The process of purchasing a mobile home can seem daunting, but a well-structured agreement is crucial for a smooth and legally sound transaction. This article provides a comprehensive guide to creating a mobile home purchase agreement template, covering essential clauses and best practices. Understanding these elements is vital for protecting your interests and ensuring a successful purchase. Mobile Home Purchase Agreement Template – a clear and legally sound agreement is the foundation of a secure transaction. It’s more than just a document; it’s a roadmap for a successful partnership between buyer and seller. Let’s delve into the key components and how to tailor this template to your specific needs.

Before diving into the specifics, it’s important to grasp the core principles of a mobile home purchase agreement. This agreement outlines the terms and conditions of the sale, protecting both the buyer and the seller. It’s a legally binding contract, so it’s essential to have it reviewed by an attorney before signing. A comprehensive agreement should address crucial aspects like the property’s condition, financing, and dispute resolution. It’s also vital to understand that this agreement is a starting point; you may need to customize it based on your individual circumstances.

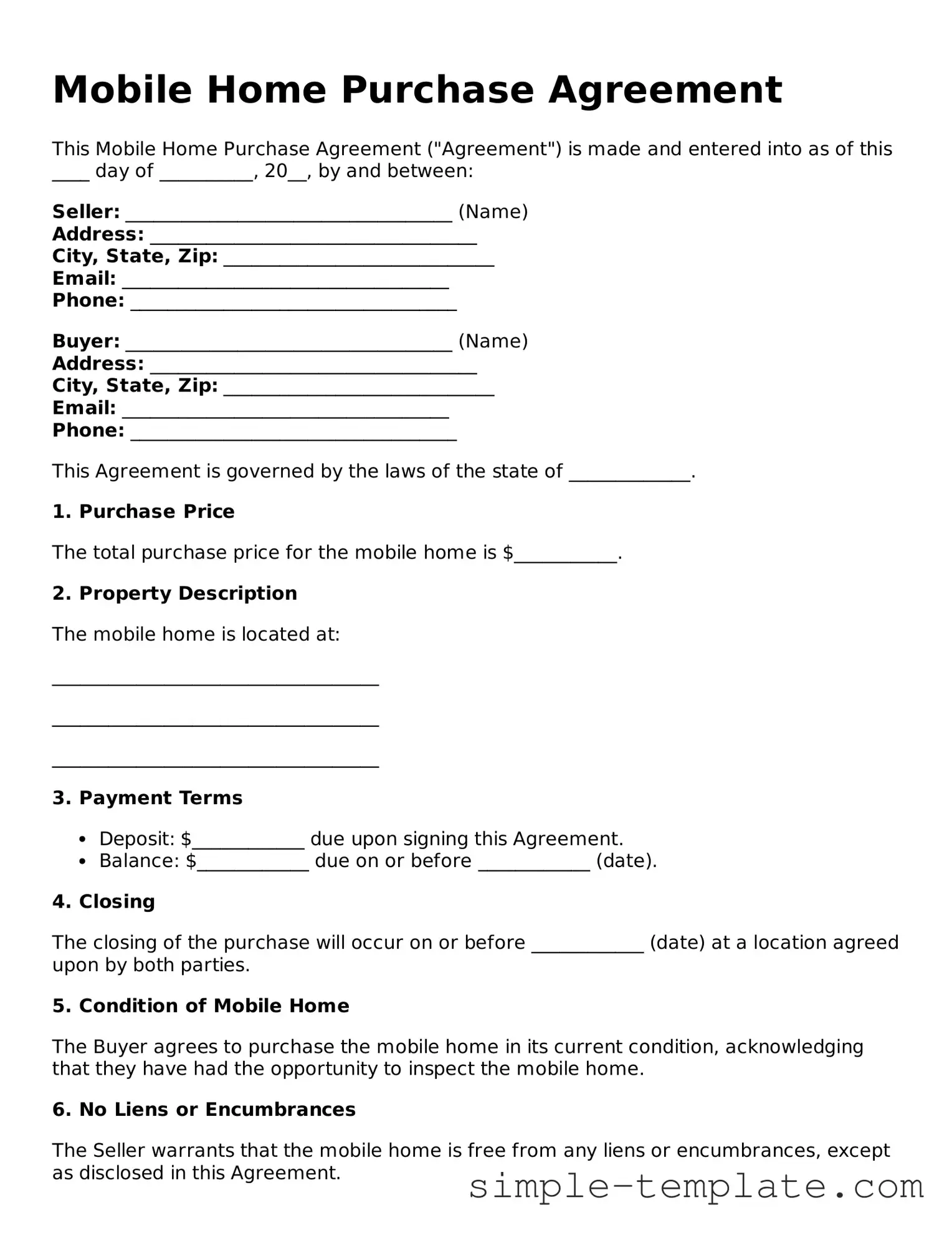

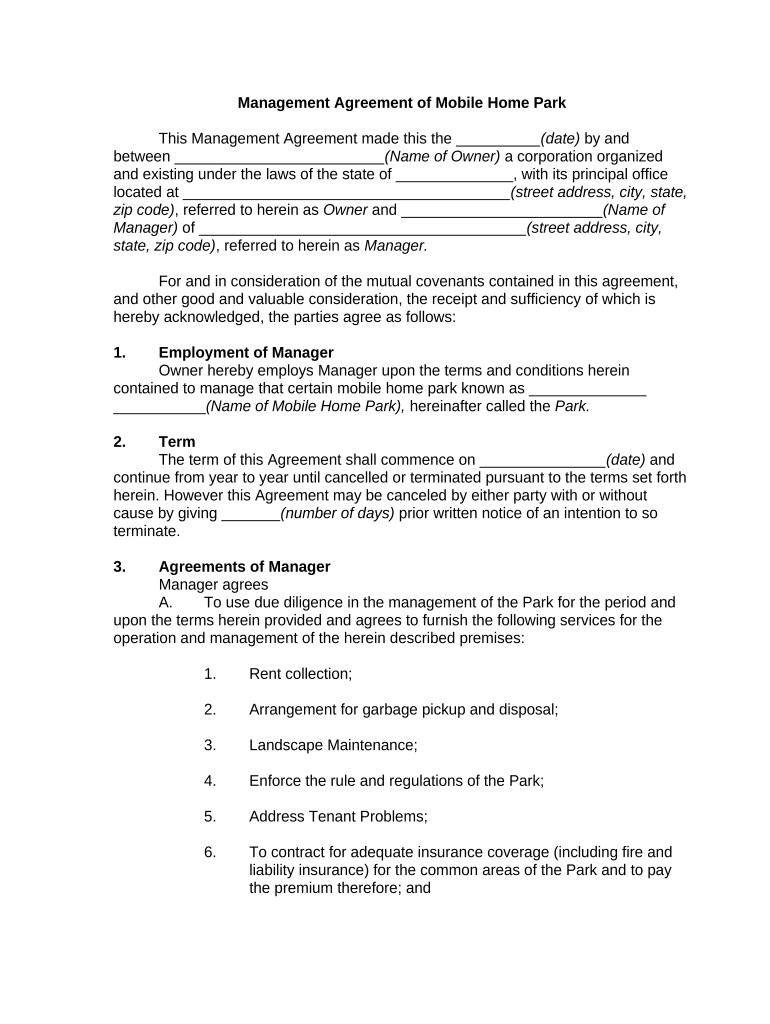

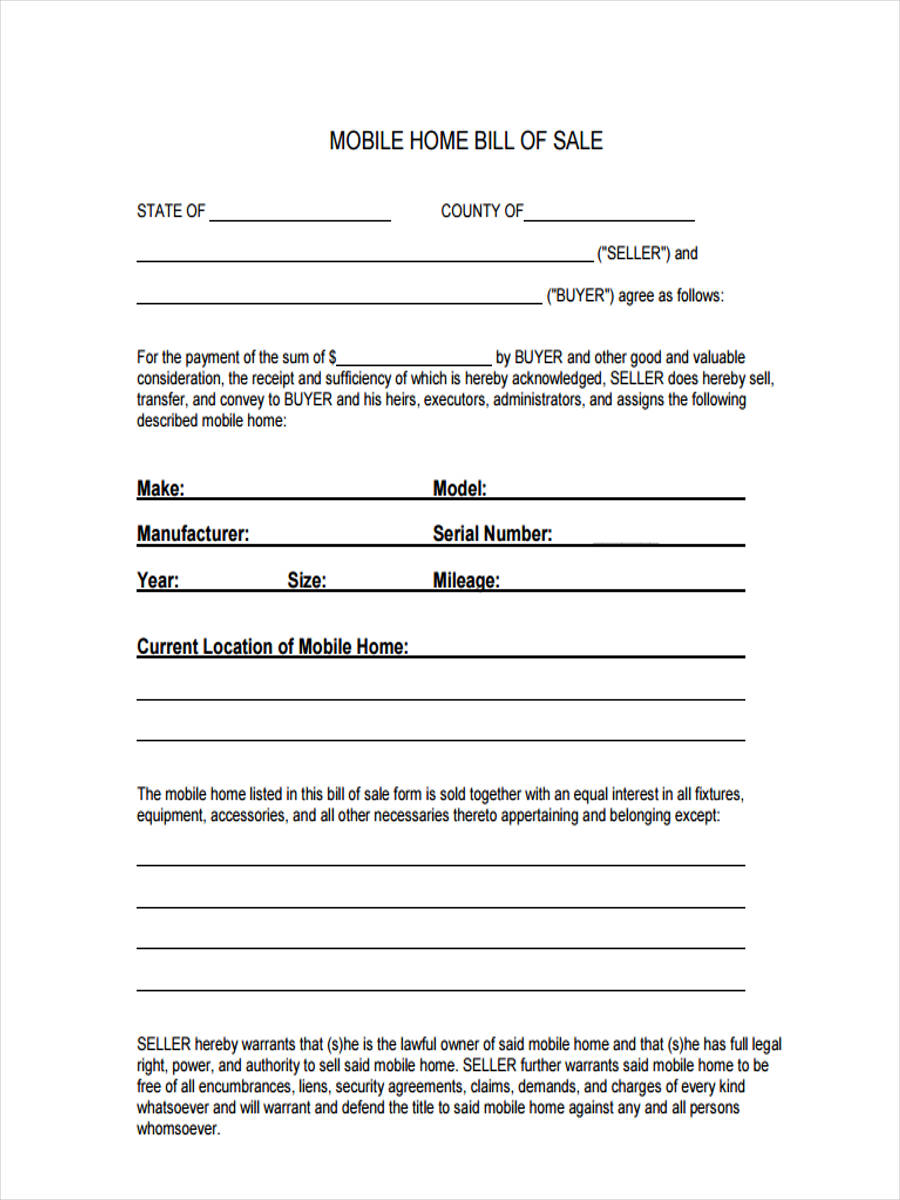

The agreement should clearly state the parties involved – the buyer and the seller – and their respective roles. It also outlines the property’s address, legal description, and any existing liens or encumbrances. A detailed inspection is a critical step, and the agreement should specify the process for addressing any issues discovered during the inspection. Remember, a thorough inspection is your opportunity to identify potential problems before you commit to the purchase.

Let’s examine some of the most important clauses that should be included in a mobile home purchase agreement. These clauses are designed to protect both parties and ensure a fair transaction.

