Creating a solid business agreement is a crucial step for any small business owner. It protects both you and your customers, outlining expectations and responsibilities to foster a reliable and mutually beneficial relationship. A well-drafted agreement can prevent misunderstandings, minimize disputes, and provide a clear path for resolving issues. This guide provides a comprehensive overview of what to include in a small business agreement template, ensuring you’re prepared for a successful partnership. Small Business Agreement Template – understanding the fundamentals is the first step towards safeguarding your business.

The process of creating a business agreement can seem daunting, but breaking it down into manageable sections makes it much easier. It’s a proactive measure that demonstrates professionalism and a commitment to clear communication. A thoughtfully crafted agreement isn’t just a legal document; it’s a roadmap for a thriving business. It’s a contract, but one designed to be flexible and adaptable to the unique needs of your business. Consider consulting with an attorney to ensure your agreement is legally sound and tailored to your specific circumstances.

Before diving into the specifics, it’s vital to understand why a business agreement is so important. It’s far more than just a formality; it’s a foundational element of a healthy business relationship. Without a written agreement, disputes can arise quickly and become costly, potentially jeopardizing the entire venture. A clear agreement establishes boundaries, clarifies roles and responsibilities, and provides a framework for handling disagreements. It’s a powerful tool for protecting your business’s interests and ensuring everyone is on the same page. Ignoring the need for a business agreement can lead to significant headaches down the line.

The benefits extend beyond simply preventing disputes. A well-defined agreement can also streamline operations, improve communication, and foster trust among partners or employees. It’s an investment in the long-term stability and success of your business. Furthermore, it can be invaluable for attracting investors or securing loans, as lenders often require a comprehensive business agreement as part of the due diligence process. Ultimately, a strong agreement demonstrates your commitment to professionalism and responsible business practices.

