p

Are you ready to close the chapter on a loan or mortgage? A crucial step in this process is obtaining a payoff letter. This document officially outlines the exact amount needed to fully satisfy your debt obligation. Navigating the payoff process can seem daunting, but understanding the importance of a payoff letter and having access to a reliable template can simplify things significantly. This post will delve into the necessity of a payoff letter, explain what information it contains, and provide you with a comprehensive guide to using a payoff letter template. We’ll also touch upon common scenarios where a payoff letter is required, and offer tips for ensuring a smooth and accurate payoff process. Whether you’re refinancing, selling a property, or simply paying off a loan, a payoff letter is your key to a clean financial slate.

Understanding the Importance of a Payoff Letter Template

A payoff letter is more than just a statement; it’s a legally binding document that confirms the total amount required to pay off your existing loan or mortgage. It differs from a regular statement in that it includes principal balance, accrued interest, any applicable prepayment penalties, and other fees that need to be paid for a complete payoff. Obtaining a payoff letter is essential for several reasons:

- Accurate Calculation: It provides the most up-to-date and accurate figure, taking into account daily accruing interest.

- Legal Protection: It serves as proof that you have fully satisfied your debt obligation, protecting you from future claims.

- Refinancing: Lenders require a payoff letter from your existing lender to process your refinance application.

- Selling a Property: Escrow companies need a payoff letter to ensure your mortgage is paid off during the property sale.

- Peace of Mind: It gives you confidence that you have fulfilled your financial obligations and are free from the debt.

Using a payoff letter template can save you time and ensure that you request all the necessary information from your lender. While a template isn’t a replacement for an official document from your lending institution, it helps you understand what data to look for and verify when you receive the final payoff letter.

What Information Should a Payoff Letter Include?

A comprehensive payoff letter template should guide you in identifying the following critical information when reviewing the actual document from your lender:

- Account Information: This includes your name, address, loan account number, and the property address (if applicable).

- Payoff Amount: The precise amount required to pay off the loan on a specific date, taking into account interest and fees. This should be clearly stated as the “Payoff Amount” or similar.

- Good Through Date: The date until which the payoff amount is valid. Interest accrues daily, so the payoff amount changes after this date.

- Breakdown of Costs: An itemized list of the principal balance, accrued interest, any applicable prepayment penalties, late fees, and other charges.

- Payment Instructions: Detailed instructions on how to make the payment, including acceptable methods (e.g., wire transfer, certified check), payee name, and mailing address.

- Contact Information: The lender’s contact information, including a phone number and address, should you have any questions.

- Reconveyance Information: Information on the process of releasing the lien on the property after the payoff is complete.

- Any Special Instructions: Any specific instructions or requirements for processing the payoff, such as required documentation or forms.

How to Use a Payoff Letter Template Effectively

While we aren’t providing a specific HTML template here, the principle is to understand the elements that *would* be present in such a template. A useful template would act as a checklist to compare against the official payoff letter you receive from your lender. Here’s how to leverage a template effectively:

- Understanding the Required Fields: The template will show you the essential information you should expect to see in your payoff letter.

- Verification: Use the template to verify that all the information in the official payoff letter is accurate. Compare the payoff amount, good through date, and payment instructions against your understanding and records.

- Questioning Discrepancies: If you find any discrepancies, immediately contact your lender to clarify and correct them before making the payment.

- Record Keeping: Keep a copy of the template and the official payoff letter for your records. This documentation is essential for confirming your payoff and resolving any potential future issues.

- Understanding Daily Accrual: Be mindful of the “good through” date and understand that the amount changes *daily* because of interest. Verify the final amount again on the day you send the payment.

Remember, a payoff letter template is a tool to help you understand and verify the information provided by your lender. Always rely on the official payoff letter from your lending institution for the final payoff amount and instructions. Don’t hesitate to contact your lender directly if you have any questions or concerns about the information provided in the letter.

By using a payoff letter template in conjunction with the official documentation from your lender, you can ensure a smooth and accurate payoff process, giving you peace of mind and allowing you to move forward with your financial goals.

