The world of online transactions can be complex, and clarity is paramount. A well-drafted Payment Terms Agreement Template is crucial for protecting both your business and your customers. This template provides a solid foundation for establishing clear expectations regarding payment, refunds, dispute resolution, and other important aspects of your service. It’s more than just a formality; it’s a vital tool for minimizing risk and fostering trust. This comprehensive guide will walk you through the key elements of a robust Payment Terms Agreement Template, ensuring you’re prepared for a wide range of scenarios. Let’s dive in.

In today’s digital landscape, where transactions often occur remotely, a clear and legally sound Payment Terms Agreement Template is no longer optional. It’s a fundamental element of responsible business practices. It protects your business from potential disputes, clarifies your obligations to customers, and sets the stage for a smooth and predictable transaction process. Without a template, you risk misunderstandings, legal challenges, and damage to your reputation. A well-crafted agreement demonstrates professionalism and builds confidence with your clientele. Furthermore, it can be a valuable asset for future reference and compliance purposes.

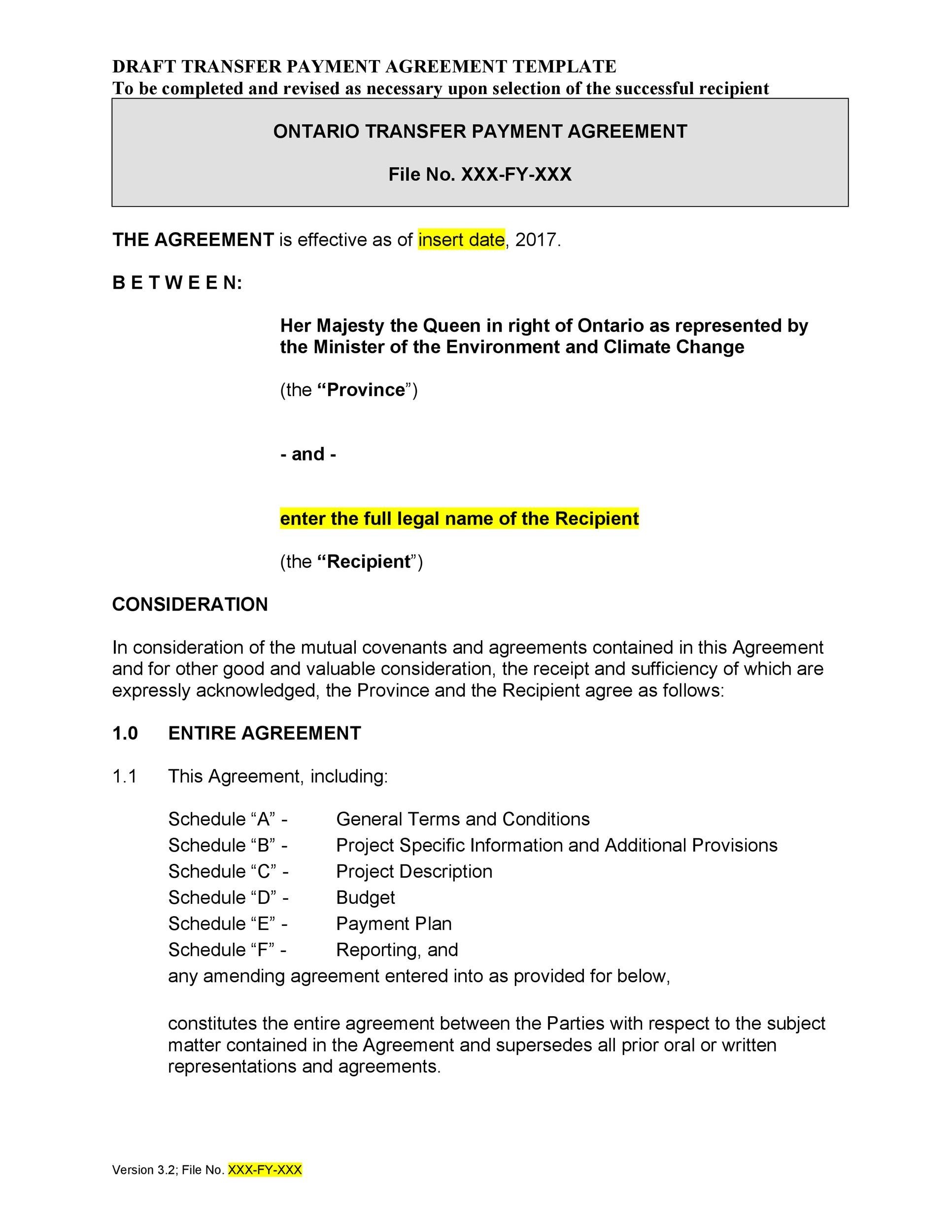

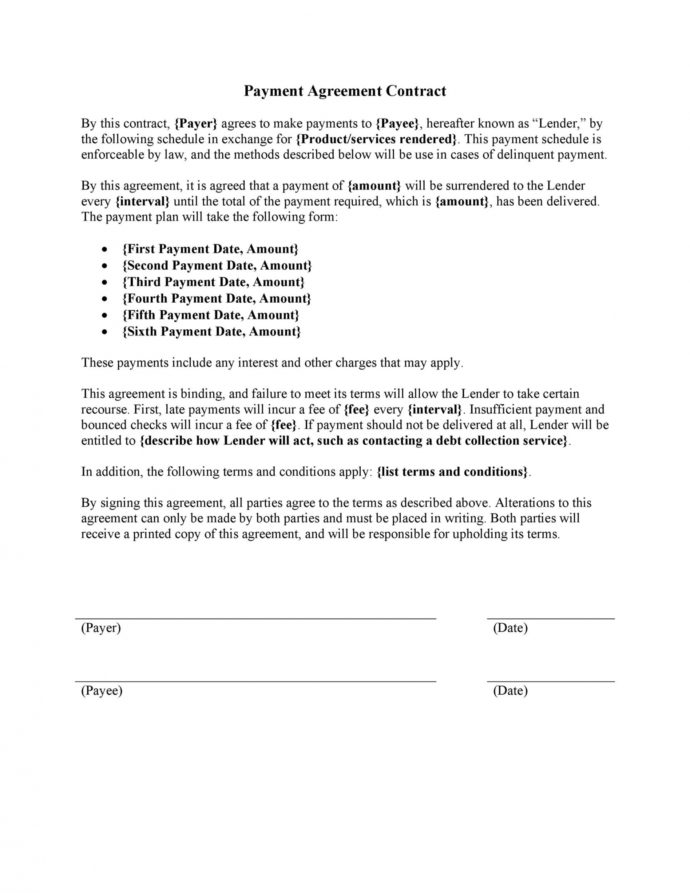

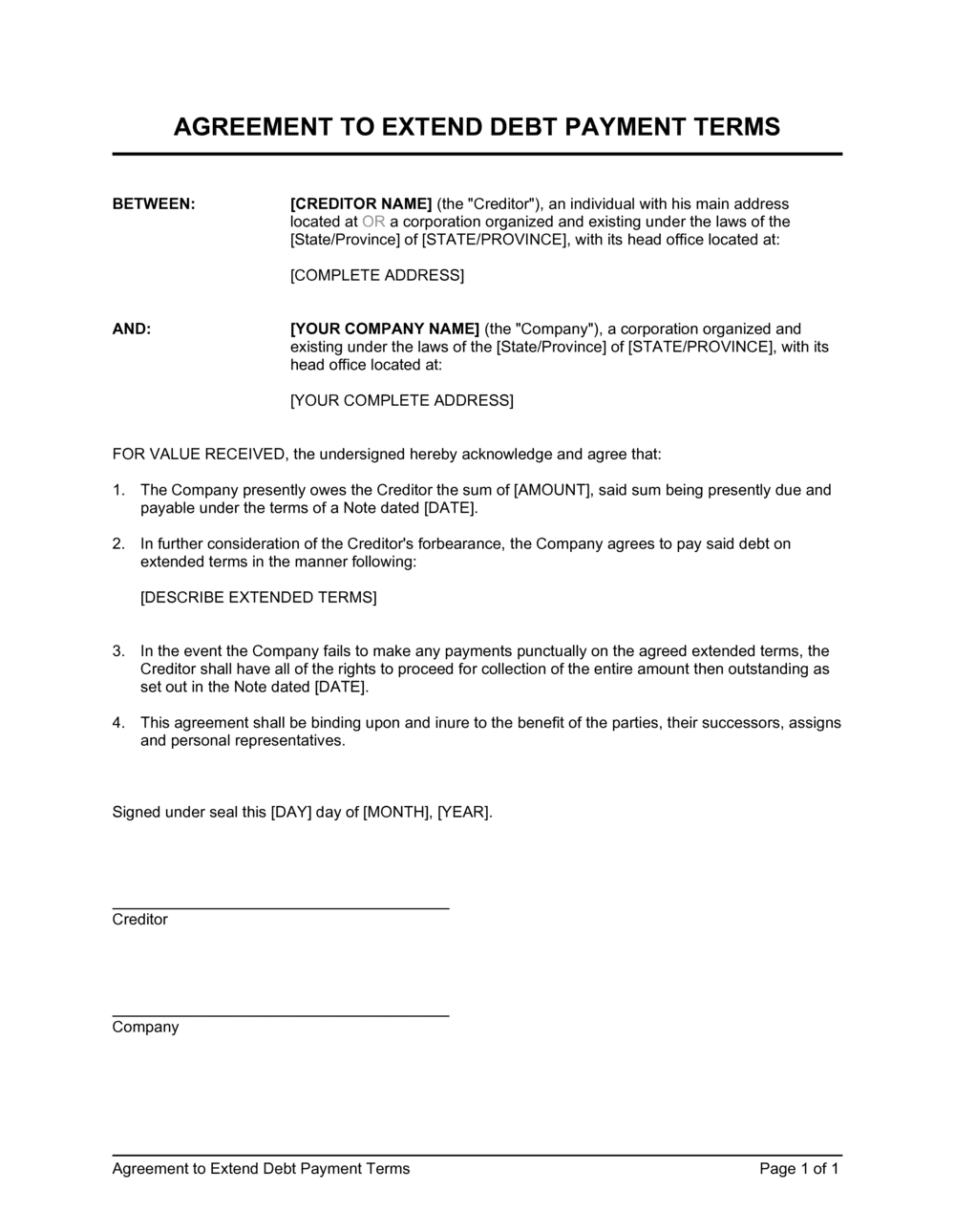

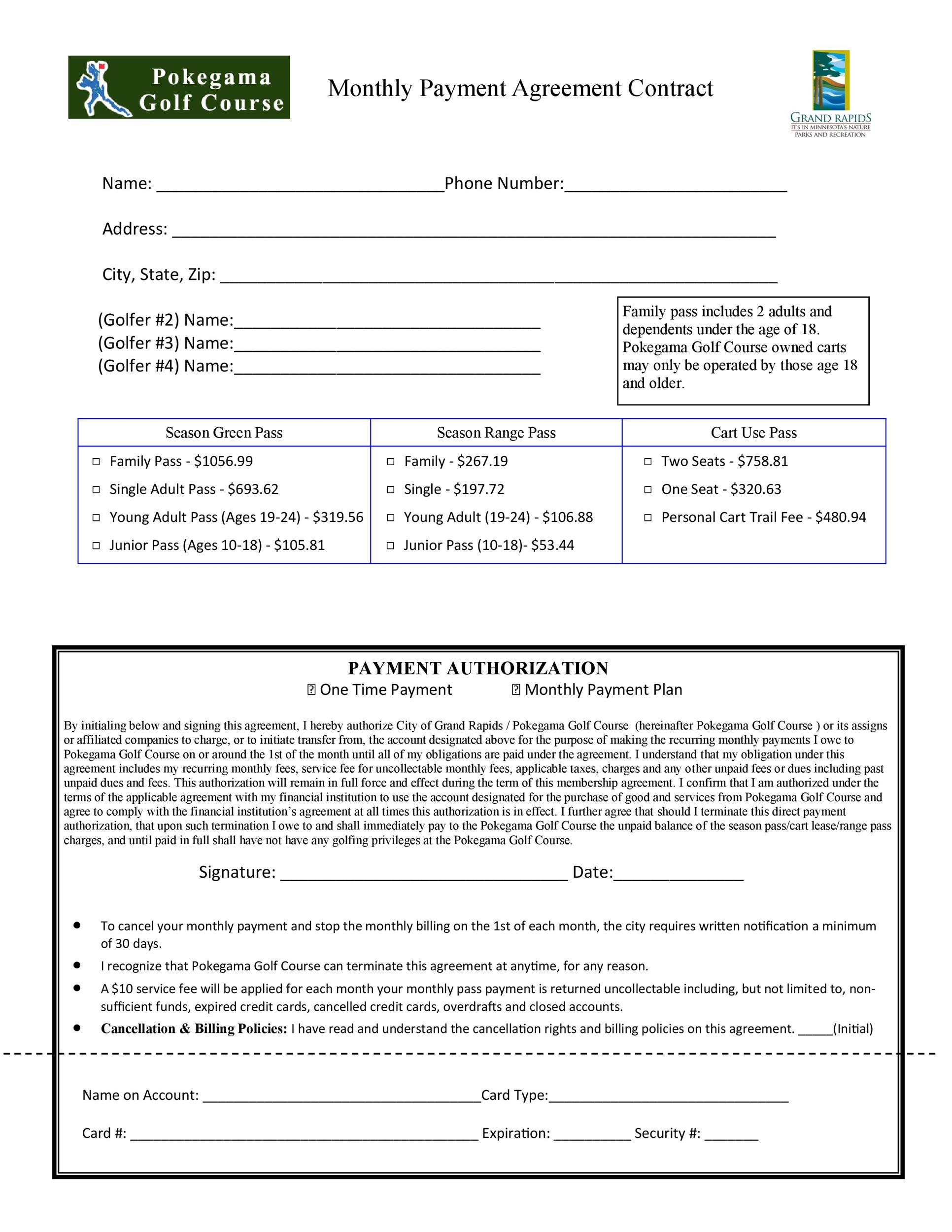

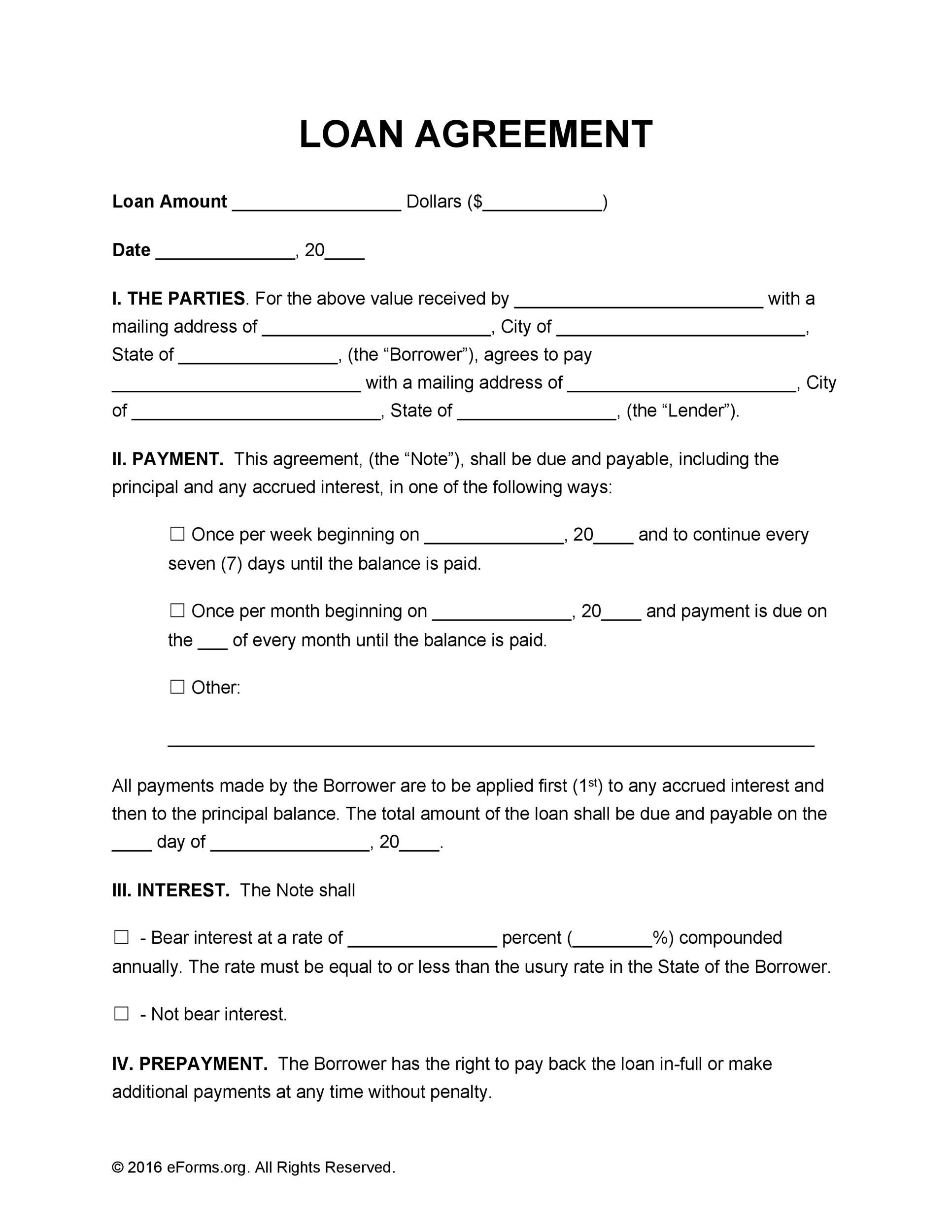

A comprehensive Payment Terms Agreement Template typically includes the following key sections:

Let’s be explicit: the phrase “Payment Terms Agreement Template” is frequently used in discussions about this topic. It’s a common shorthand for a document that defines the rules of engagement for transactions. It’s not just a generic template; it’s a specific agreement tailored to your business’s unique needs and circumstances. Using a template ensures consistency and minimizes the risk of errors. It’s a starting point, not a final solution – always consult with legal counsel to ensure your agreement is compliant with applicable laws.

