p

Are you struggling with negative items on your credit report? Derogatory marks like late payments, collections, or charge-offs can significantly impact your credit score, making it harder to get approved for loans, mortgages, or even rent an apartment. While disputing inaccurate information is a common first step, sometimes you need to take a more proactive approach. This is where a “Pay For Delete” letter comes in. This strategy involves negotiating with the creditor or collection agency to remove the negative entry from your credit report in exchange for your payment. While not guaranteed to work, a well-crafted Pay For Delete letter can be a powerful tool in your credit repair arsenal. Let’s delve into understanding the Pay For Delete letter template and how to use it effectively.

Pay For Delete Letter Template: Your Guide to Credit Repair

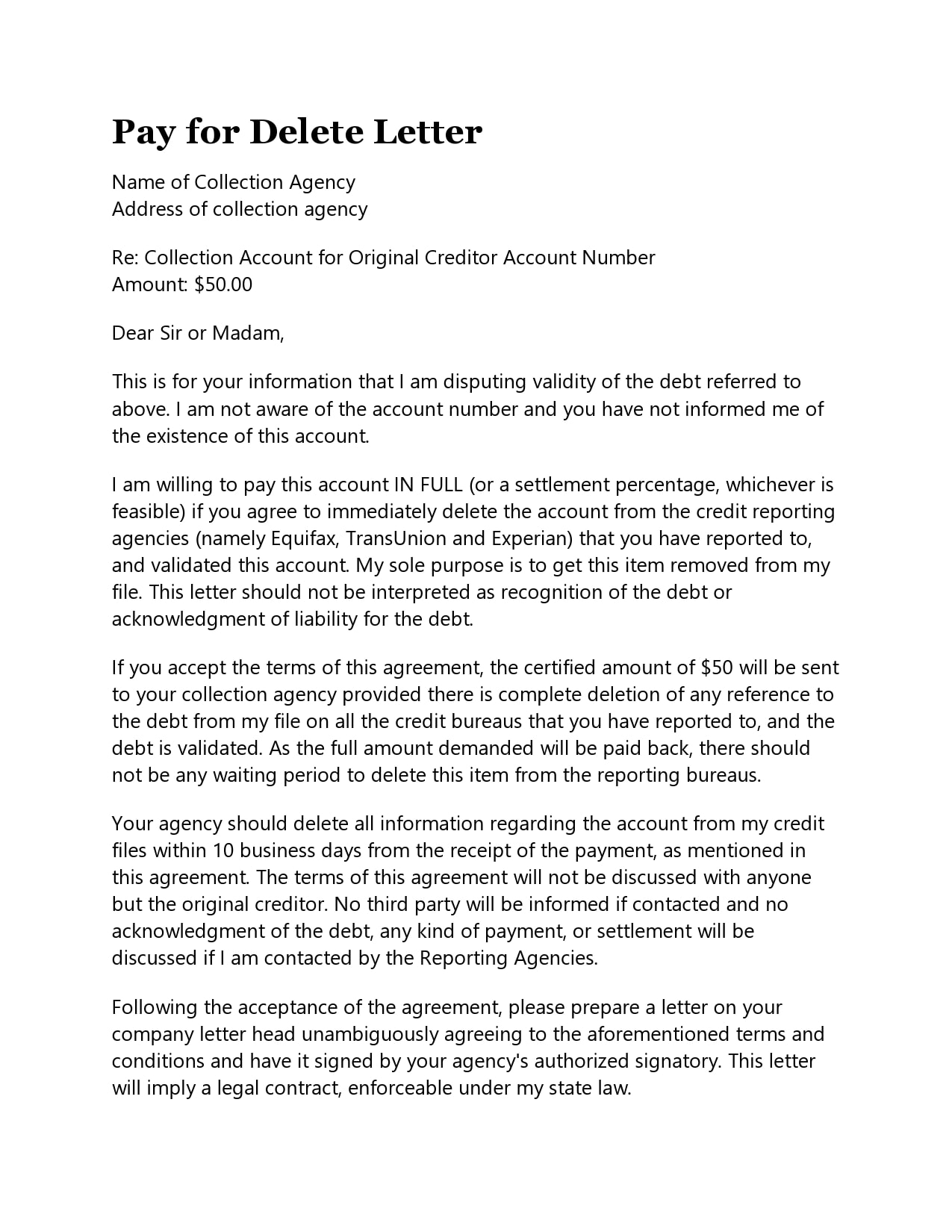

A Pay For Delete letter is a formal request you send to a creditor or collection agency. It proposes a deal: you will pay the outstanding debt (or a negotiated settlement) in return for them removing the negative entry associated with that debt from your credit report. The idea is that the creditor benefits from receiving payment, and you benefit from improved credit. It’s crucial to understand that creditors are not obligated to agree to this, and some may have policies against it. However, it’s definitely worth trying, especially for older debts that are nearing the statute of limitations.

