Tracking your expenses is a cornerstone of sound financial management, whether you’re a freelancer, a small business owner, or simply trying to get a better handle on your personal finances. Without a clear understanding of where your money is going, it’s difficult to identify areas where you can cut back, save more, or make informed financial decisions. Fortunately, you don’t need to be a spreadsheet wizard to effectively monitor your spending. A well-designed Monthly Expense Report Template Excel can streamline the process, providing a clear and organized overview of your financial activity.

The beauty of using Excel for expense tracking lies in its flexibility and customization options. You can tailor the template to perfectly match your specific needs, adding categories, formulas, and visualizations to gain deeper insights into your spending habits. This level of control is often lacking in simpler expense tracking apps, and it allows for a more nuanced understanding of your financial situation. Furthermore, Excel’s robust calculation capabilities make it easy to generate summaries, identify trends, and compare spending across different months.

Many individuals and businesses struggle with disorganized expense tracking, often relying on scattered receipts and mental notes. This can lead to missed deductions, inaccurate budgeting, and ultimately, financial stress. A structured approach, facilitated by a dedicated template, eliminates these pitfalls and promotes financial clarity. The ability to easily categorize expenses, calculate totals, and generate reports empowers you to take control of your finances and work towards your financial goals.

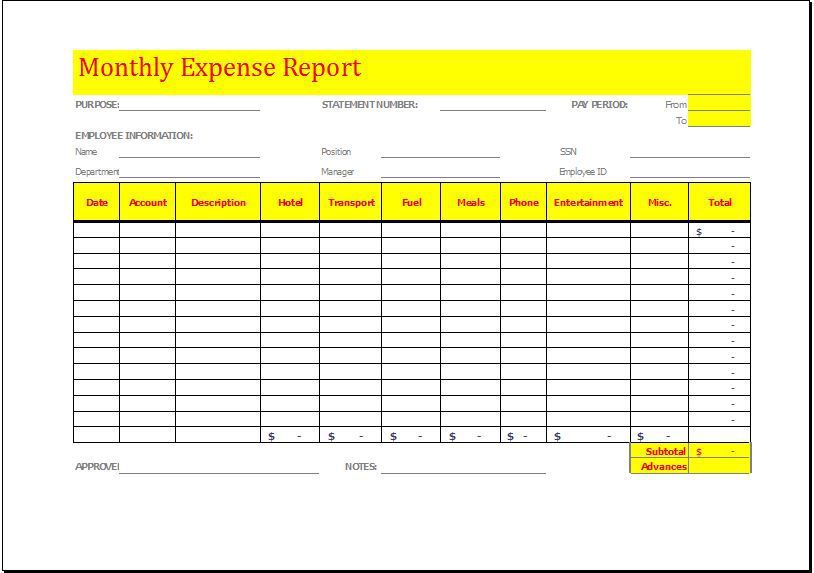

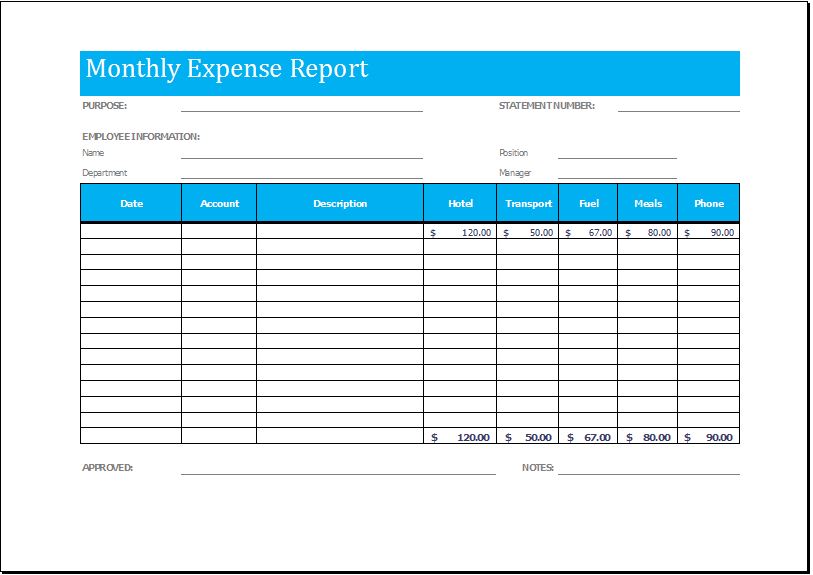

Choosing the right template is crucial. While numerous options are available online, a good Monthly Expense Report Template Excel should be intuitive, customizable, and capable of producing clear and actionable insights. It should also be easy to update and maintain, ensuring that your expense tracking remains a consistent and reliable process.

