Compliance with the Payment Card Industry Data Security Standard (PCI DSS) is no longer a suggestion; it’s a fundamental requirement for any organization that accepts, processes, stores, or transmits cardholder data. The stringent regulations and ongoing audits can be a significant undertaking, demanding considerable time, resources, and expertise. Many businesses, particularly smaller ones, struggle to maintain full compliance, leading to potential fines, reputational damage, and ultimately, a loss of customer trust. To effectively navigate this complex landscape, a structured approach is essential, and a Pci Dss Gap Analysis Report Template provides the framework for identifying vulnerabilities and prioritizing remediation efforts. This document serves as a roadmap, guiding organizations through the process of assessing their current security posture and developing a plan to achieve and maintain PCI DSS compliance. It’s more than just a checklist; it’s a strategic tool for bolstering data protection and minimizing risk.

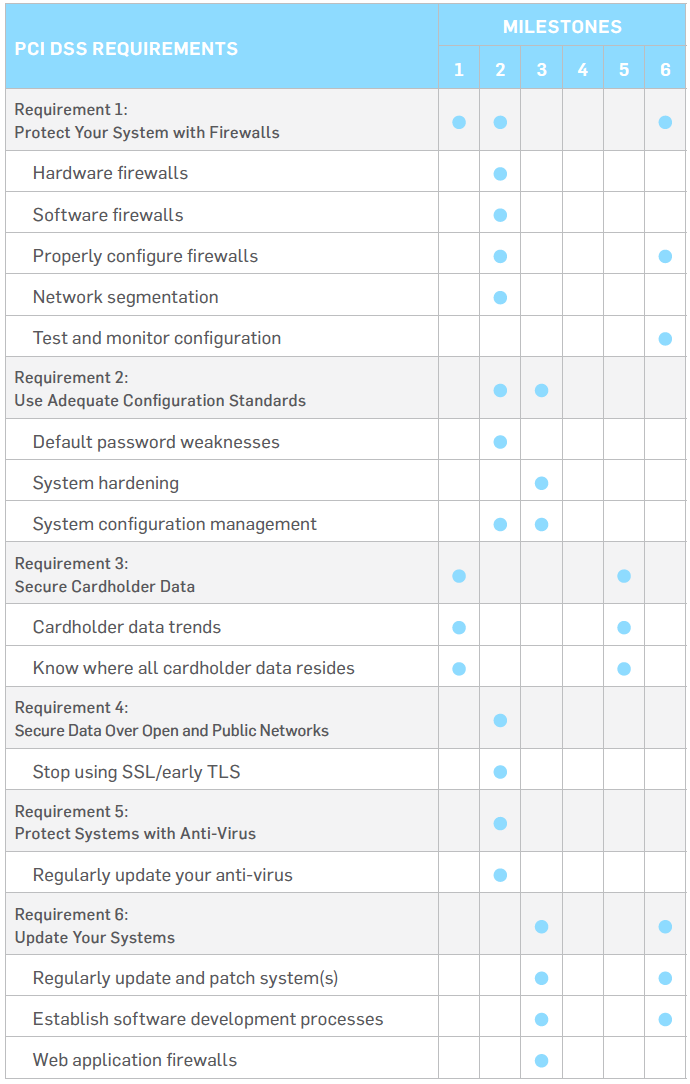

Successfully navigating the PCI DSS can feel overwhelming. The standard’s 12 requirements cover a broad range of security controls, from network security and data encryption to vulnerability management and incident response. Each requirement is further broken down into specific controls, demanding meticulous attention to detail. A proactive approach, utilizing tools like a gap analysis, is crucial to avoid costly surprises during audits. Ignoring potential weaknesses can lead to significant penalties, and the cost of remediation can quickly escalate. Investing in a robust gap analysis process, supported by a well-designed template, is a smart investment in long-term security and business continuity. This isn’t about simply ticking boxes; it’s about genuinely understanding your organization’s security risks and implementing effective controls to mitigate them.