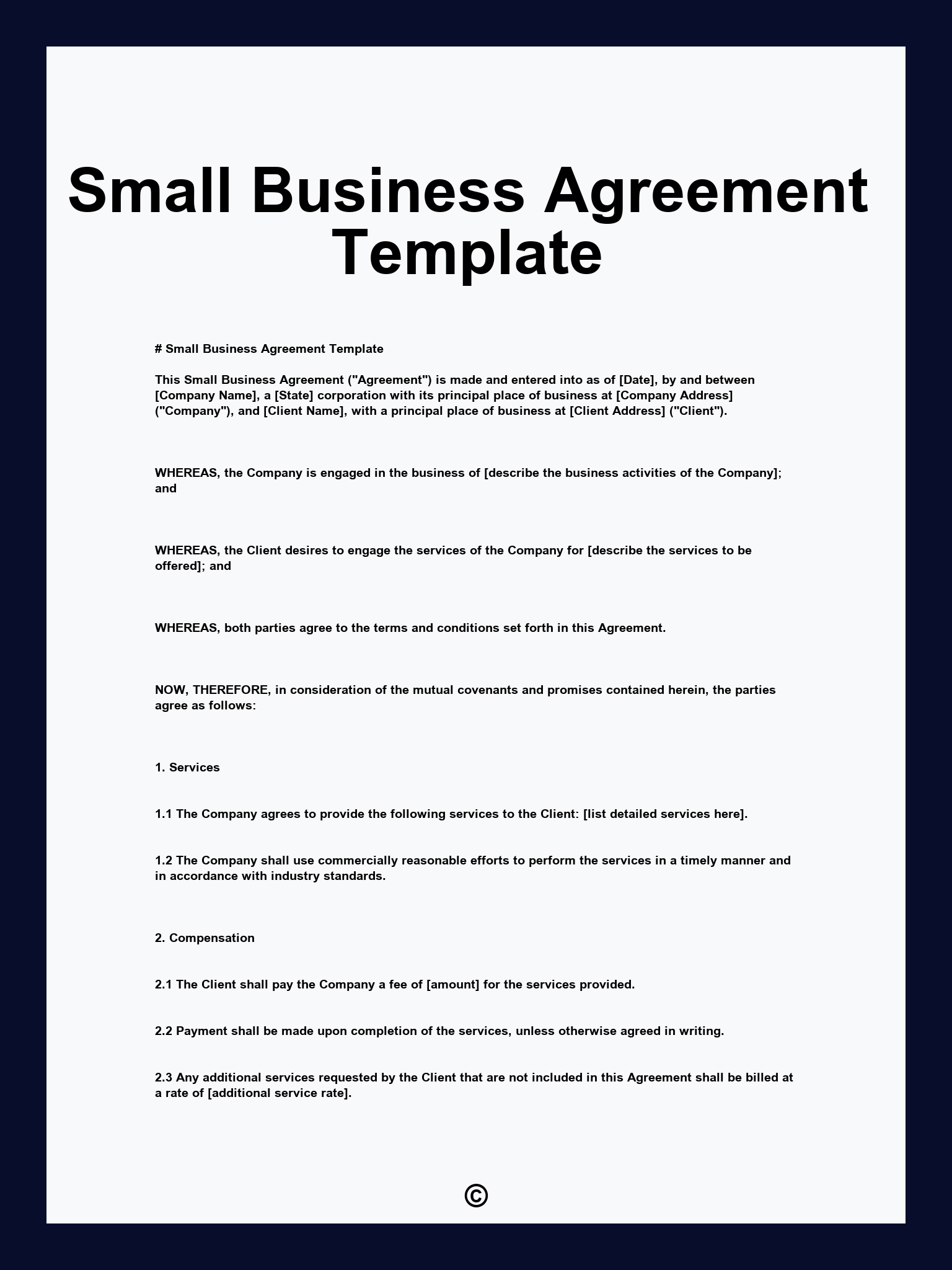

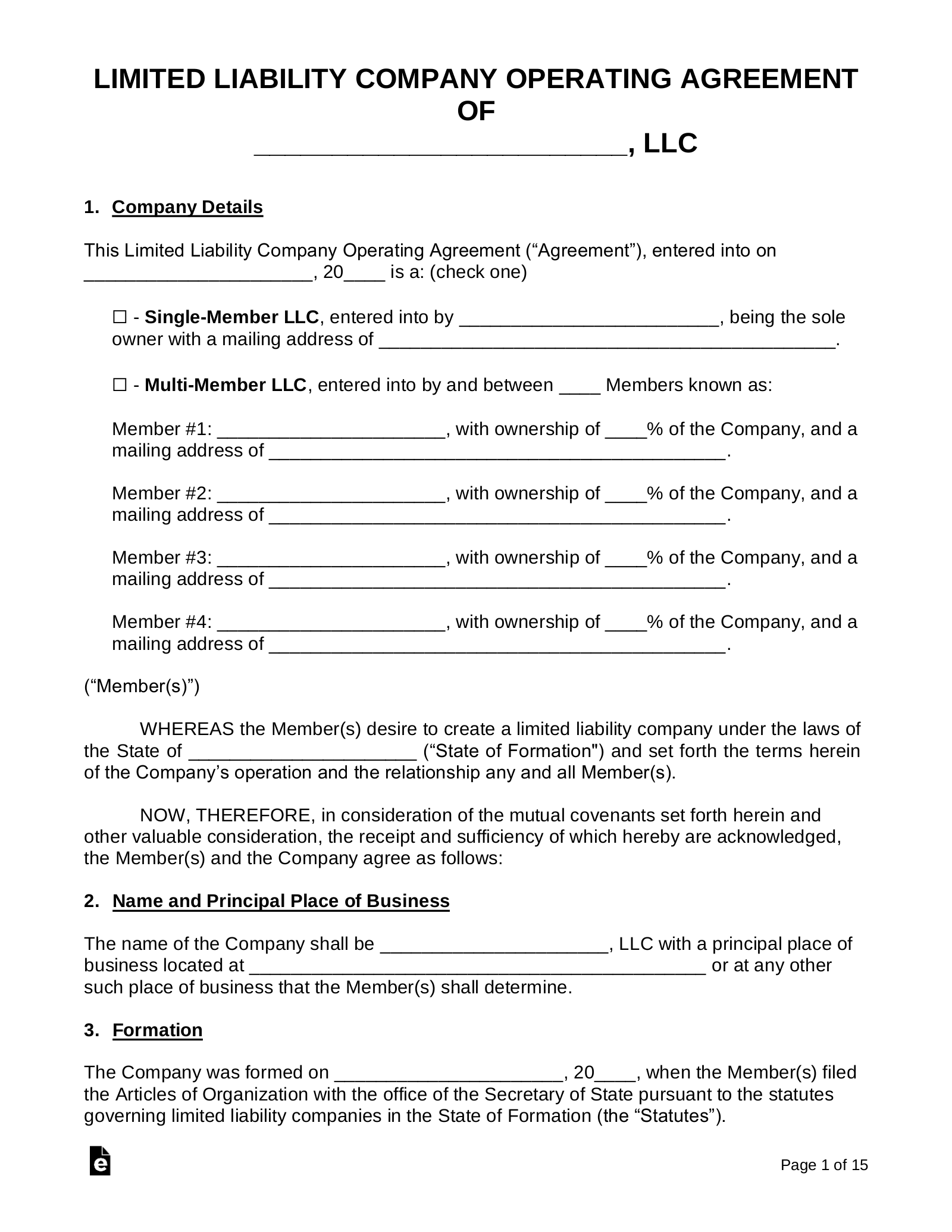

Let’s examine the essential elements that should be included in a small business agreement. Each section plays a vital role in defining the terms of your business relationship. Here’s a breakdown of the key areas:

This section clearly defines the scope of the agreement. It outlines what services or products are being provided, the duration of the relationship, and the geographic area covered. It’s important to be specific and avoid ambiguity. For example, if you’re providing marketing services, specify the services included (e.g., social media management, content creation, email marketing). Clearly stating the start and end dates of the agreement is also crucial.

This section details the specific services you will be offering to your client or partner. Be as detailed as possible, including the frequency of service delivery, the