Understanding the Components of a Pay For Delete Letter

Before we get to the template itself, let’s break down the essential elements that every effective Pay For Delete letter should include:

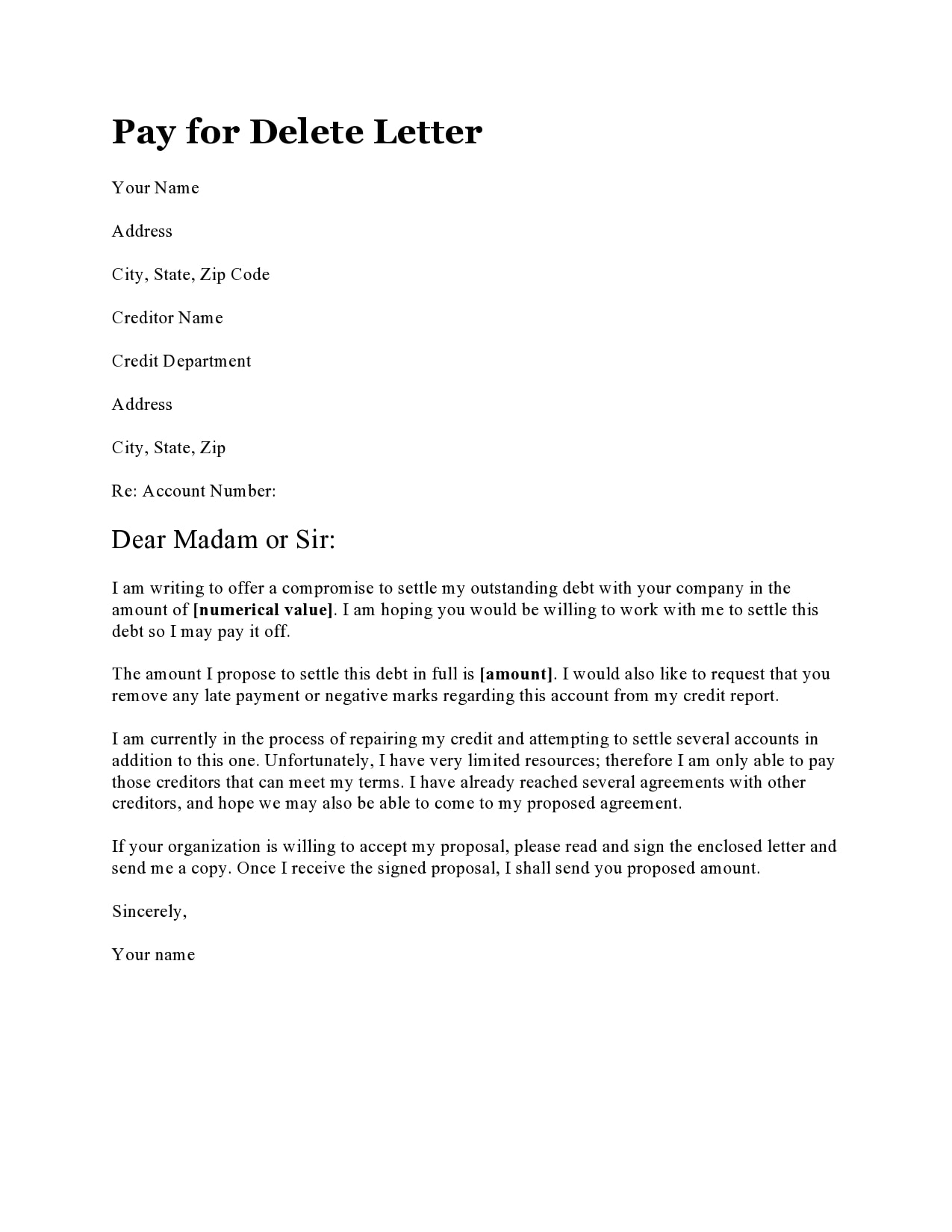

- Your Contact Information: Include your full name, current address, phone number, and email address. Make sure this information matches what’s on your credit report.

- Creditor/Collection Agency Information: Clearly state the name and address of the creditor or collection agency you are contacting. Verify this information using your credit report or any correspondence you have received from them.

- Account Number: Provide the specific account number associated with the debt you are referencing. This is crucial for accurate identification.