If you are searching about Payoff Letter Template – PARAHYENA you’ve came to the right web. We have 9 Pics about Payoff Letter Template – PARAHYENA like Payoff Letter Template Fill Online, Printable, Fillable,, 59% OFF, Payoff Letter Template – PARAHYENA and also Payoff Letter Template – PARAHYENA. Here you go:

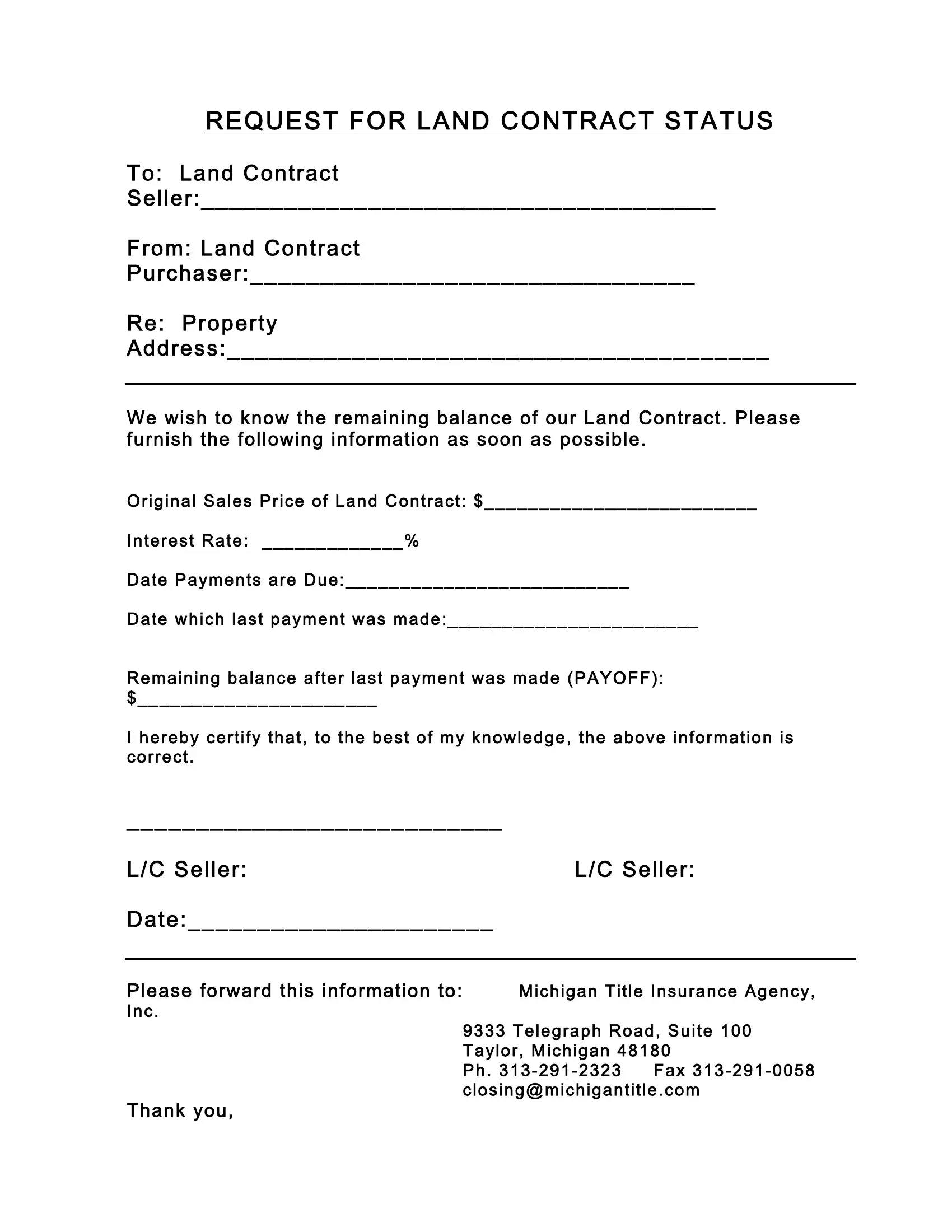

Payoff Letter Template – PARAHYENA

www.parahyena.com

Payoff Letter Template – PARAHYENA

www.parahyena.com

Personal Loan Payoff Letter Template, Personal Loan Payoff Template

www.etsy.com

Auto Loan Payoff Letter Template | HQ Printable Documents

whoamuu.blogspot.com

promissory promise agreement templates interest loan contracts payoff templatelab minasinternational documents dannybarrantes

