The world of international trade relies heavily on secure and reliable financial arrangements. A crucial element of this is the Trade Finance Loan Agreement Template, a legally binding contract that facilitates financing for businesses involved in cross-border transactions. This article will delve into the key aspects of this agreement, providing a comprehensive overview for businesses seeking to establish a strong foundation for their international trade operations. Understanding the nuances of this document is paramount for minimizing risk and maximizing the potential benefits of trade finance. The core purpose of the Trade Finance Loan Agreement Template is to outline the terms and conditions of a loan provided to facilitate trade, ensuring both the lender and the borrower are protected. It’s a complex document, requiring careful consideration and expert legal review.

Before diving into the specifics, it’s vital to grasp why a robust Trade Finance Loan Agreement Template is so important. Trade finance encompasses a wide range of transactions – from importing raw materials to exporting finished goods – and often involves significant sums of money. Without a clearly defined agreement, risks associated with payment delays, currency fluctuations, and potential disputes can arise, jeopardizing the entire transaction. A well-structured template provides a framework for managing these risks, fostering trust and promoting smooth, efficient trade. It’s not just about legal compliance; it’s about protecting your business’s interests and ensuring a successful trade partnership. The template serves as a roadmap, guiding all parties involved through the process and minimizing potential misunderstandings.

A comprehensive Trade Finance Loan Agreement Template typically includes several key sections. Let’s examine some of the most important elements:

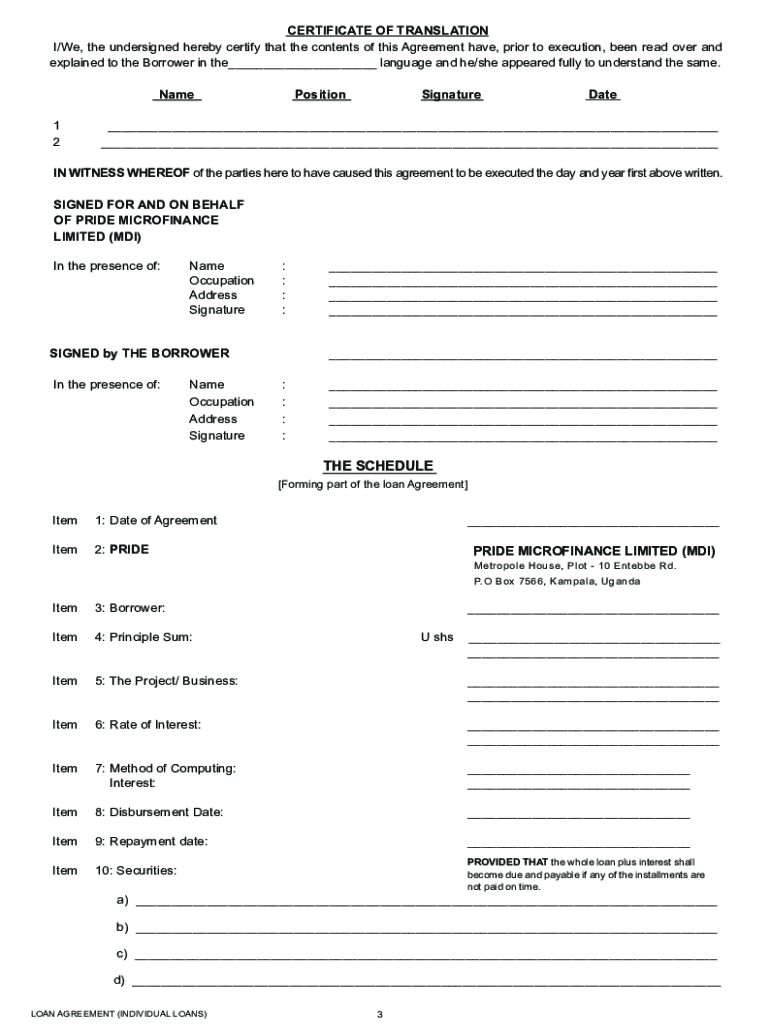

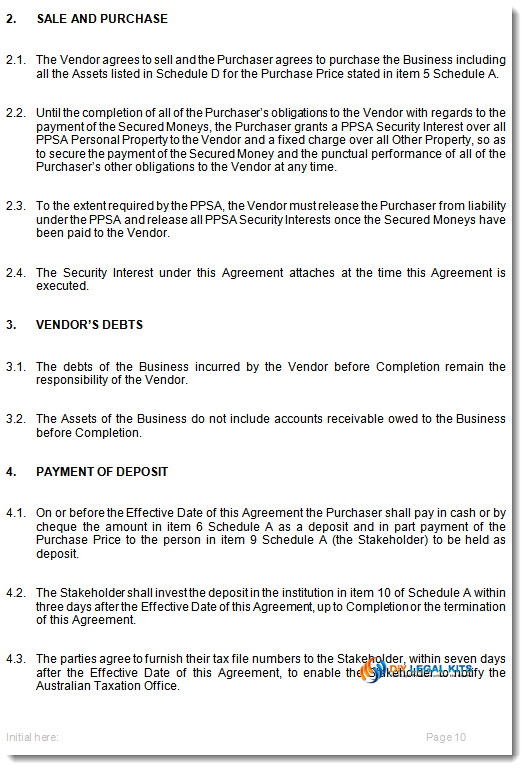

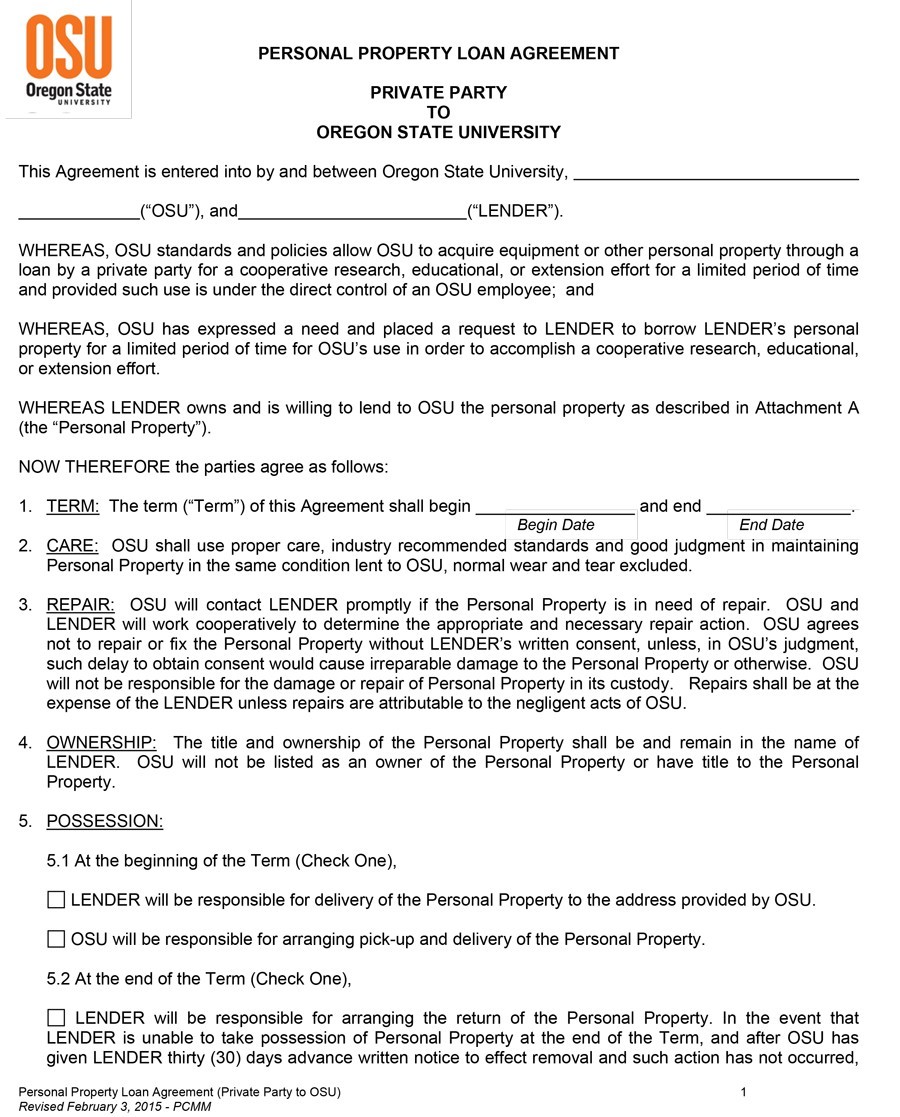

This section clearly identifies the parties involved in the agreement – the borrower (the business seeking financing), the lender (the financial institution providing the loan), and any other relevant third parties, such as banks, insurance companies, or customs brokers. It’s crucial to accurately define the roles and responsibilities of each party. For example, the borrower should specify the nature of the goods being traded, the intended destination, and the amount of financing required.

