Past Due Letter Template: A Comprehensive Guide to Gentle & Effective Debt Recovery

Successfully managing your accounts receivable is crucial for the financial health of any business. Unfortunately, late payments and outstanding invoices are a common challenge. Knowing how to address these situations professionally and effectively is paramount. A well-crafted *past due letter template* is an indispensable tool in this process. It allows you to communicate clearly and firmly with customers about their overdue obligations while maintaining a professional relationship, increasing the likelihood of timely payment and preserving customer goodwill. This guide will walk you through the essential components of a past due letter template, offering insights and best practices to help you recover outstanding debts efficiently.

Sending a past due letter isn’t just about demanding payment; it’s about clearly communicating the status of the account, reminding the customer of their obligation, and outlining the consequences of continued non-payment. It also provides an opportunity to offer assistance, such as payment plans or alternative payment methods, demonstrating a willingness to work with the customer to resolve the issue.

Why Use a Past Due Letter Template?

Utilizing a standardized past due letter template offers several advantages:

- Consistency: Ensures all overdue accounts are handled with the same level of professionalism and clarity.

- Efficiency: Saves time by eliminating the need to draft a new letter for each overdue invoice.

- Legal Protection: Helps document communication efforts, which can be valuable if legal action becomes necessary.

- Improved Recovery Rates: A clear and consistent approach often results in faster payment.

- Professionalism: Maintains a positive image for your business, even when dealing with difficult situations.