- Date of the Letter: Use the current date.

- Clear and Concise Language: State your proposal clearly and directly. Avoid being overly emotional or apologetic. Keep the tone professional and business-like.

- Offer to Pay (or Settle): Specify the amount you are willing to pay. You can offer to pay the full amount, or you can attempt to negotiate a settlement for a lesser amount. Be prepared to negotiate.

- Explicit Agreement for Deletion: This is the most important part! Clearly state that your payment is contingent upon the deletion of the negative entry from all three major credit bureaus (Equifax, Experian, and TransUnion).

- Timeline for Deletion: Specify a reasonable timeframe for the creditor or collection agency to remove the negative entry after you make the payment. 30-45 days is generally acceptable.

- Method of Payment: Indicate how you will make the payment (e.g., certified check, money order). Avoid providing bank account information directly.

- Closing and Signature: End the letter with a polite closing, such as “Sincerely,” and your signature.

Pay For Delete Letter Template in HTML List Format

Below is a sample Pay For Delete letter template that you can adapt to your specific situation. Remember to replace the bracketed information with your own details.

- [Your Full Name]

- [Your Current Address]

- [Your Phone Number]

- [Your Email Address]

- [Date]

- [Creditor/Collection Agency Name]

- [Creditor/Collection Agency Address]

- Subject: Account Number: [Your Account Number] – Request for Deletion of Negative Credit Information

- Dear [Creditor/Collection Agency Contact Person, if known, otherwise use “Credit Department”],

- I am writing to you regarding account number [Your Account Number], which is currently listed on my credit report as a negative item. I understand that this account has impacted my credit score, and I am seeking to resolve this matter.

- I am willing to pay [Amount you are offering – either full amount or a settlement offer] in exchange for your agreement to completely remove all negative information related to this account from my credit reports with Equifax, Experian, and TransUnion.

- I understand that this agreement means you will delete the entire entry from my credit reports, not just update it.

- Upon receipt of [Amount you are offering] by [Method of Payment – e.g., certified check], I expect written confirmation that you have initiated the deletion process with all three credit bureaus. I request that the deletion be completed within [Number] days (e.g., 30 days) of receiving the payment.

- Please send written confirmation of your agreement to these terms to my address listed above. If I do not receive confirmation within [Number] days (e.g., 14 days), I will assume that you are not willing to accept my offer.

- Thank you for your time and consideration in this matter. I look forward to a positive resolution.

- Sincerely,

- [Your Signature]

- [Your Typed Name]

Important Considerations and Tips

- Keep a Copy: Always keep a copy of the letter you send for your records.

- Send Certified Mail: Send the letter via certified mail with return receipt requested. This provides proof that the creditor or collection agency received your letter.

- Follow Up: If you don’t hear back within the timeframe you specified, follow up with a phone call or another letter.

- Get it in Writing: *Never* make a payment without a written agreement from the creditor or collection agency confirming that they will delete the negative item from your credit report.

- Monitor Your Credit Report: After making the payment and receiving confirmation of deletion, monitor your credit report regularly to ensure the negative item has been removed. You can obtain free credit reports from AnnualCreditReport.com.

- Not Always Successful: Be prepared for the possibility that the creditor or collection agency will not agree to a Pay For Delete. If this happens, explore other credit repair options, such as disputing inaccurate information or waiting for the negative item to age off your credit report.

While using a Pay For Delete letter template is a helpful tool, remember that it’s just one aspect of credit repair. Building good credit habits, like paying your bills on time and keeping your credit utilization low, is the best long-term strategy for maintaining a healthy credit score. Good luck!