Payoff Letter From Bank Sample With Examples [Word]

![Payoff Letter from Bank Sample with Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2023/03/Payoff-Letter-from-Bank-PDF.jpg?fit=1414%2C2000&ssl=1)

templatediy.com

Payoff Letter Template Fill Online, Printable, Fillable,, 59% OFF

www.micoope.com.gt

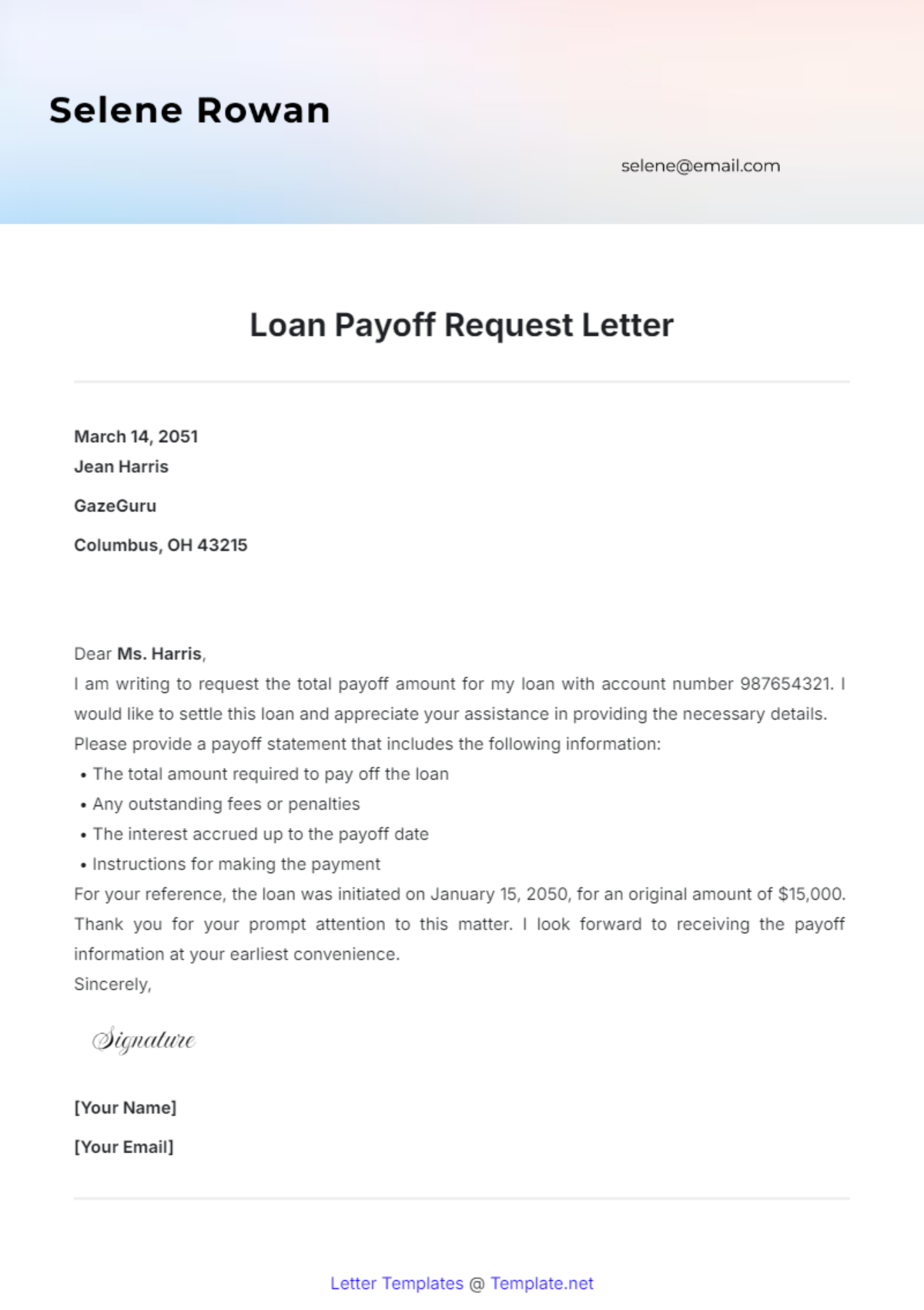

Free Loan Payoff Request Letter Template To Edit Online

www.template.net

