Creating a solid financial plan is crucial for the survival and growth of any small business. A well-structured annual budget isn’t just about numbers; it’s about projecting future revenue, managing expenses, and making informed decisions to achieve your business goals. This comprehensive guide will walk you through creating a robust Small Business Annual Budget Template, equipping you with the tools and knowledge to take control of your finances. Small Business Annual Budget Template – the foundation for a successful and sustainable business. Without a clear budget, you’re essentially flying blind, increasing the risk of financial instability and hindering your potential. Investing time in developing a budget now will pay dividends in the long run, allowing you to anticipate challenges and capitalize on opportunities. Let’s dive in.

Before we begin building your template, it’s vital to understand why a budget is so important. A budget provides a roadmap for your finances, allowing you to track income and expenses, identify areas for improvement, and ultimately, increase profitability. It’s not about restricting spending; it’s about conscious spending. By analyzing where your money is going, you can identify inefficiencies and make adjustments to optimize your resources. Furthermore, a budget demonstrates to lenders and investors that you are responsible and financially stable. A poorly managed budget can lead to missed payments, strained relationships with suppliers, and ultimately, business failure. A well-crafted budget is a powerful tool for driving growth and securing your business’s future.

There are various budgeting methods you can employ. The most common are:

Choosing the right approach depends on your business size, industry, and complexity. For many small businesses, a combination of methods might be most effective. Regardless of the method, consistency and accuracy are key.