Finally, remember that the template is just a tool. The real value comes from consistently using it and analyzing the data it provides. Regularly reviewing your expense reports can reveal surprising spending patterns and highlight opportunities for improvement, ultimately leading to greater financial well-being.

There are numerous benefits to utilizing a dedicated template for tracking your monthly expenses. Beyond the obvious organization it provides, a well-structured template can significantly improve your financial awareness and decision-making.

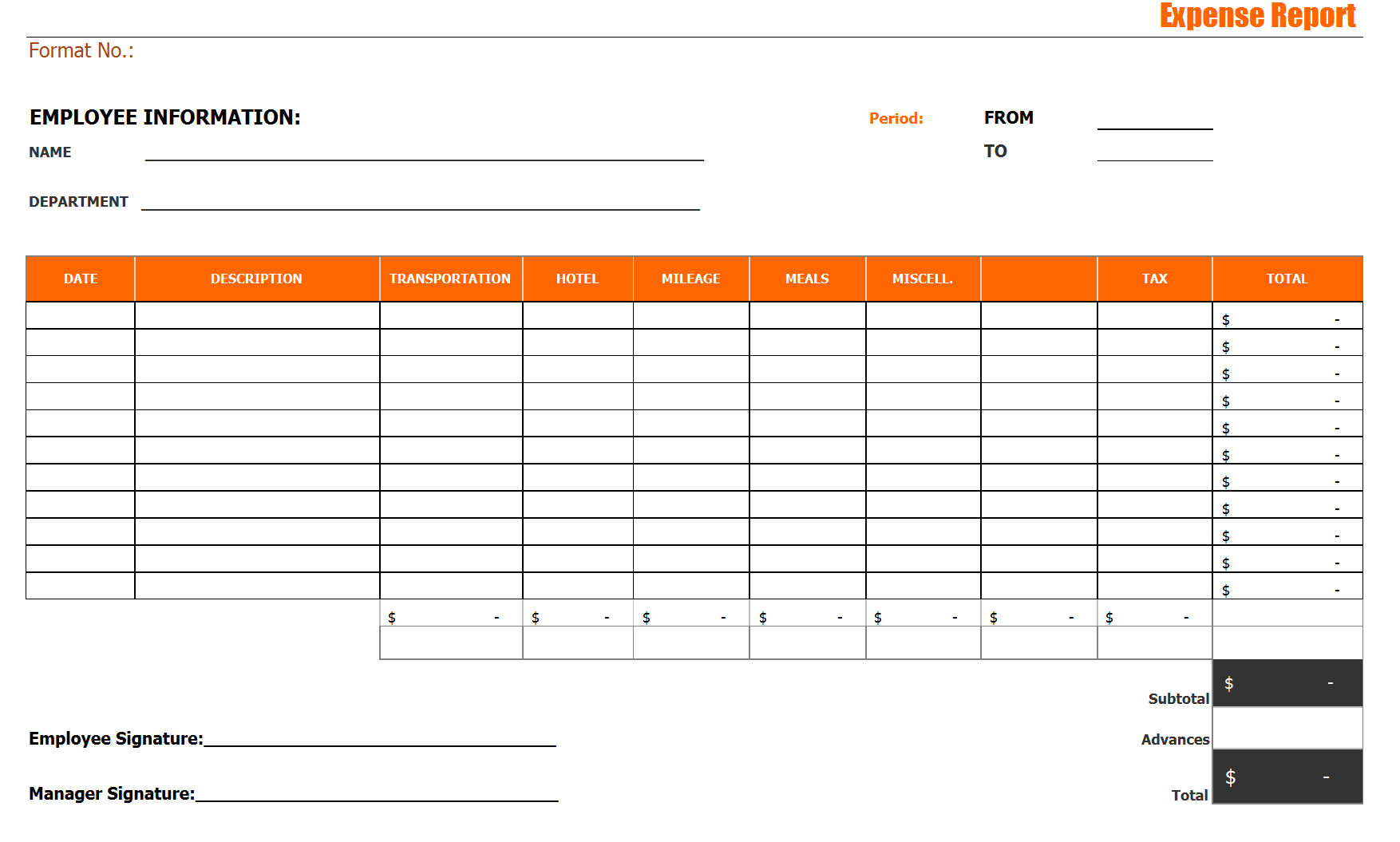

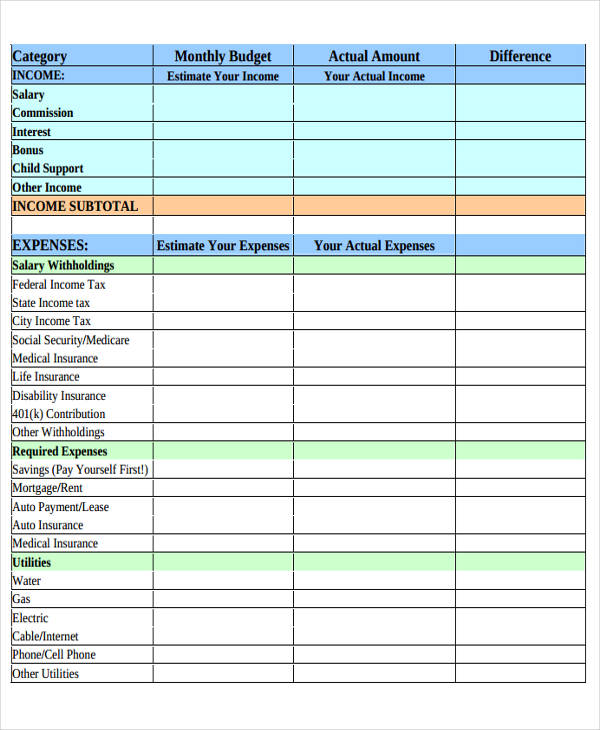

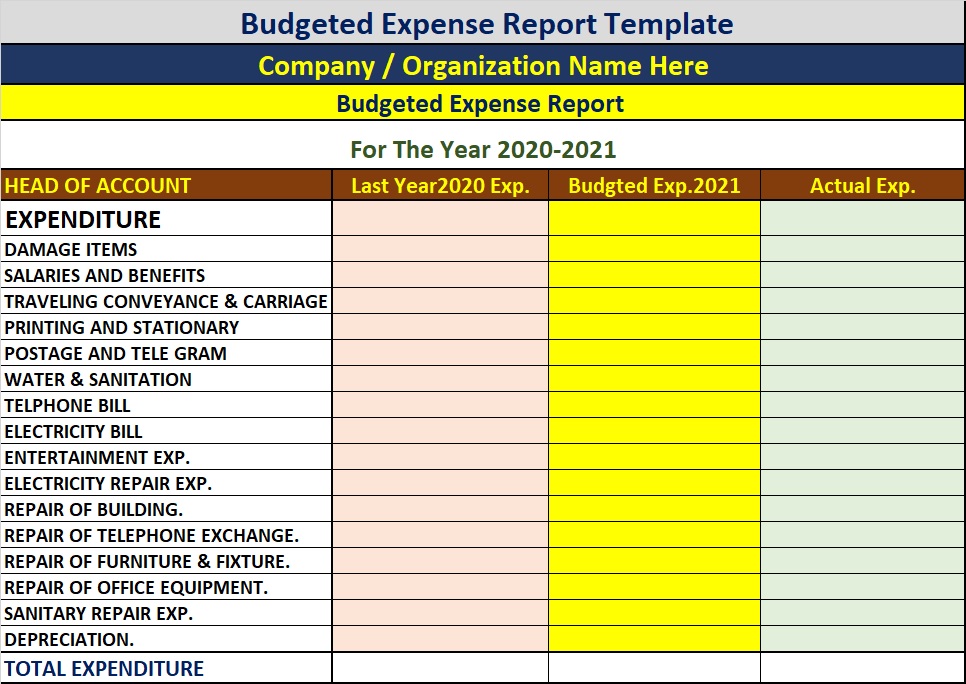

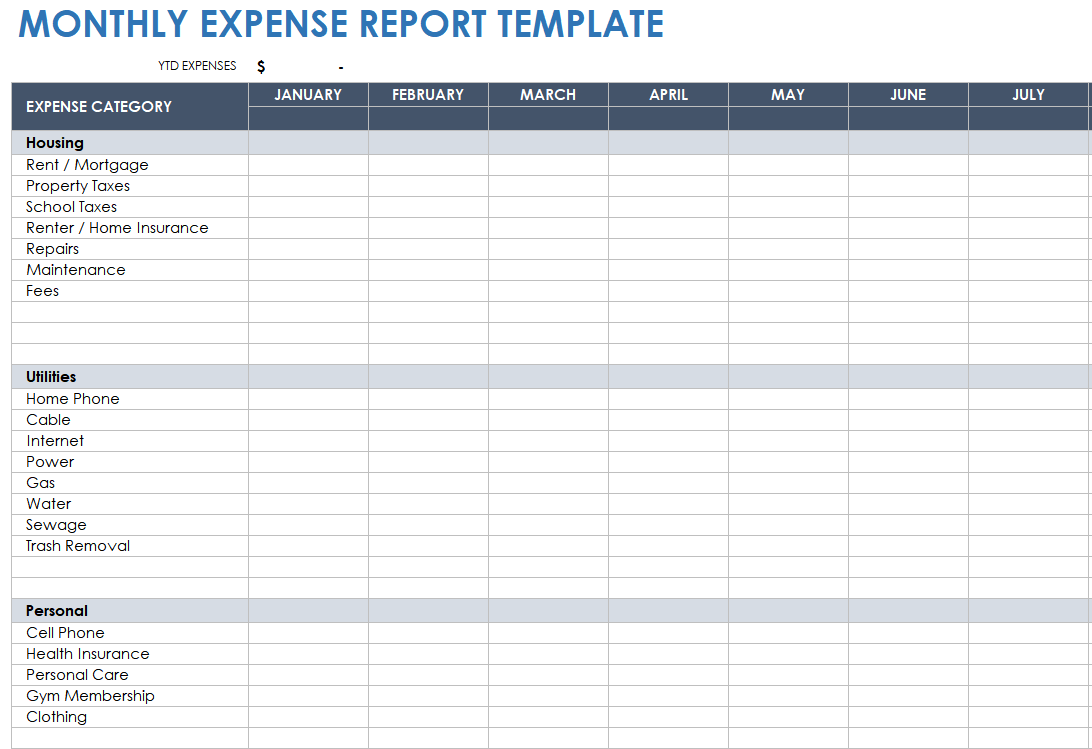

Manually tracking expenses using pen and paper or a basic spreadsheet can be time-consuming and prone to errors. A Monthly Expense Report Template Excel automates many of these tasks, reducing the risk of mistakes and saving you valuable