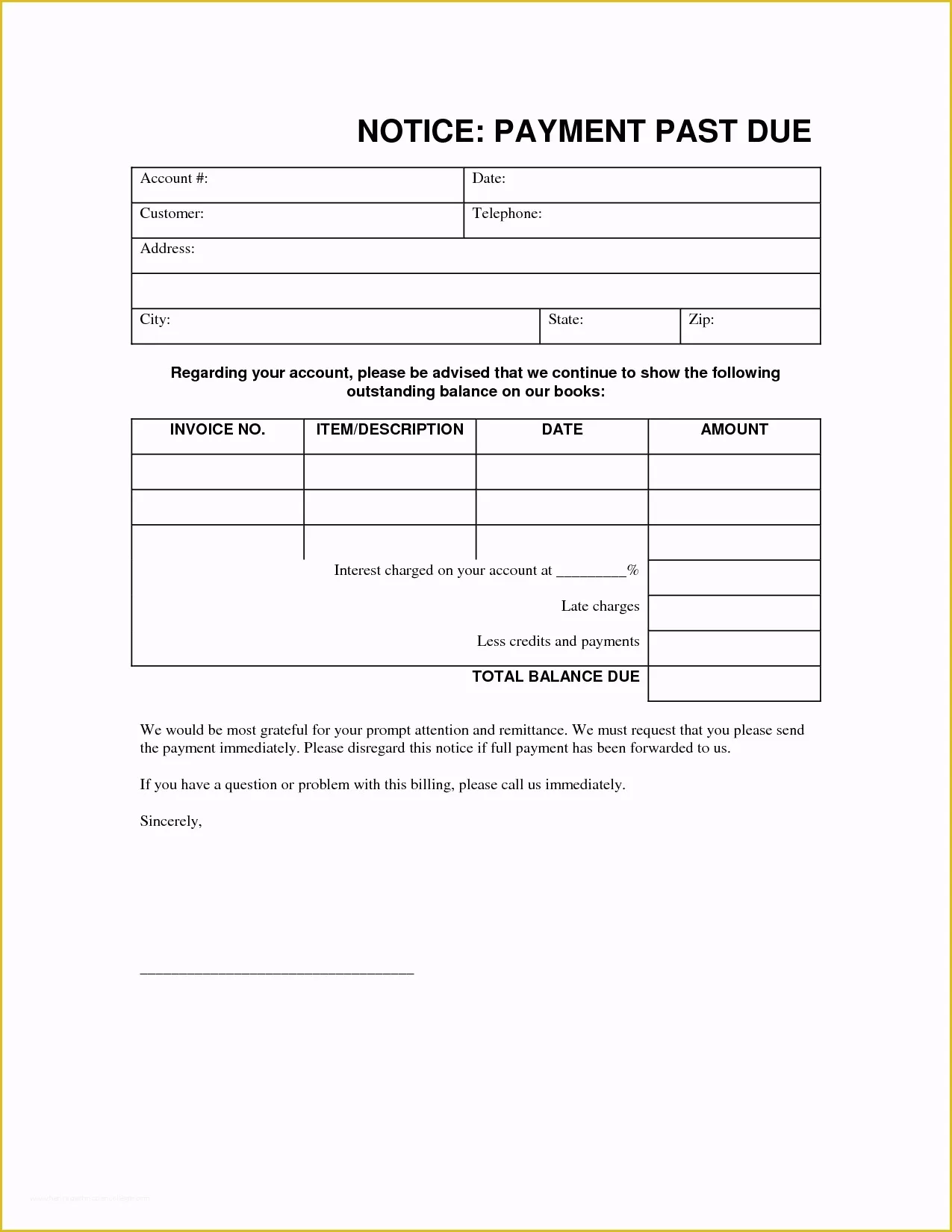

Essential Elements of an Effective Past Due Letter Template

A successful past due letter should include the following key elements. Remember to tailor these elements to the specific circumstances of each case, maintaining a balance between firmness and respect.

- Company Information: Your company name, address, and contact information should be clearly displayed.

- Date: The date the letter was sent.

- Customer Information: The customer’s name, address, and account number.

- Subject Line: A clear and concise subject line, such as “Past Due Invoice” or “Payment Reminder.”

- Salutation: A professional greeting, such as “Dear [Customer Name].”

- Invoice Details: Clearly state the invoice number, invoice date, and original amount due.

- Overdue Amount: Specify the exact amount currently outstanding.

- Payment Due Date: Remind the customer of the original payment due date.

- Statement of Overdue Status: Clearly state that the invoice is past due and that prompt payment is required.

- Call to Action: Provide clear instructions on how to make a payment, including accepted payment methods.

- Consequences of Non-Payment: Outline the potential consequences of continued non-payment, such as late fees, interest charges, or legal action. Be specific and avoid vague threats.

- Offer of Assistance: Show willingness to work with the customer by offering payment plans or alternative payment options.

- Closing: A professional closing, such as “Sincerely” or “Regards.”

- Signature: Your signature and printed name.

Past Due Letter Template Stages (Example Structure)

It’s generally recommended to send a series of past due letters, each escalating in tone and urgency.

- First Notice (Gentle Reminder): A polite reminder sent shortly after the due date, simply highlighting the outstanding balance.