The agreement should clearly define the property’s boundaries, including the exact location and any easements or restrictions. It’s crucial to specify the condition of the property at the time of sale. A detailed description of any existing damage or defects should be included. This section should also address any pending repairs or maintenance. A comprehensive inspection report, prepared by a qualified inspector, is highly recommended and should be referenced in the agreement.

The agreed-upon purchase price should be clearly stated, along with the method of payment. This typically includes a down payment, and the remaining balance should be paid according to a schedule. The agreement should specify any contingencies related to financing, such as the buyer’s ability to secure a mortgage. It’s also important to outline the process for transferring ownership and the timing of the final payment.

If the buyer requires financing, this clause outlines the terms of the loan. The agreement should specify the lender’s requirements, the loan amount, and the interest rate. The buyer should also be responsible for providing the lender with all necessary documentation. The seller should be prepared to negotiate with the lender to secure financing.

The agreement should clearly state the seller’s responsibility for ensuring a clear title to the property. This includes verifying the seller’s ownership and ensuring there are no liens or encumbrances on the property. The agreement should also address the transfer of ownership and the process for transferring the title to the buyer.

A warranty is a guarantee provided by the seller regarding the property’s condition. This warranty should cover defects that are not due to negligence or willful misconduct. The agreement should require the seller to disclose any known defects or issues with the property. A thorough disclosure statement is essential, outlining any known problems.