time. The pre-defined categories and formulas ensure consistency and accuracy in your data entry.

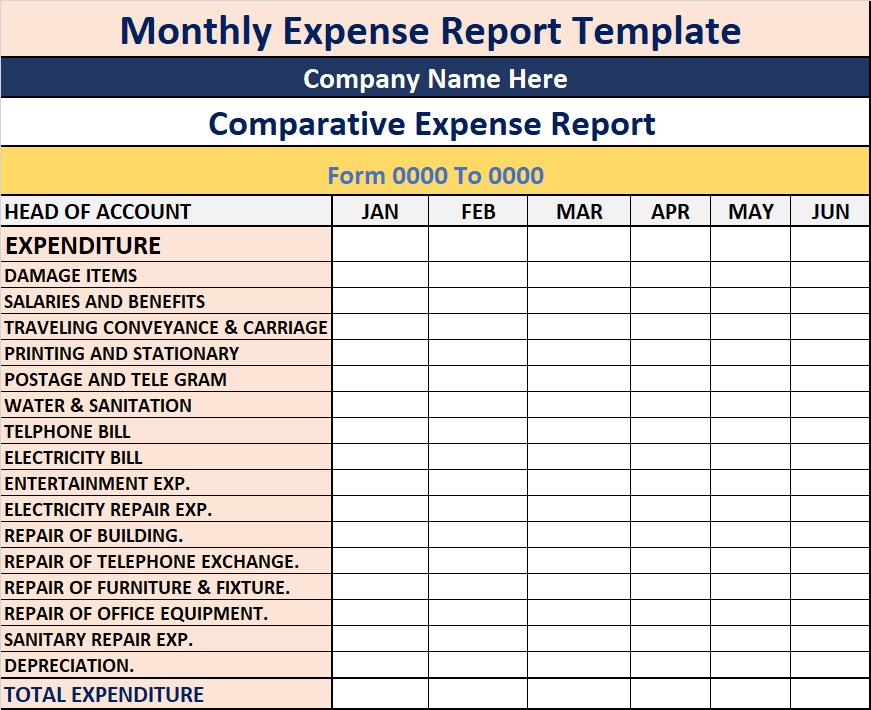

By providing a clear picture of your spending habits, an expense report template allows you to create more realistic and effective budgets. You can identify areas where you’re overspending and make adjustments to align your spending with your financial goals. This proactive approach to budgeting is essential for long-term financial stability.