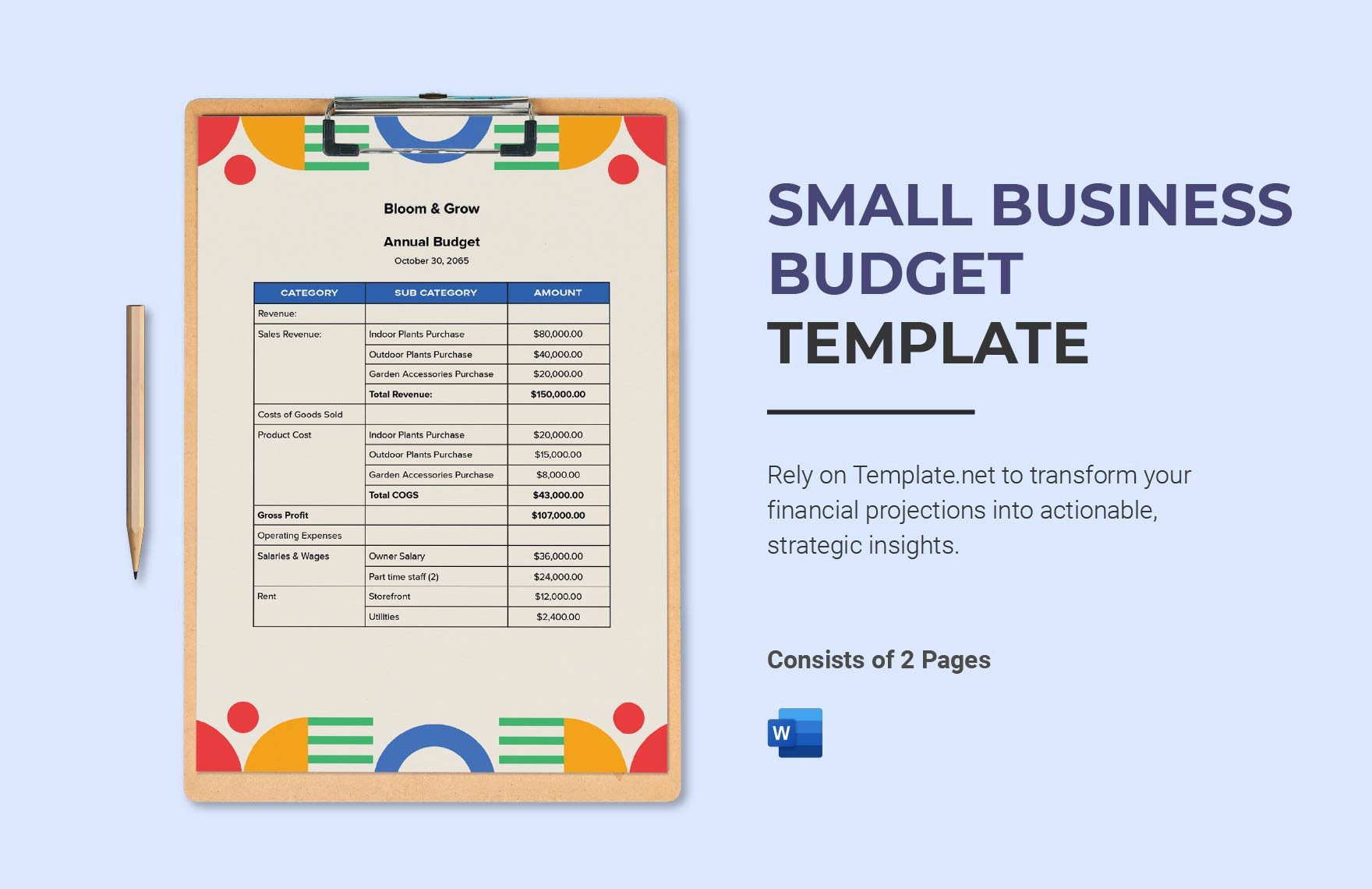

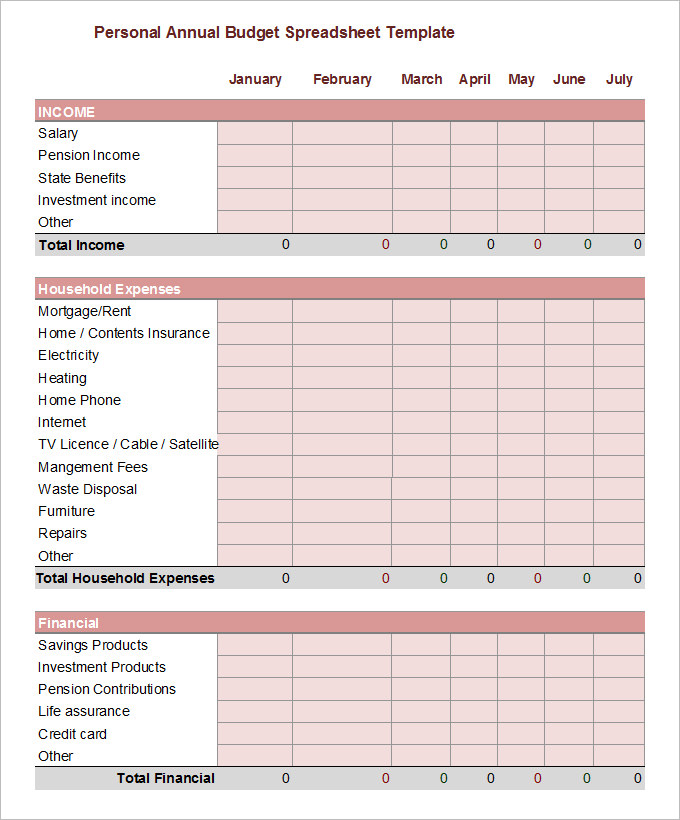

A comprehensive Small Business Annual Budget Template should include the following key components:

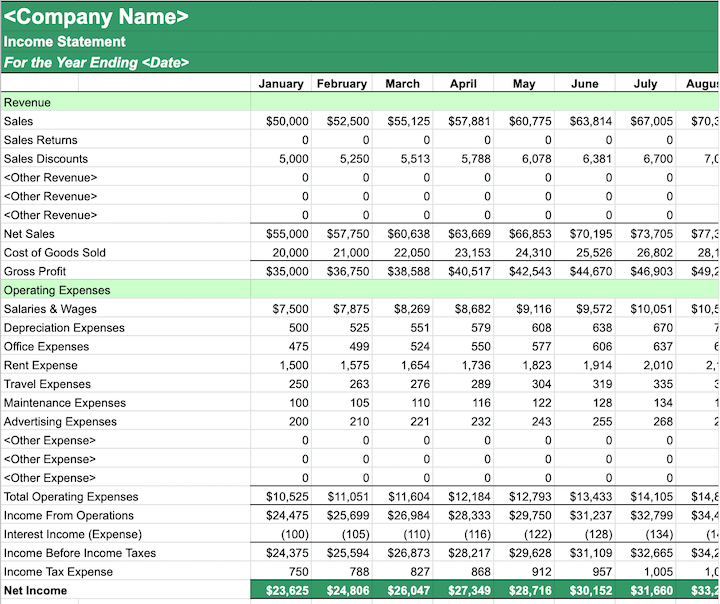

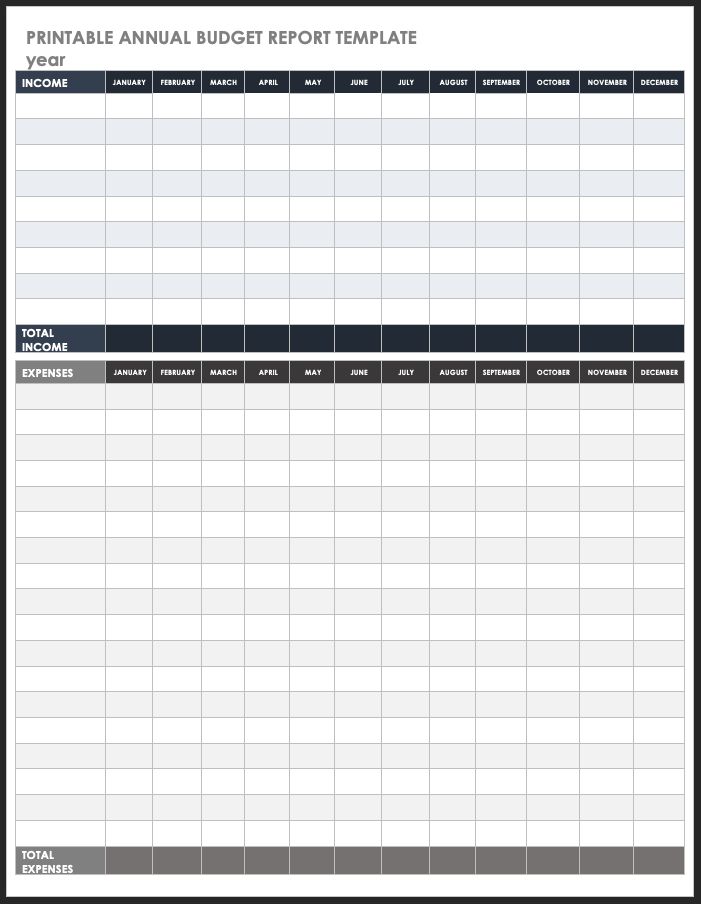

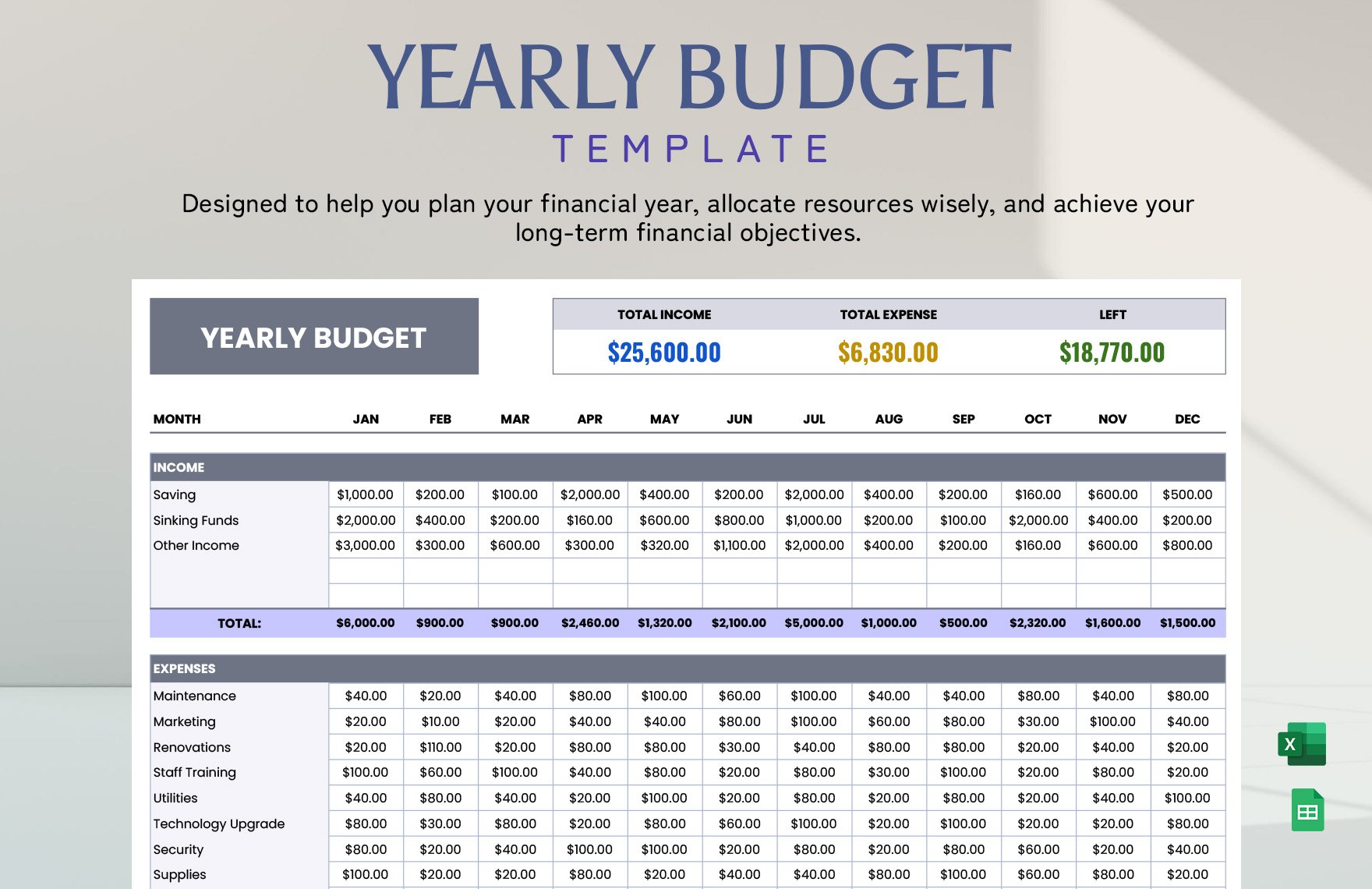

Revenue Projections: This is the foundation of your budget. Estimate your expected income from sales, services, or other revenue streams. Be realistic and consider seasonal fluctuations. Research market trends and competitor activity to inform your projections. Small Business Annual Budget Template relies heavily on accurate revenue forecasting.