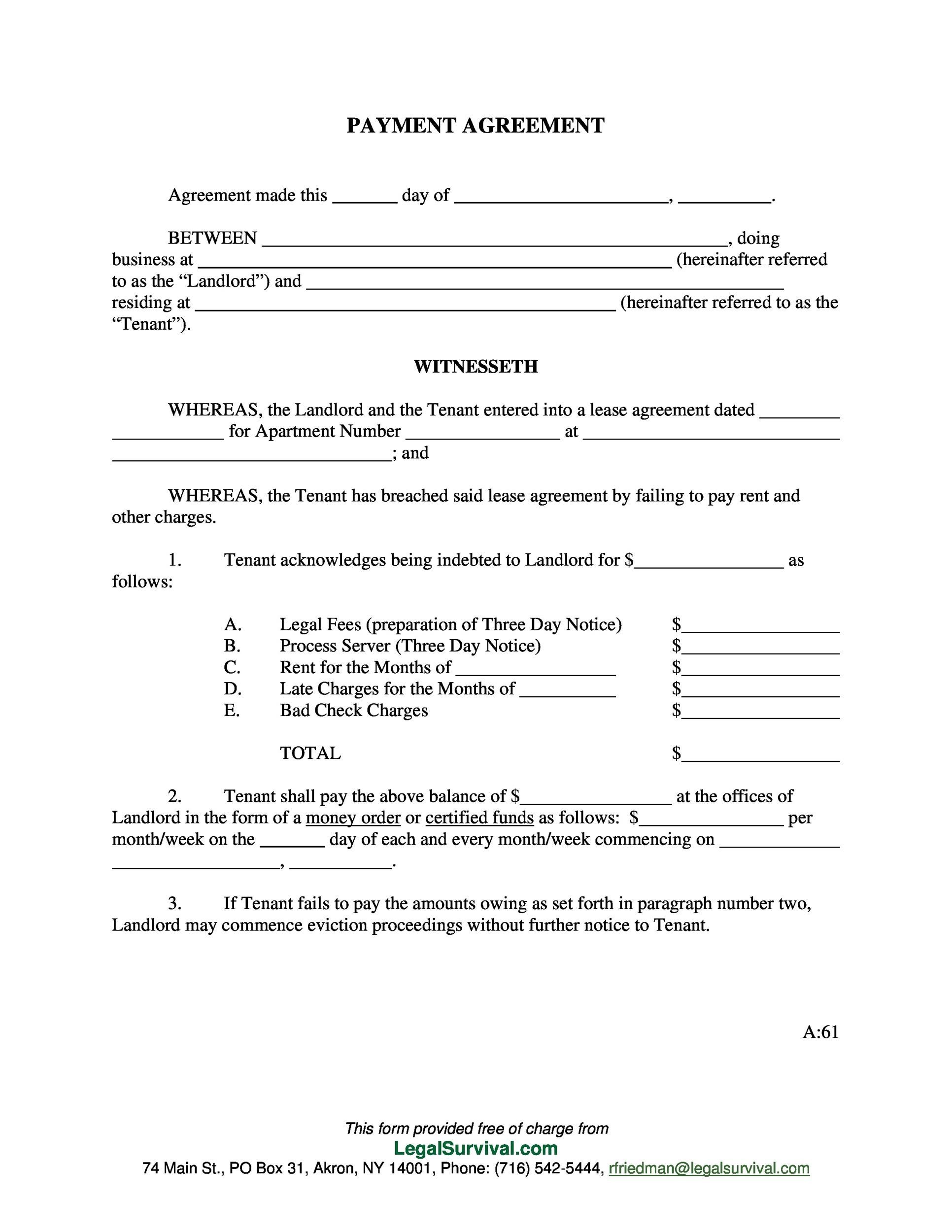

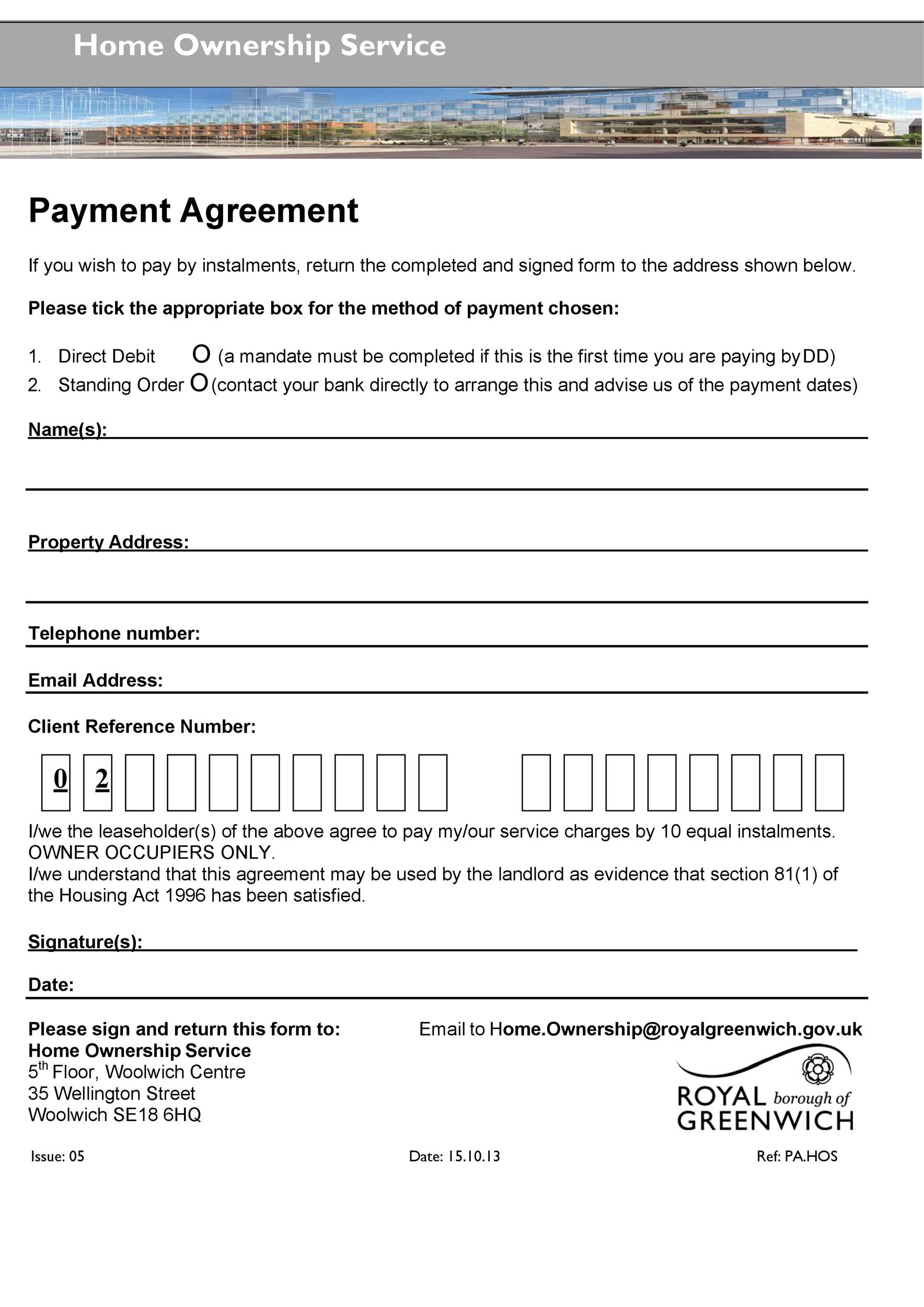

This section is crucial for setting expectations upfront. It should clearly list all the payment methods you accept, including:

