The world of international trade is increasingly reliant on complex financial instruments, and one of the most frequently utilized is the Murabaha agreement. This document outlines the key terms and conditions of a Murabaha agreement, providing a framework for businesses involved in sourcing and exporting goods. Understanding this template is crucial for ensuring a smooth and legally sound transaction. Murabaha Agreement Template – a meticulously crafted document, it’s more than just a formality; it’s a roadmap for minimizing risk and maximizing profitability. This article will delve into the core components of a Murabaha agreement, explaining its purpose, key clauses, and best practices for implementation. It’s designed to be a comprehensive resource for businesses seeking to leverage this powerful financing tool.

The Murabaha agreement, derived from the Arabic word “murabaha” meaning “to sell with a cost,” is a standardized contract that dictates the price and delivery schedule for goods. It’s a crucial tool for manufacturers, distributors, and importers seeking to secure financing for international purchases. Unlike traditional financing, Murabaha doesn’t involve a purchase price but rather a cost-plus-margin, ensuring the seller is compensated for their efforts and the goods’ value. It’s a highly structured approach, designed to protect both the buyer and seller, fostering trust and predictability within the global supply chain. The agreement’s strength lies in its transparency and its focus on a fixed cost, minimizing ambiguity and potential disputes.

Before diving into the specific clauses, it’s important to grasp the fundamental principles underpinning a Murabaha agreement. At its heart, it’s a cost-plus-margin arrangement. The seller (the Mubashir) offers a price (the Mubdah) that covers the cost of production, transportation, and other associated expenses. The buyer (the Mursi) then pays this price, effectively paying for the goods themselves. The key element is the fixed cost – the price agreed upon – which is the basis for the entire transaction. This fixed cost is meticulously documented and agreed upon upfront, providing a clear and predictable framework. The agreement also includes a defined delivery schedule, outlining the timeframe for the goods’ arrival at the buyer’s location. This schedule is critical for ensuring timely delivery and minimizing disruptions.

Let’s examine some of the most important clauses that typically feature in a Murabaha agreement. These clauses are designed to protect all parties involved and ensure a successful transaction.

![]()

This section clearly defines the parties to the agreement – the Mubashir (seller) and the Mursi (buyer). It also defines key terms such as “goods,” “price,” “delivery date,” and “currency.” Specificity is paramount here; clearly defining what constitutes “goods” prevents misunderstandings and potential disputes. For example, a precise description of the product being sold is essential.

A detailed description of the goods being supplied is absolutely critical. This section outlines the technical specifications, quality standards, and any certifications required. It’s vital to include information about dimensions, materials, tolerances, and any relevant industry standards. This ensures the buyer has a clear understanding of the product’s quality and can assess its suitability for their needs. Failure to adequately define specifications can lead to disagreements about product acceptance.

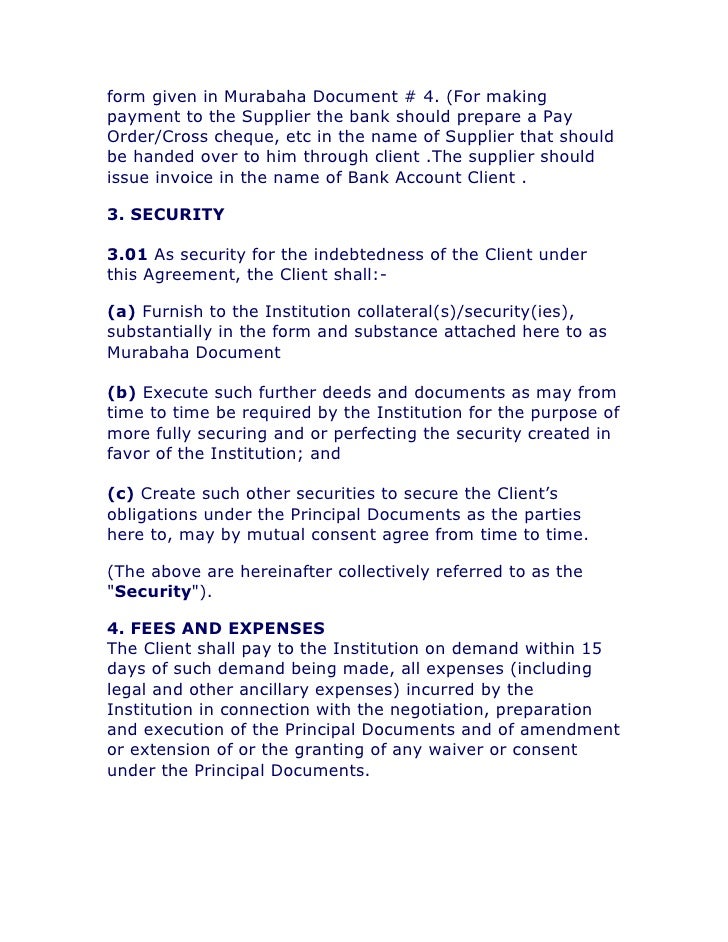

This section outlines the agreed-upon price, the payment schedule, and the method of payment. The price should be clearly stated, and the payment terms should be unambiguous. Typically, payments are made in installments, with the final payment contingent on the delivery of the goods. The agreement should also specify any potential penalties for late payment.

The agreement details the delivery schedule, including the start and end dates of the shipment. It specifies the mode of transportation, the carrier, and the responsibilities for shipping costs and insurance. Clear communication regarding delivery timelines is essential to avoid delays and disruptions. Consider including clauses addressing potential delays due to weather or other unforeseen circumstances.

This section addresses potential risks and liabilities associated with the transaction. It clarifies who is responsible for what in case of damage, loss, or delays. It’s important to define the responsibilities of each party, including their obligations to provide documentation and ensure the goods’ safe delivery. A well-defined risk allocation clause can significantly reduce potential disputes.

This section specifies the governing law that will apply to the agreement and outlines the process for resolving any disputes that may arise. This could include arbitration or mediation, providing a structured and efficient method for resolving disagreements. Having a clear dispute resolution mechanism can save time and money in the long run.

Implementing a Murabaha agreement offers numerous benefits for businesses involved in international trade. Firstly, it provides price certainty – the buyer knows the agreed-upon price upfront, reducing the risk of unexpected cost increases. Secondly, it fosters transparency – all parties are aware of the terms and conditions of the transaction. Thirdly, it streamlines the financing process – the agreement allows businesses to secure financing without the complexities of traditional loans. Finally, it promotes trust and collaboration – the structured nature of the agreement encourages open communication and minimizes the potential for misunderstandings.

Successful implementation of a Murabaha agreement requires careful planning and attention to detail. Here are some best practices:

The Murabaha agreement is a powerful tool for businesses seeking to navigate the complexities of international trade. By carefully considering the key clauses and following best practices, businesses can leverage this agreement to secure favorable financing, minimize risk, and foster long-term partnerships. The template provided here is a starting point, and it’s crucial to tailor the agreement to the specific needs and circumstances of each transaction. As global trade continues to expand, the importance of a well-structured Murabaha agreement will only increase. Ultimately, a robust agreement is an investment in a successful and sustainable international business relationship.