level of support provided, and any associated costs. It’s helpful to include a list of deliverables and a process for tracking progress. For instance, if you’re providing web design services, specify the types of websites you’ll be designing, the design timeline, and the revision process. This section is critical for establishing clear expectations and preventing misunderstandings about what’s expected.

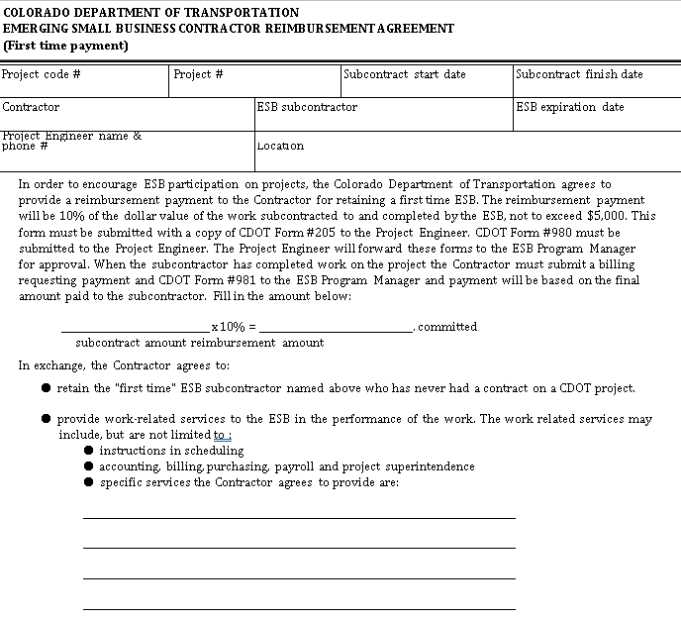

This section outlines how and when payments will be made. It should specify the payment schedule, accepted payment methods, and any late payment fees. It’s also important to address potential payment disputes and establish a process for resolving them. Consider including clauses regarding escrow accounts for larger transactions. For example, you might specify a percentage of the total payment as a deposit, with the remaining balance due upon completion of the services.