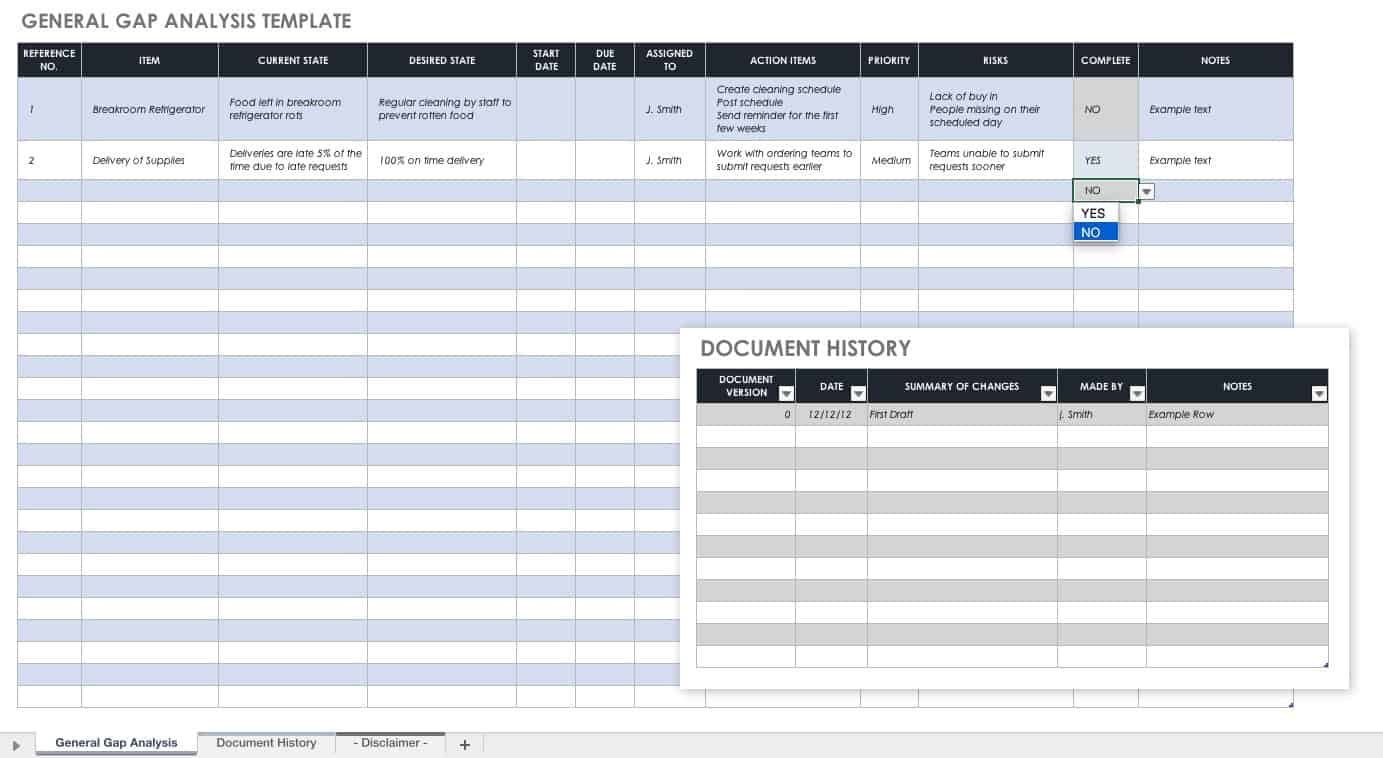

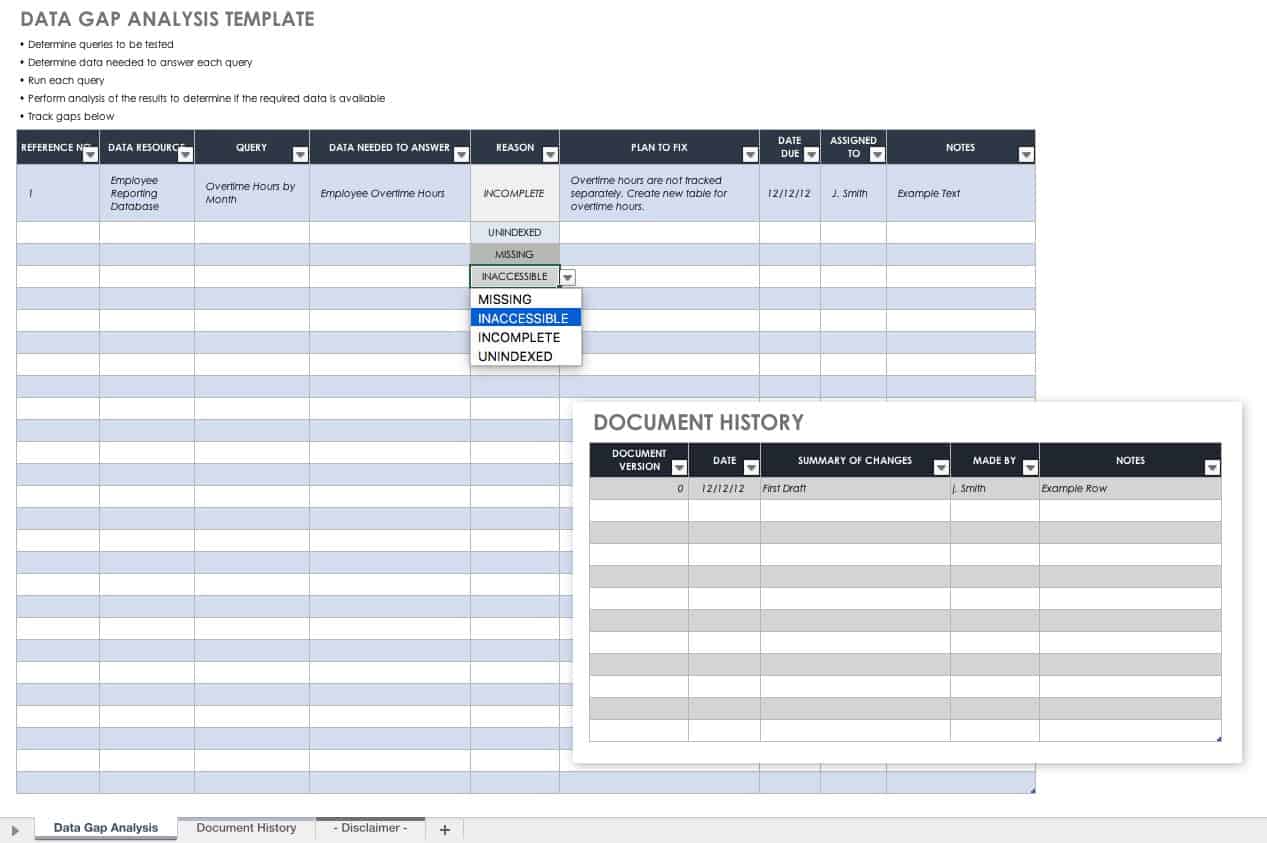

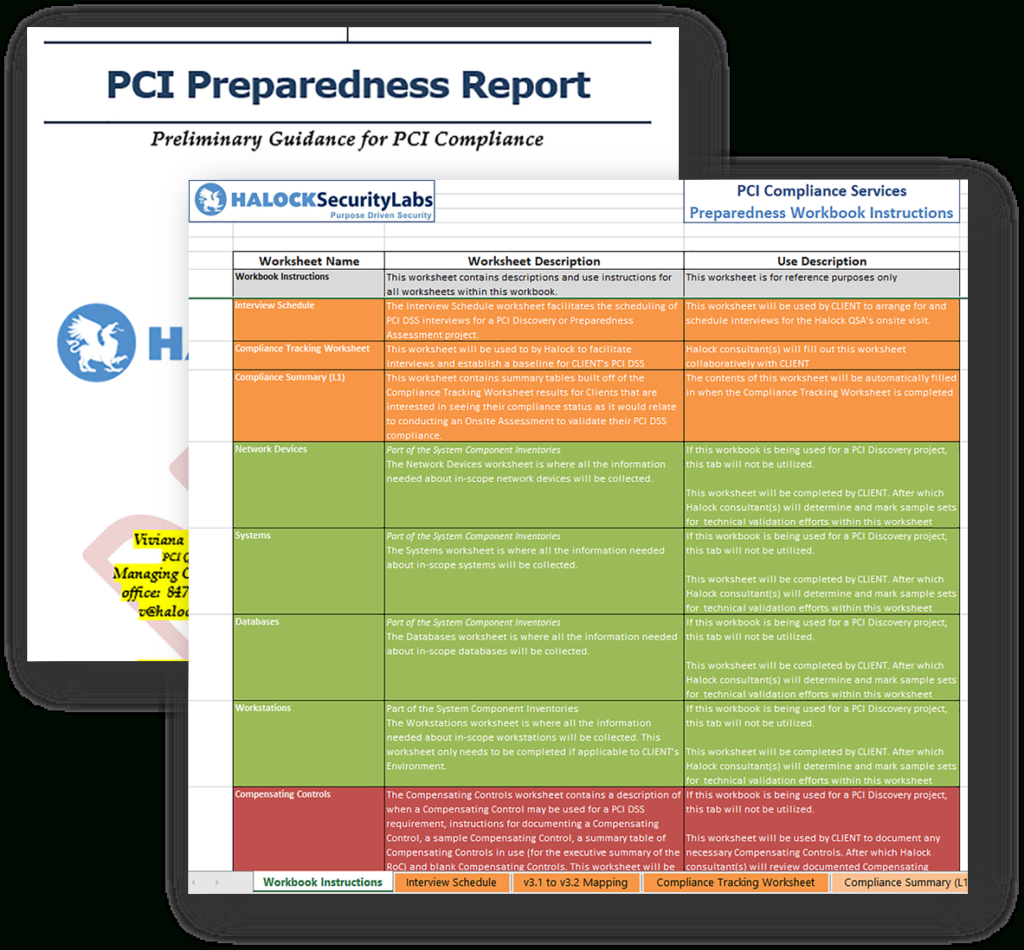

A Pci Dss Gap Analysis Report Template isn’t a one-size-fits-all solution. The ideal template will be adaptable to your specific business environment, considering factors such as the size of your organization, the types of transactions you process, and the technologies you utilize. However, a good template will consistently include key sections that facilitate a thorough assessment. These typically encompass a detailed inventory of systems and data, a review of existing security policies and procedures, and a systematic evaluation of compliance with each of the PCI DSS requirements. Furthermore, the template should provide space for documenting findings, assigning responsibility for remediation, and tracking progress over time. Choosing the right template – or customizing an existing one – is the first step toward a successful compliance journey.

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to protect cardholder data. It’s maintained by the PCI Security Standards Council (PCI SSC) and is enforced by participating Qualified Security Assessors (QSAs). Compliance is mandatory for any organization that handles cardholder data, regardless of size. The standard is divided into 12 requirements, grouped into categories:

A gap analysis is a systematic process of identifying the differences between your current security posture and the requirements of the PCI DSS. It’s not simply a checklist; it’s a detailed assessment that reveals specific vulnerabilities and areas for improvement. The goal is to pinpoint where your organization falls short of compliance and to develop a prioritized plan for remediation.

There are primarily two types of gap analysis:

Performing a gap analysis offers numerous benefits:

A comprehensive Pci Dss Gap Analysis Report Template should include the following key components:

Within the control assessment section, you’ll typically find subsections for each PCI DSS requirement. For example, for Requirement 1 (Build and Maintain a Secure Network), you might include sections for:

Once the gap analysis is complete, the next step is to develop a remediation plan. This plan should be prioritized based on the severity of the identified gaps and the potential impact of vulnerabilities. It’s crucial to assign responsibility for each remediation task to a specific individual or team. Regularly track progress against the remediation plan and update the Pci Dss Gap Analysis Report Template to reflect completed actions. Documentation is key – maintain records of all remediation activities to demonstrate compliance.

Achieving PCI DSS compliance is not a one-time event; it’s an ongoing process. Regularly monitor your security controls to ensure they remain effective. Conduct periodic vulnerability scans, penetration tests, and internal audits. Stay informed about changes to the PCI DSS standard and update your security policies and procedures accordingly. Consider engaging a QSA to conduct an annual assessment to verify ongoing compliance.

A Pci Dss Gap Analysis Report Template is an indispensable tool for any organization handling cardholder data. It provides a structured approach to assessing security posture, identifying vulnerabilities, and developing a prioritized remediation plan. By investing in a thorough gap analysis and consistently monitoring security controls, organizations can significantly reduce their risk of data breaches, avoid costly fines, and maintain customer trust. Remember that compliance is not just about meeting the requirements; it’s about fostering a culture of security and continuously improving your data protection practices. Regularly updating your template and adapting your approach to evolving threats are crucial for long-term success in maintaining PCI DSS compliance.