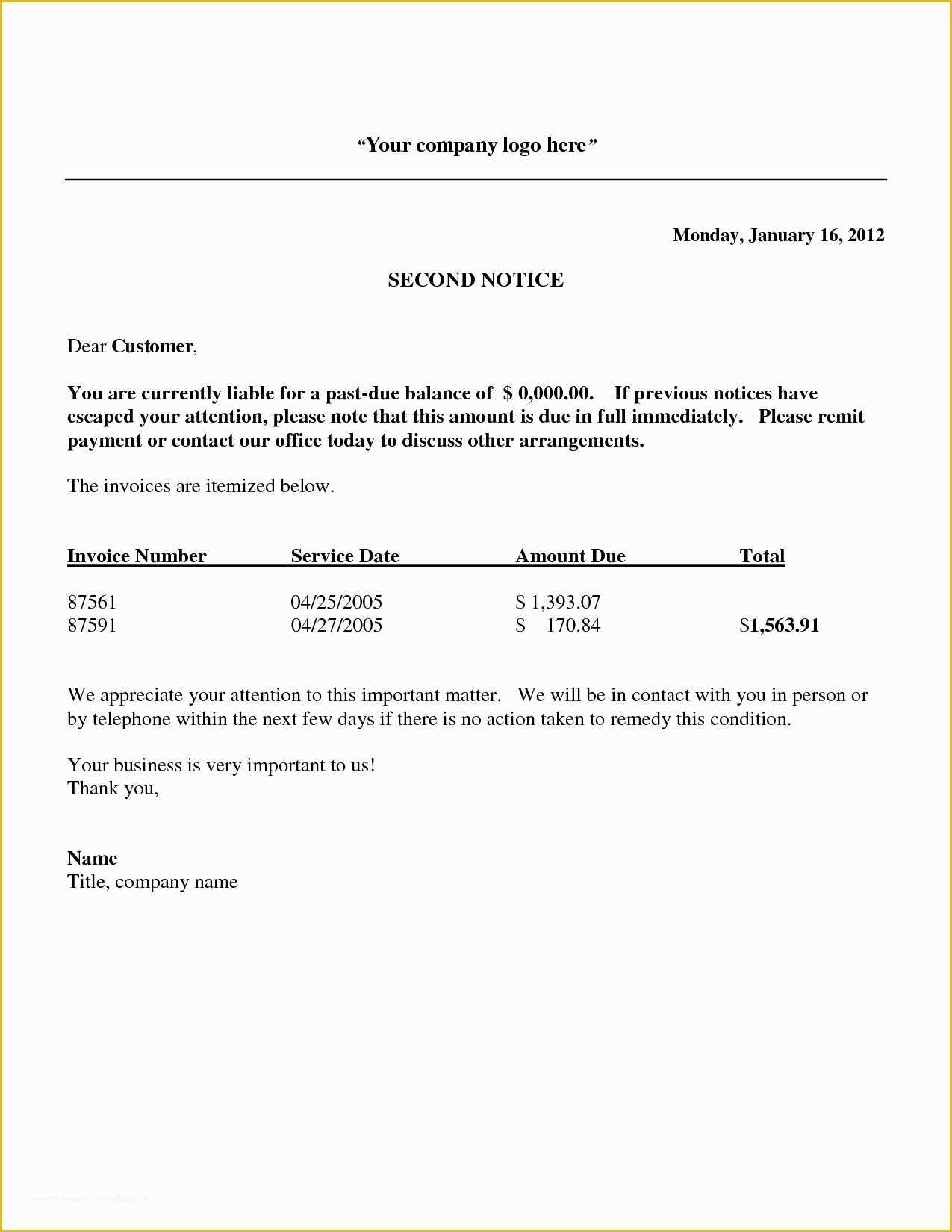

- Second Notice (More Firm): Sent a week or two after the first notice, expressing concern about the overdue payment and reiterating the payment terms.

- Third Notice (Urgent Demand): Sent a week or two after the second notice, emphasizing the urgency of the situation and outlining the consequences of continued non-payment.

