Creating a robust and legally sound Shareholder Agreement is a critical step for any Limited Liability Company (LLC) or S Corporation. These agreements outline the rights, responsibilities, and expectations of the company’s owners, ensuring clarity and minimizing potential disputes. A well-drafted agreement protects the interests of all shareholders and provides a framework for resolving disagreements. This guide provides a comprehensive overview of what to include in a Shareholder Agreement, along with key considerations for its effective implementation. Understanding the nuances of these agreements is essential for the long-term success and stability of your S Corp.

The formation of an S Corp and LLC offers significant tax advantages, but it also introduces a layer of complexity. A Shareholder Agreement formalizes the relationship between shareholders, defining their roles, responsibilities, and how decisions will be made. Without a formal agreement, disputes can arise, leading to costly litigation and disrupting the company’s operations. It’s a proactive measure that safeguards the interests of all stakeholders and promotes a collaborative environment. Furthermore, a clearly defined agreement can be invaluable during a sale or merger, providing a clear roadmap for the future. Ignoring the need for a Shareholder Agreement can create significant legal risks.

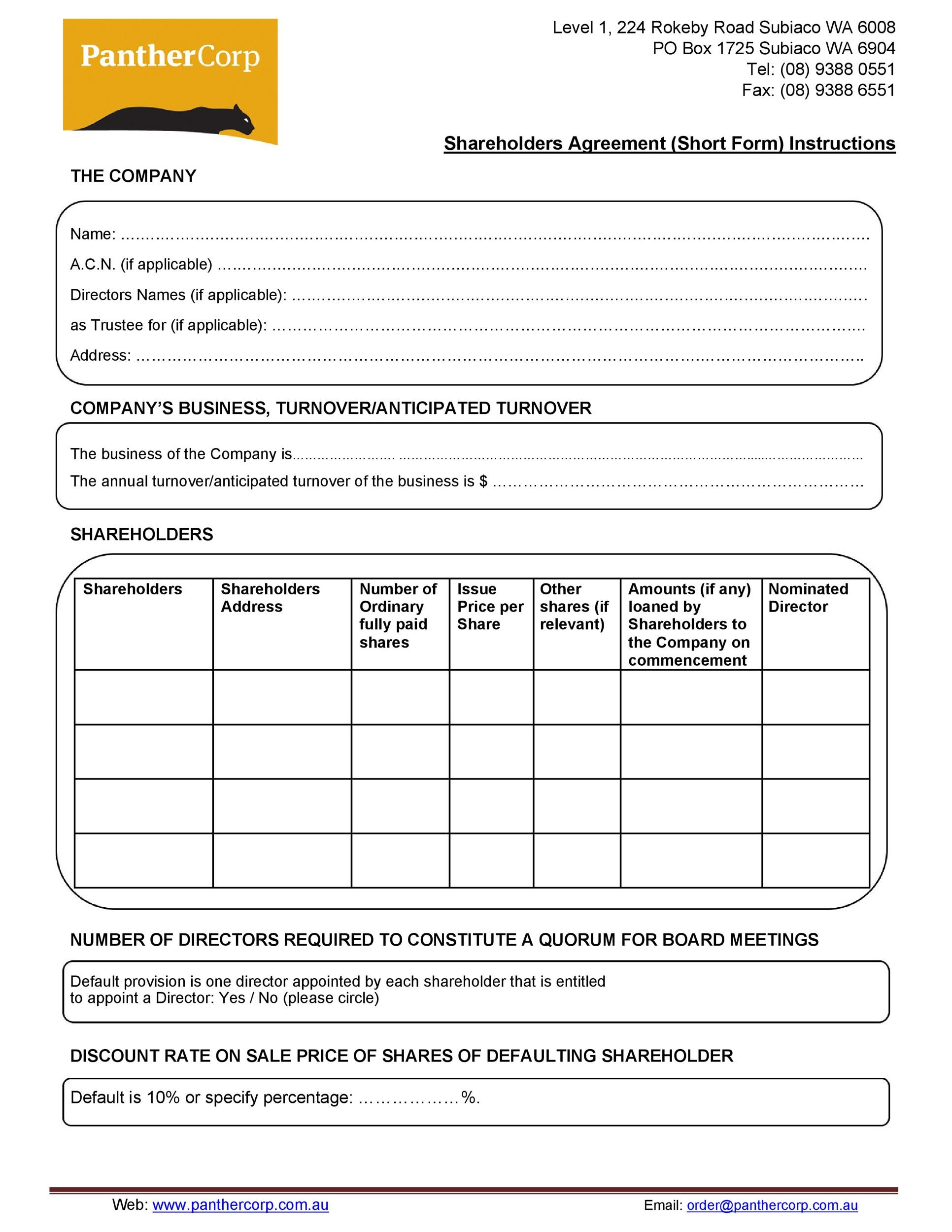

A comprehensive Shareholder Agreement typically covers several key areas. These include:

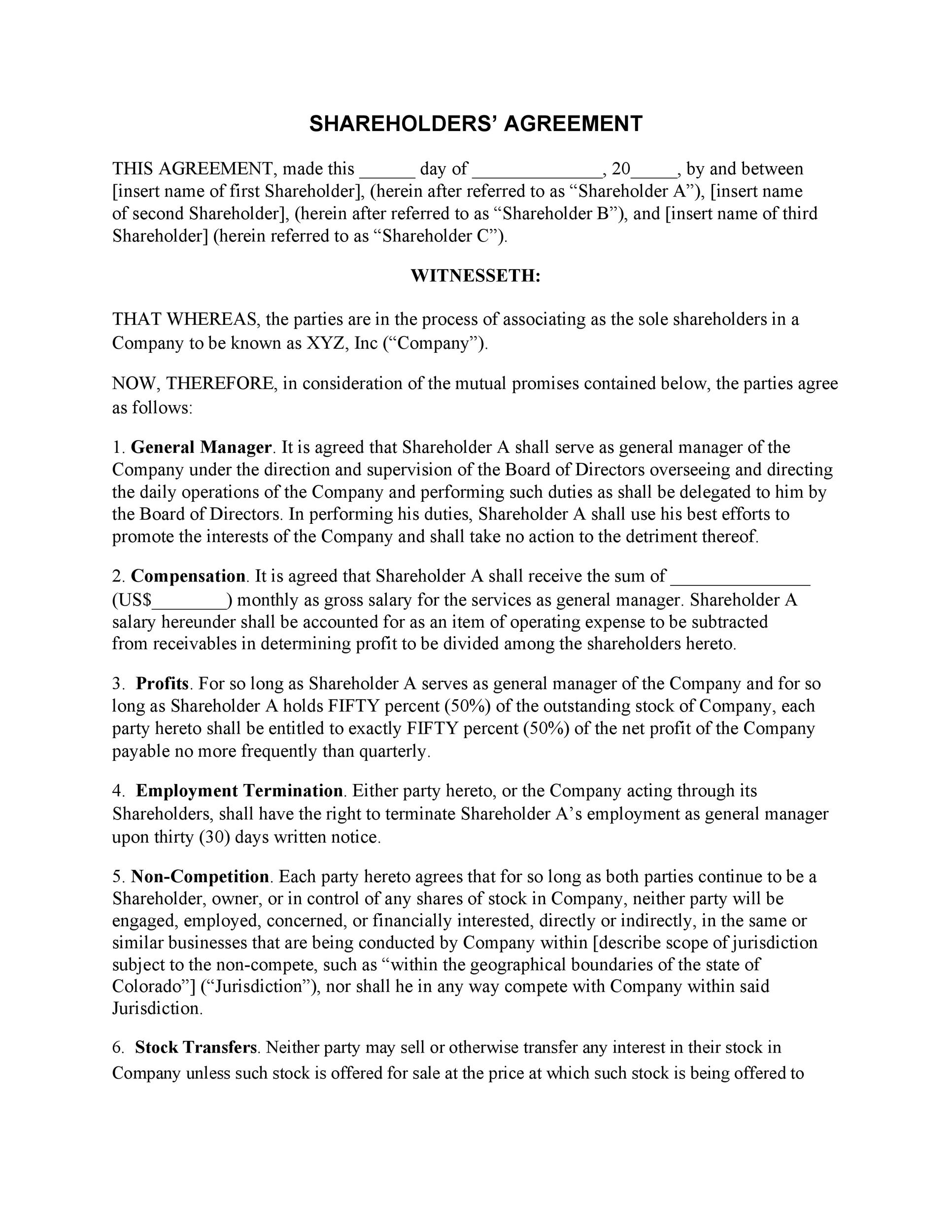

A critical element of a Shareholder Agreement is clearly defining the roles and responsibilities of each shareholder. This helps to avoid confusion and ensures that everyone understands their obligations. For example, it might specify that one shareholder is responsible for managing the day-to-day operations of the company, while another is responsible for financial planning and reporting. A well-defined role assignment minimizes potential conflicts and promotes accountability. It’s important to consider the expertise and experience of each shareholder when assigning responsibilities.

The board of directors plays a vital role in overseeing the company’s operations and ensuring compliance with the Shareholder Agreement. The agreement should outline the board’s composition, responsibilities, and decision-making processes. It’s crucial to establish clear lines of authority and ensure that the board has the necessary expertise to effectively manage the company. A robust board structure can significantly enhance the company’s stability and long-term success.