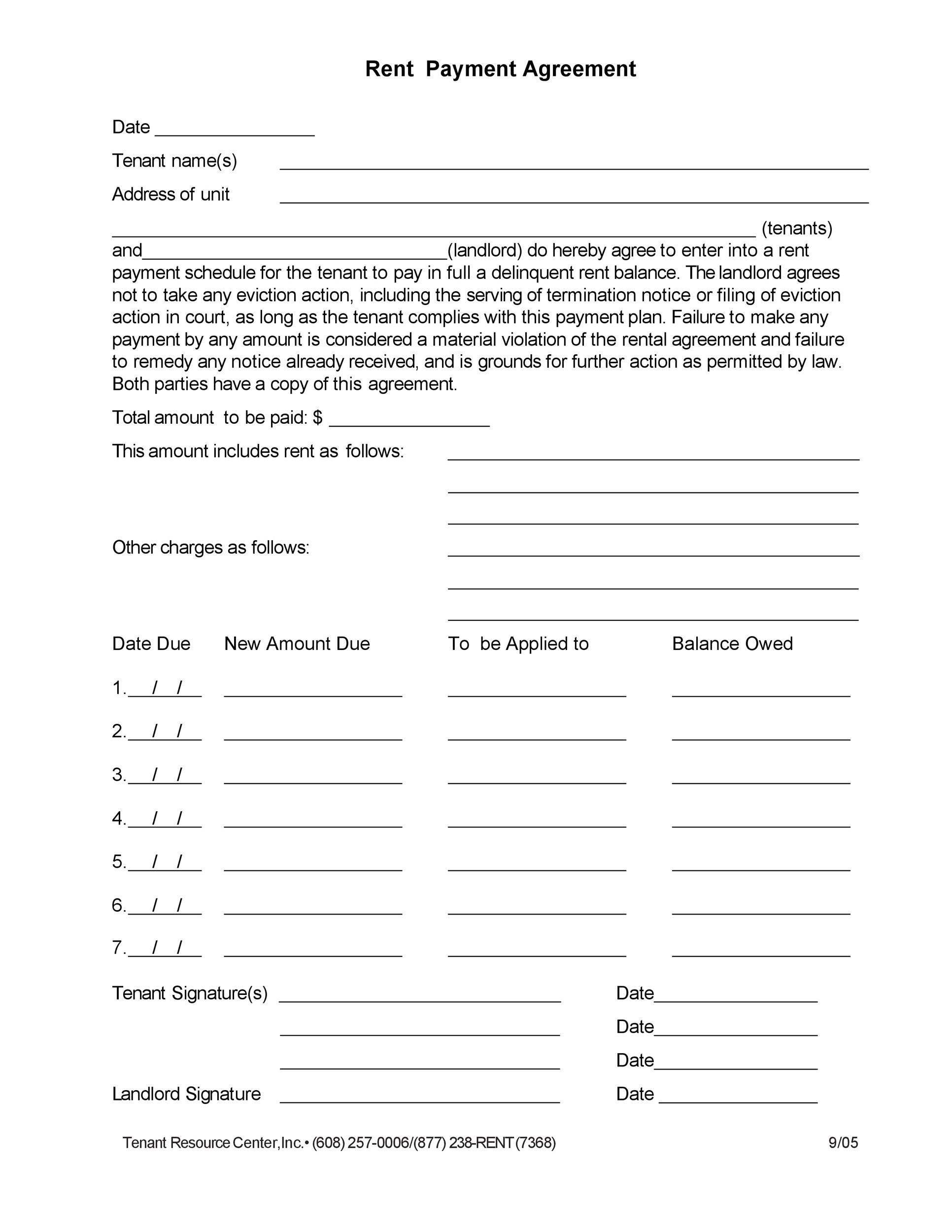

Clearly state the due dates for each payment type. Consider offering:

Detail the fees charged for late payments. Be transparent about the calculation method (e.g., a percentage of the outstanding balance). Consider offering a grace period for late payments, but clearly state the terms of the grace period.

This section is vital for protecting your business from disputes. It should clearly outline the conditions under which refunds will be issued, including:

This section addresses situations where a customer wishes to cancel their service. It should clearly state the terms for cancellation, including:

Establish a clear process for resolving disputes. Options include:

Specify the jurisdiction whose laws will govern the agreement. This is important for determining which legal principles apply in case of a dispute.

This section limits your liability for damages arising from the use of your service. It’s important to be careful about how you phrase this section, as it can have significant legal implications. Consult with legal counsel to ensure your limitations are appropriate.

A well-crafted Payment Terms Agreement Template is an indispensable tool for any business that offers services or products online. It’s a critical component of responsible business practices, protecting your interests and fostering trust with your customers. By understanding the key elements outlined in this guide, you can create a template that effectively addresses your specific needs and minimizes potential risks. Remember to always consult with legal counsel to ensure your agreement complies with applicable laws and regulations. Investing in a quality Payment Terms Agreement Template is an investment in the long-term success of your business. Don’t underestimate the value of this document – it’s a cornerstone of a secure and reliable transaction process.