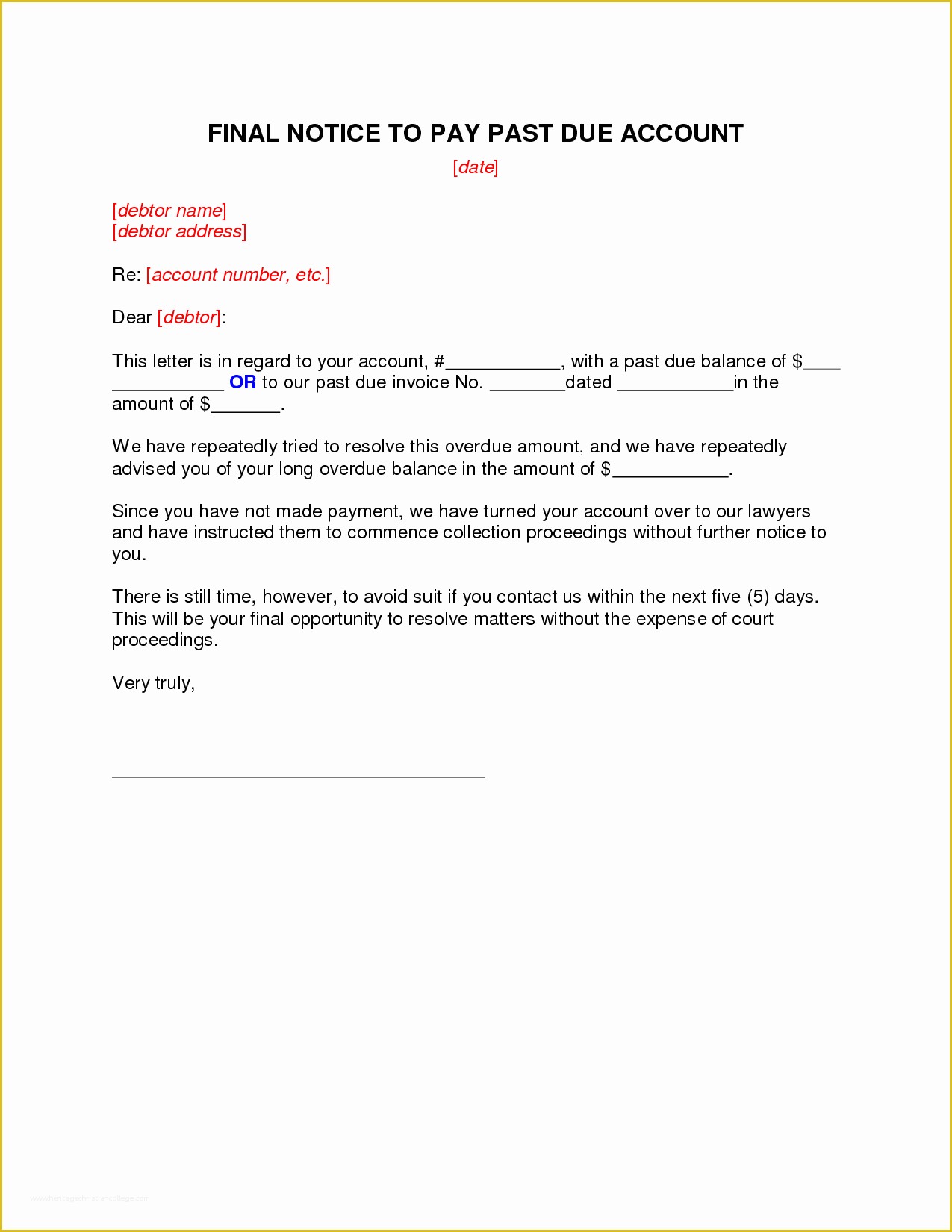

- Final Notice (Legal Action): A final warning before taking legal action, clearly stating the intention to pursue legal remedies if payment is not received by a specific date. This letter is often reviewed by legal counsel.

Example Past Due Letter Template (First Notice)

This is a basic example; remember to tailor it to your specific needs:

[Your Company Name] [Your Company Address] [Your Company Phone Number] [Your Company Email Address] [Date] [Customer Name] [Customer Address] Subject: Gentle Reminder: Invoice [Invoice Number] Dear [Customer Name], This is a friendly reminder that invoice [Invoice Number] for [Amount] is now past due. The original due date was [Due Date]. You can review the invoice details attached to this email or by logging into your account on our website: [Website Address]. Please remit payment as soon as possible. You can make a payment through the following methods: * Online: [Payment Link] * Mail: [Mailing Address] * Phone: [Phone Number] If you have already made a payment, please disregard this notice. If you have any questions or require further assistance, please don't hesitate to contact us. Thank you for your business. Sincerely, [Your Name] [Your Title]

Tips for Using Your Past Due Letter Template Effectively

- Be Prompt: Send your first notice shortly after the due date.

- Be Clear and Concise: Use straightforward language and avoid ambiguity.

- Be Professional: Maintain a respectful and courteous tone, even when dealing with difficult situations.

- Document Everything: Keep records of all communication with the customer.

- Follow Up: Don’t rely solely on letters; consider making phone calls to follow up on overdue accounts.

- Consider Legal Counsel: If a significant amount is overdue and the customer is unresponsive, consult with an attorney.

- Customize: Tailor each letter to the specific circumstances of the customer and the overdue invoice. Don’t just send a generic template.

By implementing a well-designed past due letter template and following these best practices, you can significantly improve your debt collection efforts and maintain positive customer relationships. Remember that consistent communication and a willingness to work with your customers are key to resolving overdue payments successfully.

If you are looking for Past Due Invoice Letter Template Samples Letter Template Collection Images you’ve came to the right page. We have 9 Pictures about Past Due Invoice Letter Template Samples Letter Template Collection Images like Free Past Due Letter Template Of Fresh Past Due Letter Template, Free Past Due Letter Template Of Past Due Invoice Letter Invoice and also Past Due Invoice Letter Template Samples Letter Template Collection Images. Read more:

Past Due Invoice Letter Template Samples Letter Template Collection Images

www.tpsearchtool.com

Past Due Invoice Letter Template Samples Letter Template Collection Images

Free Past Due Letter Template Of Past Due Invoice Letter Invoice

www.heritagechristiancollege.com

Free Past Due Letter Template Of Past Due Invoice Letter Invoice …

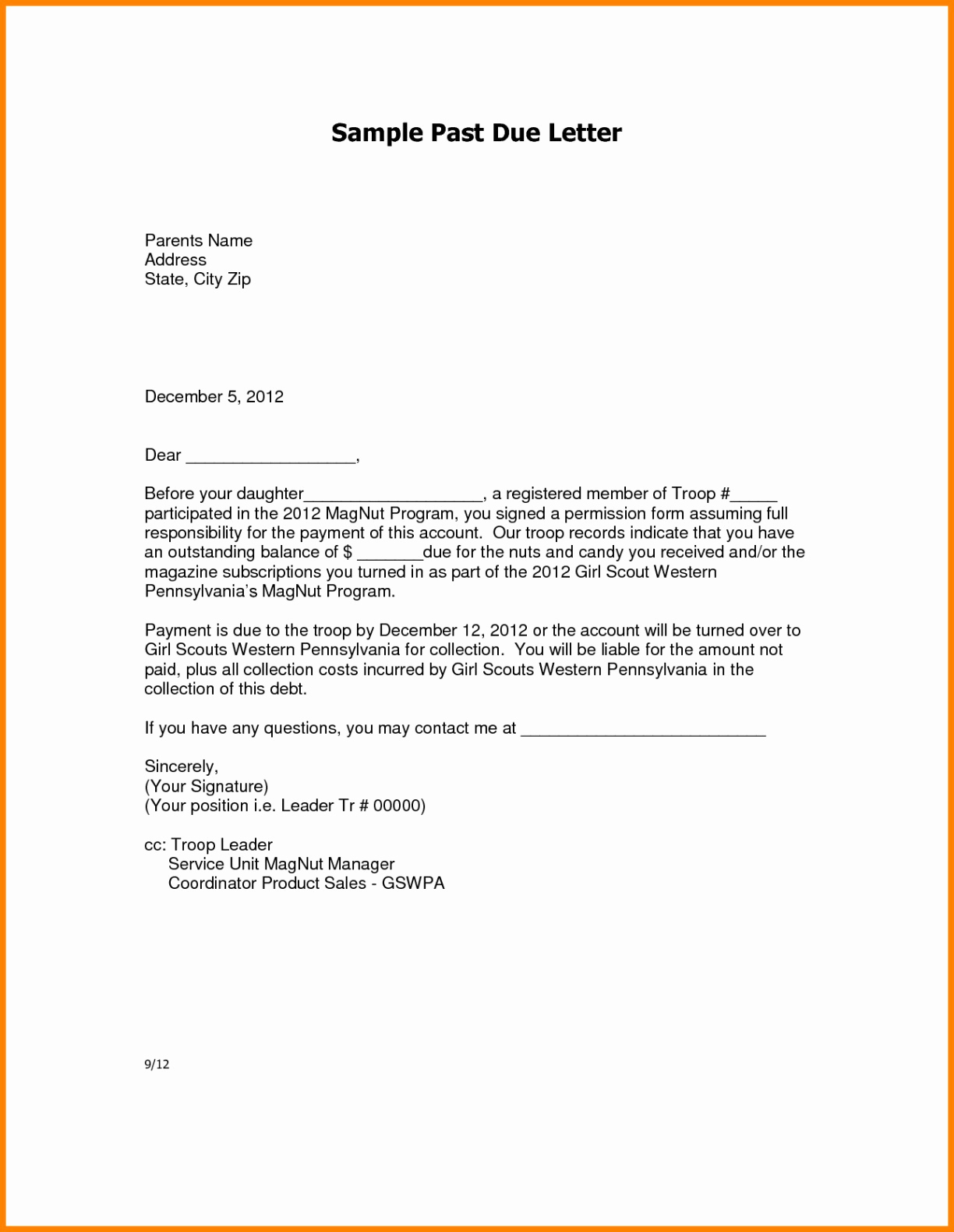

Past Due Letter Template – PARAHYENA

www.parahyena.com

Past Due Letter Template – PARAHYENA

Free Past Due Letter Template Of Past Due Invoice Letter Template

www.heritagechristiancollege.com

Free Past Due Letter Template Of Past Due Invoice Letter Template …

Past Due Rent Letter

ar.inspiredpencil.com

Past Due Rent Letter