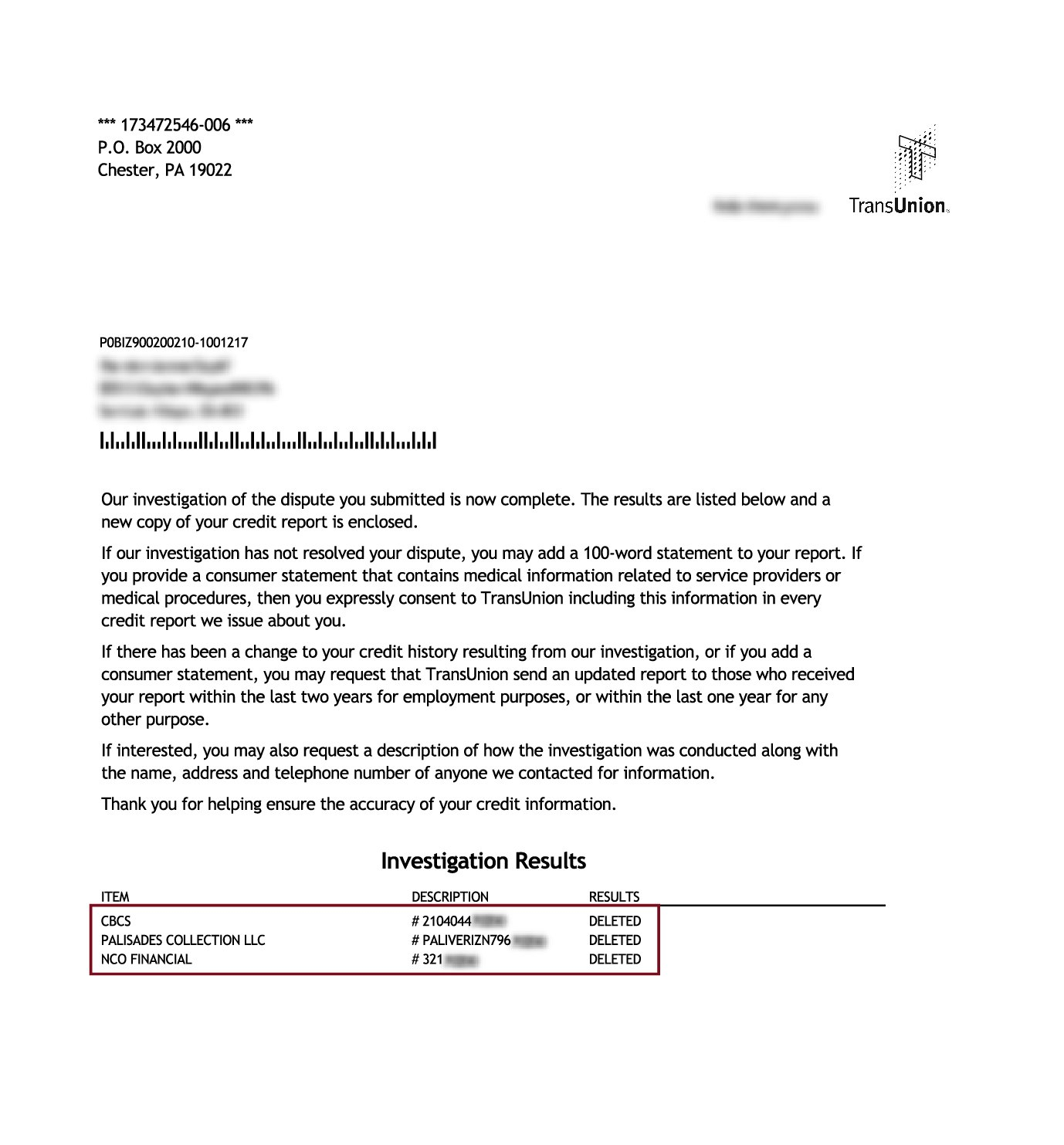

If you are searching about Goodwill Letter Template To Remove Paid Collections Collection with Pay you’ve visit to the right place. We have 9 Images about Goodwill Letter Template To Remove Paid Collections Collection with Pay like Heloc Statement Sample And Pay For Delete Letter Template Beautiful, 40 Effective Pay for Delete Letter Templates (100% FREE) and also Goodwill Letter Template To Remove Paid Collections Collection with Pay. Here you go:

Goodwill Letter Template To Remove Paid Collections Collection With Pay

vancecountyfair.com

Pay For Delete Letter | Template And Sample – Pay For Delete Letter

www.etsy.com

Pay For Delete Letter | PDF Letter & Sample | LawDistrict

www.lawdistrict.com

40 Effective Pay For Delete Letter Templates (100% FREE)

templatearchive.com

40 Effective Pay For Delete Letter Templates (100% FREE)

templatearchive.com

Free Printable Pay For Delete Letter Templates [PDF, Word]

![Free Printable Pay For Delete Letter Templates [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/07/Download-Pay-for-Delete-Letter.jpg?gid=697)

www.typecalendar.com

Heloc Statement Sample And Pay For Delete Letter Template Beautiful

vancecountyfair.com

Free Printable Pay For Delete Letter Templates [PDF, Word]

![Free Printable Pay For Delete Letter Templates [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/07/Pay-for-Delete-Letter-Template.jpg)

www.typecalendar.com

Free Pay For Delete Letter Template | PDF | Word

esign.com

esign

Pay for delete letter. Pay for delete letter. Free printable pay for delete letter templates [pdf, word]