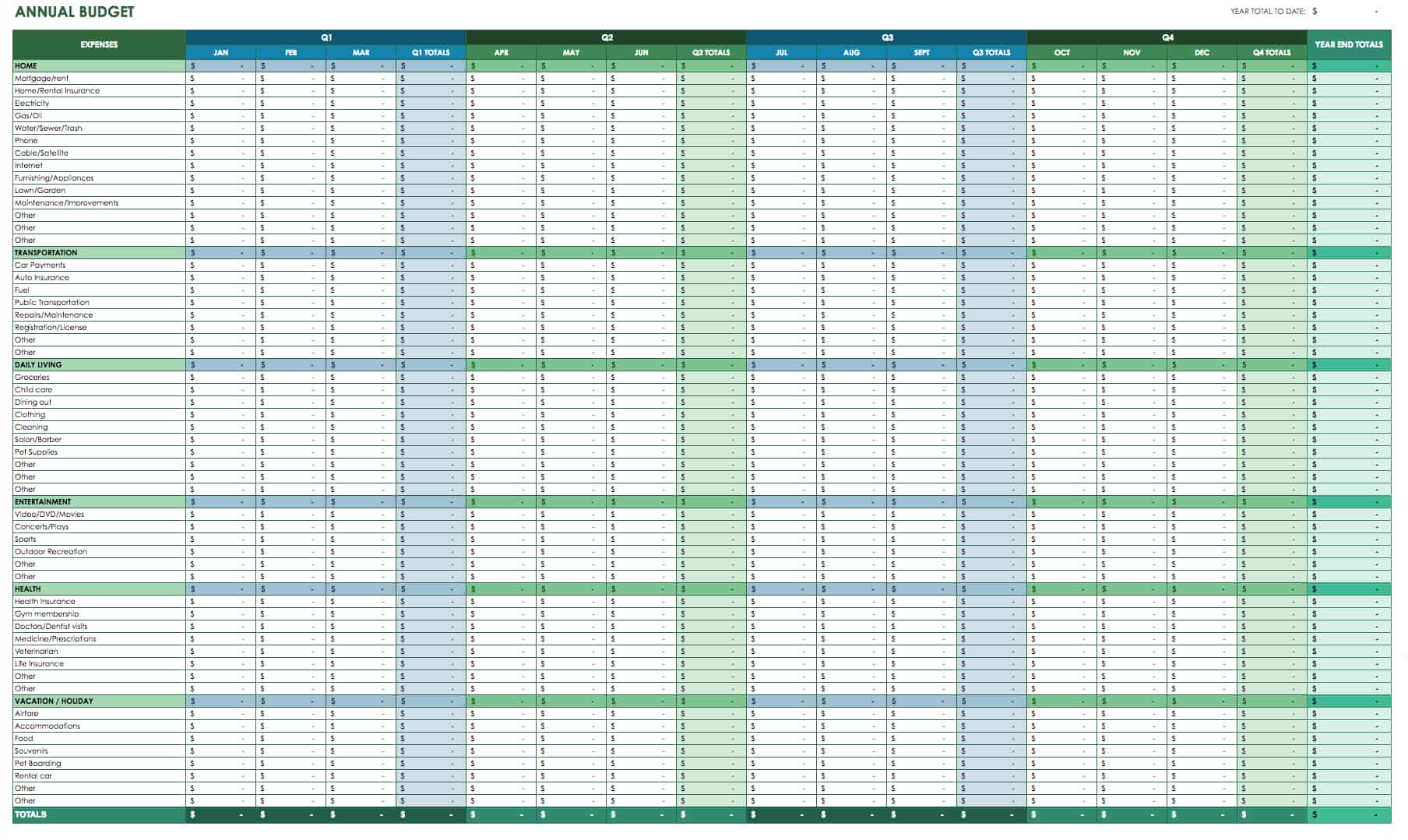

Expense Budgeting: Categorize your expenses into fixed costs (rent, salaries, insurance) and variable costs (materials, marketing, utilities). Fixed costs remain relatively constant regardless of sales volume. Variable costs fluctuate with your sales. Carefully track and analyze each expense category.

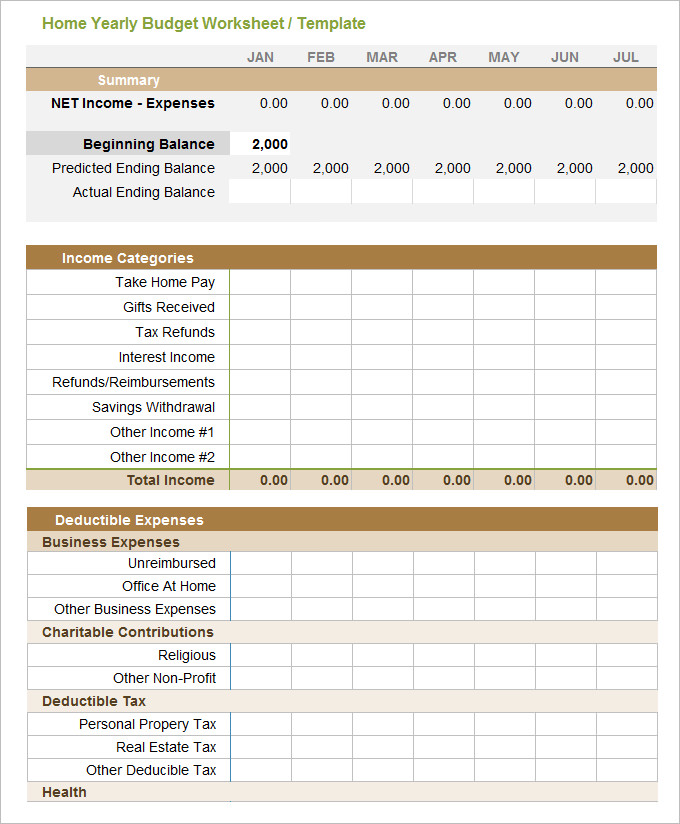

Cash Flow Forecast: This is critical for small businesses. It predicts the movement of cash in and out of your business over the year. It helps you anticipate potential cash shortages and plan accordingly. A cash flow forecast allows you to manage your working capital effectively.

Profit & Loss (P&L) Statement: This statement summarizes your revenues, expenses, and profits over a specific period (typically a year). It’s a key indicator of your business’s financial health.

Balance Sheet: This provides a snapshot of your assets, liabilities, and equity at a specific point in time. It’s a more detailed view of your financial position.

Let’s examine some specific areas within your budget:

A budget isn’t just about numbers; it’s about managing cash flow. A cash flow forecast is essential for ensuring you have enough money to meet your obligations. Monitor your cash inflows and outflows closely and take steps to optimize your cash position. Consider offering early payment discounts to encourage faster payments.

Creating and maintaining a Small Business Annual Budget Template is a critical investment in your business’s future. By carefully planning your finances, tracking your expenses, and forecasting your revenue, you can increase your chances of success. Remember that a budget is a living document that should be reviewed and adjusted regularly. With diligent planning and consistent monitoring, you can gain control of your finances, achieve your business goals, and build a thriving enterprise. Small Business Annual Budget Template – a tool for growth and stability. Don’t underestimate the power of a well-crafted financial plan.