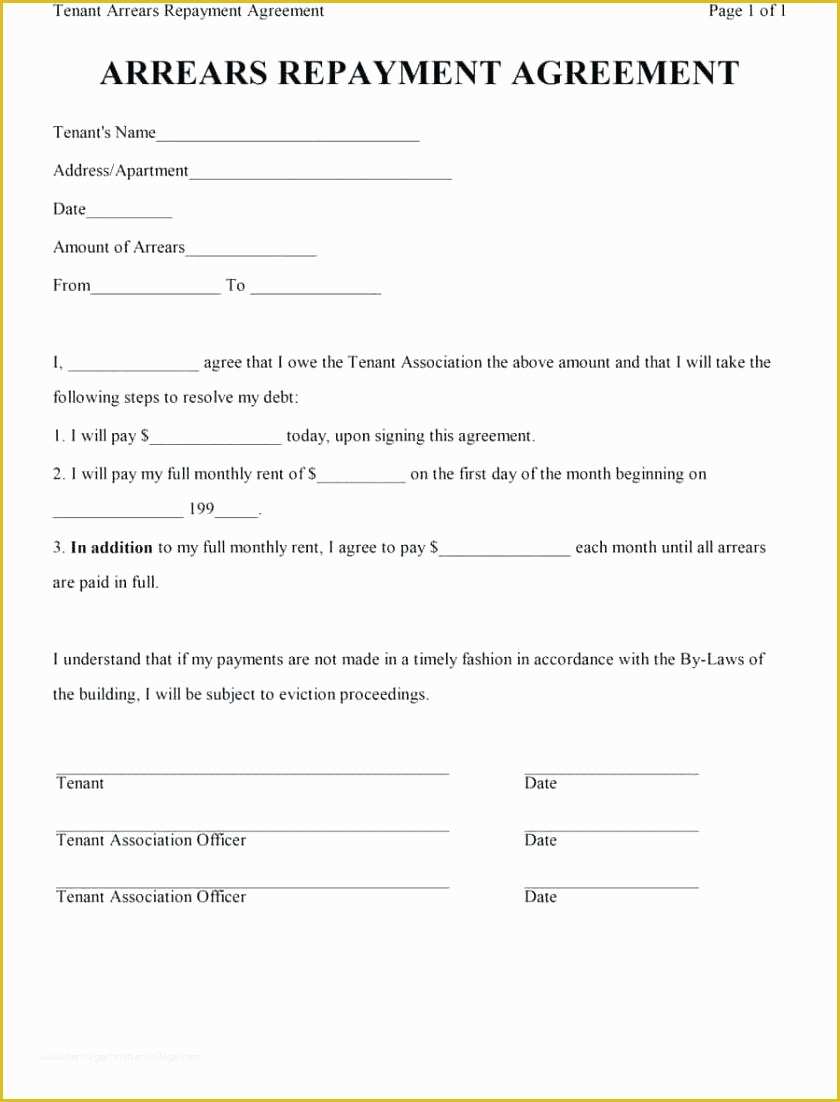

This section outlines the specific terms of the loan, including the amount of capital available, the interest rate, repayment schedule, and any collateral requirements. The lender will typically specify the type of loan (e.g., secured, unsecured) and the conditions under which the loan can be repaid. It’s important to clearly define the loan’s purpose and how it will be used.

The Trade Finance Loan Agreement Template often requires the borrower to provide collateral to secure the loan. This could include goods, accounts receivable, or other assets. The lender will assess the value and liquidity of the collateral to determine the level of risk involved. A strong security arrangement minimizes the lender’s potential losses if the borrower defaults. Proper documentation and valuation are critical here.

These sections outline the borrower’s promises and assurances regarding the accuracy of the information provided. The borrower represents that they have the right to enter into the agreement and that the information provided is true and accurate. The lender, in turn, warrants that they have the right to enforce the agreement and that they have sufficient funds to fulfill their obligations. This section is vital for mitigating potential legal claims.

This section specifies the jurisdiction whose laws will govern the agreement and how disputes will be resolved. Common methods include arbitration and mediation, offering a more efficient and less costly alternative to litigation. Clearly defining the dispute resolution process ensures a fair and predictable outcome.

Beyond the legal provisions, a successful Trade Finance Loan Agreement Template must also address customs and regulatory compliance. International trade is heavily regulated, and compliance with customs regulations is essential to avoid delays and penalties. The agreement should specify the borrower’s responsibilities for ensuring that all goods are properly documented and declared. It should also outline the lender’s procedures for verifying the authenticity of the goods and ensuring compliance with import/export regulations. Failure to comply with these regulations can lead to significant financial repercussions.

Implementing a well-structured Trade Finance Loan Agreement Template offers numerous benefits:

While a Trade Finance Loan Agreement Template provides a solid foundation, it’s crucial to remember that it’s not a substitute for legal counsel. The complexities of international trade and finance require specialized expertise. It’s highly recommended to engage with a qualified trade finance lawyer to review the agreement and ensure it meets your specific needs and complies with all applicable laws and regulations. They can also help you navigate the intricacies of customs regulations and other compliance requirements.

The Trade Finance Loan Agreement Template is a cornerstone of international trade finance. By carefully considering the key components and ensuring compliance with relevant regulations, businesses can significantly mitigate risks, streamline transactions, and foster long-term partnerships with international partners. Investing in a well-drafted template is an investment in the stability and success of your international trade operations. As international trade continues to grow, the importance of a robust and legally sound agreement will only increase.