The agreement should specify the date on which the closing will take place and the process for transferring ownership to the buyer. This includes the signing of the final documents and the transfer of the title. It’s advisable to schedule the closing well in advance to allow sufficient time for all necessary paperwork and inspections.

The mobile home purchase agreement template can be adapted to suit various situations. For example:

It is absolutely crucial that both the buyer and seller have the agreement reviewed by a qualified attorney before signing. An attorney can ensure that the agreement is legally sound and protects your interests. They can also advise you on any potential risks or liabilities. Don’t rely solely on this template; professional legal guidance is essential.

Purchasing a mobile home is a significant investment, and a well-crafted mobile home purchase agreement is a vital step in ensuring a successful transaction. By understanding the key clauses and tailoring the agreement to your specific needs, you can protect your interests and secure a smooth and rewarding experience. Remember to prioritize thorough inspection, clear communication, and professional legal review. A solid agreement is the cornerstone of a secure and lasting mobile home purchase. Mobile Home Purchase Agreement Template – a proactive approach to protecting your investment is key to a positive outcome.

The mobile home purchase agreement serves as a critical document, establishing the foundation for a legally sound and mutually beneficial transaction. By carefully considering the various clauses and tailoring the agreement to your specific circumstances, you can minimize risks and maximize your chances of a successful purchase. Investing the time and resources to create a comprehensive agreement is an investment in your future and a guarantee of a secure and enjoyable mobile home ownership experience. Don’t underestimate the importance of this document – it’s a vital tool for navigating the complexities of mobile home purchasing.