This section addresses ownership of intellectual property created during the course of the agreement. It’s particularly important if you’re working with freelancers or contractors. Clearly define who owns the intellectual property – you, the client, or a joint ownership arrangement. It’s also advisable to include a clause regarding confidentiality, protecting your business’s proprietary information. This protects your valuable assets and prevents unauthorized use.

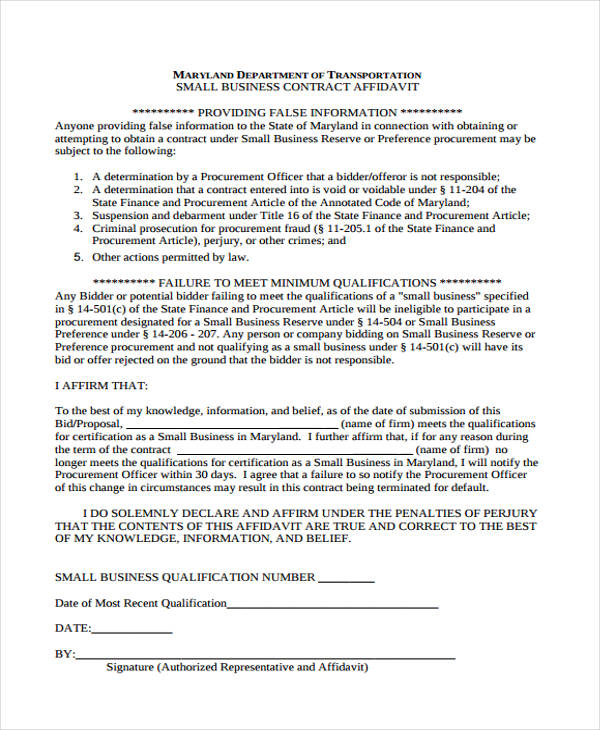

This section protects your business’s confidential information, including customer lists, pricing strategies, and marketing plans. It should outline the obligations of both parties to maintain confidentiality and prohibit the disclosure of sensitive information. A confidentiality clause is essential for protecting your competitive advantage. Consider including a non-disclosure agreement (NDA) as part of this section.

This section details the circumstances under which the agreement can be terminated by either party. It should specify the notice period required and the consequences of termination. It’s important to clearly outline the process for ending the agreement amicably. For example, you might specify that termination will be effective upon written notice of termination, with a period of [number] days.

This section specifies the jurisdiction whose laws will govern the agreement and how disputes will be resolved. It might also include a clause for mediation or arbitration. Choosing a clear dispute resolution mechanism can help streamline the process of resolving disagreements and minimize legal costs. Consulting with an attorney to determine the appropriate governing law and dispute resolution process is highly recommended.

This section addresses insurance coverage. It may be necessary to include clauses regarding liability insurance, professional liability insurance, or other relevant coverage. This protects your business from potential financial losses due to accidents or other unforeseen events.

Creating a comprehensive small business agreement is a vital investment in the future of your business. It’s a proactive step that protects your interests, fosters trust, and minimizes potential disputes. By carefully considering the key components outlined in this guide, you can develop a robust agreement that meets your specific needs and strengthens your business relationships. Remember, a well-crafted agreement isn’t just a legal document; it’s a foundation for a successful and sustainable business. Investing the time and effort to create a solid agreement will undoubtedly pay dividends in the long run.

In conclusion, a well-structured small business agreement is an indispensable tool for any entrepreneur. It’s a critical component of a successful business relationship, offering protection, clarity, and a framework for resolving potential issues. By diligently addressing the key elements outlined in this guide – encompassing scope, services, payment terms, intellectual property, confidentiality, termination, governing law, and insurance – you can establish a legally sound agreement that safeguards your business’s interests and promotes long-term prosperity. Don’t underestimate the value of this proactive measure; it’s an investment in the stability and success of your venture.