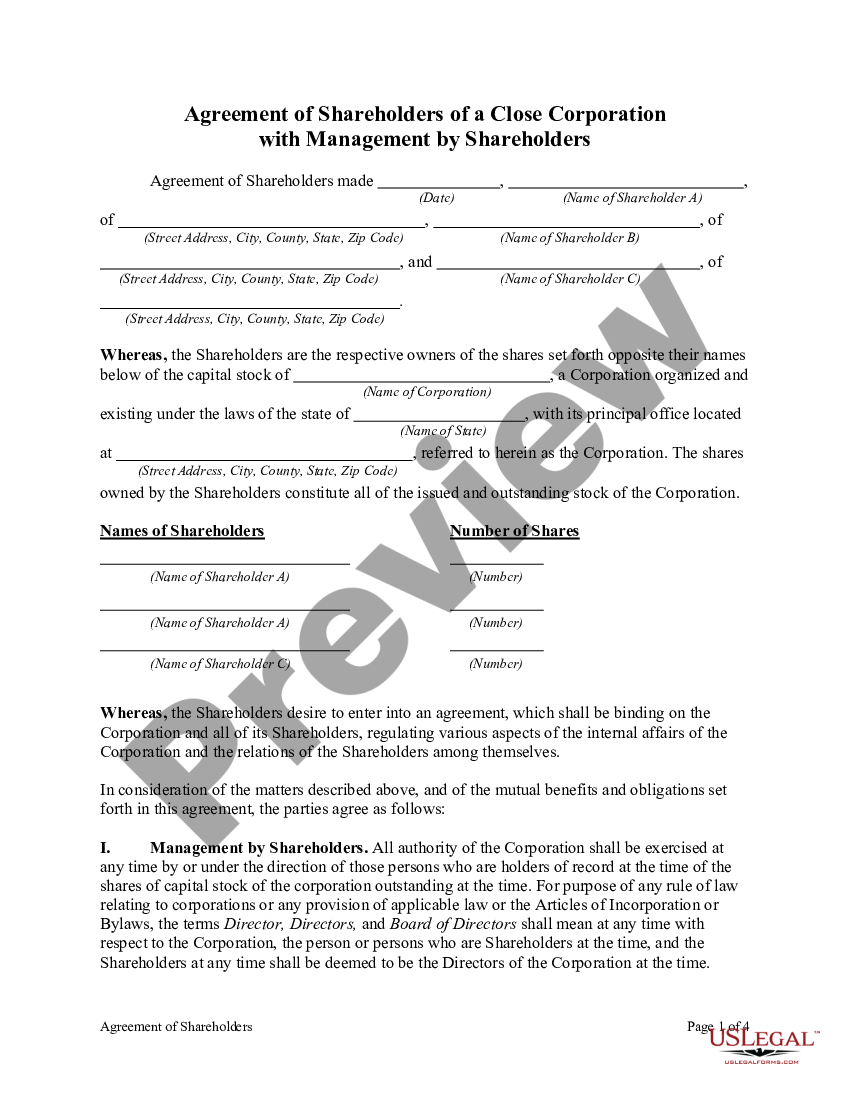

The voting rights structure is a cornerstone of the Shareholder Agreement. It determines how shareholder votes are cast and how decisions are made. The agreement should specify the voting rights for each class of shares, including whether shareholders have the right to vote on major corporate decisions. It’s important to consider the impact of voting rights on the company’s governance and the interests of different shareholder groups. A fair and transparent voting system is essential for maintaining trust and confidence among shareholders.

Many Shareholder Agreements include provisions restricting the transferability of shares. This can protect minority shareholders and prevent unwanted takeovers. The agreement should specify the conditions under which shares can be transferred, such as requiring a majority shareholder’s approval or a specific number of shares to be transferred. These restrictions are designed to maintain control and prevent opportunistic transactions.

A well-defined dispute resolution mechanism is essential for resolving disagreements among shareholders. Common options include mediation, arbitration, and litigation. Mediation involves a neutral third party who helps the parties reach a mutually agreeable solution. Arbitration is a more formal process where a neutral arbitrator hears both sides of the dispute and makes a binding decision. Litigation is the most formal and adversarial process, typically involving a court. The choice of dispute resolution mechanism should be carefully considered based on the specific circumstances of the case and the desired outcome.

The Shareholder Agreement should outline a clear and transparent amendment process. Any changes to the agreement must be approved by a majority of the shareholders, as specified in the agreement. It’s important to maintain a record of all amendments and to ensure that all shareholders are notified of any changes. A well-defined amendment process helps to prevent disputes and ensures that the agreement remains up-to-date.

It’s crucial to consider the tax implications of the Shareholder Agreement, particularly for S Corporations. The tax treatment of shareholder distributions and dividends can vary depending on the specific circumstances. Consulting with a tax professional is recommended to ensure compliance with all applicable tax laws.

Drafting a Shareholder Agreement requires careful consideration of legal and business principles. It’s highly recommended to seek legal advice from an experienced attorney specializing in corporate law. Furthermore, it’s essential to ensure that the agreement is drafted in a clear, concise, and unambiguous manner. Regularly reviewing and updating the agreement is also crucial to reflect changes in the company’s structure or circumstances. Maintaining a comprehensive record of all agreements and amendments is vital for protecting the interests of all shareholders.

A well-crafted Shareholder Agreement is a cornerstone of a successful S Corp or LLC. It provides a framework for managing relationships, protecting interests, and ensuring the long-term stability of the company. By carefully considering the key components outlined in this guide, and seeking professional legal advice, you can create an agreement that effectively safeguards the interests of all shareholders and promotes a collaborative and prosperous business environment. Remember that the agreement should be tailored to the specific circumstances of your company and should be reviewed and updated periodically to reflect any changes in the business or its stakeholders.