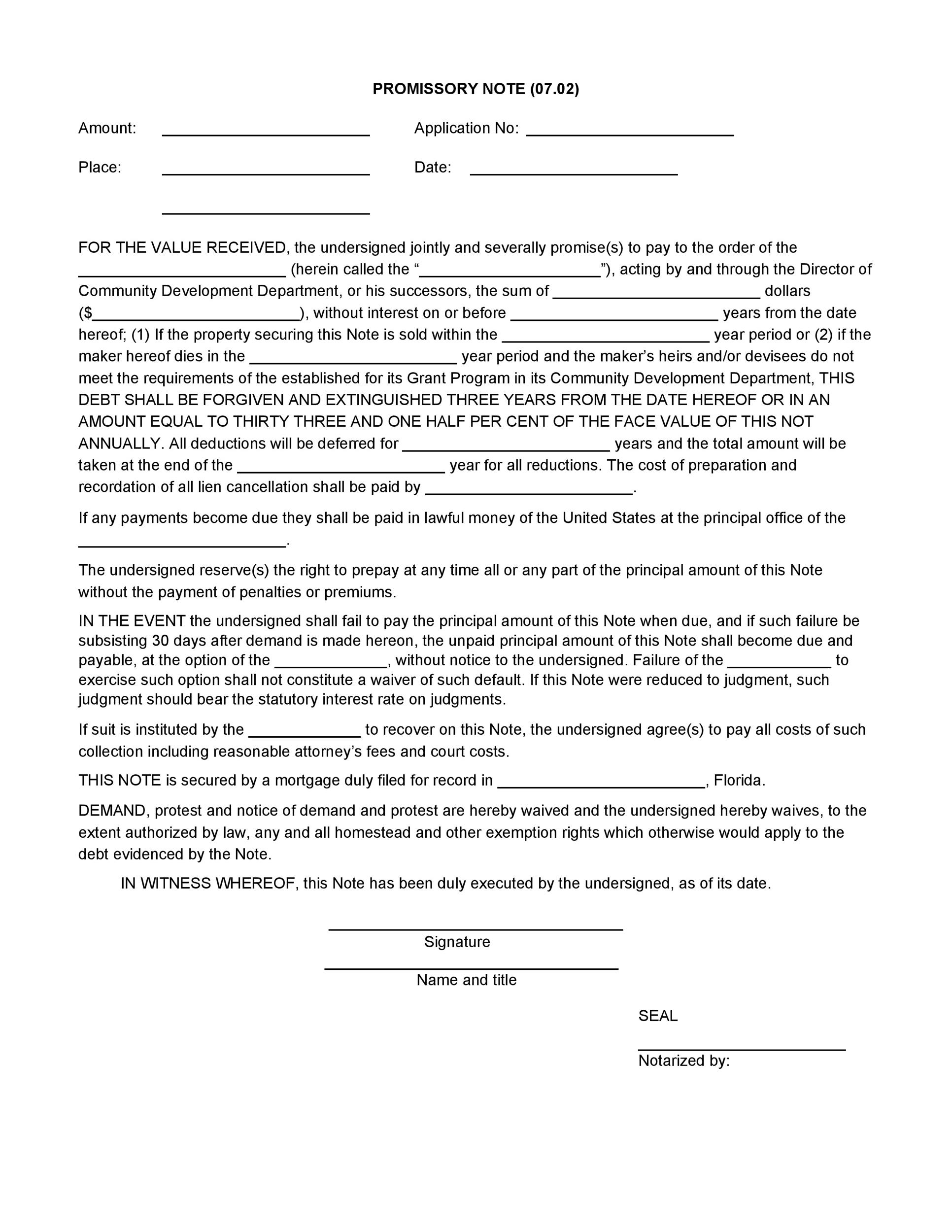

A Loan Promissory Note is a written promise by one party (the maker or borrower) to pay a specific sum of money to another party (the payee or lender) at a specified date or on demand. It’s a legally enforceable document that serves as evidence of a debt. Unlike a simple IOU, a promissory note includes detailed terms and conditions, making it a more robust and reliable instrument.