For freelancers and small business owners, accurate expense tracking is crucial for tax preparation. A detailed expense report can serve as a valuable record of deductible expenses, simplifying the tax filing process and potentially reducing your tax liability. Keeping organized records can save you time and money when it comes time to file your taxes.

Excel’s charting and analysis capabilities allow you to visualize your spending patterns and identify trends over time. This can help you understand how your expenses are changing and make informed decisions about your financial future. For example, you might notice a recurring expense that you can eliminate or a seasonal spending pattern that you can plan for.

![]()

Not all expense report templates are created equal. When selecting a template, consider the following features to ensure it meets your specific needs.

The template should allow you to easily add, edit, and delete expense categories to reflect your unique spending habits. Common categories include housing, transportation, food, entertainment, and utilities, but you may need to add more specific categories depending on your situation.

Look for a template that automatically calculates totals, subtotals, and percentages. This eliminates the need for manual calculations and reduces the risk of errors. Formulas for calculating variances between budgeted and actual expenses are also highly valuable.

Charts and graphs can provide a quick and easy way to visualize your spending patterns. A good template should offer a variety of chart types, such as pie charts, bar graphs, and line graphs.

The template should allow you to generate reports that summarize your expenses over a specific period. This can be helpful for tracking progress towards your financial goals and identifying areas for improvement.

The template should be easy to use and understand, even if you’re not an Excel expert. Clear instructions and intuitive navigation are essential.

While pre-made templates are readily available, creating your own can offer greater customization and a deeper understanding of your financial data. Here’s a step-by-step guide:

Open a new Excel workbook and create a new sheet. Rename the sheet “Monthly Expense Report.”

In the first column, list your expense categories (e.g., Rent/Mortgage, Groceries, Transportation, Utilities, Entertainment, etc.). Be as specific as possible.

Create columns for “Date,” “Description,” and “Amount.”

At the bottom of the “Amount” column, use the SUM() function to calculate the total expenses for the month.

Add a column for “Budgeted Amount” and another for “Variance” (Budgeted Amount – Actual Amount). Use formulas to calculate the variance for each category.

Use Excel’s charting tools to create visualizations of your spending patterns.

Once you have a basic template in place, you can enhance it with advanced features to gain even deeper insights into your finances.

Use conditional formatting to highlight expenses that exceed your budget or to identify spending patterns. For example, you could highlight all expenses greater than a certain amount or color-code categories based on their percentage of total spending.

Pivot tables allow you to summarize and analyze your expense data in a variety of ways. You can use pivot tables to compare spending across different months, categories, or time periods.

Macros can automate repetitive tasks, such as generating reports or updating formulas. This can save you time and effort in the long run.

Consider integrating your expense report template with other financial tools, such as budgeting apps or accounting software. This can streamline your financial management process and provide a more holistic view of your finances.

There are numerous free and paid Monthly Expense Report Template Excel options available online. Free templates are a good starting point, but they may lack some of the advanced features and customization options offered by paid templates.

Websites like Microsoft Templates, Smartsheet, and Vertex42 offer a variety of free expense report templates. These templates are often a good choice for individuals who need a basic expense tracking solution.

Paid templates typically offer more advanced features, such as customizable categories, automated calculations, data visualization tools, and reporting capabilities. They may also include customer support and regular updates. Etsy and other online marketplaces are good places to find paid templates.

A well-designed Monthly Expense Report Template Excel is an invaluable tool for anyone seeking to gain control of their finances. By providing a clear and organized overview of your spending habits, it empowers you to make informed decisions, create realistic budgets, and work towards your financial goals. Whether you choose to use a pre-made template or create your own, the key is to consistently track your expenses and analyze the data to identify areas for improvement. Embrace the power of Excel and take the first step towards a more financially secure future.