Free Past Due Letter Template Of Fresh Past Due Letter Template

www.heritagechristiancollege.com

Free Past Due Letter Template Of Fresh Past Due Letter Template …

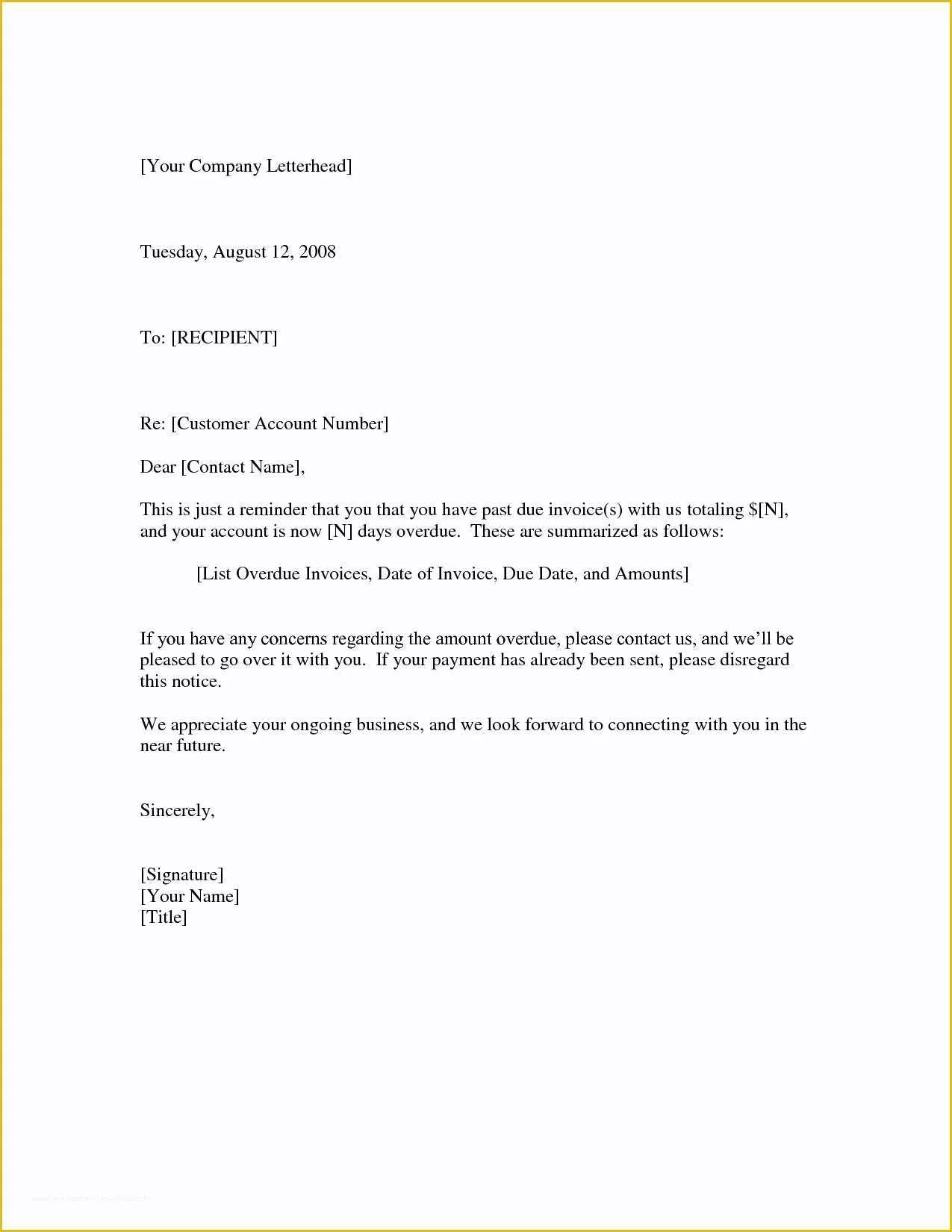

Free Overdue Payment Reminder Letter Template To Edit Online

www.template.net

Free Overdue Payment Reminder Letter Template to Edit Online

Past Due Letter Template – PARAHYENA

www.parahyena.com

Past Due Letter Template – PARAHYENA

Free Past Due Letter Template Of Free Past Due Invoice Template

www.heritagechristiancollege.com

Free Past Due Letter Template Of Free Past Due Invoice Template …

Free overdue payment reminder letter template to edit online. Free overdue payment reminder letter template to edit online. Past due letter template – parahyena