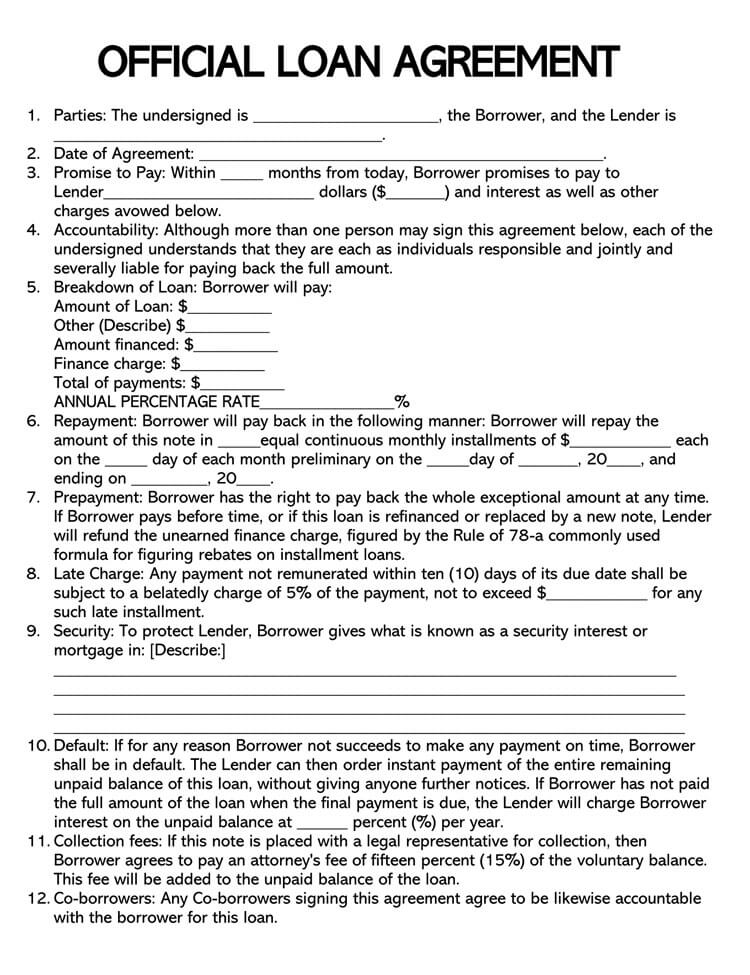

Several essential elements must be included in a comprehensive promissory note:

Different lending scenarios require different types of promissory notes. Here are some common variations:

A secured promissory note is backed by collateral, meaning the lender has the right to seize and sell specific assets if the borrower defaults. This reduces the lender’s risk. Examples of collateral include real estate, vehicles, or equipment. An unsecured promissory note, on the other hand, is not backed by collateral. These notes typically carry higher interest rates to compensate the lender for the increased risk.

A demand promissory note is payable immediately upon the lender’s request. This provides the lender with flexibility but can be disadvantageous to the borrower. A term promissory note specifies a fixed repayment schedule and maturity date, providing more predictability for both parties.

A simple promissory note involves a lump-sum repayment of the principal and interest on the maturity date. An installment promissory note requires the borrower to make regular payments of principal and interest over a specified period.

Using a Loan Promissory Note Template is a convenient and efficient way to create a legally sound document. Numerous templates are available online, often offered by legal websites or financial institutions. However, it’s crucial to choose a template that is appropriate for your specific situation and to carefully review and customize it before signing.

Once you’ve selected a template, carefully fill in all the required information, ensuring accuracy and completeness. Pay close attention to the following:

While a Loan Promissory Note Template provides a solid starting point, it’s essential to be aware of legal considerations and best practices.

Promissory note laws vary by state. It’s crucial to ensure your note complies with the laws of the state governing the agreement. This includes usury laws, which limit the amount of interest that can be charged.

Depending on state law, you may need to have the promissory note witnessed or notarized to make it legally enforceable. Notarization adds an extra layer of authenticity by verifying the signatures of the parties involved.

For complex loans or significant amounts of money, it’s always advisable to consult with an attorney. An attorney can review the promissory note, ensure it complies with all applicable laws, and advise you on any potential risks.

Several common mistakes can render a promissory note unenforceable. These include:

A Loan Promissory Note Template is an invaluable tool for documenting loan agreements and protecting the interests of both borrowers and lenders. By understanding the key components of a promissory note, choosing the right type of note, and carefully customizing the template, you can create a legally sound document that minimizes the risk of disputes and ensures a smooth and transparent lending process. Remember to prioritize accuracy, clarity, and compliance with applicable state laws. When in doubt, seeking legal advice is always a prudent step, especially for complex or high-value loans. A well-crafted promissory note is not just a formality; it’s a cornerstone of responsible financial transactions.