Mortgage Loan Payoff Letter Template Samples Letter Template Collection

www.vrogue.co

Auto Loan Payoff Letter Template Samples Letter Cover Templates Inside

vancecountyfair.com

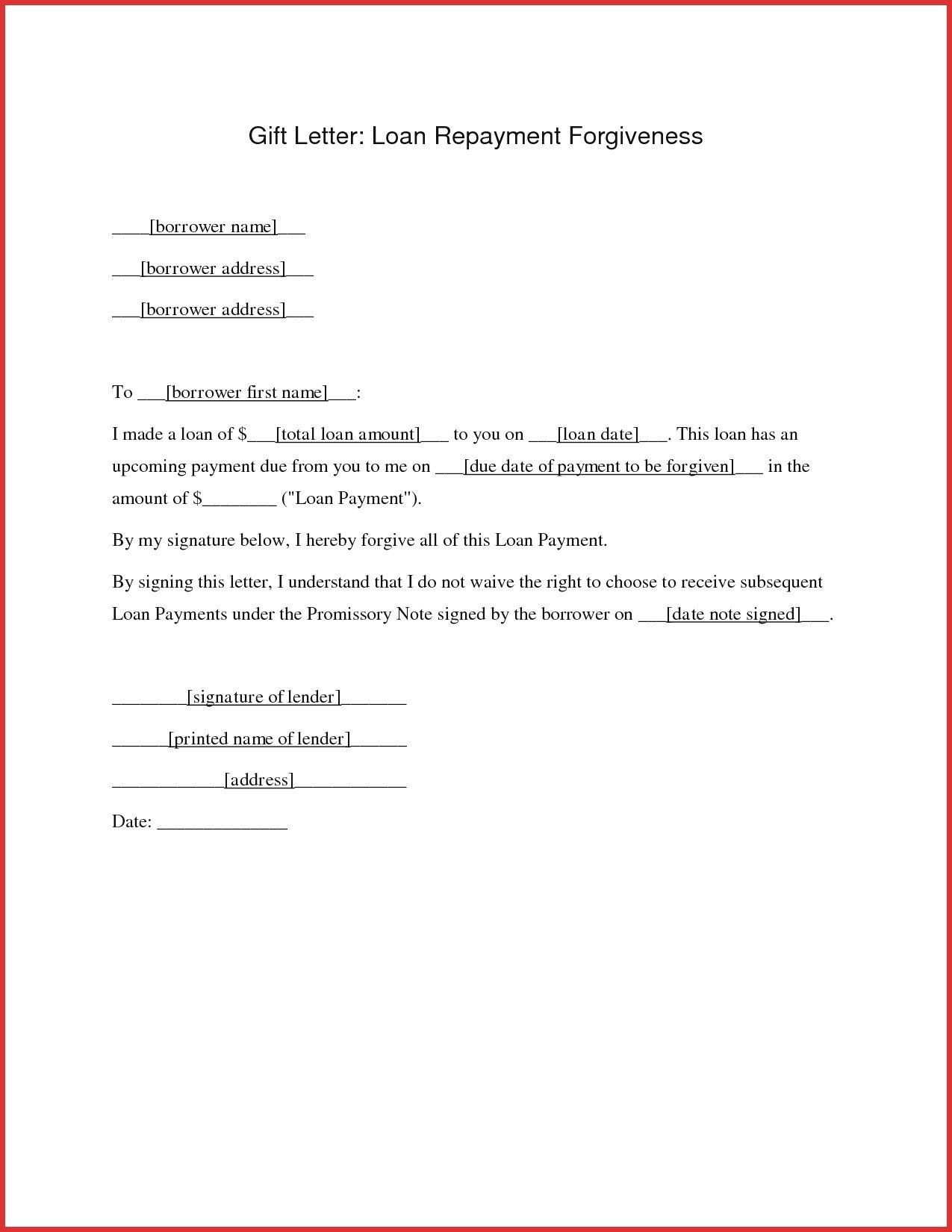

letter payoff loan repayment spreadsheet forgiveness

Payoff letter from bank sample with examples [word]. Mortgage loan payoff letter template samples letter template collection. Auto loan payoff letter template